Widely available access to technologies investors can use today was unthinkable 10 years ago. Cost of hardware, cloud computing and open source libraries plus an exponential growth of educational resources made possible in some aspects to reduce the gap between retail traders and institutional traders in automatic trading. Some differences remain however and R&D resources (research and development) and programming languages used are the main factors that differentiate the retails from the pros.

Why retail traders chose automatic trading?

there are many profiles of traders thus the choice of using a trading bot can depend on several factors and causes. From the complete beginners that buy or sometimes decide to rent a black box solution ( no access to the code ) to the sophisticated trader developer the spectrum is quite wide.

Using a trading bot has its own list of risks which is necessary to consider before to decide to use it on real money accounts. some basic questions need satisfactory answers: What is going to happen in the worst case scenario ? What is the trading strategy behind the code? What are the sources of performance generated during the backtesting period?

The access to algorithmic trading even for investors strangers to code and programming should be seen a source of risks and opportunities. Important to keep in mind that screening for automated solution that fit risk and preferences is an activity that is under the due diligence umbrella and it requires some skills and experience.

Buying a trading from developers with access to code as a commissioned work based on specific requirements of strategy ( generation of alpha, risks attribution, frequency of trades, leverage) is more expensive than a product on the shelf available for anyone but the specification on tailor made software could add value to a diversified portfolio of instruments and strategies, where an allocation to algo trading strategies would substitute or complete other allocations.

Traders with coding skills can directly design, code and backtest strategies thus they might have an edge to direct access to the product development.

Besides strategy diversification, often is mentioned that choosing an algo trading program eliminates the stress regarding trading execution and monitoring. Remain however the task to monitor the performance of the trading program, since differences between backtesting and real trading are likely to emerge.

Resources for research and development

Quant trading firms typically have more resources, access to sophisticated technology, and a team of specialized personnel to conduct extensive, high-frequency, and complex research. They can leverage large datasets and computational power for real-time analysis and trading. On the other hand, private investors usually have fewer resources, rely on publicly available information, and might conduct less frequent and less complex research. The scale, depth, and frequency of research are often significantly higher at quant trading firms compared to private investors.

Retail investors can find useful resources and education for algo trading through online platforms like Coursera or Udacity, which offer courses on algorithmic trading and quantitative finance. Books like “Algorithmic Trading: Winning Strategies and Their Rationale” by Ernest Chan can also be beneficial. Forums and communities such as Quantitative Finance Stack Exchange or Reddit’s r/algotrading are great for discussions and advice. Websites of brokerages that support algo trading often have educational resources too. Lastly, attending webinars, workshops, or local meetups can provide hands-on experience and networking opportunities in the algo trading community.

Differences in programming languages

Python is often chosen in algo trading in the institutional investors space for its ease of use and rapid prototyping, whereas C++ is favored for its high performance and expressiveness. C++ is a better choice for large projects or latency-sensitive algorithms due to its performance advantages, while Python is more suitable for quickly testing ideas or for medium-frequency trading applications where performance is not as critical. Others programming languages used by Institutional investors are Java and R (leveraged for its statistical analysis libraries)

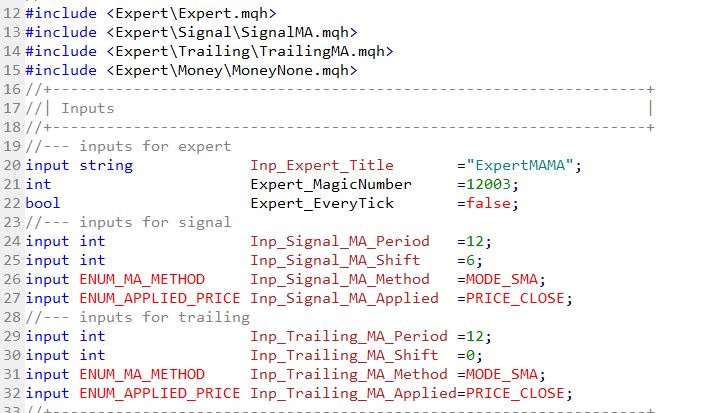

Some of the popular retail trading platforms include MetaTrader 4/5, Thinkorswim, and NinjaTrader. MetaTrader 4/5 primarily supports MQL4/5, Thinkorswim supports thinkScript, and NinjaTrader supports NinjaScript and C#. Each platform has its own dedicated language, but some may also have APIs for other languages like Python or C++

It has to be mentioned that even sophisticated large institutional investors can build fragile trading systems where risk can emerge from operational side and not from market risk. Knight Capital lost over $400 million in 2012 due to a trading glitch.

Conclusion

While quantitative and algo trading in different solutions can be deployed by traders and investors in really few steps thanks to technologies advances some relevant differences remain between the retail and the pros.

A sounding due diligence has to work as a compass to screen the quality and the suitability for an algo trading programme. The service of an independent financial advisor could be helpful in the choice because bias can lead to the wrong program. Advertising on social media does not mean that a trading program is legit: avoid transfer of funds to companies (using often deepfakes of famous celebrities) promising to multiply a small deposit as 99.999% is a fraud.