The world of finance is complex, interwoven with various elements that can bring about fluctuation and unpredictability. Traditional financial theory has always served as the bedrock for understanding these complexities. However, the current economic climate – characterized by high short-term interest rates in the United States, a looming debt ceiling risk, and diminishing risk premium in stocks – is challenging the tenets of this conventional wisdom. These unusual circumstances are raising a pertinent question: Does traditional financial theory still make sense?

1. High Short-Term Interest Rates: A Challenge to the Liquidity Preference Theory

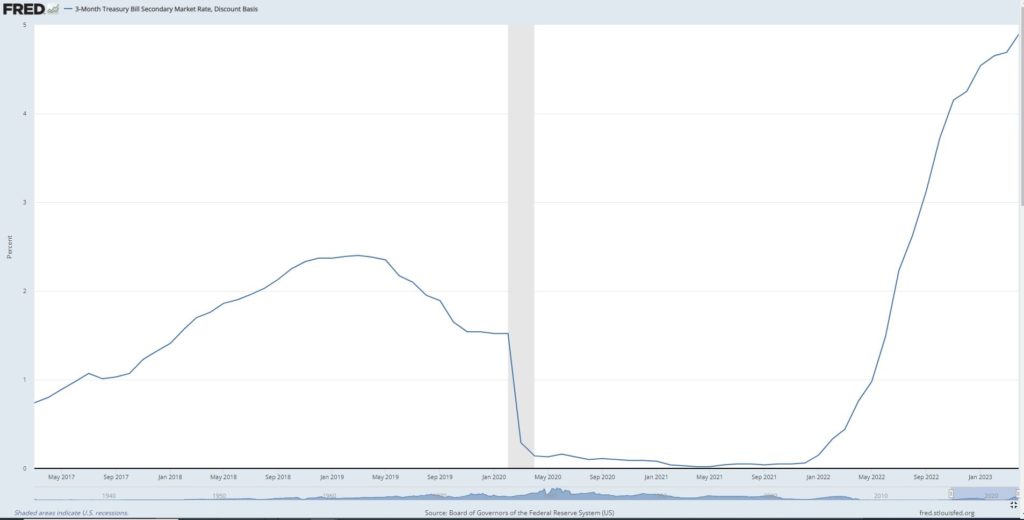

The liquidity preference theory, formulated by John Maynard Keynes, posits that investors prefer liquidity over committing funds in the long term, resulting in higher interest rates for long lending than for short-term. But the current situation defies this principle, as we witness soaring short-term interest rates . Investors are implicitly assuming that risks are greater in the short term.

2. The Debt Ceiling Risk: An Obstacle for the Efficient Market Hypothesis

Another cornerstone of traditional financial theory is the efficient market hypothesis (EMH), which asserts that all known information is already reflected in the market prices. However, the debt ceiling risk presents a unique challenge to this theory.

The debt ceiling is a cap on the amount of debt the federal government can accumulate. A failure to raise or suspend this limit can lead to a default on U.S. Treasury obligations. Despite this alarming prospect, markets appear to be largely nonchalant, with little evidence of panic or even major concern. If EMH were strictly applicable, one would expect to see the possibility of a debt ceiling-induced default reflected in market prices. This apparent disconnect between market prices and the debt ceiling risk suggests that the EMH may not fully capture the intricacies of market behavior.

3. Lower Risk Premium in Stocks: The Puzzle of the Capital Asset Pricing Model

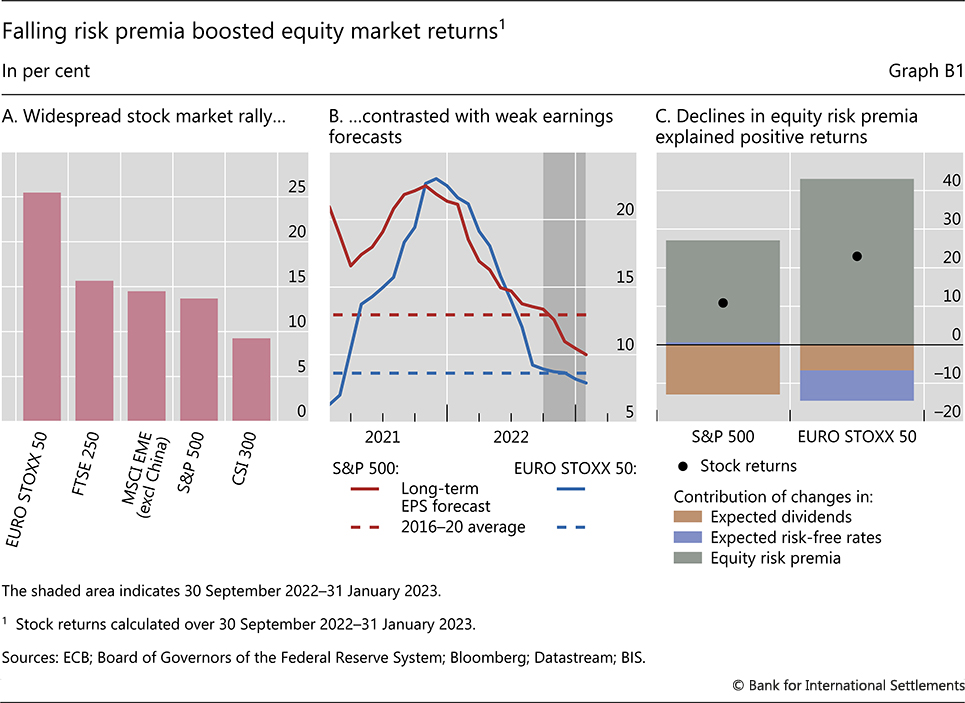

The Capital Asset Pricing Model (CAPM) is another foundation of traditional financial theory. It postulates a positive linear relationship between the risk and expected return of an investment. The higher the risk of an investment, the higher the return expected by investors, termed as the ‘risk premium’.

However, recent trends show that risk premiums in stocks have been shrinking. Investors are seemingly willing to accept lower returns for the same level of risk, which is contrary to the fundamental assumptions of CAPM.

A Time to Reconsider?

As we grapple with these irregularities, it may be time to reconsider the extent to which traditional financial theory explains the modern economic world. While these theories have been instrumental in shaping our understanding of financial markets, they are, after all, simplifications of a complex reality.

That is not to say that these theories are no longer relevant or useful. Rather, their limitations remind us of the need for continuous learning and adaptation in finance. The dynamic nature of the financial markets, underpinned by evolving investor behavior, economic policy, and technological innovation, necessitates a more nuanced and flexible approach to understanding and predicting market movements.

In this era of anomalies, it is crucial for market participants, policymakers, and researchers to reassess traditional financial theories and to cultivate an environment that encourages the development of new paradigms. The aim is to better capture the realities.