Salesforce, Inc. is a prominent provider of cloud-based enterprise software, specializing in customer relationship management (CRM). Founded in 1999 by Marc Russell Benioff and Parker Harris, the company offers a comprehensive suite of services including sales force automation, customer support, marketing automation, and more. Headquartered in San Francisco, Salesforce also provides professional services such as guidance, training, and advisory support.

Recent news surrounding Salesforce (CRM) indicates a mixed financial landscape for the company, which could have significant implications for its stock performance. Despite Salesforce reporting solid Q2 earnings and revenues that beat estimates, the company’s stock experienced a decline, primarily due to a weaker-than-expected sales outlook and concerns over its AI strategy implementation. This was highlighted in multiple reports, including those from Barrons.com and CNBC TV, which noted a more than 3% drop in share prices following the earnings announcement.

Furthermore, Salesforce’s strategic decisions, such as laying off 4,000 employees due to advancements in AI technology, suggest a significant shift towards automation but have also raised investor concerns about the immediate financial implications and long-term impacts on the company’s operational model. This move, covered by sources like GuruFocus.com and Yahoo Finance, reflects broader industry trends towards AI but also introduces uncertainties regarding workforce management and future growth trajectories.

Overall, these developments could influence investor confidence and market perceptions of Salesforce’s adaptability to technological changes and economic conditions, potentially affecting the stock’s volatility and future investment attractiveness.

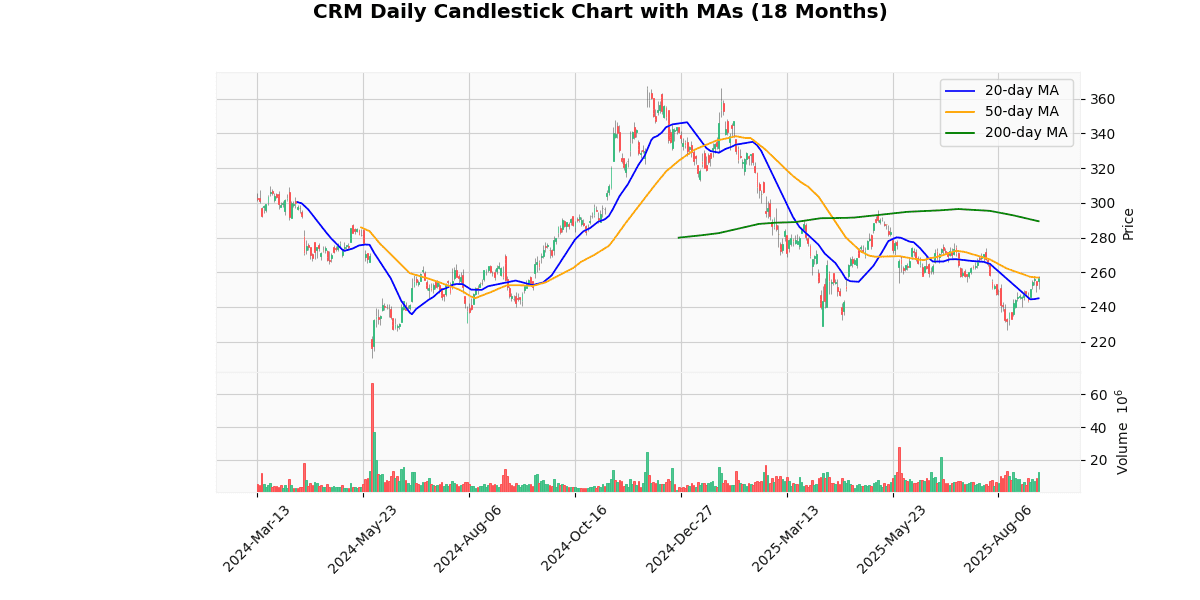

The current price of the asset is $256.45, showing a positive change of 1.42% today. This suggests a short-term bullish sentiment as the price is also close to the week’s high of $258.00, only about 0.6% below it. However, the asset is significantly below its 52-week and year-to-date highs, which are around $367, indicating a substantial -30% drop from these peaks. This reflects a longer-term bearish trend.

The asset’s price is currently above the 20-day moving average (MA20) by about 4.67%, suggesting recent upward momentum. However, it is slightly below the 50-day moving average (MA50) and significantly below the 200-day moving average (MA200) by 11.37%, which might indicate underlying weakness in the medium to long term.

The Relative Strength Index (RSI) at 56.59 points to neither overbought nor oversold conditions, supporting a stable outlook in the immediate term. The Moving Average Convergence Divergence (MACD) at -0.29, however, indicates potential bearish momentum as it suggests the short-term trend is weaker than the long-term trend.

Overall, while there’s some recent positive movement, the asset’s performance is mixed across different time frames, with significant challenges in regaining its previous highs.

## Price Chart

Salesforce (NYSE: CRM) reported its Q2 2026 financial results, showcasing a robust performance with a revenue increase of 10% year-over-year to $10.2 billion. The growth was consistent in constant currency terms at 9%. Subscription and support revenue, a critical segment, rose by 11% to $9.7 billion. The company’s current remaining performance obligation (cRPO) also grew by 11% to $29.4 billion, indicating strong future revenue potential.

Net income saw a significant rise of 32% from the previous year, reaching $1.887 billion, with diluted EPS climbing to $1.96 from $1.47. Salesforce’s operating margins remained strong, with GAAP and non-GAAP figures at 22.8% and 34.3%, respectively. The company has been active in returning value to shareholders, repurchasing $2.2 billion in shares and distributing $399 million in dividends.

Looking ahead, Salesforce has raised its full-year revenue guidance to between $41.1 billion and $41.3 billion, reflecting an 8.5% to 9% year-over-year increase. The company also anticipates a 12% to 13% growth in operating cash flow for FY26. These projections underscore Salesforce’s continued growth trajectory and operational efficiency.

## Earnings Trend Table

| Date | Estimate EPS | Reported EPS | Surprise % | |

|---|---|---|---|---|

| 0 | 2025-09-03 | 2.78 | 2.91 | 4.68 |

| 1 | 2025-05-28 | 2.54 | 2.58 | 1.38 |

| 2 | 2025-02-26 | 2.61 | 2.78 | 6.58 |

| 3 | 2024-12-03 | 2.44 | 2.41 | -1.32 |

| 4 | 2024-08-28 | 2.36 | 2.56 | 8.59 |

| 5 | 2024-05-29 | 2.38 | 2.44 | 2.72 |

| 6 | 2024-02-28 | 2.26 | 2.29 | 1.15 |

| 7 | 2023-11-29 | 2.06 | 2.11 | 2.39 |

Over the past eight quarters, the trend in earnings per share (EPS) for the company under review shows a consistent growth in both estimated and reported EPS, with the reported figures frequently surpassing the estimates. Starting from Q4 2023, the EPS has increased from an estimate of 2.06 to 2.78 by Q3 2025, reflecting a steady upward trajectory. Similarly, reported EPS has grown from 2.11 in Q4 2023 to 2.91 in Q3 2025.

The company has consistently beaten EPS estimates in six out of the eight quarters, with the most significant positive surprises occurring in Q3 2024 (8.59% above the estimate) and Q1 2025 (6.58% above the estimate). The only exception to this trend is Q4 2024, where the company reported an EPS of 2.41, slightly below the estimate of 2.44, marking a -1.32% surprise.

This pattern of outperforming EPS estimates suggests effective management forecasting and operational execution that exceeds analyst expectations. The consistent growth in EPS also indicates a robust financial performance, likely driven by effective cost management strategies and possibly increasing revenues. This positive trend in EPS is a strong indicator of the company’s financial health and operational efficiency.

## Dividend Payments Table

| Date | Dividend |

|---|---|

| 2025-06-18 | 0.416 |

| 2025-04-10 | 0.416 |

| 2024-12-18 | 0.4 |

| 2024-09-18 | 0.4 |

| 2024-07-09 | 0.4 |

| 2024-03-13 | 0.4 |

The dividend data over the last eight samples, spanning from March 2024 to June 2025, indicates a stable trend with a slight increase observed in 2025. Initially, dividends were consistently distributed at $0.4 per share from March 2024 through December 2024. This consistency suggests a period of financial stability and a commitment to maintaining shareholder value without any fluctuations.

Starting in 2025, the dividend per share saw an increase to $0.416, first noted in April and subsequently confirmed in June. This increment, although modest, represents a positive adjustment, possibly reflecting improved company profitability or a strategic decision by the management to enhance shareholder returns. The maintenance of this new dividend level in consecutive distributions (April and June 2025) further indicates that this may be a new baseline rather than a one-time boost.

Overall, the trend shows prudent financial management with a careful approach towards increasing shareholder value while ensuring sustainability in dividend payments.

In the recent series of analyst rating changes, there has been notable activity impacting the stock’s outlook and target prices.

1. **Oppenheimer on August 26, 2025**: Oppenheimer reiterated its “Outperform” rating but adjusted the target price from $370 to $315. This reduction in target price suggests a recalibration of expectations, possibly due to revised earnings forecasts or market conditions impacting the company’s future growth prospects.

2. **DA Davidson on August 15, 2025**: DA Davidson upgraded its rating from “Underperform” to “Neutral” with a set target price of $225. This upgrade indicates a shift in perspective, potentially due to improvements in the company’s operational efficiency or market dynamics that mitigate previously identified risks.

3. **Erste Group on June 5, 2025**: Erste Group downgraded its recommendation from “Buy” to “Hold.” This change reflects a more cautious stance on the stock, suggesting that while the previous growth expectations or favorable conditions might be tapering, the fundamentals do not yet justify a sell rating.

4. **Cantor Fitzgerald on June 3, 2025**: Cantor Fitzgerald initiated coverage with an “Overweight” rating and a target price of $325. This initiation at a relatively high target price indicates a strong bullish outlook from Cantor Fitzgerald, likely based on robust growth prospects or underappreciated market opportunities identified by their analysis.

These adjustments provide a mixed but nuanced view of the stock, reflecting ongoing reassessments of the company’s financial health and market position.

As of the latest data, the current price of the stock is $256.45. This price is notably below the average target price suggested by recent analyst ratings. For instance, Oppenheimer recently adjusted their target from $370 to $315 while maintaining an “Outperform” rating. Similarly, Cantor Fitzgerald initiated coverage with an “Overweight” rating and a target price of $325. These target prices suggest a potential upside from the current market price.

On the other hand, DA Davidson upgraded the stock from “Underperform” to “Neutral” with a target price of $225, which is below the current trading price, indicating a mixed analyst outlook. Erste Group’s downgrade from “Buy” to “Hold” also suggests a cautious stance, although no specific target price was provided.

The divergence in analyst opinions and target prices indicates varying expectations about the company’s future performance, reflecting different assessments of its earnings potential, market position, and broader economic factors influencing its sector.