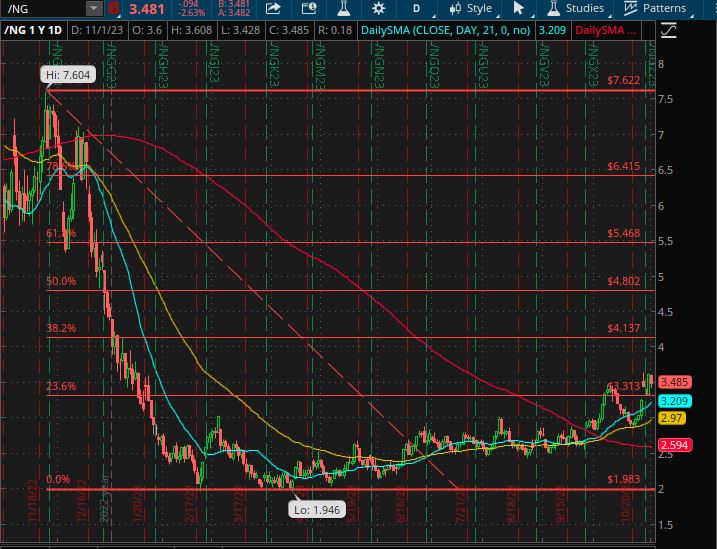

The commodity last week made a breakout above 3$/BTU and then consolidated above the 23.6% Fibonacci retracement which worked as a resistance but now is a support. From its 2023 low of 1.946 Natural Gas Futures have risen more than 50% , and this is not an abnormal percentage considering the selloff started on the last quarter of the previous year.

If the rally continues next key level is the 38.2% Fibonacci resistance at 4.13 $/BTU. Sharp and fast retracements are also possible thus position highly leveraged would be at risk of faster stop out/margin call.

The commodity has clearly periods of low volatility , showing some trendless activity and then some quarters showing strong direction, with very high volatility.

The dynamics of Natural Gas prices are influenced by a variety of factors, with seasonality and geopolitical pressures being notable among them. Below is an in-depth examination of these aspects:

Seasonality Effect on Natural Gas Prices:

Price Elasticity and Storage Levels:

Natural Gas prices exhibit seasonality patterns largely due to the relative high price elasticity seen in storage and consumption volumes. The storage levels and gas consumption rates respond quickly to market price changes, illustrating a notable seasonality effect.

Inventory Effect and Seasonal Rallies:

Compared to oil prices, the inventory effect isn’t as apparent for natural gas, which explains the larger seasonal swing in its prices. There are two distinct price rallies characteristic of seasonality in natural gas: a large rally during winter in the U.S. and EU driven by a surge in supply for heating purposes.

Typical Gas Forward Curve:

A typical gas forward curve suggests higher gas prices during winter months, with slight increases also noted in July and August. Conversely, prices are lower during weak-demand months like April, May, and September through November.

Decreasing Seasonality:

Despite the traditional seasonality, a decline in price spread suggests that market participants expect less seasonal variability in natural gas prices compared to previous years. However, supply and demand factors at the time of physical sale often determine the eventual price.

Geopolitical Pressures and LNG Demand:

Increasing LNG Demand:

Geopolitical landscapes have contributed to a 49% increase in the daily volume of Henry Hub futures and options complex from April 2021 to April 2022, showcasing how geopolitical factors can significantly influence LNG demand and, by extension, Henry Hub prices.

US LNG Exports:

An increase in US LNG exports could lead to higher Henry Hub gas prices if the export demand is strong enough to tighten the domestic supply-demand balance.

European Energy Crisis:

The recent European energy crisis has heightened the demand for US natural gas, placing it in a position of acute geopolitical relevance. The crisis, exacerbated by the war in Ukraine and then by the conflict between Israel and the terrorists of Hamas, has further increased the demand for US LNG exports, impacting Henry Hub prices. The impossibility for Israel to operate the Tamar gas field, just 35 km off the coast of Gaza, is bringing down to zero the export of Israeli LNG from Egypt to Europe.

Price Surges:

Between July 2021 and July 2022, US natural gas prices at Henry Hub rose by over 250%, reflecting the significant impact geopolitical factors can have on natural gas prices.

The interplay between seasonality, geopolitical pressures, and other market dynamics continues to shape the pricing and demand for natural gas, making it a complex, multifaceted market to navigate.