Strategy, Inc. is a company specializing in enterprise analytics and mobility software solutions. Founded in 1989 by Michael J. Saylor and Sanjeev K. Bansal, the company is based in Vienna, VA. Strategy, Inc. offers its products, including the notable Hyper platform, through licensing and cloud-based subscriptions, complemented by related services.

Recent news highlights significant developments for Strategy, a company deeply involved in cryptocurrency investments, particularly Bitcoin. On August 25, 2025, Strategy made headlines by purchasing an additional 3,081 Bitcoins valued at $356.9 million, as reported by Cryptonews. Despite this substantial acquisition, the company’s stock is experiencing a downturn, as noted in a Barrons.com article discussing Strategy’s stock price fall following the purchase.

Further complicating the situation, Strategy also sold a large number of its shares (875,301 MSTR shares) after updating its market NAV guidance the previous week, indicating potential liquidity moves or strategic financial adjustments. This sale was covered by Blockspace, suggesting a significant reshuffle in Strategy’s asset management approach.

Amidst these corporate maneuvers, the broader cryptocurrency market, including Bitcoin, Ethereum, and XRP, faced a sharp decline, erasing recent gains in a flash crash scenario. This market volatility is closely tied to Strategy’s performance given its heavy investment in Bitcoin, impacting investor sentiment and stock valuation.

Overall, these developments could signal a cautious or bearish outlook for Strategy’s stock in the short term, influenced by both its aggressive investment strategy in a volatile market and broader economic factors affecting cryptocurrency valuations.

The current price of $349.38 represents a significant decline of 2.79% today, indicating a bearish sentiment in the market. This price is near the week’s high of $351.5 but has recovered slightly from the week’s low of $339.27, suggesting some volatility within the week. The price is substantially below the 52-week high of $543.00 by approximately 35.66%, highlighting a longer-term downward trend. However, it has greatly surpassed the 52-week low of $113.69, showing considerable gains over the past year.

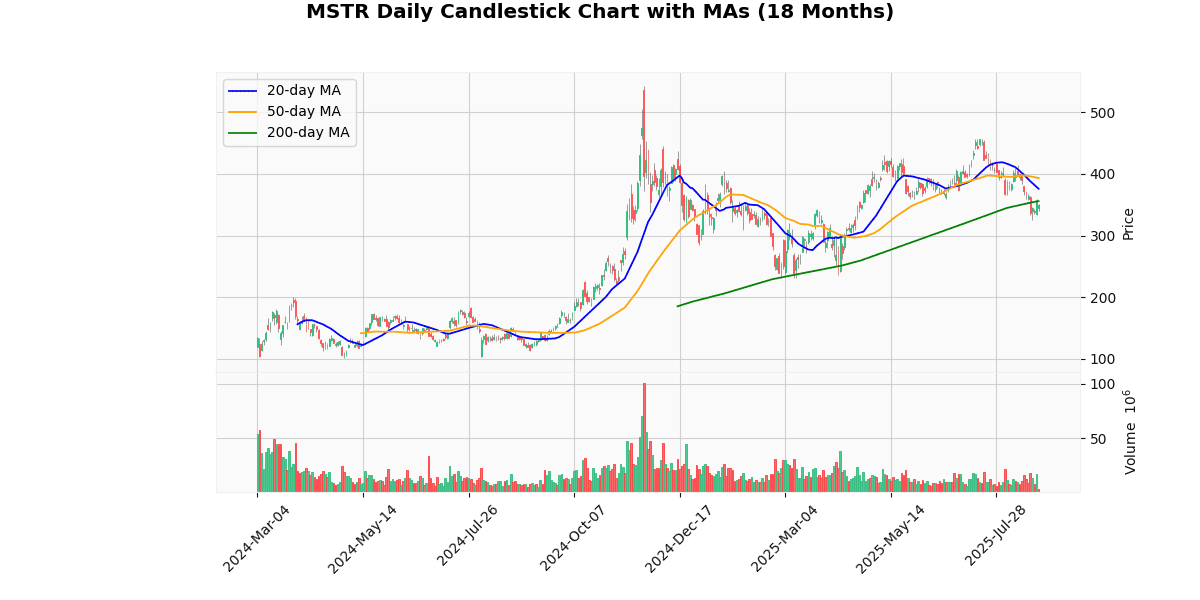

The moving averages indicate a bearish trend, with the price below the 20-day (-7.04%), 50-day (-11.15%), and slightly below the 200-day (-1.8%) moving averages. This suggests that the stock has been underperforming in the short to medium term.

The Relative Strength Index (RSI) at 39.92 is below the neutral 50 mark, which typically indicates bearish momentum and possibly an oversold condition. The Moving Average Convergence Divergence (MACD) at -14.81 further supports this bearish outlook, as it indicates negative momentum.

Overall, the stock is currently facing downward pressure, with both short-term and medium-term indicators suggesting a bearish trend. Investors might be cautious, watching for potential stabilization or a reversal signal before considering entry.

## Price Chart

MicroStrategy Incorporated reported a robust financial performance for the second quarter of 2025 on July 31, 2025. The company’s revenue saw an 8.9% increase year-over-year, reaching $118.9 million, up from $109.2 million in Q2 2024. This growth was attributed to expanded market presence and enhanced product offerings. Net income for the quarter significantly improved by 43.3%, standing at $8.0 million compared to $5.6 million in the same quarter the previous year. Earnings per share (EPS) also rose by 37.5% to $1.80.

Adjusted EBITDA increased by 10.9% to $40.5 million. The company’s working capital grew by 2.5% to $234 million, and its cash position strengthened by 15.9% to $120 million. Product utilization rates for its cloud services climbed to 80%, reflecting a 5% growth. MicroStrategy declared a quarterly dividend of $0.50 per share and announced a $200 million share repurchase plan, signaling strong confidence in its future growth. Management projects a revenue growth of 10% to 12% for the full year, emphasizing ongoing improvements in operational efficiencies.

## Earnings Trend Table

| Date | Estimate EPS | Reported EPS | Surprise % | |

|---|---|---|---|---|

| 0 | 2025-07-31 | 21.48 | 32.60 | 51.4 |

| 1 | 2025-05-05 | -0.11 | -16.49 | -14890.91 |

| 2 | 2025-02-05 | -0.07 | -3.30 | -4300.00 |

| 3 | 2024-10-30 | -0.14 | -1.72 | -1119.86 |

| 4 | 2024-08-01 | -0.01 | -0.57 | -5094.57 |

| 5 | 2024-04-29 | 0.34 | -8.26 | -2565.67 |

| 6 | 2024-02-06 | 0.55 | 5.62 | 921.82 |

| 7 | 2023-11-01 | 0.69 | -8.98 | -1401.45 |

The EPS trends over the last eight quarters reveal significant volatility and unexpected results relative to estimates. Initially, in Q4 2023, the company reported a substantial negative surprise with EPS of -8.98 against an estimate of 0.69, marking a -1401.45% surprise. This trend of negative surprises continued, with Q1 2024 and Q2 2024 showing EPS far below expectations, at -2565.67% and -5094.57% surprise percentages respectively.

A notable deviation occurred in Q3 2024, where the company reported a positive EPS of 5.62 against an estimate of 0.55, resulting in a 921.82% positive surprise.

This pattern suggests extreme unpredictability in the company’s financial performance, with a general trend of underperforming against estimates. The data indicates either a fundamental issue in forecasting or unexpected financial challenges, impacting the reliability of earnings estimates and suggesting potential instability in the company’s financial health.

The most recent rating changes for the entity in question reflect a dynamic and evolving perspective from various financial analysis firms, particularly Monness Crespi & Hardt, which has been actively adjusting its stance over recent months.

1. **Monness Crespi & Hardt – July 15, 2025**: The firm reiterated its “Sell” rating but adjusted the target price from $175 to $200. This adjustment suggests that while the firm maintains a bearish outlook on the stock, it acknowledges some upward valuation adjustments, possibly due to external market factors or improved company fundamentals that were not strong enough to shift the overall investment rating.

2. **H.C. Wainwright – April 29, 2025**: This firm initiated coverage with a “Buy” rating and set a target price of $480. This optimistic outlook significantly contrasts with the views from Monness Crespi & Hardt, indicating a potentially divergent analysis of the company’s future growth prospects or operational efficiency.

3. **Monness Crespi & Hardt – April 1, 2025**: The firm downgraded the stock from “Neutral” to “Sell” and set a target price at $220 at the time of the downgrade. This change indicates a shift from a stance of neutrality to a more bearish outlook, suggesting a reassessment of the company’s expected performance or market conditions that could negatively impact its valuation.

4. **Monness Crespi & Hardt – March 19, 2025**: The initiation of coverage with a “Neutral” stance without a specified target price suggests initial uncertainty or lack of sufficient data to make a more definitive rating. This position serves as a baseline from which the firm’s perception of the company became progressively negative.

These rating changes highlight a period of significant reassessment and differing opinions among analysts, reflecting the complexities of market conditions and internal company dynamics affecting stock performance.

The current price of the stock is $349.38. The average target price, based on recent analyst ratings, shows a significant divergence in expectations. Monness Crespi & Hardt recently reiterated a “Sell” rating with a target price adjustment from $175 to $200, indicating a bearish outlook. Conversely, H.C. Wainwright has initiated coverage with a “Buy” rating, setting a much more optimistic target price of $480. This disparity suggests a varied perception of the stock’s future performance among analysts.

Disclaimer: The information provided here is for educational and informational purposes only and should not be interpreted as financial advice, investment recommendations, or trading guidance. Markets involve risk, and past performance is not indicative of future results. You should always conduct your own research and consult with a qualified financial advisor before making any investment decisions. By acting, you accept full responsibility for your choices.