Tesla Inc. Shares drops 2.1% After Earnings Report

Current Price: $439.59

-2.09%

on October 24, 2025

Tesla, Inc. is a pioneering company founded in 2003 by visionaries including Elon Musk and Jeffrey B. Straubel. Headquartered in Austin, Texas, Tesla specializes in the design, manufacturing, and sale of electric vehicles and energy solutions. With distinct segments for Automotive and Energy Generation and Storage, Tesla is at the forefront of sustainable technology, driving innovation in both transportation and renewable energy.

📰 Recent Developments

Tesla Inc. announced its third-quarter 2024 financial results, posting revenue of $25.2 billion, an 8% increase from the prior year, alongside GAAP net income of $2.2 billion. Vehicle deliveries totaled 462,890 units, with production reaching 469,796 vehicles, and energy storage deployments hit a record 9.4 GWh.

The company provided updates on its autonomous driving initiatives, confirming plans to launch unsupervised Full Self-Driving in Texas and California in 2025, pending regulatory clearance. Production of the Cybercab robotaxi and next-generation affordable vehicle is targeted to begin in 2025, aiming for 20-30% annual vehicle growth.

Operationally, Tesla expanded its Supercharger network with new installations in Europe and initiated preparations for a Megapack factory in Shanghai to boost energy storage output.

No significant strategic partnerships, acquisitions, regulatory approvals, legal developments, or management changes were reported during this period.

📊 Earnings Report Summary

Tesla, Inc. (TSLA) reported its Q3 2025 financial results on October 22, 2025, highlighting a total revenue increase of 12% year-over-year (YoY) to $28.1 billion. Automotive revenue rose by 6% to $21.2 billion, while energy generation and storage revenue surged 44% to $3.4 billion. Gross profit slightly increased to $5.1 billion, but total GAAP gross margin fell by 185 basis points to 18.0%. Operating income plummeted 40% to $1.6 billion, leading to a decreased operating margin of 5.8%. Net income attributable to common stockholders decreased 37% YoY to $1.4 billion, with diluted EPS (GAAP) dropping to $0.39. Despite these challenges, Tesla achieved record free cash flow of nearly $4.0 billion and maintained strong vehicle deliveries at 497,099 units. The company continues to focus on innovation and market expansion, launching new products and enhancing its operational capabilities.

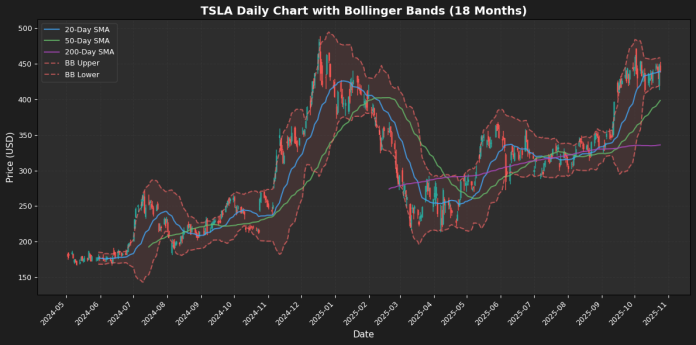

📈 Technical Analysis

Daily Price Change: -2.09%

Technical Indicators

| Metric | Value |

|---|---|

| Current Price | $440.62 |

| Daily Change | -1.86% |

| MA20 | $438.71 |

| MA50 | $398.14 |

| MA200 | $335.82 |

| 52W High | $488.54 |

| 52W Low | $212.11 |

| % from 52W High | -9.81% |

| % from 52W Low | 107.73% |

| YTD % | 16.17% |

| BB Position | 54.93% |

| RSI | 55.25 |

| MACD | 10.78 |

The current price of $440.62 reflects a daily decline of approximately 0.42%, indicating a slight bearish sentiment. The stock remains 9.81% below its 52-week high of $488.54, while still being 107.73% above its 52-week low of $212.11.

Short-term moving averages show a bullish trend, with the 20-day MA at $438.71 above the 50-day MA of $398.14, and the 200-day MA at $335.82, suggesting a strong upward momentum over the longer term.

The RSI at 55.25 indicates the stock is neither overbought nor oversold, maintaining a neutral stance. The MACD of 10.78 supports this momentum, showing potential for further upward movement.

Bollinger Bands reveal the price is approaching the upper band at $458.06, which may act as resistance, while the lower band at $419.36 provides support. Overall, the stock exhibits a solid bullish trend with healthy volatility.

💰 Earnings History

| Earnings Date | EPS Estimate | Reported EPS | Surprise(%) | Event Type |

|---|---|---|---|---|

| 2025-04-22 | 0.39 | 0.27 | -30.98 | Earnings |

| 2025-01-29 | 0.76 | 0.73 | -4.25 | Earnings |

| 2024-10-23 | 0.58 | 0.72 | 23.24 | Earnings |

| 2024-07-23 | 0.62 | 0.52 | -16.62 | Earnings |

| 2024-04-23 | 0.51 | 0.45 | -12.04 | Earnings |

| 2024-01-24 | 0.74 | 0.71 | -4.39 | Earnings |

| 2023-10-18 | 0.72 | 0.66 | -8.25 | Earnings |

| 2023-07-19 | 0.82 | 0.91 | 10.63 | Earnings |

Analyzing the earnings per share (EPS) trends from the provided data reveals a mixed performance over the observed periods. The most recent earnings report from April 2025 shows a significant negative surprise of -30.98%, with the reported EPS of 0.27 falling well below the estimate of 0.39. This contrasts sharply with the previous quarter in October 2024, where the company exceeded expectations with a reported EPS of 0.72 against an estimate of 0.58, resulting in a positive surprise of 23.24%.

However, the overall trend indicates volatility, as three out of the last four quarters have seen the company miss EPS estimates, including two quarters with substantial negative surprises (-16.62% and -12.04%). The only consistent positive surprise occurred in July 2023, where the EPS exceeded expectations by 10.63%. This inconsistency may raise concerns among investors regarding the company’s ability to maintain earnings growth moving forward.

⭐ Analyst Ratings

| Date | Status | Outer | Rating | Price |

|---|---|---|---|---|

| 2025-10-23 | Reiterated | Truist | Hold | $280 → $406 |

| 2025-10-23 | Reiterated | Mizuho | Outperform | $450 → $485 |

| 2025-10-23 | Reiterated | Deutsche Bank | Buy | $435 → $440 |

| 2025-10-23 | Reiterated | Canaccord Genuity | Buy | $490 → $482 |

The recent rating changes reflect a cautiously optimistic outlook among analysts, despite some adjustments in price targets. Truist’s decision to maintain a “Hold” rating while increasing its price target from $280 to $406 suggests a recognition of potential upside, yet indicates a lack of conviction in a strong buy recommendation. Mizuho’s reiteration of an “Outperform” rating with a price target increase from $450 to $485 signals confidence in the stock’s performance relative to peers, suggesting positive momentum.

In contrast, Deutsche Bank’s slight upward adjustment from $435 to $440 while maintaining a “Buy” rating indicates a stable outlook, though it may imply limited short-term growth. Canaccord Genuity’s reduction of its price target from $490 to $482, while still holding a “Buy” rating, reflects a more cautious stance, perhaps due to market volatility or company-specific risks. Overall, the mixed signals suggest analysts are balancing optimism with prudence in the current market environment.

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.