# Tesla Inc.: Leading the Charge in Electric Vehicles and AI

Tesla Inc. is a pioneering company in the electric vehicle and energy generation sectors. Founded in 2003, Tesla has been at the forefront of innovation under the leadership of Elon Musk. The company’s core segments include Automotive, focusing on electric vehicle design and sales, and Energy Generation and Storage, specializing in solar energy products and services. With a strong emphasis on sustainability and cutting-edge technology, Tesla has captured global attention for its ambitious goals in transforming the automotive industry.

## Recent News:

Tesla has been making headlines recently, with a mix of positive and negative developments impacting its stock. The company faced challenges in the European market, losing market share to competitors due to limitations in its vehicle lineup, leading to a drop in sales. On the other hand, Tesla climbed after launching a new Robotaxi service, showcasing its advancements in autonomous driving technology. However, the stock experienced a significant decline following an earnings miss, despite receiving unexpected support from former President Trump. These events have stirred market sentiments and influenced investor perceptions of Tesla’s future performance.

## Price Chart

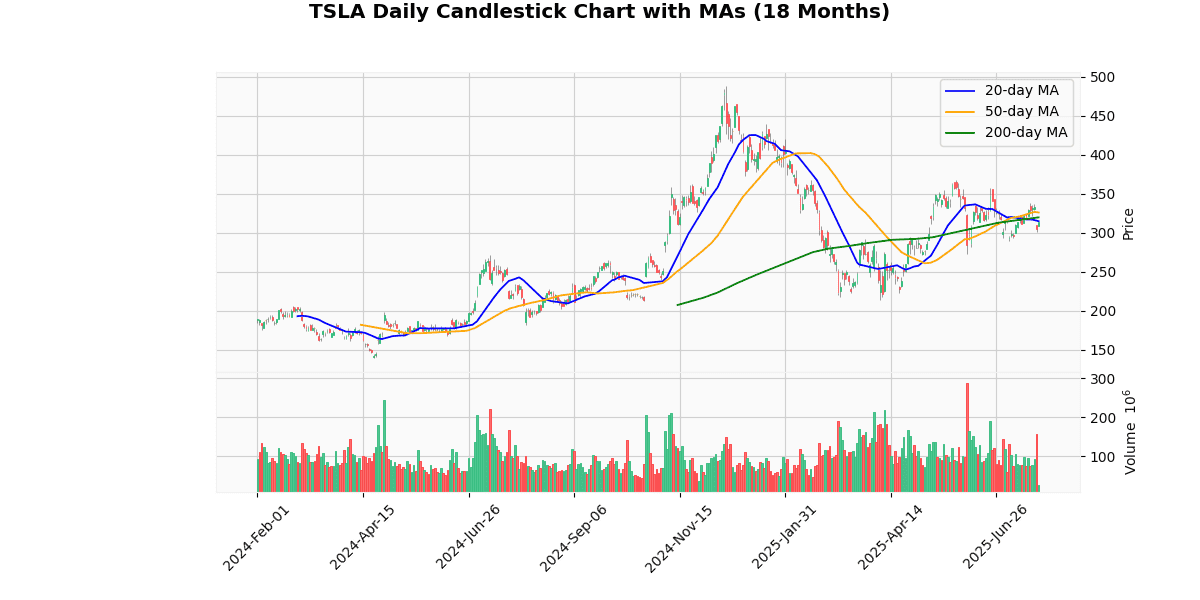

## Price Trend:

Tesla’s current price stands at $313.08, with notable movements compared to its moving averages and historical highs and lows. The stock is trading below its 20-day, 50-day, and 200-day moving averages, indicating a bearish trend. While the 52-week high was $488.54 and the low was $182.00, the YTD high and low were $439.74 and $214.25, respectively. The RSI at 47.59 suggests a neutral position, while the MACD of 0.33 indicates a slight bullish momentum. Despite recent fluctuations, Tesla’s stock price reflects a mix of challenges and opportunities in the market.

## Q10 Summary:

In the Q2 2025 financial results, Tesla reported total revenues of $22.5 billion, down 12% YoY, primarily driven by lower vehicle deliveries and regulatory credit revenue. Automotive revenues decreased by 16% YoY, while Energy Generation and Storage revenues fell by 7% YoY. The company’s GAAP operating income and net income also experienced declines, with EPS down 18% YoY. Tesla highlighted its focus on AI and robotics, launching new vehicle models and autonomous services. The company aims to navigate global trade challenges and drive profitability through cost efficiencies and software innovations.

## Earnings Trend Table

| # | Date | Estimate EPS | Reported EPS | Surprise % |

|---|---|---|---|---|

| 0 | 2025-07-23 | 0.40 | 0.40 | 0.70 |

| 1 | 2025-04-22 | 0.39 | 0.27 | -30.98 |

| 2 | 2025-01-29 | 0.76 | 0.73 | -4.25 |

| 3 | 2024-10-23 | 0.58 | 0.72 | 23.24 |

| 4 | 2024-07-23 | 0.62 | 0.52 | -16.62 |

| 5 | 2024-04-23 | 0.51 | 0.45 | -12.04 |

| 6 | 2024-01-24 | 0.74 | 0.71 | -4.39 |

| 7 | 2023-10-18 | 0.72 | 0.66 | -8.25 |

## Earnings Trend:

Over the last eight quarters, Tesla has shown fluctuations in its EPS figures, with a downward trend in the most recent quarter. Despite revenue declines, the company continues to invest in future technologies and product developments to maintain its competitive edge in the market. Investors are closely monitoring Tesla’s ability to balance growth initiatives with financial performance to drive long-term value creation.

## Dividend Payments Table

| Date | Dividend |

|---|

## Dividend Summary:

Tesla did not declare a quarterly dividend in the Q2 2025 financial results. The company’s focus remains on reinvesting capital into its operations and growth strategies, rather than distributing dividends to shareholders. Tesla’s dividend policy reflects its commitment to innovation and expansion, prioritizing investments in R&D and new business opportunities.

## Conclusion:

As Tesla’s stock price currently trades below its average target price of $349, investors may see potential value in the company despite recent challenges. While EPS trends have shown some volatility, Tesla’s strategic focus on AI, robotics, and new vehicle models signals a long-term growth trajectory. The absence of dividends underscores Tesla’s growth-oriented approach, emphasizing capital reinvestment for future innovation. Investors should closely monitor Tesla’s execution of its strategic initiatives and financial performance to assess its long-term investment potential.