Texas Instruments Reports Strong Revenue Growth, Shares Increases

Current Price: $180.84

+0.70%

on October 21, 2025

Texas Instruments Incorporated, founded in 1930 and headquartered in Dallas, TX, is a leading designer and manufacturer of semiconductors. The company operates through three main segments: Analog, which processes real-world signals; Embedded Processing, focused on task-specific optimization; and Other. Texas Instruments plays a crucial role in transforming analog signals into digital data, catering to various applications across industries.

📰 Recent Developments

Texas Instruments Incorporated reported its third-quarter 2024 financial results, revealing revenue of $4.0 billion, a 10% decline from the prior year, primarily due to softer demand in industrial and automotive markets. Earnings from operations reached $1.8 billion, reflecting ongoing cost management efforts amid macroeconomic pressures. The company also provided fourth-quarter guidance, projecting revenue between $3.95 billion and $4.35 billion.

In product updates, Texas Instruments launched new additions to its SimpleLink Wi-Fi portfolio, including the CC33xx series, designed for low-power IoT applications with enhanced security features to support edge computing deployments.

Operationally, the company expanded its manufacturing capacity in Dallas, Texas, with a new 300mm wafer fabrication facility aimed at boosting analog and embedded processing production over the next several years.

No significant strategic partnerships, acquisitions, regulatory approvals, legal developments, or management changes were announced during this period.

📊 Earnings Report Summary

Texas Instruments (TI) reported strong Q3 2025 results, with revenue reaching $4.74 billion, a 14% increase from $4.15 billion in Q3 2024. Operating profit rose 7% to $1.66 billion, while net income remained stable at $1.36 billion, leading to a slight EPS increase to $1.48. Cash flow from operations improved by 10% to $6.90 billion, and free cash flow surged 65% to $2.42 billion, representing 14% of revenue. TI returned $6.56 billion to shareholders, a 26% increase year-over-year, with dividends up 4% to $1.24 billion and stock repurchases significantly reduced to $119 million. The Analog segment was a standout performer, generating $3.73 billion in revenue (+16%). Looking ahead, TI anticipates Q4 revenue between $4.22 billion and $4.58 billion, with EPS between $1.13 and $1.39, reflecting ongoing operational strength and commitment to shareholder value.

📈 Technical Analysis

Daily Price Change: +0.70%

Technical Indicators

| Metric | Value |

|---|---|

| Current Price | $180.84 |

| Daily Change | 0.70% |

| MA20 | $179.45 |

| MA50 | $186.73 |

| MA200 | $184.51 |

| 52W High | $220.10 |

| 52W Low | $137.77 |

| % from 52W High | -17.84% |

| % from 52W Low | 31.26% |

| YTD % | -1.01% |

| BB Position | 59.49% |

| RSI | 50.41 |

| MACD | -2.29 |

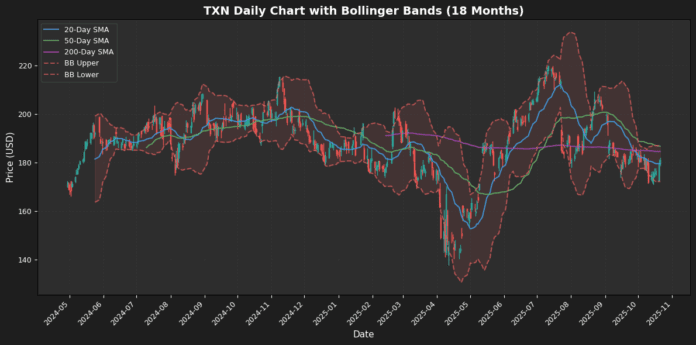

The current price of $180.84 reflects a modest daily gain of $0.70, indicating stability within the trading session. The stock is currently positioned 17.84% below its 52-week high of $220.10, while being 31.26% above its low of $137.77, suggesting a recovery trend from lower levels. The moving averages indicate a bearish sentiment, with the 20-day MA at $179.45 below the 50-day MA of $186.73 and the 200-day MA of $184.51. The RSI stands at 50.41, indicating neutral momentum, while the MACD of -2.29 suggests potential bearish pressure. Bollinger Bands show the stock trading near the upper band at $186.78, with the lower band at $172.11, reflecting low volatility. Overall, the stock appears to be consolidating, with mixed signals from the indicators.

💰 Earnings History

| Earnings Date | EPS Estimate | Reported EPS | Surprise(%) | Event Type |

|---|---|---|---|---|

| 2025-04-23 | 1.07 | 1.28 | 19.91 | Earnings |

| 2025-01-23 | 1.2 | 1.3 | 7.97 | Earnings |

| 2024-10-22 | 1.38 | 1.47 | 6.84 | Earnings |

| 2024-07-23 | 1.17 | 1.22 | 4.56 | Earnings |

| 2024-04-23 | 1.07 | 1.2 | 12.3 | Earnings |

| 2024-01-23 | 1.47 | 1.49 | 1.57 | Earnings |

| 2023-10-24 | 1.82 | 1.85 | 1.85 | Earnings |

| 2023-07-25 | 1.76 | 1.87 | 6.13 | Earnings |

Analyzing the EPS trends from the provided earnings data reveals a consistent pattern of positive surprises, indicating strong performance relative to market expectations. Over the last few earnings reports, the company has consistently reported EPS figures that exceed estimates, with the most notable surprise occurring on April 23, 2025, where the reported EPS of 1.28 surpassed the estimate of 1.07 by nearly 20%.

Looking at the trend, the EPS has shown a gradual increase from 1.76 in July 2023 to a peak of 1.49 in January 2024, followed by a slight fluctuation but remaining above the estimates. The company seems to be managing its operations effectively, leading to an upward trajectory in earnings. Moreover, the average surprise percentage across these reports is positive, suggesting that analysts may be underestimating the company’s earnings potential. This trend could bolster investor confidence and potentially enhance stock performance in the future.

💵 Dividend History

| Date | Dividend |

|---|---|

| 2025-07-31 | 1.36 |

| 2025-04-30 | 1.36 |

| 2025-01-31 | 1.36 |

| 2024-10-31 | 1.36 |

| 2024-07-31 | 1.3 |

| 2024-05-07 | 1.3 |

| 2024-01-30 | 1.3 |

| 2023-10-30 | 1.3 |

Analyzing the provided dividend data reveals a steady upward trend in dividends over the past few years. From the end of 2023 to mid-2025, dividends increased from $1.30 to $1.36, indicating a consistent commitment to returning value to shareholders. This incremental growth suggests that the company is not only maintaining profitability but also prioritizing shareholder rewards, which can enhance investor confidence.

The regularity of the dividend payments, occurring quarterly, reflects a stable cash flow and operational efficiency. The modest increase of $0.06 per share from 2024 to 2025, while not dramatic, signifies a careful and sustainable approach to dividend policy. Companies often face pressures to increase dividends, but a measured increase can be a sign of prudent management, especially in uncertain economic climates. Overall, these trends indicate a positive outlook for the company’s financial health and its dedication to shareholder engagement.

⭐ Analyst Ratings

| Date | Status | Outer | Rating | Price |

|---|---|---|---|---|

| 2025-10-20 00:00:00 | Downgrade | Mizuho | Neutral → Underperform | $150 |

| 2025-10-13 00:00:00 | Downgrade | BofA Securities | Neutral → Underperform | $190 |

| 2025-07-28 00:00:00 | Upgrade | Wolfe Research | Peer Perform → Outperform | $230 |

| 2025-07-23 00:00:00 | Reiterated | Wells Fargo | Equal Weight | $215 → $195 |

Recent rating changes reflect a cautious sentiment among analysts regarding certain stocks. The downgrades from Mizuho and BofA Securities, both shifting from “Neutral” to “Underperform,” indicate a growing concern over the companies’ future performance, particularly in light of market volatility or disappointing earnings projections. Mizuho’s downgrade at a price of $150 and BofA’s at $190 suggest that analysts are anticipating significant challenges ahead, which could impact investor confidence.

Conversely, Wolfe Research’s upgrade from “Peer Perform” to “Outperform” at a price of $230 demonstrates a more optimistic outlook for that particular stock, potentially signaling strong fundamentals or positive market developments. This upgrade contrasts sharply with the downgrades, indicating a bifurcated market where some companies are viewed favorably while others face headwinds. Additionally, Wells Fargo’s reiteration with a price adjustment from $215 to $195 suggests a reassessment rather than a complete shift in outlook, reflecting a more tempered perspective on growth potential. Overall, these changes highlight the dynamic nature of market sentiment and the importance of ongoing analysis.

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.