Thailand SET Index Shines with 0.90% Gain Amid Mixed Asian Markets

Note: This analysis covers the Asian trading session close for October 23, 2025. All times are in US Eastern Time (ET).

📊 Asian Indices Performance

| Index | Price | Daily Change (%) |

|---|---|---|

| Shanghai Composite | 3922.41 | +0.22 |

| Nikkei 225 | 48641.61 | -1.35 |

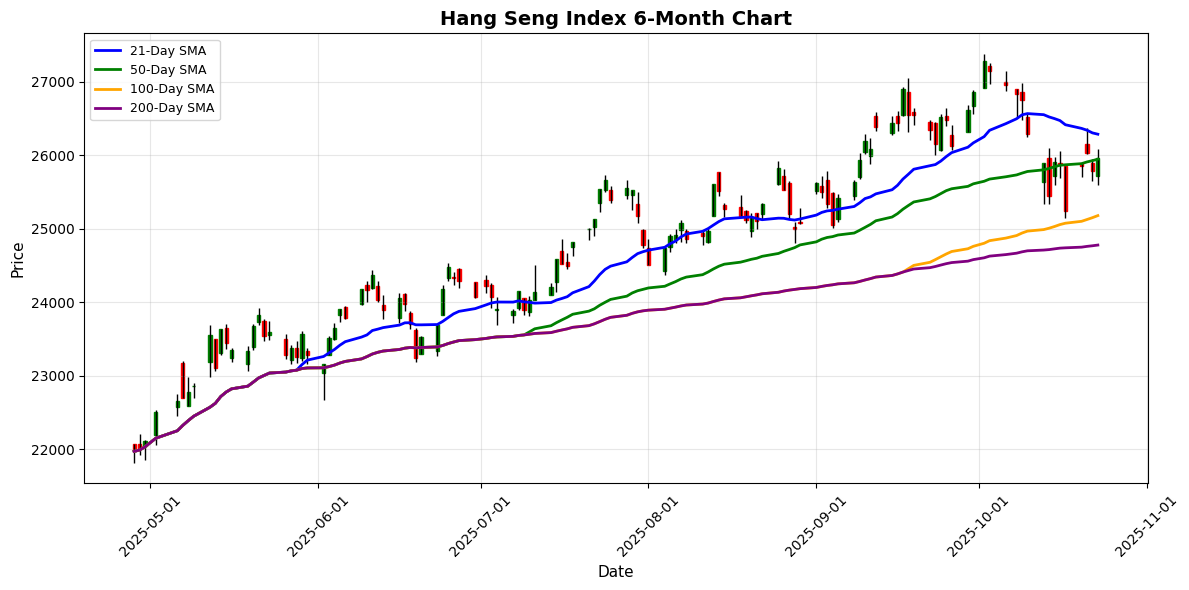

| Hang Seng Index | 25967.98 | +0.72 |

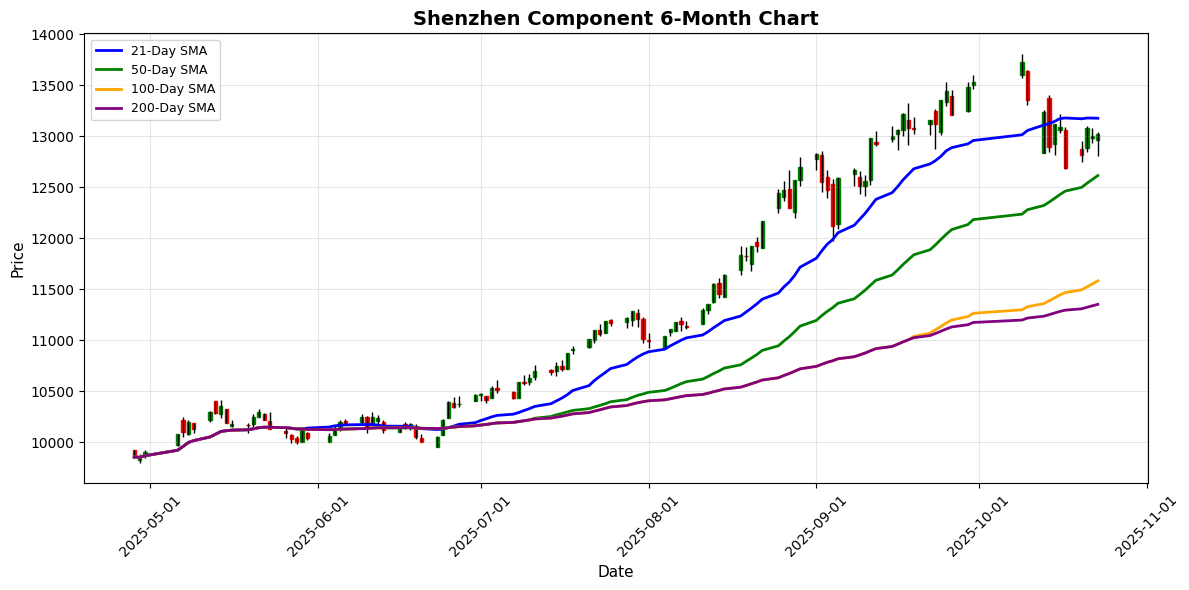

| Shenzhen Component | 13025.45 | +0.22 |

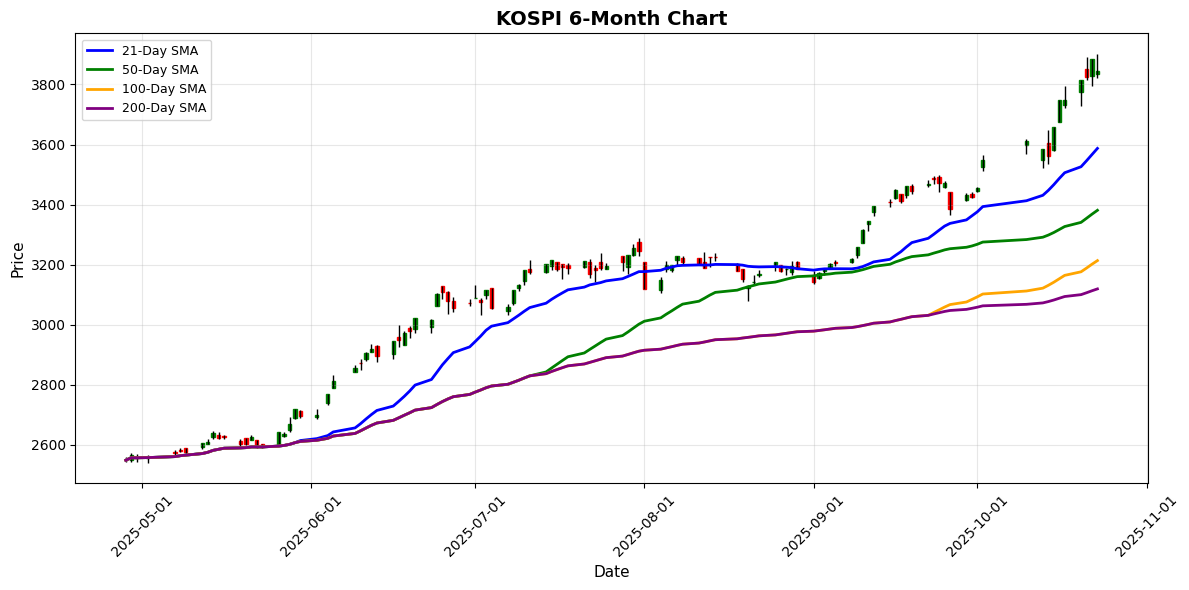

| KOSPI | 3845.56 | -0.98 |

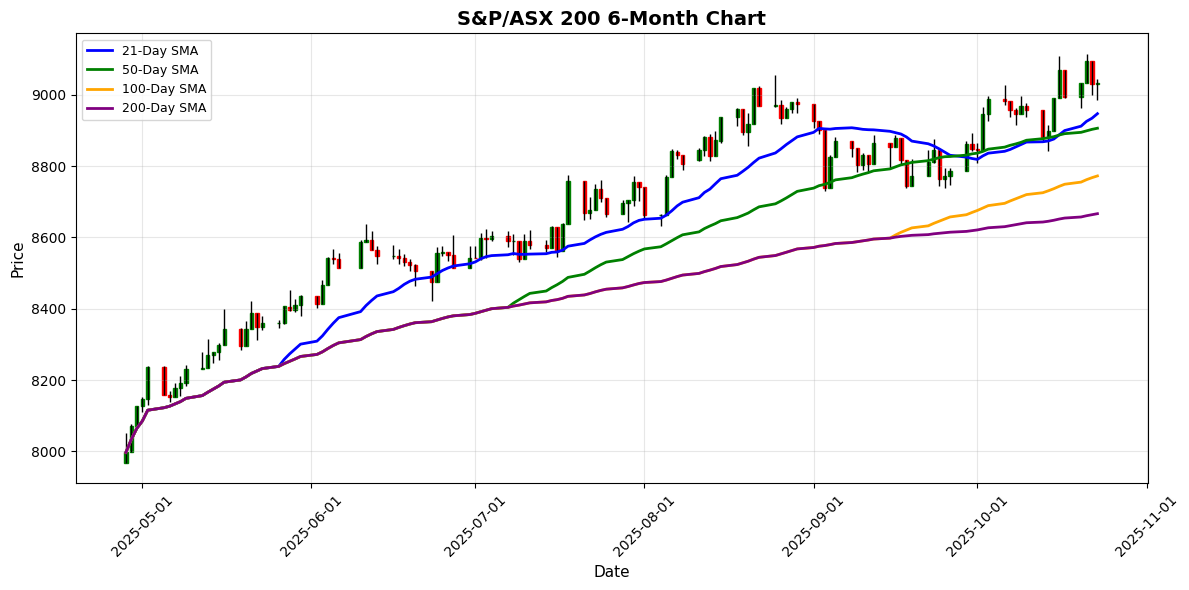

| S&P/ASX 200 | 9032.80 | +0.03 |

| NIFTY 50 | 25891.40 | +0.09 |

| Straits Times Index | 4416.27 | +0.51 |

| S&P/NZX 50 | 13377.10 | +0.53 |

| Thailand SET Index | 1302.35 | +0.90 |

| FTSE Bursa Malaysia KLCI | 1608.00 | +0.33 |

| TAIEX | 27532.26 | -0.42 |

📰 Market Commentary

On October 23, 2025, Asian markets exhibited a mixed performance, influenced by a combination of regional economic developments and specific events impacting investor sentiment.

The Hang Seng Index in Hong Kong saw a positive shift, rising by 0.72% to close at 25,967.98, buoyed by a generally optimistic outlook among investors despite recent legal controversies, including a high-profile manslaughter case involving a local surgeon. The case, while not directly affecting market fundamentals, has drawn attention to the healthcare sector’s regulatory environment, potentially influencing investor confidence in related stocks.

Conversely, the Nikkei 225 in Japan experienced a decline of 1.35%, closing at 48,641.61. This drop can be attributed to concerns over the potential implications of political changes, particularly with the expected continuation of policies by Japan’s new leadership, which may not favor a strong yen. The market sentiment reflects apprehension over the stability of economic policies that have historically supported equity growth.

In South Korea, the KOSPI fell by 0.98%, closing at 3,845.56, as investors reacted to global market trends and domestic economic indicators that suggested a slowdown in growth. The mixed signals from the U.S. economy also contributed to the cautious sentiment in the region.

The Shanghai Composite and Shenzhen Component indices both showed slight gains, with increases of 0.22% and 0.22%, respectively, indicating a stable outlook in mainland China. The Straits Times Index in Singapore rose by 0.51%, reflecting positive investor sentiment in the region, possibly bolstered by the recent appointment of Bikram Sen as market head for global South Asia at Bank of Singapore, signaling strategic growth in wealth management.

Additionally, the legal proceedings initiated by Withers on behalf of Asian investors regarding the Credit Suisse AT1 bond write-down have sparked interest among bondholders, reflecting a proactive stance in seeking redress and potentially impacting market dynamics in the financial sector.

Overall, while some indices faced downward pressure due to political and economic uncertainties, others showed resilience, reflecting a complex interplay of regional developments and investor sentiment across Asia.

📅 Economic Calendar – Asian Session

All times are in US Eastern Time (ET)

| Date | Time | Cur | Imp | Event | Actual | Forecast |

|---|---|---|---|---|---|---|

| 2025-10-22 | 01:00 | 🇸🇬 | Medium | Core CPI (YoY) (Sep) | 0.40% | 0.20% |

| 2025-10-22 | 01:00 | 🇸🇬 | Medium | CPI (YoY) (Sep) | 0.7% | 0.6% |

| 2025-10-22 | 19:30 | 🇯🇵 | Medium | National Core CPI (YoY) (Sep) | 2.9% | |

| 2025-10-22 | 19:30 | 🇯🇵 | Medium | National CPI (MoM) (Sep) | ||

| 2025-10-22 | 20:30 | 🇯🇵 | Medium | au Jibun Bank Services PMI (Oct) |

On October 23, 2025, significant economic data releases from Asia have implications for traders, particularly concerning Singapore and Japan.

In Singapore, the Core CPI (YoY) for September came in at 0.40%, outperforming the forecast of 0.20%. Additionally, the overall CPI (YoY) also exceeded expectations, reported at 0.7% against a forecast of 0.6%. These stronger-than-expected inflation figures may signal a tightening monetary policy stance from the Monetary Authority of Singapore, potentially boosting the Singaporean dollar and positively impacting Singaporean indices.

Conversely, Japan’s National Core CPI (YoY) data, released at 19:30 ET, is anticipated to be 2.9%, but the actual figure has not yet been disclosed. Similarly, the National CPI (MoM) and au Jibun Bank Services PMI for October are pending release. The market is closely monitoring these indicators as they could influence the Bank of Japan’s policy direction, especially amid ongoing inflation concerns.

Overall, today’s data highlights a mixed outlook for Asian economies, with Singapore showing resilience in inflation metrics while Japan’s upcoming releases may steer market sentiment in the region. Traders should remain vigilant for further developments.

📈 Individual Index Charts

Shanghai Composite

Hang Seng Index

Shenzhen Component

KOSPI

S&P/ASX 200

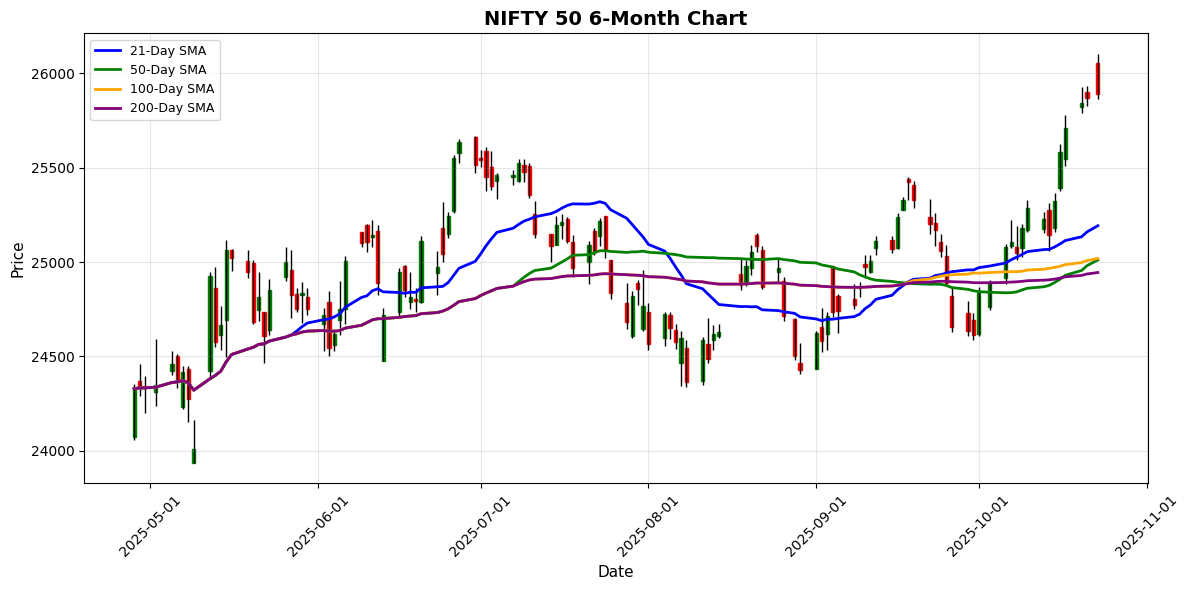

NIFTY 50

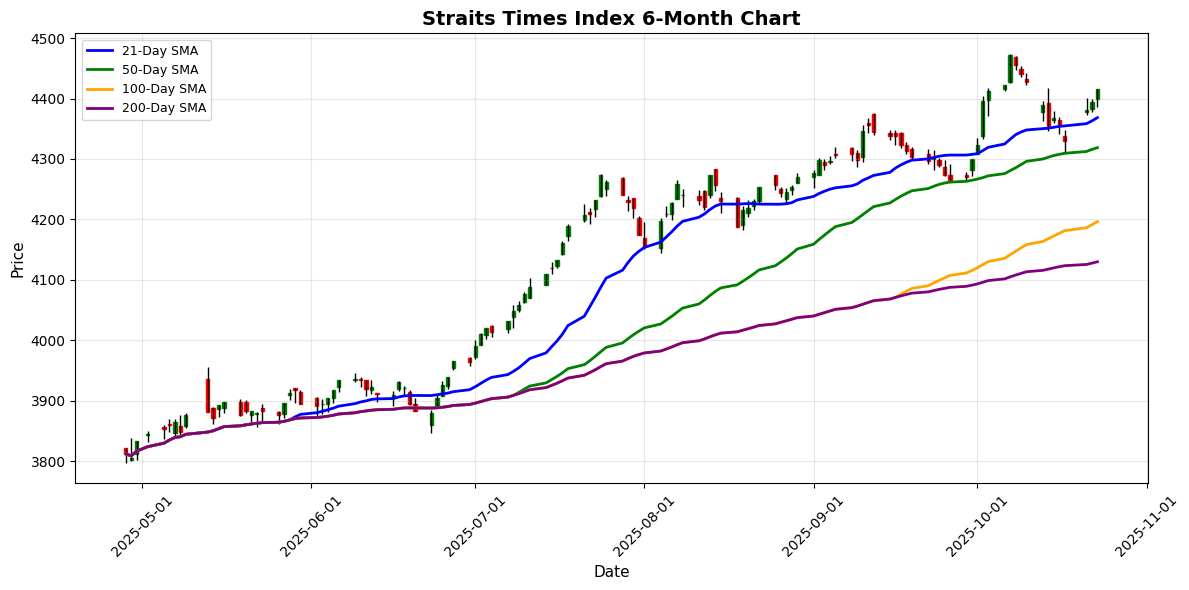

Straits Times Index

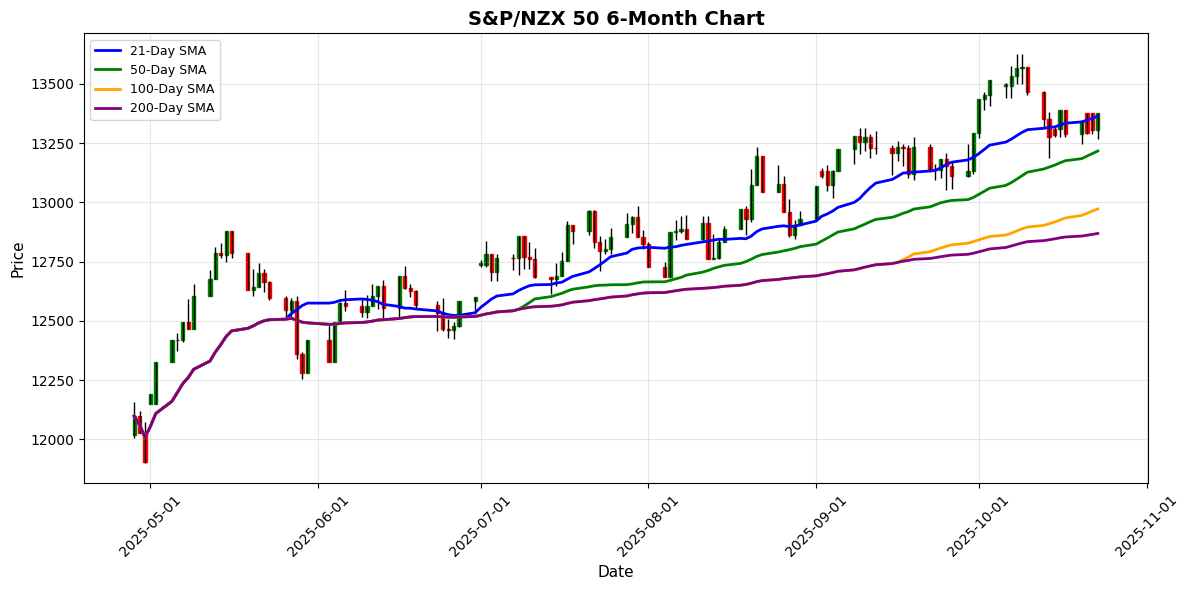

S&P/NZX 50

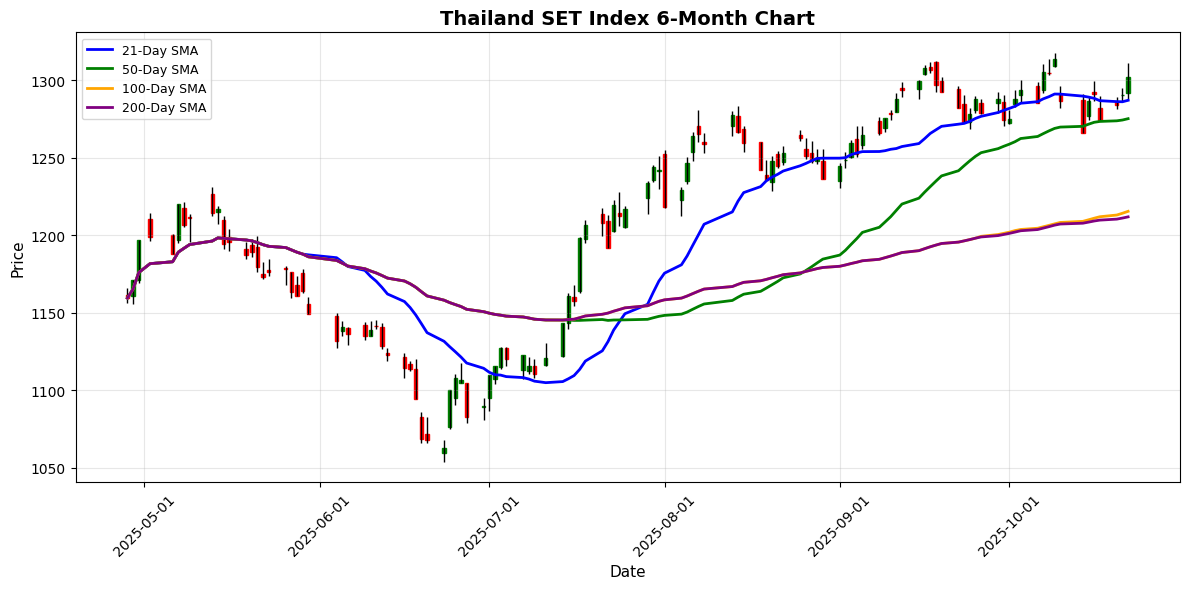

Thailand SET Index

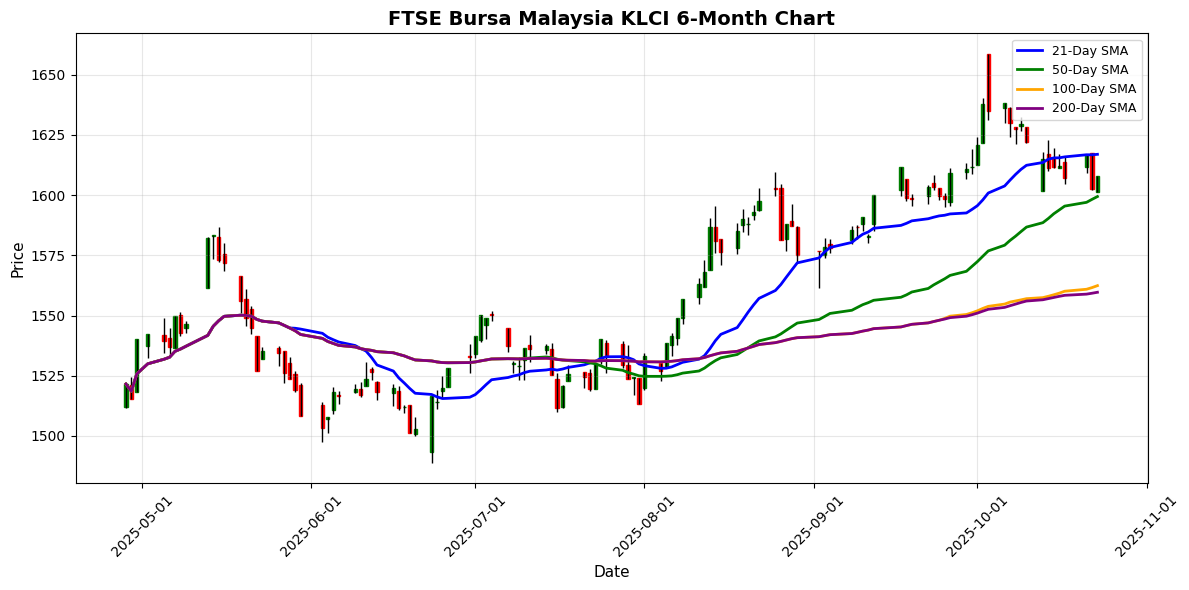

FTSE Bursa Malaysia KLCI

💱 FX, Commodities & Crypto

In the foreign exchange market, the USD/JPY pair saw a notable increase, rising by 0.48% to 152.6170, driven by expectations of continued monetary policy divergence between the U.S. and Japan. The USD/CNY and USD/SGD also experienced slight gains, reflecting ongoing trade dynamics and regional economic conditions.

In commodities, gold rose 1.73% to $4,136.50, buoyed by safe-haven demand amid geopolitical tensions. Crude oil surged 5.66% to $61.83, influenced by supply constraints and OPEC+ production decisions.

In the cryptocurrency sector, Bitcoin increased by 1.90% to $109,658.77, while Ethereum gained 2.53% to $3,903.18, supported by positive market sentiment and institutional interest. Overall, price movements across these asset classes reflect a complex interplay of economic indicators, geopolitical events, and market speculation.

Currency Pairs

| Currency Pair | Price | Daily Change (%) |

|---|---|---|

| USD/JPY | 152.62 | +0.48 |

| USD/CNY | 7.12 | +0.02 |

| USD/SGD | 1.30 | +0.20 |

| AUD/USD | 0.65 | +0.28 |

| NZD/USD | 0.57 | +0.10 |

| USD/INR | 87.84 | +0.16 |

Commodities

| Commodity | Price | Daily Change (%) |

|---|---|---|

| Gold | 4136.50 | +1.73 |

| Crude Oil | 61.83 | +5.66 |

Cryptocurrencies

| Crypto | Price | Daily Change (%) |

|---|---|---|

| Bitcoin | 109658.77 | +1.90 |

| Ethereum | 3903.18 | +2.53 |

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.