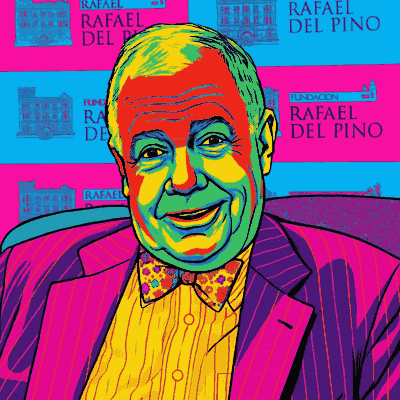

# The Contrarian’s Contrarian: The Worldly Wisdom of Jim Rogers

In the pantheon of investing greats, Jim Rogers stands apart. While Warren Buffett preaches buying wonderful companies within the United States “forever,” and George Soros famously broke the Bank of England, Rogers carved his legacy as the ultimate global contrarian and adventurer. A co-founder of the Quantum Fund with Soros—a fund that delivered a staggering 4,200% return over a decade—Rogers later eschewed Wall Street for a life traversing the globe on a motorcycle, seeking investment truths where others feared to tread.

His philosophy is a unique blend of macroeconomic analysis, historical study, and an almost innate sense for spotting seismic shifts long before they appear on a Bloomberg terminal. To understand Rogers is to understand that the next great opportunity is almost never found in the headlines of today, but on the back roads of tomorrow.

## The Philosophy: Invest in Change, See the World

Rogers’s investment bedrock is breathtakingly simple in theory yet profoundly difficult in practice: **”Invest in what you know.”** But for Rogers, “knowing” doesn’t mean reading a quarterly report; it means firsthand observation.

His methodology is built on several core principles:

1. **The Power of Contrarian Thinking:** Rogers is famous for his maxim, “Sell euphoria, buy despair.” He believes the herd is almost always wrong at the market’s major turning points. His most famous calls have been based on this principle—shorting tech stocks before the 2000 dot-com bust and predicting the commodities supercycle in the late 1990s when natural resources were universally despised.

2. **Macro-Top-Down Investing:** Unlike stock-pickers who start with a company, Rogers starts with the world. He analyzes global macroeconomic trends—shifts in trade, demographics, politics, and agriculture—to identify entire sectors or countries poised for long-term change. He then finds the best way to invest in that theme, be it through commodities, currencies, or equities.

3. **The Importance of History:** Rogers is a voracious student of history. He believes that while technology changes, human nature and the patterns of commerce do not. By understanding the economic cycles of the past—like the last great commodities bull market in the 1970s—he attempts to anticipate the cycles of the future.

## Famous Calls and Investments

Rogers’s career is a case study in prescient, and often early, calls:

* **The Commodities Supercycle (1998-2008):** While the tech world was enamored with IPOs, Rogers saw that decades of underinvestment in mines, farms, and oil fields had set the stage for a historic supply crunch. He launched his own commodities index and famously predicted a bull market that would last for years. He was right; commodities saw an unprecedented rally, with oil, gold, and agricultural products soaring.

* **China’s Rise:** After his first motorcycle trip across China in the 1990s, Rogers became one of the earliest and most vocal Western bulls on the Chinese economy. He saw the immense productivity, work ethic, and shift towards capitalism. He taught his young daughters Mandarin, proclaiming the 21st century would be the “century of China.”

* **The U.S. Bear Market Call:** For years, Rogers has been a critic of U.S. fiscal policy, citing soaring debt levels and irresponsible spending. He has repeatedly warned that this will lead to a painful bear market and a loss of confidence in the U.S. dollar as the world’s reserve currency.

## Rogers Today: Caution and Commodities

Never one to follow the crowd, Rogers’s current views remain staunchly contrarian. He is deeply concerned about the global debt bubble, calling it the worst in recorded history. He sees the massive money printing by central banks as storing up immense problems, namely inflation and currency crises.

His investment stance reflects this pessimism:

* **He is Short U.S. Equities:** He believes the long bull market has created inflated valuations and complacency.

* **He is Long Commodities (Again):** He views agriculture as one of the most compelling opportunities, noting that farmers are aging and few young people are entering the profession amidst rising global demand for food.

* **He is Long China:** Despite recent economic troubles, he maintains a long-term bullish stance, though he is careful to distinguish between buying Chinese companies listed abroad and those on domestic exchanges.

* **He Owns Safe-Haven Assets:** He holds significant positions in gold and silver, which he views as real money and a hedge against currency debasement.

## Lessons for the Individual Investor

While few can replicate Rogers’s globe-trotting lifestyle or his high-risk trades, his core principles are universally applicable:

1. **Do Your Own Homework:** Never buy a stock because a TV pundit or newsletter recommends it. Research it yourself. Understand the business, the industry, and the broader economic context.

2. **Be Contrarian, But Be Patient:** It’s not enough to just bet against the crowd. You must be right, and you must be early. A contrarian bet can be painful for a long time before it pays off. As Rogers says, “Wait for the pitch you can hit.”

3. **Look Beyond Your Border:** The best opportunities aren’t always at home. Broaden your horizon and consider global markets and trends.

4. **Understand Macro Trends:** Pay attention to interest rates, currency movements, and government policy. These forces have a greater impact on your portfolio than most individual company news.

Jim Rogers remains a fascinating figure—part investor, part prophet, part adventurer. His career is a powerful testament to the value of independent thought, relentless curiosity, and the courage to act on one’s convictions, even when standing alone.