# The Goldman Sachs Group, Inc. (GS) Earnings Commentary

# Goldman Sachs Group, Inc.: Navigating Financial Services with Strength and Innovation

## 1. Introduction

Goldman Sachs Group, Inc. is a renowned financial services company with a rich history dating back to 1869. The company operates through various segments, including Global Banking and Markets, Asset and Wealth Management, and Platform Solutions. Known for its investment banking, global investments, and consumer banking services, Goldman Sachs is a key player in the financial industry, headquartered in New York, NY.

## 2. Recent News

In recent news, Goldman Sachs has been making waves in the financial world. The company delivered a powerhouse performance in Q2, beating profit forecasts and showcasing strength in equities. The stock is set to outperform, with a surge in trading revenue and investment banking revenue driving profits higher. Additionally, Goldman Sachs announced a 33.3% dividend increase, further boosting investor confidence in the company’s financial health and growth prospects.

## 3. Price Trend

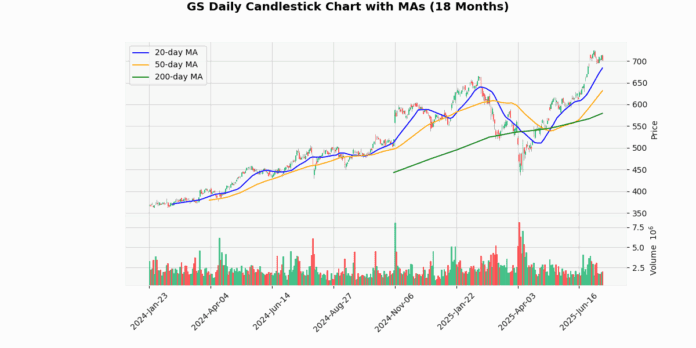

Goldman Sachs’ current price stands at $702.51, with a slight increase to $706.28. The stock has been trading above its 20-day moving average by 2.75%, indicating short-term bullish momentum. However, it is trading below its 50-day and 200-day moving averages by 11.26% and 21.24%, respectively. The 52-week high is at $726.0, while the low is at $428.38, showcasing significant price fluctuations. The Relative Strength Index (RSI) stands at 63.96, indicating a neutral position, and the Moving Average Convergence Divergence (MACD) at 24.64 suggests a bullish signal.

## 4. Q10 Summary

Goldman Sachs reported impressive Q2 results, with net revenues of $14.58 billion, a 15% increase year-over-year. The company’s net earnings reached $3.72 billion, with an EPS of $10.91. Notable highlights include a 33% dividend increase, record assets under supervision, and a surge in net interest income by 56%. The effective income tax rate increased to 20.2%, and the firm returned $3.96 billion to common shareholders during the quarter.

## Earnings Trend Table

| Date | Estimate EPS | Reported EPS | Surprise % | |

|---|---|---|---|---|

| 0 | 2025-07-16 | 9.65 | 10.91 | 13.06 |

| 1 | 2025-04-14 | 12.35 | 14.12 | 14.33 |

| 2 | 2025-01-15 | 8.22 | 11.95 | 45.30 |

| 3 | 2024-10-15 | 6.89 | 8.40 | 21.98 |

| 4 | 2024-07-15 | 8.34 | 8.62 | 3.30 |

| 5 | 2024-04-15 | 8.56 | 11.58 | 35.28 |

| 6 | 2024-01-16 | 3.51 | 5.48 | 56.02 |

| 7 | 2023-10-17 | 5.31 | 5.47 | 2.98 |

## 5. Earnings Trend

Goldman Sachs has shown consistency in its earnings performance over the last eight quarters. The company has demonstrated a strong EPS trend, with a 27% increase year-over-year in Q2 2025. While there was a slight decrease from the previous quarter, the overall EPS growth remains robust. Investors can expect continued positive surprises and stable earnings growth from Goldman Sachs.

## Dividend Payments Table

| Date | Dividend |

|---|---|

| 2025-05-30 | 3 |

| 2025-02-28 | 3 |

| 2024-12-02 | 3 |

| 2024-08-30 | 3 |

| 2024-05-30 | 2.75 |

| 2024-02-28 | 2.75 |

| 2023-11-29 | 2.75 |

| 2023-08-30 | 2.75 |

## 6. Dividend Summary

Goldman Sachs has increased its dividend by 33.3% in the latest announcement, reflecting the company’s confidence in its financial position and future prospects. Over the last eight samples, the dividend trend has been positive, with a focus on rewarding shareholders through consistent dividend growth.

## 7. Ratings

Recent rating changes for Goldman Sachs include downgrades from firms like Citizens JMP, HSBC Securities, Morgan Stanley, and Daiwa Securities. These downgrades indicate a shift in market sentiment towards the company, with revised target prices and rating adjustments affecting investor perceptions.