The People’s Bank of China cut its benchmark loan prime rate by 10 basis points, as it was expected by the financial community.

Hang Seng down -264.89 points to 19,648.00, -1.33% while the Shanghai Composite is losing 0.47% at 3,240.36.

US cash equity session was closed yesterday for the celebration of Juneteenth National Independence Day.

DAX in Germany losing 0.29% to 16,153.75 and Euro Stoxx 50 is at 4,362.95 , almost unchanged.

Futures in negative territory heading for a negative opening for US indices: Dow Futures -0.25% , Nasdaq100 contract losing 0.14% and S&P500 futures down 0.17%.

Crude Oil WTI is holding above 70$ at 71.61 $/barrel while Gold is trading below 1.970 at 1,967.4 , down 0.19%.

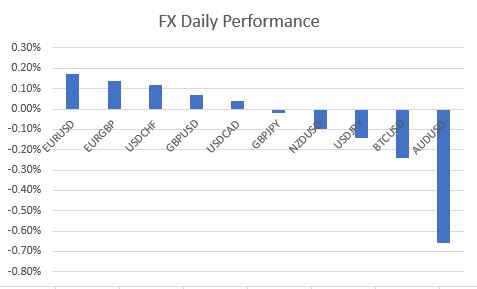

AUD/USD is the worst performing rate among the major pairs. At 0.6805 is down 0.66% following the Minutes of the Reserve Bank of Australia, which triggered speculation that tightening process would be close to an end. EUR/USD up by 0.17% at 1.094

Before the opening of US spot equity session will be released Building Permits and Housing Starts. Fed’s Williams, will hold a speech during the session. The Federal Reserve Bank of New York president is considered to have an hawkish perspective on current setting of monetary policy.