Published in 1923, this masterpiece of financial literature has guided generations of traders and investors. Written as a first-person narrative, the book chronicles the life and trading philosophy of one of the most

legendary speculators in American history.

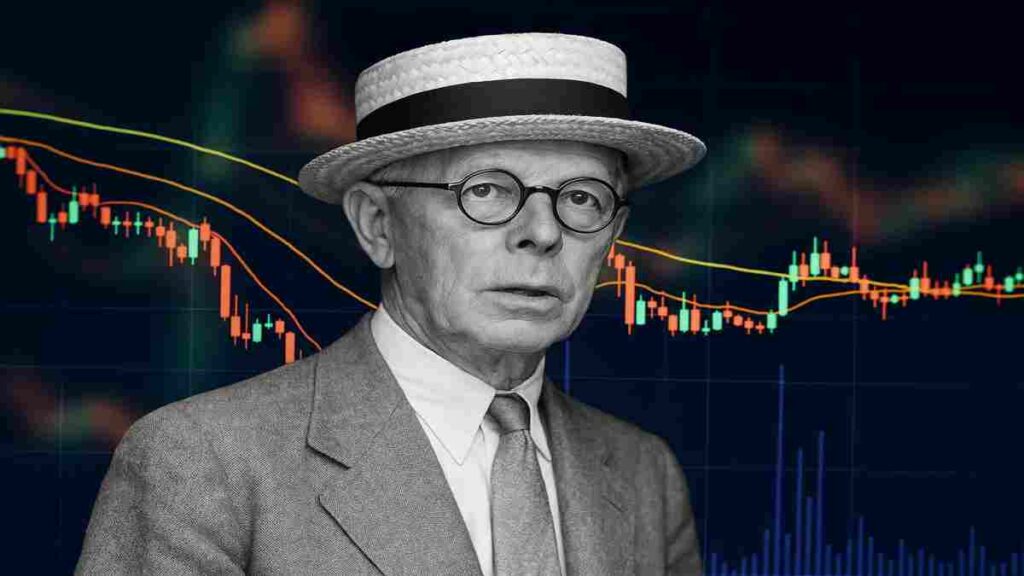

Bio of Edwin Lefèvre: Edwin Lefèvre (1871–1943) was an American journalist, writer, and diplomat, who is most noted for his writings on Wall Street business.. Edwin Lefèvre’s experiences directly influenced Reminiscences of a Stock Operator, providing timeless insights into trading and speculation.

Jesse Lauriston Livermore (July 26, 1877 – November 28, 1940) was an American stock trader. He is considered a pioneer of day trading and was the basis for the main character of Reminiscences of a Stock Operator, a best-selling book by Edwin Lefèvre. At one time, Livermore was one of the richest people in the world; however, at the time of his suicide, he had liabilities greater than his assets.

In a time when accurate financial statements were rarely published, getting current stock quotes required a large operation, and market manipulation was rampant, Livermore used what is now known as technical analysis as the basis for his trades. His principles, including the effects of emotion on trading, continue to be studied.

Some of Livermore’s trades, such as taking short positions before the 1906 San Francisco earthquake and just before the Wall Street Crash of 1929, are legendary within investing circles. Some observers have regarded Livermore as the greatest trader who ever lived, but others have regarded his legacy as a cautionary tale about the risks of leverage to seek large gains rather than a strategy focused on smaller yet more consistent returns.. Jesse Livermore’s experiences directly influenced Reminiscences of a Stock Operator, providing timeless insights into trading and speculation.

The book’s enduring popularity stems from its honest portrayal of both triumph and failure, offering readers

a realistic view of speculation that few modern works can match.

The Roaring ’20s: A Wild West of Speculation

Published in 1923, Reminiscences of a Stock Operator emerged during the Roaring Twenties, a decade of post-World War I economic exuberance. The U.S. economy boomed with a 42% GDP rise from 1921-1929, driven by industrial growth and consumer credit, which tripled installment buying. Stock markets soared, with the Dow Jones up 500%, fueled by retail speculation and radio-hyped tips. Margin trading allowed 90% borrowing, amplifying gains, while unregulated “bucket shops” let small traders bet on prices without ownership—often rigged. The Federal Reserve focused on banks, not bubbles, and no SEC existed until 1934, permitting insider trading and market pools. This chaos shaped Livermore’s tactics, warning of speculation’s pitfalls before the 1929 Crash triggered reforms. In 2025, these lessons echo in crypto volatility and AI-driven markets.

Understanding this historical context is crucial to appreciating Livermore’s achievements and the principles he developed.

The era he traded in lacked modern regulations, computer systems, and instant global communication, yet the psychological

principles he discovered remain universally applicable to today’s markets.

In “Reminiscences of a Stock Operator,” Jesse Livermore gives an intimate account of his transformation from an impulsive, inexperienced trader to a seasoned speculator with a profound understanding of market psychology. The book, presented as a fictionalized narrative, offers timeless insights into trading strategies, market dynamics, and the psychological challenges faced by traders. Livermore’s experiences underscore the critical relationship between emotional intelligence and analytical decision-making, providing guidance for traders navigating the complexities of financial markets.

1. Jesse Livermore’s Trading Style and Philosophy

Livermore’s trading journey begins in the humble confines of bucket shops, where he develops a knack for tape reading—an essential skill that involves analyzing price movements to foresee stock trends. He treats trading not merely as a gamble, but as a science grounded in systematic observation and strategy. The ‘sitting tight’ principle emerges as one of his vital philosophies, emphasizing that successful trading often requires the discipline to maintain winning positions rather than prematurely cashing in profits. Livermore insists that the true test of a trader’s acumen lies in being right AND having the patience to sit tight on that position until the market confirms it. He articulates this idea through numerous anecdotes that showcase his successes and failures, revealing that market trends operate on lines of least resistance and that recognizing these trends is crucial to successful trading.

Moreover, Livermore’s embrace of market trends is characterized by a deep understanding of crowd psychology. He notes that stock prices are often influenced by the collective sentiment of the market rather than underlying fundamentals. By reading the ‘tape’—the stream of prices and trading volumes—Livermore learns to anticipate market moves and to use those insights to his advantage. His emphasis on psychological factors, such as fear and greed, defines a core aspect of his trading philosophy, indicating that successful traders must cultivate a keen awareness of not only their own impulses but also those of the market participants around them.

2. Major Successes and Devastating Defeats

Livermore experienced a rollercoaster of highs and lows throughout his career, a testament to the volatile nature of financial markets. His notable triumph during the 1907 market panic exemplifies his ability to capitalize on chaos; he shorted stocks effectively, amassing a fortune when most traders succumbed to panic. Similarly, his adept handling of cotton trades showcases an early awareness of market manipulation—skillfully reading price movements and industry signals to extract substantial profits.

However, his path to success was fraught with significant pitfalls. Livermore endured multiple bankruptcies driven by factors such as overleveraging and emotional decision-making. A particularly harrowing setback occurred during a failed attempt to corner the cotton market, resulting in massive financial losses that starkly reminded him of the dangers of speculative fervor. His pride often clouded his judgment, leading him to take on substantial risk when he felt invincible, only to face the subsequent reality of financial ruin. This cycle of rise, fall, and recovery illustrates not only his resilience but also the importance of emotional fortitude and humility in trading.

Livermore’s comebacks further cemented his legacy; after each bankruptcy, he returned to the markets with renewed insight, applying lessons learned from previous mistakes. His willingness to adapt and reflect on his failures underscores a crucial principle: resilience is a necessary trait for anyone seeking long-term success in trading.

3. Market Psychology and Timeless Lessons

At the heart of Livermore’s narrative lies a profound exploration of market psychology and crowd behavior. He astutely observes that human emotions, such as fear and greed, significantly influence trading patterns. The tendency to follow tips and market rumors—often leading to disaster—serves as a warning against blind speculation. Livermore emphasizes the importance of independent thinking, advocating for a methodical approach rooted in thorough analysis rather than succumbing to the manipulations prevalent in the trading environment.

His keen insights extend to the importance of proper position sizing and risk management. Livermore illustrates that understanding one’s tolerance for risk is vital, as overexposure can result in catastrophic losses. He recalls a pivotal moment when he learned the value of cutting losses quickly; by recognizing the signs of shifting market sentiment, Livermore adapted his strategies to mitigate damage—a lesson that remains relevant for traders today.

The distinction between gambling and intelligent speculation is another foundational lesson from Livermore’s experiences. He argues that successful traders must employ strategies based on careful analysis and data, distinguishing their decisions from those driven by luck or emotional impulses. Livermore’s reflections on manipulation and unpredictability reveal a nuanced understanding of market mechanics; this awareness enables traders to navigate the volatile seas of speculative trading with greater confidence.

4. Key Anecdotes, Stories, and Modern Relevance

Throughout “Reminiscences of a Stock Operator,” Livermore shares captivating anecdotes that illustrate his evolution and the lessons gleaned from his experiences. One memorable story involves his encounter with “Old Turkey,” a sage trader who imparts wisdom about bull markets, pedalling the adage that during such periods “the trend is your friend.” This perspective reinforces the value of aligning trades with prevailing market conditions—an insight still paramount for traders today.

Another significant lesson surfaces when Livermore reflects on the unpredictability of trading; he notes that what is ‘expected’ rarely occurs. This acknowledgment of the inherent uncertainty within financial markets encourages modern traders to adopt adaptive strategies and maintain a flexible mindset. Warnings against excessive leverage and impatience echo throughout his narrative, reinforcing the core principle that successful trading relies not just on intellectual prowess, but also on a disciplined, patient approach to the markets.

For contemporary traders, Livermore’s experiences illustrate how to harness market dynamics effectively and cultivate a mindset resilient to the emotional fluctuations that accompany trading. His struggles with overconfidence serve as a cautionary tale; it is essential to balance ambition with calculated risk. The timeless lessons presented in Livermore’s account guide traders towards developing an analytical perspective, applying psychological insights to navigate the evolving landscape of modern markets.

In conclusion, “Reminiscences of a Stock Operator” is not merely a chronicle of Jesse Livermore’s trading experiences but a profound exploration of the intricate interplay between psychology, strategy, and market dynamics. Livermore’s story encapsulates essential trading principles that resonate across generations—underscoring that in the world of finance, wisdom derived from both success and failure plays a crucial role in crafting a trader’s journey. As modern markets continue to evolve, the enduring relevance of Livermore’s insights ensures that his legacy will guide traders in the pursuit of achievement and mastery.

In conclusion, ‘Reminiscences of a Stock Operator’ remains essential reading for anyone serious about trading and investing.

Jesse Livermore’s journey from teenage bucket shop trader to Wall Street legend offers lessons that transcend time and technology.

His emphasis on patience, independent thinking, and emotional discipline speaks directly to the challenges traders face today.

While markets have evolved with electronic trading, algorithmic systems, and global connectivity, the psychological principles

Livermore discovered remain unchanged. Fear and greed still drive market participants. Crowds still make the same mistakes.

The speculator who masters their emotions and thinks independently still has the advantage.

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.