Leverage serves as a powerful but double-edged sword in trading and investing. It has the potential to amplify gains significantly, but it can also magnify losses, making it crucial for investors and traders to be aware of the risks involved. This article explores leverage, with examples from margin trading on stocks and futures, to illustrate its potential benefits and dangers.

Leverage involves borrowing capital to increase the potential return on an investment. By using leverage, traders can control a larger position than their cash balance would otherwise permit. This means that leverage allows an individual to amplify their exposure to the market without needing an equivalent amount of cash on hand.

Margin trading is a form of leverage that is commonly used in the stock market. In margin trading, you borrow money from a broker to purchase stocks. To engage in this type of trading, one must have a margin account with a broker, which allows borrowing funds to buy stocks. Brokers usually require you to have a certain percentage of the purchase price as a down payment, known as the initial margin. For instance, if you want to buy $10,000 worth of stock and the initial margin requirement is 50%, you need to have at least $5,000 in your account. This setup gives you buying power of $10,000, allowing you to purchase twice the amount of stock you could with your own funds.

To illustrate this, suppose you have $5,000 and decide to use it as margin to buy $10,000 worth of stock. If the stock price increases by 10%, your investment grows to $11,000, leading to a profit of $1,000, which amounts to a 20% return. However, if the stock price drops by 10%, your investment falls to $9,000, resulting in a $1,000 loss, equating to a 20% loss. This example demonstrates how leverage magnifies both gains and losses.

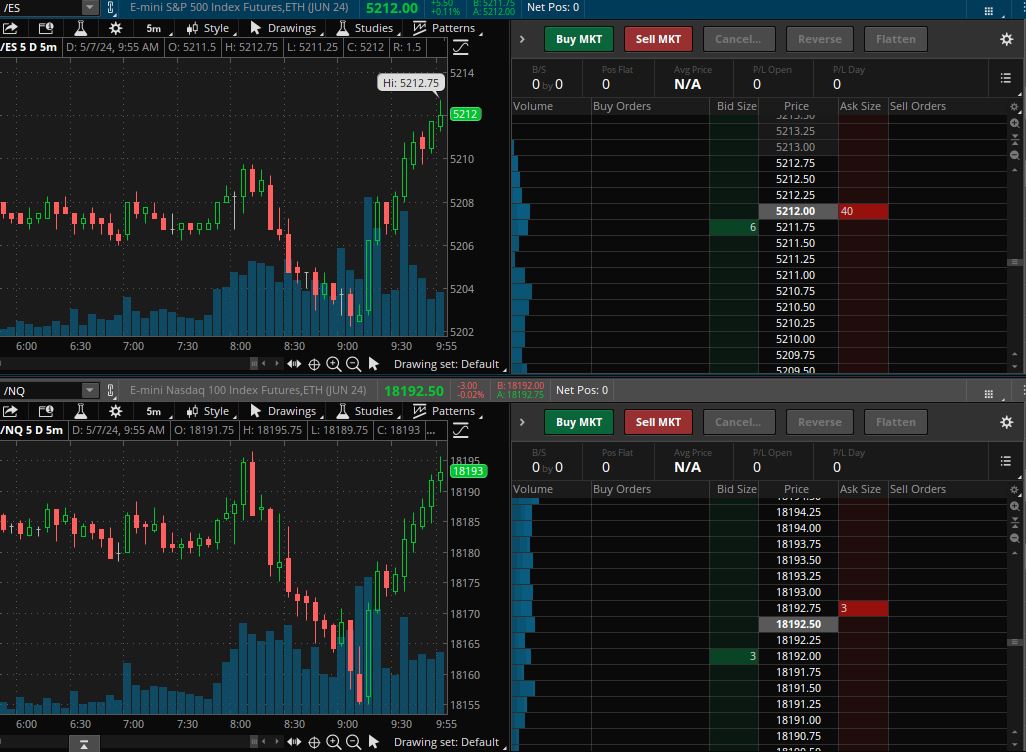

Futures contracts, on the other hand, are inherently leveraged. When trading futures, you only need to deposit a small percentage of the contract’s value, known as the initial margin. This margin is typically between 5% and 10% of the contract value, providing even greater leverage than stock margin trading. For example, if you’re trading a futures contract worth $100,000 with an initial margin of 10%, you need to deposit $10,000 as margin to control the $100,000 position. If the contract value increases by 1%, your investment rises to $101,000, yielding a $1,000 profit, which is a 10% return on margin. However, if the contract value decreases by 1%, your investment falls to $99,000, resulting in a $1,000 loss, or a 10% loss on margin.

Both stock and futures trading on margin expose you to the risk of a margin call. If your account equity falls below the maintenance margin requirement, your broker will issue a margin call, requiring you to deposit additional funds or sell assets to cover the shortfall. Furthermore, leverage magnifies losses, which can result in losing more than your initial investment. Futures, being generally more volatile than stocks, make leveraged trading in futures even riskier. Additionally, in margin trading, you pay interest on the borrowed funds, which can erode profits or exacerbate losses.

Recovering from Losses

One of the most daunting aspects of trading and investing, especially when using leverage, is the difficulty of recovering from losses. If you incur a significant loss, it requires a disproportionately larger gain to recover to the original position. For example, a 10% loss requires an 11.1% gain to recover, while a 20% loss requires a 25% gain to recover, as illustrated in the table below:

| Loss (%) | Required Gain (%) |

|---|---|

| 5 | 5.3 |

| 10 | 11.1 |

| 20 | 25 |

| 30 | 42.9 |

| 40 | 66.7 |

| 50 | 100 |

| 60 | 150 |

| 70 | 233.3 |

| 80 | 400 |

| 90 | 900 |

Leverage can accelerate this loop if losses are not cut in time. Given the magnifying effect of leverage, a small adverse price movement can quickly result in substantial losses. If not managed properly, such losses can spiral, making it increasingly difficult to recover.

Managing Leverage

To manage the risks associated with leverage, it’s crucial to implement robust risk management strategies. Setting stop-loss orders, which automatically sell your position if the price moves against you, can help limit potential losses. Additionally, it’s important to avoid over-leveraging by limiting the size of your positions relative to your overall portfolio. Regularly monitoring your margin account helps ensure you meet margin requirements and avoid margin calls. It’s also vital to fully understand the leverage you’re using and the potential consequences, as leverage ratios vary across different instruments.

In conclusion, leverage in trading and investing can be a powerful tool for increasing returns, but it also carries significant risks. By understanding how leverage works and implementing proper risk management strategies, investors can navigate the potential pitfalls of margin trading on stocks and futures.