The real estate market is notoriously known for its high entry barriers, daunting costs, and intensive management requirements. However, Real Estate Investment Trusts (REITs) provide an innovative path for individual investors to navigate these challenges and gain exposure to the lucrative property market. By transforming real estate assets into publicly-traded securities, REITs have democratized access to an asset class traditionally reserved for the wealthy, underlining the concept of inclusive growth in the financial industry.

What are REITs?

Real Estate Investment Trusts (REITs) are corporations, trusts, or associations that own and, in most cases, operate income-producing real estate. The creation of REITs back in 1960 by the U.S. Congress allowed individual investors to invest in large-scale, diversified portfolios of real estate, similar to investing in other industries through the purchase of stocks.

Specific Rules for REITs

To qualify as a REIT and reap the associated tax advantages, a company must comply with certain regulations as per the Internal Revenue Code:

Investment Requirements: At least 75% of the company’s total assets must be invested in real estate, cash, or U.S. Treasuries.

Income Sources: At least 75% of the company’s gross income must be derived from rents, interest on mortgages that finance real property, or real estate sales.

Distribution of Income: To avoid paying corporate income tax, a REIT is required to distribute at least 90% of its taxable income to shareholders annually in the form of dividends.

Shareholder Requirements: A REIT must be structured as a corporation, trust, or association and must be managed by a board of directors or trustees. It must have a minimum of 100 shareholders after its first year of existence, and no more than 50% of its shares can be held by five or fewer individuals during the last half of the taxable year.

Listing: REIT shares must be fully transferable and must be listed on a national securities exchange.

By complying with these regulations, a REIT can avoid paying corporate income tax, allowing it to distribute a larger portion of its income to shareholders. This preferential tax treatment is one of the defining advantages of REITs. However, failure to meet these stringent criteria can result in the loss of REIT status, leading to adverse tax consequences. Thus, these rules provide a regulatory framework that promotes transparency, regular income distribution, and a focus on real estate activities, making REITs an attractive investment for a wide range of individuals.

Performance in an Uncertain Economic Landscape

In the years following the COVID-19 pandemic, REITs have demonstrated robust resilience and adaptability. While certain sectors like hospitality and retail REITs initially suffered due to lockdowns and social distancing regulations, others, such as industrial and data center REITs, thrived amidst the growing demand for e-commerce and remote working capabilities.

As economies worldwide recover and reshape, the REIT landscape is also evolving. Retail REITs are finding innovative ways to repurpose their space, focusing on experiential retail or transforming into mixed-use properties. Office REITs are similarly reimagining the conventional workspace to cater to the hybrid working trend. The strong bounce-back performance of the lodging and resorts REIT sector indicates an anticipated post-pandemic tourism boom.

Risks Associated with REITs

While the benefits of investing in REITs are enticing, it’s vital to understand the associated risks. Firstly, REITs are heavily influenced by prevailing economic conditions. Any economic downturn or uncertainty can negatively impact the real estate market and thus REITs.

Secondly, REITs are also exposed to interest rate risk. As rates rise, financing costs for REITs increase, reducing their profitability. Higher rates may also make bond investments more attractive, driving investors away from REITs and decreasing their share prices.

Thirdly, specific REITs sectors might face particular risks. For example, retail REITs are vulnerable to the growth of e-commerce, while office REITs face challenges with the rise of remote work.

Lastly, like any investment, REITs are subject to market risk. Share prices can fluctuate, meaning investors can lose money if they sell when prices have fallen.

Benefits of REITs for the Modern Investor

REITs offer several unique advantages for the contemporary investor. They provide a straightforward method to diversify a traditional portfolio of stocks and bonds with real estate exposure, offering a hedge against inflation.

REITs have a mandatory payout requirement, with 90% of taxable income required to be distributed to shareholders annually, translating into attractive dividend yields for investors. They also offer a high degree of liquidity, allowing investors to buy or sell shares with ease, unlike direct real estate investment.

The Path Forward for REITs

The future trajectory of REITs is largely tied to technological advancements and demographic shifts. As urbanization increases and cities become more dense, the demand for affordable housing REITs is likely to rise. The continual technological disruption means that data centers and infrastructure REITs are well-positioned for growth.

The aging population also presents an opportunity for growth in healthcare REITs, as the demand for specialized facilities like assisted living and memory care centers is expected to increase.

Moreover, as sustainability becomes an integral part of our lives, the rise of green REITs that focus on environmentally friendly buildings is a promising trend. These REITs not only cater to increasing regulatory pressures but also tap into the growing investor appetite for socially responsible investing.

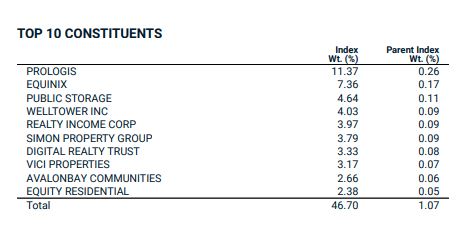

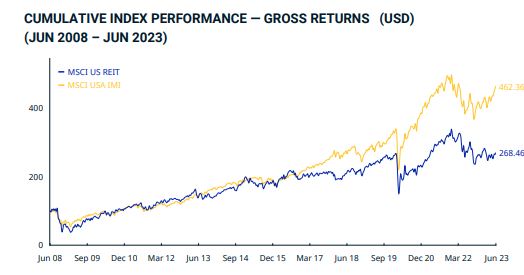

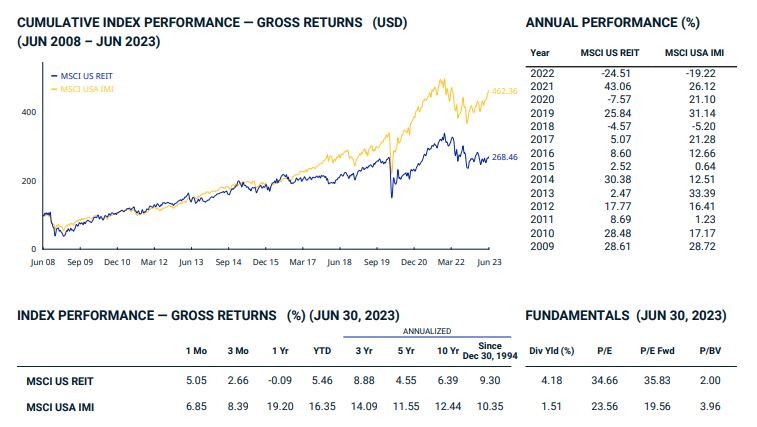

What is the MSCI US REIT Index (USD)

The MSCI US REIT Index is a free float-adjusted market capitalization weighted index that is comprised of equity Real Estate Investment Trusts (REITs). The index is based on the MSCI USA Investable Market Index (IMI), its parent index, which captures the large, mid and small cap segments of the USA market. With 124 constituents, it represents about 99% of the US REIT universe and securities are classified under the Equity REITs Industry (under the Real Estate Sector) according to the Global Industry Classification Standard (GICS®), have core real estate exposure (i.e., only selected Specialized REITs are eligible) and carry

REIT tax status.

Conclusion

In the evolving world of finance, Real Estate Investment Trusts stand as a testament to innovation and inclusive growth. While they present potential risks like any investment, a well-researched and diversified REIT portfolio can serve as a sturdy pillar for any investment strategy.

Whether you are a seasoned investor looking for diversification and passive income or a novice venturing into the world of real estate investment, REITs offer a gateway to the property market without the need for significant capital or direct management responsibilities. With their high dividend yields, potential for capital appreciation, and increasing relevance in a changing world, REITs have a promising future as an essential part of the broader investment landscape.