💱 US Dollar Steady as AUD/USD Soars; GBP/USD Faces Pressure Ahead of Fed Decision

📊 US Dollar Index (DXY)

Current Level: 98.90 (+0.22%)

In the current forex landscape, the US Dollar Index (DXY) is slightly up at 98.90, reflecting cautious market sentiment as traders await the Federal Reserve’s interest rate decision. Anticipation surrounds the Fed’s potential rate cut, which could further influence the USD’s trajectory. Against this backdrop, EUR/USD has steadied around 1.1645, showing resilience but remaining largely unchanged as traders eye the Fed’s announcement.

The USD/CNH pair is projected to hold above the critical 7.0860 level, with further declines deemed unlikely, while USD/JPY is experiencing downward pressure, potentially dropping to 151.30 amid a growing consensus on the possibility of a Bank of Japan rate hike. This shift in sentiment has contributed to a weakening of the Yen, with USD/JPY slipping below 152.00.

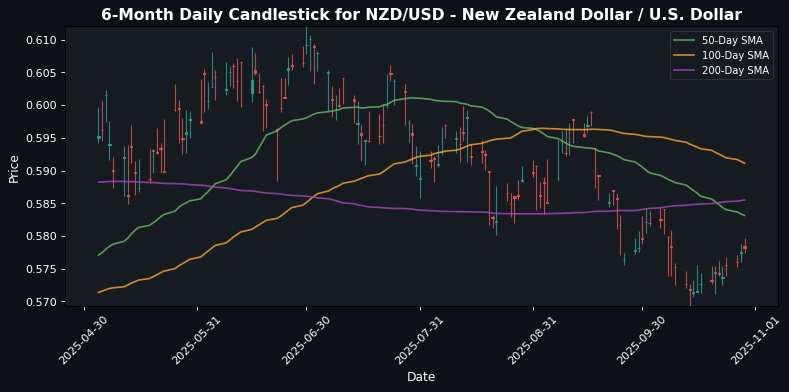

The New Zealand Dollar (NZD) is also under scrutiny, with expectations that it may test the 0.5800 mark but face resistance in breaking above it. Meanwhile, the Bank of Canada is anticipated to lower its benchmark interest rate in response to sluggish economic conditions, further affecting CAD valuations.

Gold prices have rebounded after a three-day decline, climbing 1.70% in anticipation of the Fed’s policy decisions, underscoring the metal’s status as a safe haven amid uncertainty. Overall, the FX market remains in a state of flux, heavily influenced by central bank policies and economic data releases.

📅 Today’s Economic Calendar

No significant economic events scheduled for today.

💱 Major Currency Pairs

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EUR/USD – Euro / U.S. Dollar | EURUSD | 1.1643 | -0.08% | +0.37% | -0.13% | -1.93% | +0.26% | +11.00% | +4.65% | +7.45% | 1.1687 | 1.1667 | 1.1293 | 51.26 | -0.00 |

| USD/JPY – U.S. Dollar / Japanese Yen | USDJPY | 152.2600 | -0.28% | +0.24% | +0.90% | +3.99% | +5.04% | +0.16% | +5.42% | -2.99% | 149.1746 | 147.8477 | 147.9016 | 47.34 | 0.98 |

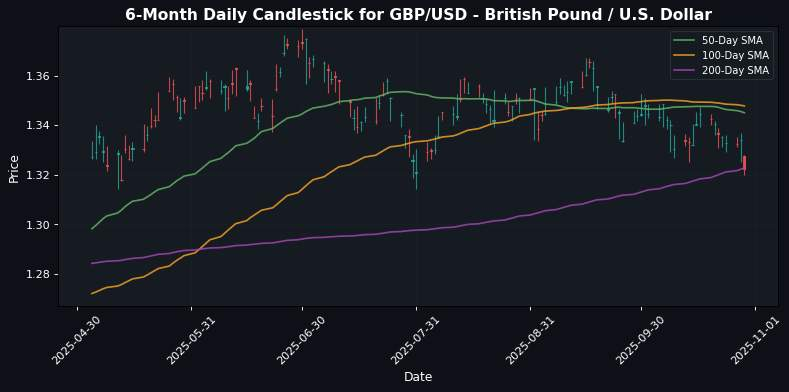

| GBP/USD – British Pound / U.S. Dollar | GBPUSD | 1.3223 | -0.89% | -1.07% | -1.51% | -3.16% | -2.88% | +5.07% | +0.22% | +3.87% | 1.3450 | 1.3477 | 1.3227 | 33.02 | -0.00 |

| USD/CHF – U.S. Dollar / Swiss Franc | USDCHF | 0.7972 | +0.33% | +0.06% | +0.45% | +1.44% | -0.99% | -11.41% | -5.30% | -11.75% | 0.7980 | 0.8009 | 0.8324 | 44.16 | -0.00 |

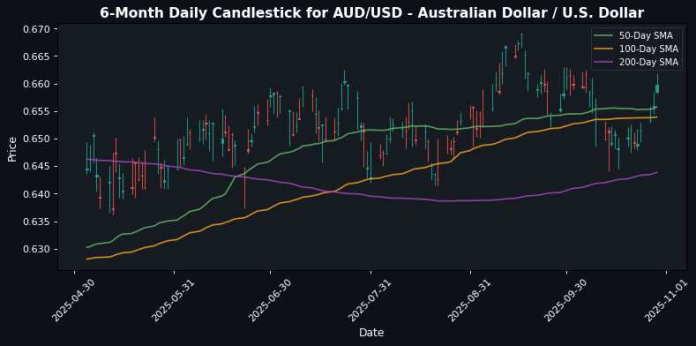

| AUD/USD – Australian Dollar / U.S. Dollar | AUDUSD | 0.6597 | +0.59% | +1.62% | +1.47% | -1.37% | +1.56% | +3.79% | -2.74% | -0.50% | 0.6557 | 0.6539 | 0.6439 | 51.92 | -0.00 |

| USD/CAD – U.S. Dollar / Canadian Dollar | USDCAD | 1.3941 | -0.36% | -0.56% | -0.53% | +1.47% | +1.56% | -1.71% | +3.44% | +1.88% | 1.3895 | 1.3799 | 1.3959 | 47.65 | 0.00 |

| NZD/USD – New Zealand Dollar / U.S. Dollar | NZDUSD | 0.5782 | +0.11% | +0.69% | +0.88% | -3.46% | -3.81% | +0.86% | -7.45% | -5.47% | 0.5831 | 0.5911 | 0.5855 | 49.51 | -0.00 |

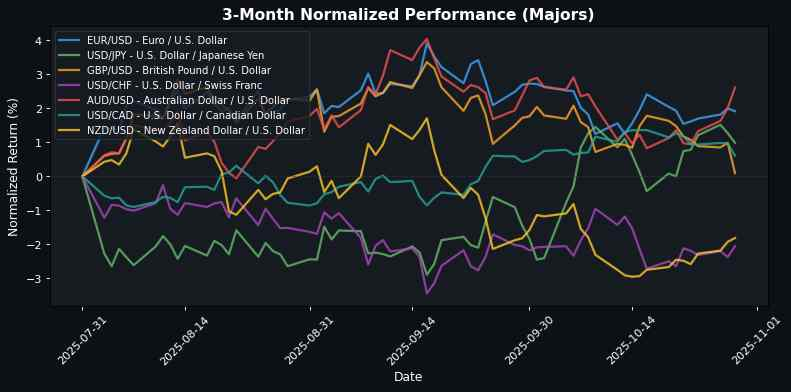

The Australian Dollar (AUD) has shown strong momentum against the U.S. Dollar (USD), rising by 0.59%, indicating robust buyer interest and potential support levels around recent lows. The Swiss Franc (CHF) also gained 0.33% against the USD, suggesting a flight to safety as investors seek stability, while the New Zealand Dollar (NZD) saw a modest increase of 0.11%, reflecting a generally positive outlook for commodity currencies.

In contrast, the British Pound (GBP) slid 0.89% against the USD, possibly influenced by ongoing economic concerns and political uncertainties in the UK. The U.S. Dollar also faced weakness against the Canadian Dollar (CAD) and the Japanese Yen (JPY), declining 0.36% and 0.28% respectively, which could indicate a strengthening risk appetite among investors and a shift away from the dollar amid fluctuating economic data and geopolitical tensions. Overall, the contrasting performances suggest a complex market sentiment, with commodity currencies

🔀 Cross Currency Pairs

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EUR/GBP | EURGBP | 0.8803 | +0.81% | +1.43% | +1.39% | +1.26% | +3.22% | +5.62% | +4.41% | +3.46% | 0.8689 | 0.8656 | 0.8534 | 73.31 | 0.00 |

| EUR/JPY | EURJPY | 177.2250 | -0.38% | +0.58% | +0.75% | +1.97% | +5.30% | +11.14% | +10.31% | +4.25% | 174.3250 | 172.4749 | 166.9356 | 47.17 | 0.87 |

| EUR/CHF | EURCHF | 0.9280 | +0.23% | +0.41% | +0.32% | -0.53% | -0.75% | -1.68% | -0.91% | -5.16% | 0.9326 | 0.9343 | 0.9381 | 37.47 | -0.00 |

| EUR/AUD | EURAUD | 1.7649 | -0.65% | -1.23% | -1.56% | -0.55% | -1.29% | +6.96% | +7.61% | +8.03% | 1.7823 | 1.7841 | 1.7533 | 49.44 | -0.00 |

| GBP/JPY | GBPJPY | 201.3010 | -1.18% | -0.83% | -0.63% | +0.70% | +2.01% | +5.23% | +5.64% | +0.76% | 200.6099 | 199.2392 | 195.5413 | 33.54 | 0.68 |

| GBP/CHF | GBPCHF | 1.0540 | -0.56% | -1.00% | -1.07% | -1.76% | -3.84% | -6.91% | -5.09% | -8.33% | 1.0732 | 1.0793 | 1.0995 | 19.78 | -0.00 |

| AUD/JPY | AUDJPY | 100.4090 | +0.27% | +1.83% | +2.35% | +2.53% | +6.67% | +3.92% | +2.50% | -3.51% | 97.8037 | 96.6634 | 95.1986 | 49.18 | 0.53 |

| AUD/NZD | AUDNZD | 1.1407 | +0.45% | +0.91% | +0.64% | +2.15% | +5.59% | +2.89% | +5.06% | +5.23% | 1.1245 | 1.1064 | 1.0997 | 52.77 | 0.00 |

| CHF/JPY | CHFJPY | 190.9710 | -0.60% | +0.19% | +0.45% | +2.52% | +6.09% | +13.05% | +11.31% | +9.93% | 186.9093 | 184.5902 | 177.9682 | 54.75 | 1.40 |

| NZD/JPY | NZDJPY | 88.0150 | -0.17% | +0.93% | +1.78% | +0.38% | +1.03% | +1.01% | -2.44% | -8.30% | 86.9564 | 87.3522 | 86.5476 | 47.31 | 0.24 |

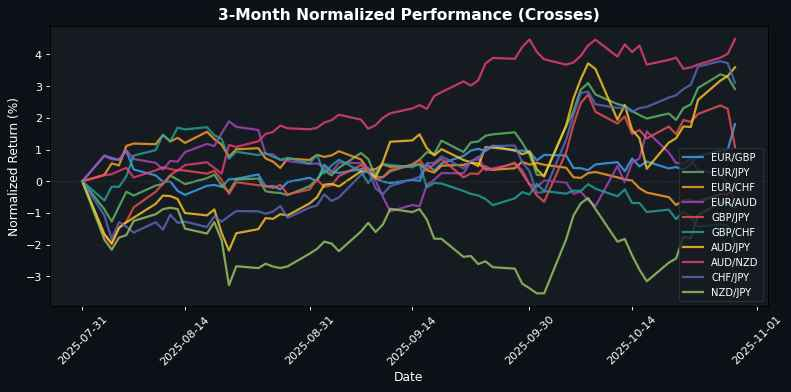

In today’s trading session, the EUR/GBP pair has shown notable strength, advancing by 0.81%, indicating increased demand for the euro against the pound, potentially driven by positive economic data from the Eurozone. The AUD/NZD and AUD/JPY pairs also demonstrated resilience, rising 0.45% and 0.27% respectively, suggesting robust bullish sentiment for the Australian dollar amid stable commodity prices. Conversely, the GBP/JPY pair faced significant downward pressure, declining 1.18%, which may reflect market concerns surrounding the UK economy, while the EUR/AUD and CHF/JPY pairs also struggled, indicating a general trend of weakness for the euro and Swiss franc against the Australian and Japanese currencies. Overall, the market is showing a divergence between the performance of the Australian dollar and the challenges faced by the British pound and euro.

🌍 Exotic and Emerging Market Currencies

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| USD/TRY – U.S. Dollar / Turkish Lira | USDTRY | 41.9557 | -0.01% | -0.03% | +0.06% | +1.57% | +5.88% | +15.89% | +22.90% | +30.12% | 41.4952 | 40.8508 | 39.1967 | 78.18 | 0.15 |

| USD/ZAR – U.S. Dollar / South African Rand | USDZAR | 17.1144 | -0.56% | -1.57% | -1.45% | -1.29% | -3.43% | -6.71% | -3.99% | -8.51% | 17.3977 | 17.5845 | 17.9901 | 48.38 | -0.04 |

| USD/THB – U.S. Dollar / Thai Baht | USDTHB | 32.2600 | -1.10% | -1.83% | -1.50% | +1.90% | -1.13% | -4.34% | -5.24% | -12.05% | 32.2950 | 32.3821 | 32.9531 | 42.56 | 0.09 |

| USD/SEK – U.S. Dollar / Swedish Krona | USDSEK | 9.3636 | -0.14% | -0.68% | -0.65% | +1.52% | -1.52% | -12.50% | -8.15% | -11.56% | 9.4194 | 9.4963 | 9.8163 | 41.64 | -0.01 |

| USD/NOK – U.S. Dollar / Norwegian Krone | USDNOK | 9.9932 | +0.06% | -0.66% | -0.63% | +2.45% | -1.19% | -10.11% | -4.86% | -5.29% | 9.9984 | 10.0652 | 10.3764 | 52.19 | 0.00 |

| USD/DKK – U.S. Dollar / Danish Krone | USDDKK | 6.4158 | +0.09% | -0.34% | +0.15% | +2.03% | -0.13% | -9.79% | -4.31% | -6.83% | 6.3880 | 6.3977 | 6.6196 | 49.13 | 0.01 |

| USD/MXN – U.S. Dollar / Mexican Peso | USDMXN | 18.4354 | +0.25% | +0.01% | +0.38% | +0.82% | -2.93% | -9.24% | -6.25% | +8.41% | 18.4878 | 18.6260 | 19.3222 | 57.68 | -0.01 |

| USD/PLN – U.S. Dollar / Polish Zloty | USDPLN | 3.6421 | +0.26% | -0.28% | +0.05% | +1.85% | -0.51% | -8.34% | -5.64% | -7.80% | 3.6388 | 3.6464 | 3.7567 | 45.36 | 0.00 |

| USD/HUF – U.S. Dollar / Hungarian Forint | USDHUF | 333.6120 | +0.14% | -0.51% | -0.08% | +1.70% | -3.42% | -12.81% | -5.66% | -7.16% | 334.8983 | 338.6945 | 354.2644 | 40.79 | -0.11 |

| USD/CZK – U.S. Dollar / Czech Koruna | USDCZK | 20.8912 | +0.14% | -0.17% | +0.27% | +2.04% | -1.96% | -12.44% | -7.20% | -8.40% | 20.8274 | 20.9828 | 21.9458 | 48.06 | 0.02 |

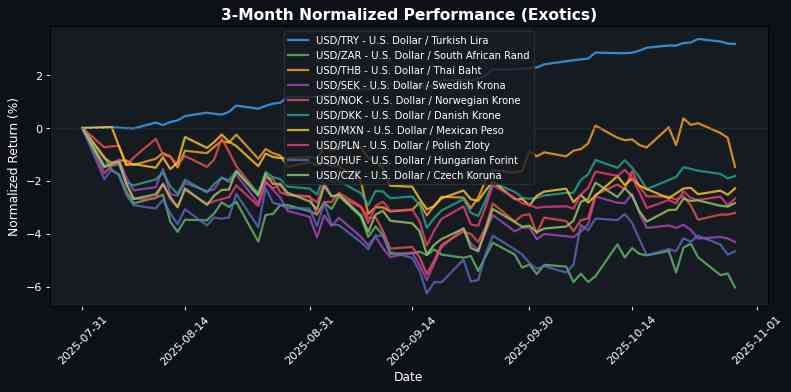

In the recent trading session, the U.S. Dollar demonstrated strength against several Eastern European currencies, with the USD/PLN leading the pack at +0.26%, buoyed by favorable economic data and interest rate expectations in the U.S. Similarly, the USD/MXN and USD/CZK showed positive momentum, reflecting a resilient dollar amidst global economic uncertainties. Conversely, the USD/THB experienced a notable decline of -1.10%, likely influenced by Thailand’s economic outlook and policy adjustments. Additionally, the USD/ZAR and USD/SEK faced modest downward pressure, indicating potential market concerns regarding South African and Swedish economic conditions, respectively. Overall, the divergence in performance highlights the varying impacts of regional economic factors on currency valuations.

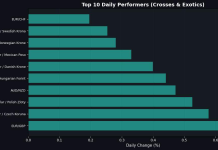

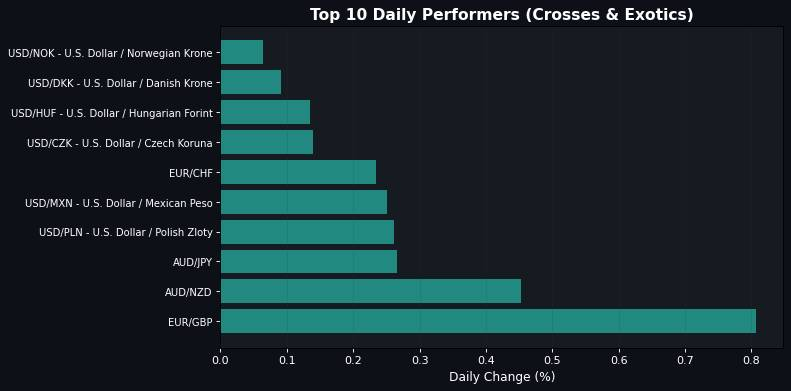

🏆 Top Daily Performers (Crosses & Exotics)

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.