US Markets Closing Bell: Amazon Layoffs Spark Concerns as Indices Rally, S&P Up 1.2%

📊 Market Recap

**Market Recap: US Markets Closing Session**

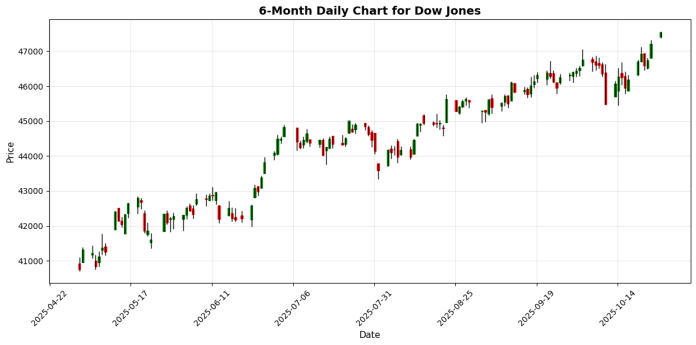

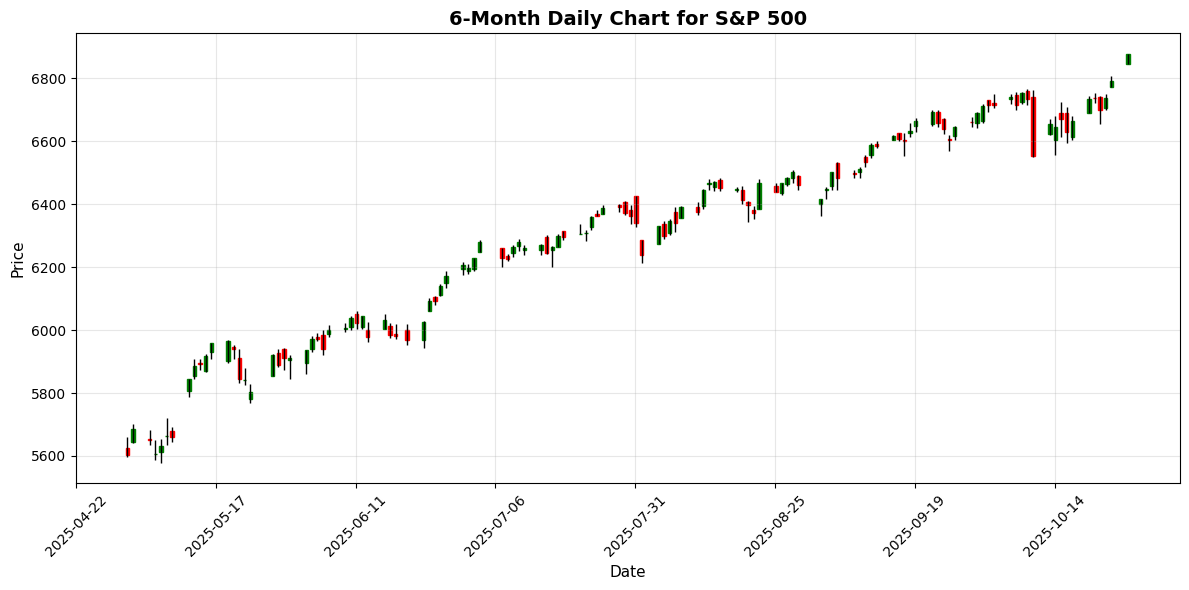

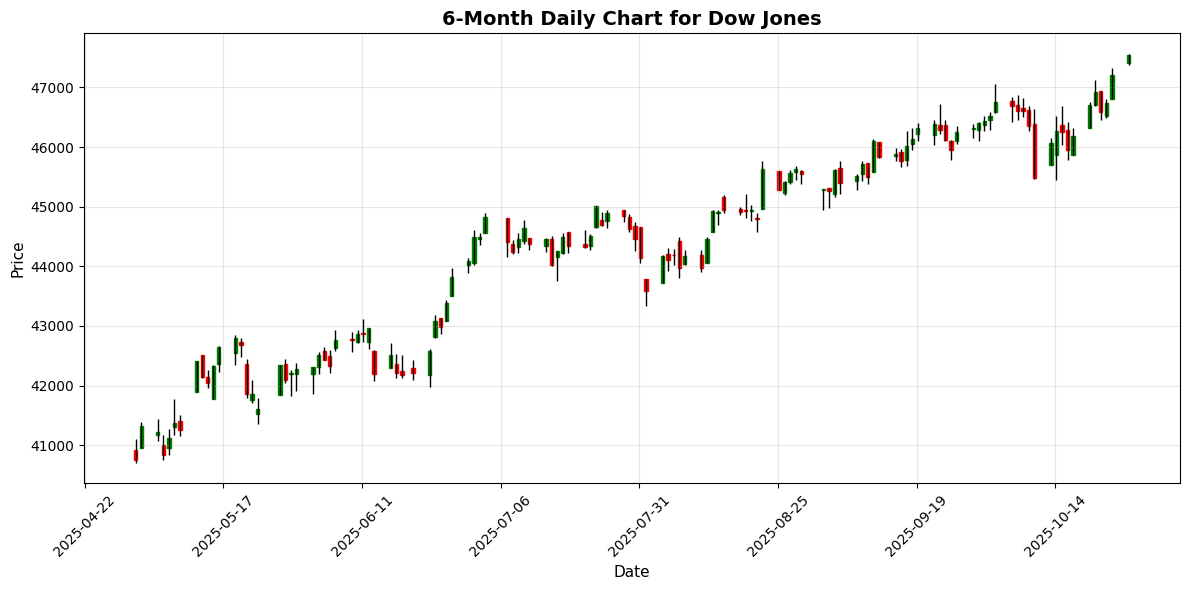

The US markets opened with a positive sentiment, buoyed by easing trade tensions between the US and China, which has fostered optimism among investors. This sentiment was reflected in the performance of major indices throughout the session, with the Dow Jones Industrial Average reaching a record high of 47,544.59, marking an increase of 0.71%. The S&P 500 advanced by 1.23% to close at 6,875.16, while the Nasdaq 100 climbed 1.04% to finish at 25,358.16.

Key drivers for today’s market performance included a favorable consumer price index (CPI) report released last Friday, which indicated that the annual inflation rate fell to 3.0% in September, slightly below expectations. This news likely contributed to a more risk-on environment, encouraging investors to allocate capital into equities. Additionally, Qualcomm’s announcement of new AI chips, which sent its stock soaring by 11%, further fueled tech sector enthusiasm.

Sector movements were varied, with technology leading the charge, driven by strong performances from Qualcomm and other tech giants. Conversely, the consumer discretionary sector faced pressure, particularly from Amazon, which is reportedly set to announce its largest layoffs in company history. This news weighed on investor sentiment toward retail stocks, contributing to a decline in that sector.

Market breadth was notably positive, with advancing stocks outpacing decliners significantly, a sign of robust market participation. Trading volume was also above average, reflecting heightened investor engagement as the week progresses.

In the currency market, the US dollar showed slight weakness against major currencies. The EUR/USD pair rose to 1.1648, reflecting a 0.11% increase, while GBP/USD also gained modestly, closing at 1.3338. In contrast, the USD/JPY pair dipped slightly to 152.84, down 0.15%. These movements indicate a cautious optimism as investors await upcoming central bank meetings.

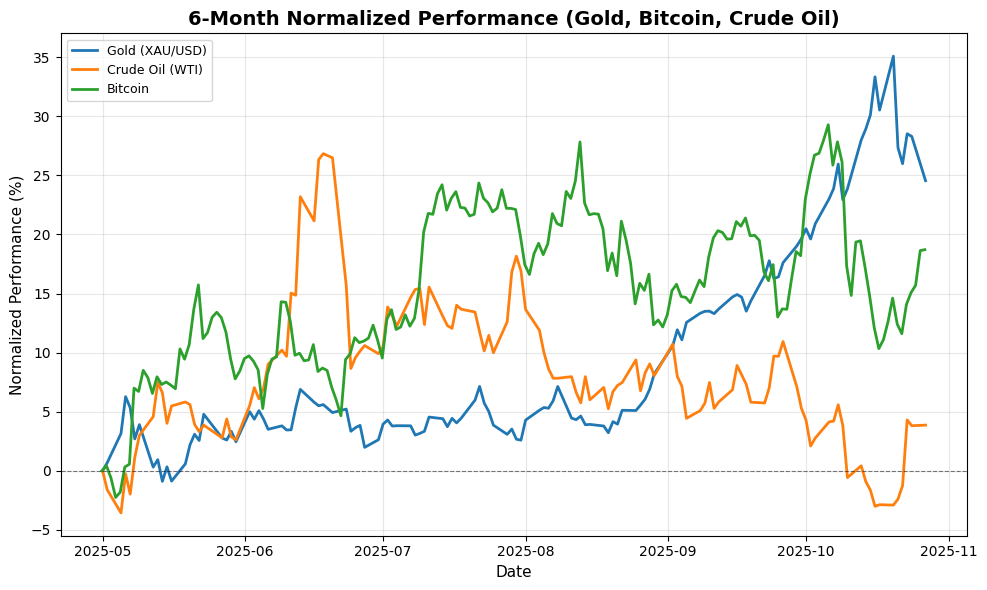

Commodities had a mixed day, with gold prices retreating to $3,998.00, down nearly 2.92%, as improved risk appetite diminished safe-haven demand. Crude oil prices edged up slightly to $61.53, reflecting stable demand amid ongoing geopolitical tensions. Bitcoin also saw a modest rise, trading at $114,550.23, up 0.07%.

Globally, markets reflected a similar optimism, with the EuroStoxx 50 up 0.64% and the Nikkei 225 gaining 2.46%. The Shanghai Composite also performed well, closing up 1.18%. This broad-based global rally underscores a collective investor sentiment favoring growth and recovery.

In summary, today’s trading session was characterized by a positive market sentiment driven by easing inflation concerns and favorable corporate news, setting a constructive tone as investors look forward to key economic indicators and central bank decisions later in the week.

US Market Indices

| Name | Price | Daily (%) |

|---|---|---|

| S&P 500 | 6875.16 | +1.23 |

| Dow Jones | 47544.59 | +0.71 |

| Nasdaq 100 | 25358.16 | +1.04 |

Global Markets

| Name | Price | Daily (%) |

|---|---|---|

| EuroStoxx 50 | 5711.06 | +0.64 |

| Nikkei 225 | 50512.32 | +2.46 |

| FTSE 100 | 9653.82 | +0.09 |

| Shanghai Composite | 3996.94 | +1.18 |

FX & Commodities

| Name | Price | Daily (%) |

|---|---|---|

| EUR/USD | 1.16 | +0.11 |

| USD/JPY | 152.84 | -0.15 |

| GBP/USD | 1.33 | +0.11 |

| Gold (XAU/USD) | 3998.00 | -2.92 |

| Crude Oil (WTI) | 61.53 | +0.05 |

| Bitcoin | 114550.23 | +0.07 |

🌍 Geopolitics and Markets

**Geopolitics and Markets Analysis**

Recent geopolitical developments have significantly influenced market dynamics, particularly with the easing of U.S.-China trade tensions, which has buoyed investor sentiment. The Dow Jones Industrial Average reached a record high as optimism surrounding a potential trade deal has reduced risk aversion, leading to a decline in gold prices below the $4,000 mark. This shift indicates a broader appetite for equities, reflecting a recovery in confidence among investors.

Central bank activities are also in focus, with the Federal Open Market Committee (FOMC) meeting this week to discuss interest rates. Market participants are closely watching for signals that could indicate the Fed’s stance on inflation, especially after the recent consumer price index (CPI) report showed inflation at 3.0% in September, slightly below expectations. This data may influence the Fed’s approach, potentially leading to a more dovish policy if inflation continues to show signs of moderation.

In the tech sector, Qualcomm’s announcement of new AI chips has resulted in a notable stock surge, highlighting the ongoing competition in the semiconductor market with AMD and Nvidia. This development is crucial as it underscores the growing importance of AI technology in driving market valuations and investor interest.

Political events, such as Javier Milei’s victory in Argentina, have also had immediate market implications, with Argentine assets rallying on hopes for pro-business reforms and strengthened ties with the U.S. Conversely, domestic political instability, as seen in Venezuela with calls to strip opposition leaders of citizenship, adds a layer of uncertainty that could deter foreign investment.

Overall, while the global economic landscape shows signs of bifurcation, with wealthier consumers maintaining spending power, the interplay of geopolitical developments, central bank policies, and political events will be pivotal in shaping market trajectories in the near term.

📅 Today’s Economic Calendar

All times are in US Eastern Time (ET)

| Date | Time | Cur | Imp | Event | Actual | Forecast |

|---|---|---|---|---|---|---|

| 2025-10-27 | 04:15 | 🇪🇺 | Medium | ECB’s Elderson Speaks | ||

| 2025-10-27 | 05:00 | 🇪🇺 | Medium | German Business Expectations (Oct) | 91.6 | |

| 2025-10-27 | 05:00 | 🇪🇺 | Medium | German Current Assessment (Oct) | 85.3 | 85.5 |

| 2025-10-27 | 05:00 | 🇪🇺 | Medium | German Ifo Business Climate Index (Oct) | 88.4 | 88.1 |

| 2025-10-27 | 05:40 | 🇪🇺 | Medium | ECB Supervisory Board Member Tuominen Speaks | ||

| 2025-10-27 | 07:00 | 🇪🇺 | Medium | German Buba Balz Speaks | ||

| 2025-10-27 | 08:30 | 🇨🇦 | Medium | Wholesale Sales (MoM) (Sep) | 0.0% | |

| 2025-10-27 | 11:30 | 🇺🇸 | Medium | 2-Year Note Auction | 3.504% | |

| 2025-10-27 | 11:30 | 🇺🇸 | Medium | Atlanta Fed GDPNow (Q3) | 3.9% | 3.9% |

| 2025-10-27 | 13:00 | 🇺🇸 | Medium | 5-Year Note Auction | 3.625% | |

| 2025-10-27 | 13:00 | 🇪🇺 | Medium | German Buba Balz Speaks |

**Overview:** Today’s economic calendar features several high-impact events, particularly from the Eurozone and the U.S. The focus is on German economic indicators and speeches from key ECB officials, which could influence the EUR, alongside U.S. Treasury auctions.

**Key Releases:**

1. **German Ifo Business Climate Index (Oct):** The index came in at 88.4, exceeding the forecast of 88.1, indicating a more optimistic business sentiment than expected.

2. **German Current Assessment (Oct):** This figure was slightly below expectations at 85.3, against a forecast of 85.5, suggesting some caution among businesses.

3. **German Business Expectations (Oct):** Reported at 91.6, this figure will be closely monitored for its implications on future economic sentiment.

**Market Impact:** The stronger-than-expected Ifo index is likely to bolster the EUR, as it signals resilience in the German economy. Conversely, the lower Current Assessment may temper enthusiasm. In the U.S., the 2-Year Note Auction yielded 3.504%, slightly lower than anticipated, which may affect USD sentiment. The Atlanta Fed’s GDPNow forecast remained stable at 3.9%, reinforcing confidence in U.S. growth. Overall, the market sentiment appears cautiously optimistic for the EUR, while the USD remains stable amidst mixed auction results.

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.