US Markets Closing Bell: Dow Rallies 500 Points on Apple Boost, S&P Up 1.1%

📊 Market Recap

**Market Recap: US Markets Close Higher Amid Apple Rally and Easing Trade Tensions**

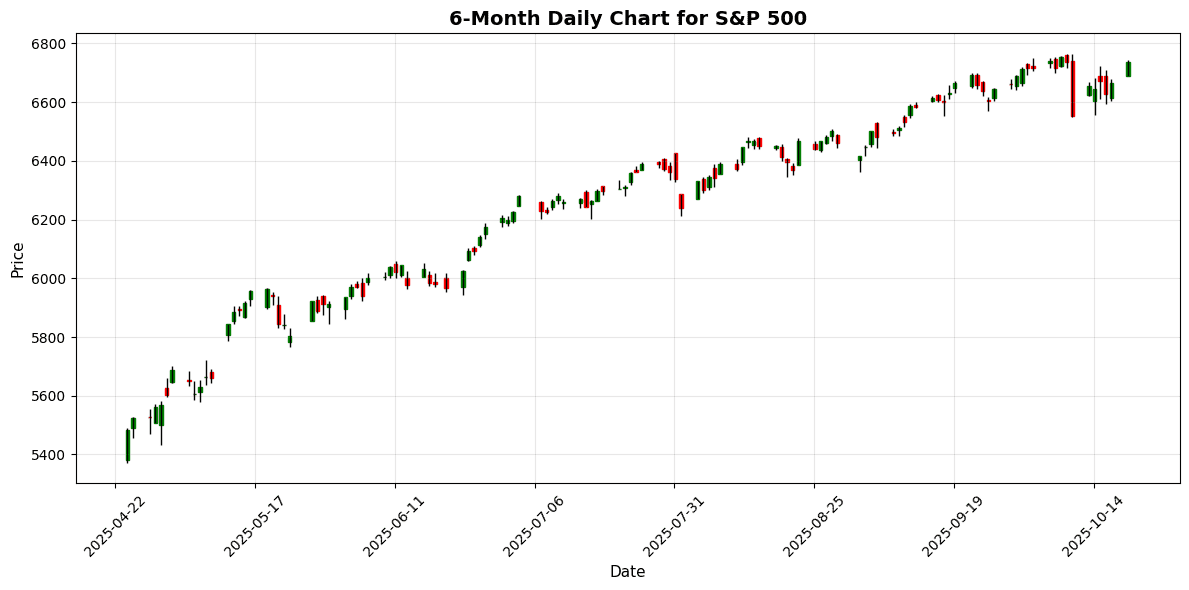

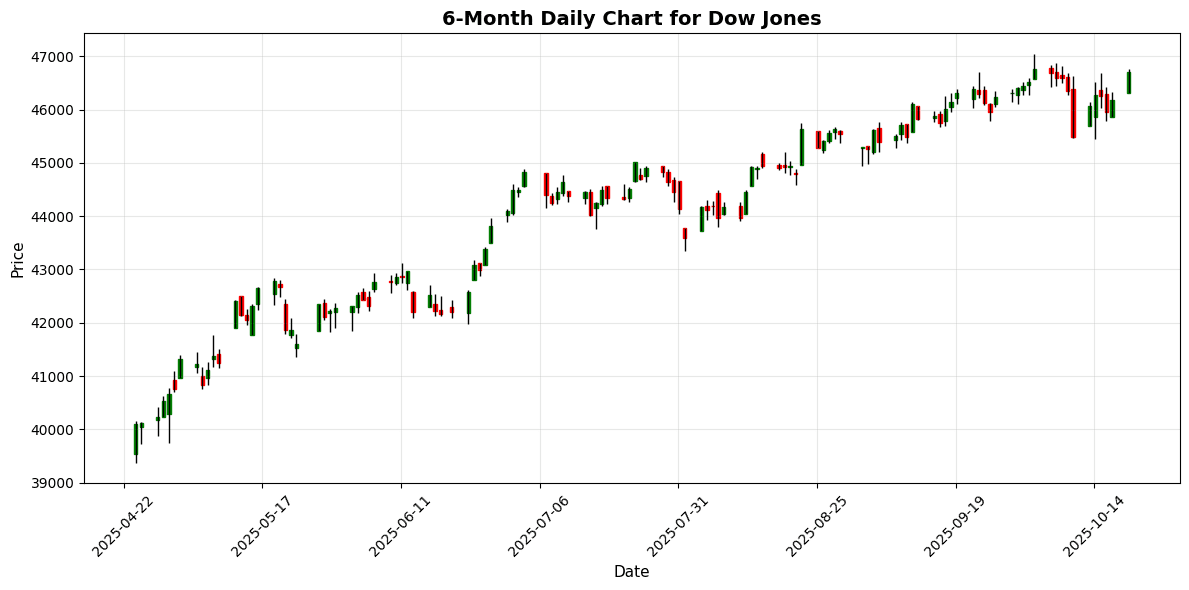

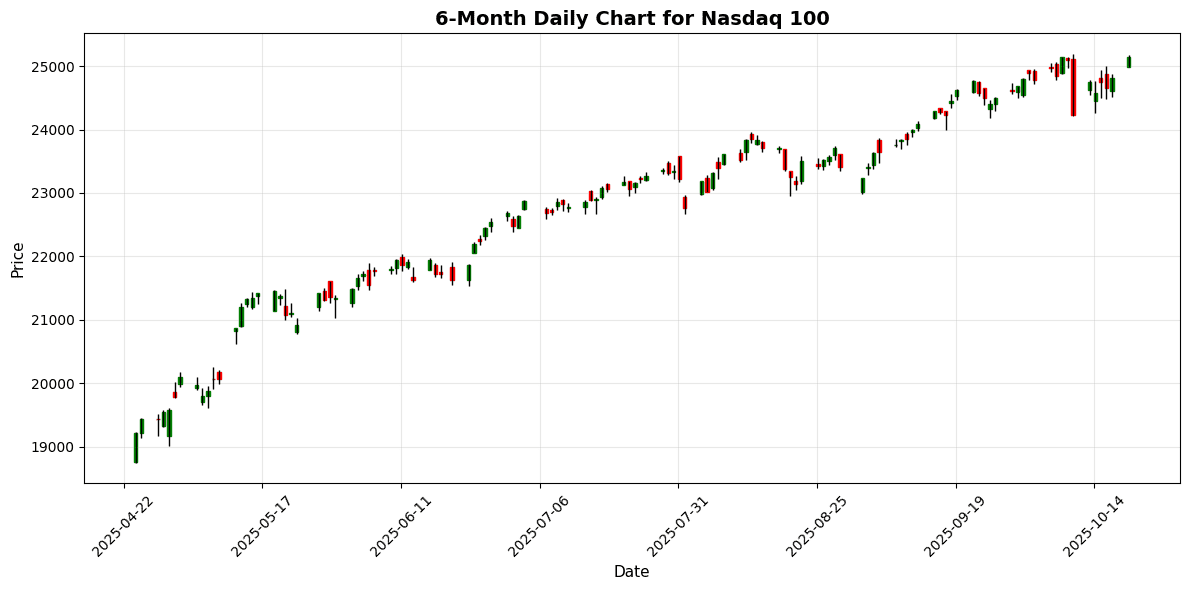

The US markets opened with a positive sentiment today, buoyed by optimism surrounding corporate earnings and a notable upgrade of Apple Inc. shares. The Dow Jones Industrial Average surged approximately 550 points shortly after the opening bell, reflecting a strong bullish trend that persisted throughout the session. By the close, the Dow finished up 550 points, or 1.12%, settling at 46,706.58. The S&P 500 and Nasdaq 100 also recorded significant gains, rising 1.07% and 1.30%, respectively, closing at 6,735.13 and 25,141.02.

Key drivers of today’s performance included the strong rebound in Apple shares, which hit a record high following a favorable upgrade from Loop Capital, citing robust iPhone demand. This rally in tech stocks helped lift the broader market, counteracting concerns related to regional bank losses and declines in some artificial intelligence stocks. Additionally, easing trade tensions between the US and China appeared to bolster investor confidence, further contributing to the upward momentum.

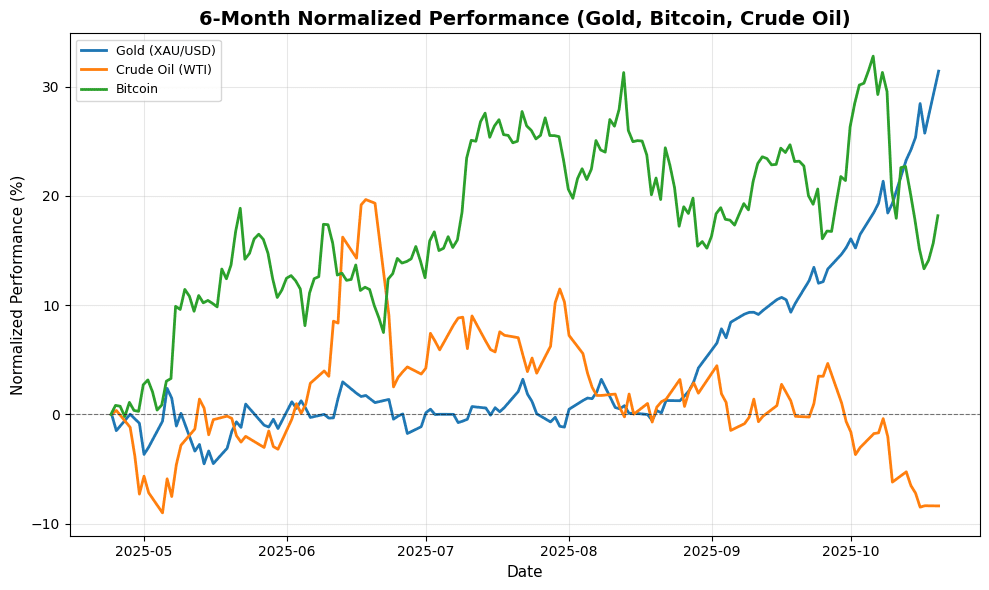

Sector-wise, technology stocks were the standout performers, with Apple leading the charge. Other notable gainers included shares in the rare earth supply chain, which rose amid ongoing discussions about critical minerals agreements between the US and Australia. Conversely, the energy sector faced headwinds, with crude oil prices dipping slightly by 0.02% to $57.53 per barrel, reflecting ongoing concerns over supply and demand dynamics.

Market breadth was notably positive, with advancing stocks outpacing decliners significantly. Volume indicators also suggested robust trading activity, indicative of strong investor participation in the rally.

In the currency markets, the US dollar showed mixed performance against major currencies, with the EUR/USD trading down 0.11% at 1.1646, while the GBP/USD and USD/JPY also saw slight declines. The fluctuations were influenced by ongoing concerns about potential US government shutdowns and the implications of Federal Reserve policy adjustments.

In commodities, gold prices soared, closing up 4.52% at $4,379.10 per ounce, reaching new record highs as investors sought safe-haven assets amid geopolitical uncertainties and expectations of continued monetary easing by the Fed. Bitcoin also gained traction, rising 2.18% to $111,031.59, reflecting renewed interest in digital currencies.

Globally, markets showed a positive tone, with the EuroStoxx 50 up 1.31% and the Nikkei 225 surging 3.37%. The mixed economic signals from China, where growth met expectations but investment saw alarming declines, continued to loom over investor sentiment.

Overall, today’s trading session illustrated a resilient market, driven by optimism in key sectors, particularly technology, amidst a backdrop of geopolitical and economic uncertainties.

US Market Indices

| Name | Price | Daily (%) |

|---|---|---|

| S&P 500 | 6735.13 | +1.07 |

| Dow Jones | 46706.58 | +1.12 |

| Nasdaq 100 | 25141.02 | +1.30 |

Global Markets

| Name | Price | Daily (%) |

|---|---|---|

| EuroStoxx 50 | 5680.93 | +1.31 |

| Nikkei 225 | 49185.50 | +3.37 |

| FTSE 100 | 9403.57 | +0.52 |

| Shanghai Composite | 3863.89 | +0.63 |

FX & Commodities

| Name | Price | Daily (%) |

|---|---|---|

| EUR/USD | 1.16 | -0.11 |

| USD/JPY | 150.74 | -0.06 |

| GBP/USD | 1.34 | -0.12 |

| Gold (XAU/USD) | 4379.10 | +4.52 |

| Crude Oil (WTI) | 57.53 | -0.02 |

| Bitcoin | 111031.59 | +2.18 |

🌍 Geopolitics and Markets

**Geopolitics and Markets Analysis**

Recent geopolitical developments are exerting significant influence on market dynamics. The U.S. and Australia have signed a critical minerals agreement, establishing an $8.5 billion project pipeline aimed at reducing reliance on China for rare earth elements. This move is likely to bolster U.S. companies in the rare earth supply chain, as evidenced by their stock price increases amid ongoing trade tensions. However, the broader implications of the U.S.-China trade relationship remain a concern, particularly as the S&P estimates that tariff costs for U.S. companies could reach $1.2 trillion this year, with consumers bearing the brunt of these expenses.

Central bank signals are also pivotal, with speculation surrounding the Federal Reserve’s interest rate policy influencing market sentiment. Recent indications of a potential continuation of the easing cycle have contributed to a decline in U.S. Treasury yields, prompting a rise in gold prices—now near record highs—as investors seek safe-haven assets amidst fiscal uncertainties, including the looming U.S. government shutdown.

Economic data releases, particularly from China, reveal a mixed outlook. While the economy grew by 4.8% in Q3, a rare drop in fixed-asset investment raises alarms about the sustainability of this growth trajectory, potentially impacting global demand and investor confidence.

Political events, such as the recent court ruling allowing President Trump to deploy the National Guard in Portland, may further influence investor sentiment, reflecting heightened domestic tensions. As global economic trends evolve, concerns over trade relations and fiscal stability will likely continue to shape market behavior, compelling investors to navigate a landscape marked by volatility and uncertainty.

📅 Today’s Economic Calendar

All times are in US Eastern Time (ET)

| Date | Time | Cur | Imp | Event | Actual | Forecast |

|---|---|---|---|---|---|---|

| 2025-10-20 | 03:00 | 🇪🇺 | Medium | German PPI (MoM) (Sep) | -0.1% | 0.1% |

| 2025-10-20 | 04:00 | 🇪🇺 | Medium | ECB’s Schnabel Speaks | ||

| 2025-10-20 | 08:30 | 🇨🇦 | Medium | RMPI (MoM) (Sep) | 1.7% | |

| 2025-10-20 | 10:00 | 🇪🇺 | Medium | ECB’s Schnabel Speaks | ||

| 2025-10-20 | 10:30 | 🇨🇦 | Medium | BoC Business Outlook Survey | ||

| 2025-10-20 | 13:00 | 🇪🇺 | Medium | German Buba Balz Speaks | ||

| 2025-10-20 | 15:00 | 🇪🇺 | Medium | German Buba President Nagel Speaks | ||

| 2025-10-20 | 17:00 | 🇺🇸 | Medium | TIC Net Long-Term Transactions (Aug) | ||

| 2025-10-20 | 21:00 | 🇪🇺 | Medium | German Buba President Nagel Speaks |

**Overview:**

Today’s economic calendar features several important events, particularly focused on the Eurozone and Canada, with potential high-impact implications for the EUR and CAD. Key releases include the German Producer Price Index (PPI) and the Canadian Raw Materials Price Index (RMPI).

**Key Releases:**

1. **German PPI (MoM) – September:** Released at 03:00 ET, the PPI showed a surprising decline of -0.1%, against a forecast of 0.1%. This unexpected drop could signal weakening producer prices, potentially impacting inflation expectations in the Eurozone.

2. **Canadian RMPI (MoM) – September:** At 08:30 ET, the RMPI rose by 1.7%, surpassing expectations. This increase suggests stronger raw material costs, which may influence future inflation and monetary policy decisions by the Bank of Canada.

**Market Impact:**

The negative German PPI could lead to a bearish sentiment for the EUR, as it raises concerns about economic growth and inflation in the Eurozone. Conversely, the positive RMPI result may bolster the CAD, reflecting stronger economic fundamentals. Market reactions may include a potential sell-off in EUR/USD and a rally in CAD pairs, as traders adjust their positions based on these data releases and speeches from ECB officials throughout the day.

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.