US Markets Closing Bell: Earnings Disappointments Weigh on Stocks, Nasdaq Falls 1.0%

📊 Market Recap

**Market Recap: U.S. Market Closing Session**

In today’s trading session, U.S. markets opened with a cautious sentiment, reflecting ongoing concerns over trade tensions, particularly between the U.S. and China. Throughout the day, indices fluctuated, ultimately closing lower as investors digested mixed earnings reports and anticipation of upcoming economic data.

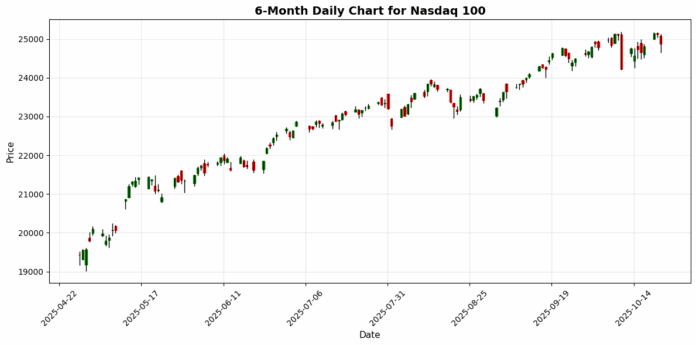

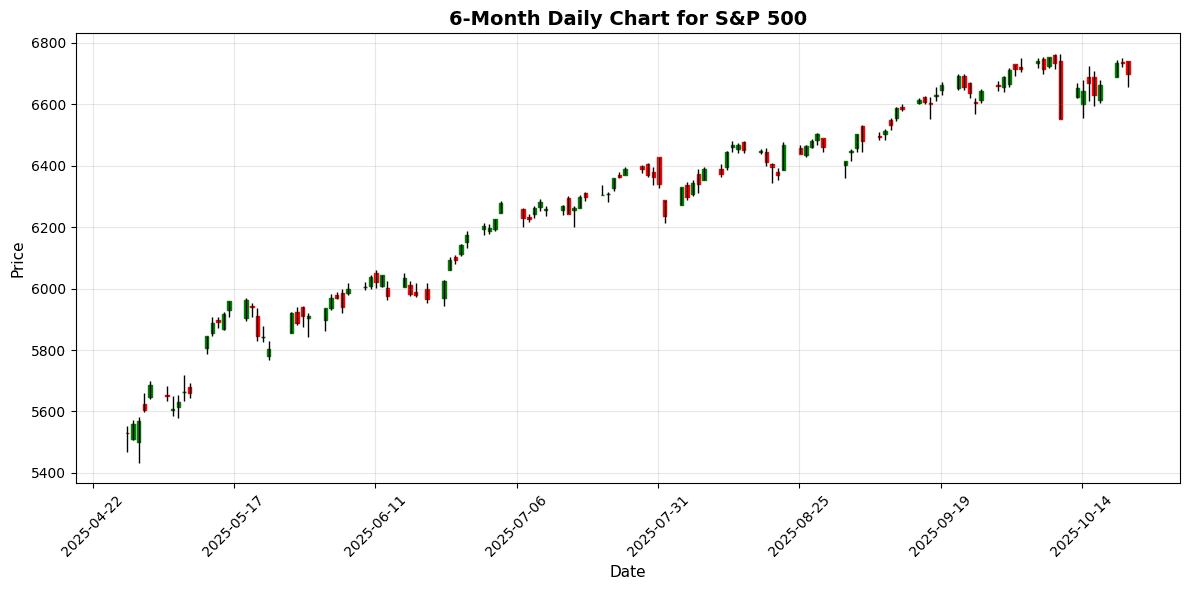

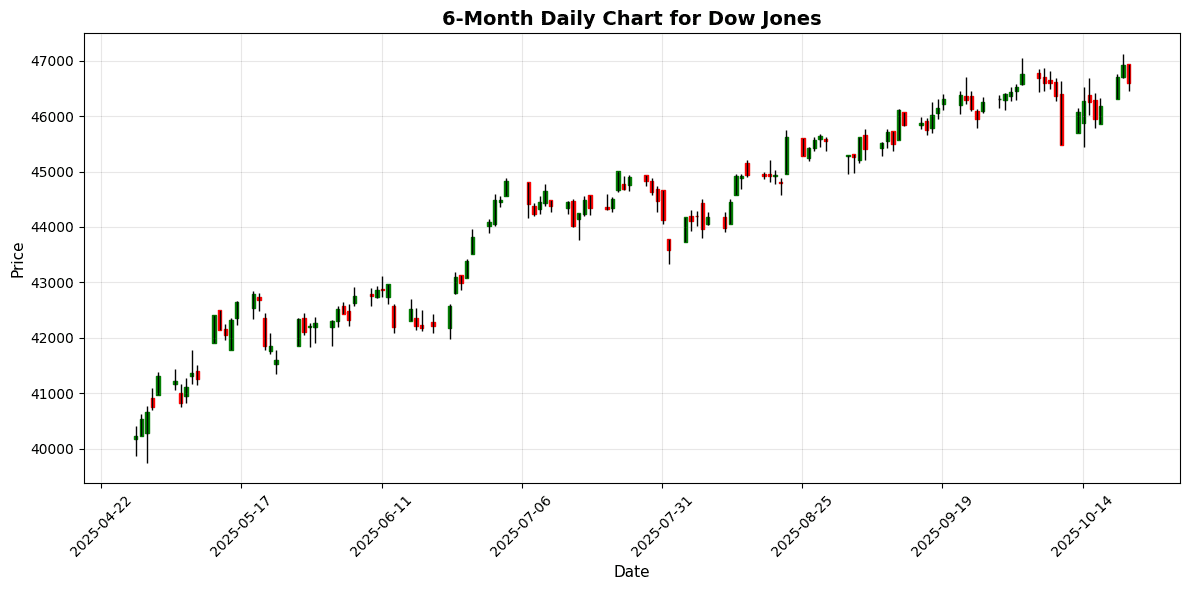

The S&P 500 fell by 0.53% to 6,699.40, while the Dow Jones Industrial Average declined 0.71% to 46,590.41. The Nasdaq 100 led the decline, dropping 0.99% to 24,879.01. Key drivers of these movements included disappointing earnings from major tech companies and renewed fears surrounding potential trade restrictions on U.S. software exports to China, which particularly impacted the tech-heavy Nasdaq.

Sector performance was mixed, with notable movements in technology and consumer discretionary stocks. Tesla reported revenue growth after two challenging quarters but saw its stock decline as adjusted earnings fell short of analysts’ expectations. Similarly, IBM’s strong earnings and lifted guidance failed to buoy its stock, which also ended the day lower. On a positive note, Southwest Airlines rose sharply after beating earnings estimates and forecasting strong demand, reflecting robust recovery in the travel sector.

Market breadth indicated a challenging environment, with declining stocks outpacing advancers. Volume was moderate, suggesting cautious trading as investors awaited critical economic indicators, including the upcoming inflation report.

In the currency markets, the Euro gained slightly against the U.S. Dollar, with EUR/USD rising 0.08% to 1.1613. The USD/JPY pair traded down marginally, settling at 151.91, while GBP/USD slipped 0.08% to 1.3357. The mixed performance in the currency markets reflects broader risk sentiment, with investors navigating geopolitical tensions and economic uncertainties.

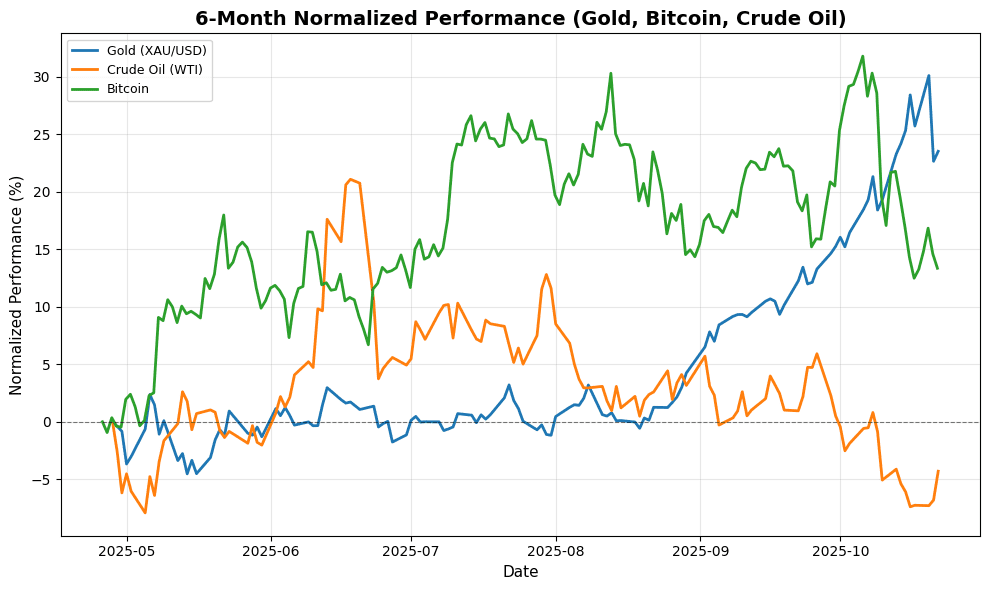

Commodity markets also exhibited volatility. Gold prices extended gains, rising 0.71% to $4,116.60, as investors sought safe-haven assets ahead of the inflation report. In contrast, crude oil prices surged by 2.70% to $59.38, driven by a surprise draw in U.S. inventories, which provided a boost to energy stocks. Bitcoin, however, fell by 1.09% to $107,289.07, continuing a trend of volatility seen in the crypto market.

Globally, European markets mirrored the U.S. trend, with the EuroStoxx 50 down 0.84%. In Asia, the Nikkei 225 showed minimal change, down 0.02%, while the Shanghai Composite edged down 0.07%. Overall, the global context reflects a cautious approach among investors as they brace for significant economic indicators and geopolitical developments in the coming days.

US Market Indices

| Name | Price | Daily (%) |

|---|---|---|

| S&P 500 | 6699.40 | -0.53 |

| Dow Jones | 46590.41 | -0.71 |

| Nasdaq 100 | 24879.01 | -0.99 |

Global Markets

| Name | Price | Daily (%) |

|---|---|---|

| EuroStoxx 50 | 5639.21 | -0.84 |

| Nikkei 225 | 49307.79 | -0.02 |

| FTSE 100 | 9515.00 | +0.93 |

| Shanghai Composite | 3913.76 | -0.07 |

FX & Commodities

| Name | Price | Daily (%) |

|---|---|---|

| EUR/USD | 1.16 | +0.08 |

| USD/JPY | 151.91 | -0.01 |

| GBP/USD | 1.34 | -0.08 |

| Gold (XAU/USD) | 4116.60 | +0.71 |

| Crude Oil (WTI) | 59.38 | +2.70 |

| Bitcoin | 107289.07 | -1.09 |

🌍 Geopolitics and Markets

**Geopolitics and Markets Analysis**

Recent geopolitical developments are increasingly influencing market dynamics, particularly amid rising trade tensions between the U.S. and China. Reports of potential U.S. software restrictions on China have contributed to a decline in the Nasdaq, highlighting investor anxiety regarding the ongoing trade war. This sentiment is further exacerbated by the Dow Jones Industrial Average’s struggle, which saw significant declines amidst fears of a renewed trade conflict.

Central bank activities remain a focal point for market participants, especially with an upcoming critical inflation report that has led to skepticism among investors. The U.S. Federal Reserve’s monetary policy signals will be closely monitored as they navigate the delicate balance between controlling inflation and supporting economic growth. The anticipated CPI data is expected to impact market sentiment significantly, particularly in the context of the recent volatility in gold prices.

On the corporate front, earnings reports from major companies like IBM and Tesla have yielded mixed results, with IBM exceeding expectations but still seeing stock declines, while Tesla’s revenue growth has not translated into positive stock performance. This disconnect suggests that broader market concerns may be overshadowing individual company fundamentals.

Internationally, India’s decision to cut Russian oil purchases and ongoing trade negotiations with the U.S. reflect shifting global trade relations. However, the collapse of earlier trade talks signals potential hurdles ahead, which could dampen market optimism.

Additionally, the recent volatility in cryptocurrencies, marked by significant losses for smaller tokens, underscores the fragility of investor sentiment amid broader economic uncertainties. As markets brace for upcoming data releases and geopolitical developments, the interplay between trade relations, central bank policies, and corporate earnings will be critical in shaping market trajectories.

📅 Today’s Economic Calendar

All times are in US Eastern Time (ET)

| Date | Time | Cur | Imp | Event | Actual | Forecast |

|---|---|---|---|---|---|---|

| 2025-10-22 | 02:00 | 🇬🇧 | High | CPI (YoY) (Sep) | 3.8% | 4.0% |

| 2025-10-22 | 02:00 | 🇬🇧 | Medium | CPI (MoM) (Sep) | 0.0% | |

| 2025-10-22 | 02:00 | 🇬🇧 | Medium | CPIH (YoY) | 4.1% | |

| 2025-10-22 | 02:00 | 🇬🇧 | Medium | PPI Input (MoM) (Sep) | -0.1% | 0.3% |

| 2025-10-22 | 07:00 | 🇪🇺 | Medium | ECB’s De Guindos Speaks | ||

| 2025-10-22 | 08:25 | 🇪🇺 | Medium | ECB President Lagarde Speaks | ||

| 2025-10-22 | 10:30 | 🇺🇸 | High | Crude Oil Inventories | -0.961M | 2.200M |

| 2025-10-22 | 10:30 | 🇺🇸 | Medium | Cushing Crude Oil Inventories | -0.770M | |

| 2025-10-22 | 11:00 | 🇪🇺 | Medium | German Buba Vice President Buch Speaks | ||

| 2025-10-22 | 13:00 | 🇺🇸 | Medium | 20-Year Bond Auction | 4.506% | |

| 2025-10-22 | 16:00 | 🇬🇧 | Medium | BoE Deputy Governor Woods Speaks | ||

| 2025-10-22 | 16:00 | 🇺🇸 | Medium | Fed Vice Chair for Supervision Barr Speaks |

Today’s economic calendar features several high-impact events, particularly concerning the GBP and USD, which could significantly influence market sentiment and currency valuations.

Key releases include the UK Consumer Price Index (CPI) for September, which came in at 3.8%, slightly below the forecast of 4.0%. This lower-than-expected inflation reading may lead to speculation about potential easing in monetary policy by the Bank of England, impacting the GBP negatively. Additionally, the Producer Price Index (PPI) Input showed a surprising contraction of -0.1% against a forecast of 0.3%, further supporting the notion of cooling inflation pressures.

In the U.S., the Crude Oil Inventories report revealed a significant draw of -0.961M barrels, contrasting sharply with the forecast of a 2.200M build. This unexpected decrease could bolster oil prices, positively affecting the USD as energy markets react.

Market reactions have shown a bearish sentiment towards the GBP following the CPI and PPI data, while the USD may gain strength from the bullish oil inventory figures. Overall, traders should remain vigilant as central bank officials speak later in the day, which could provide further insights into future monetary policy directions.

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.