US Markets Closing Bell: Investors Eye Loan Risks as Stocks Rally, S&P Up 0.5%

📊 Market Recap

**Market Recap: US Markets Close Higher Amid Mixed Sentiment**

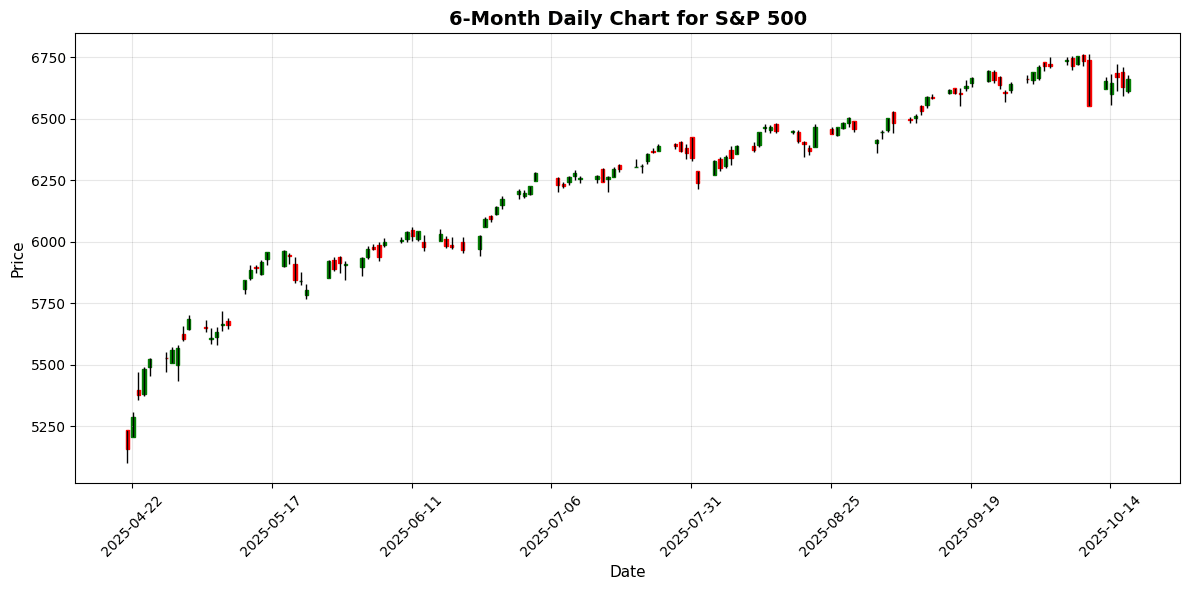

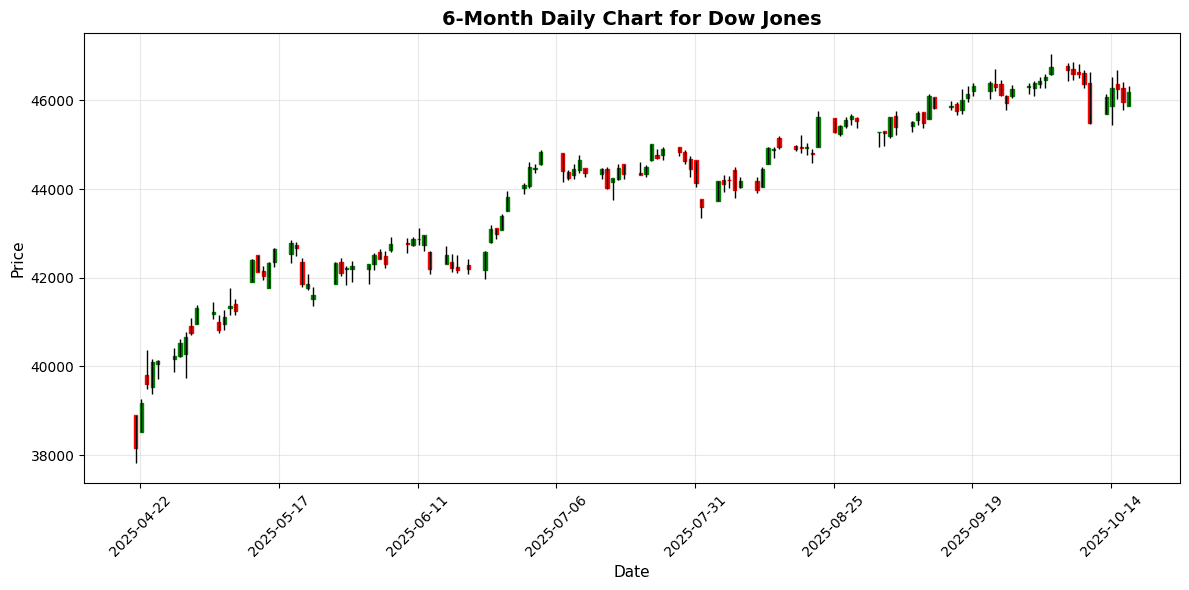

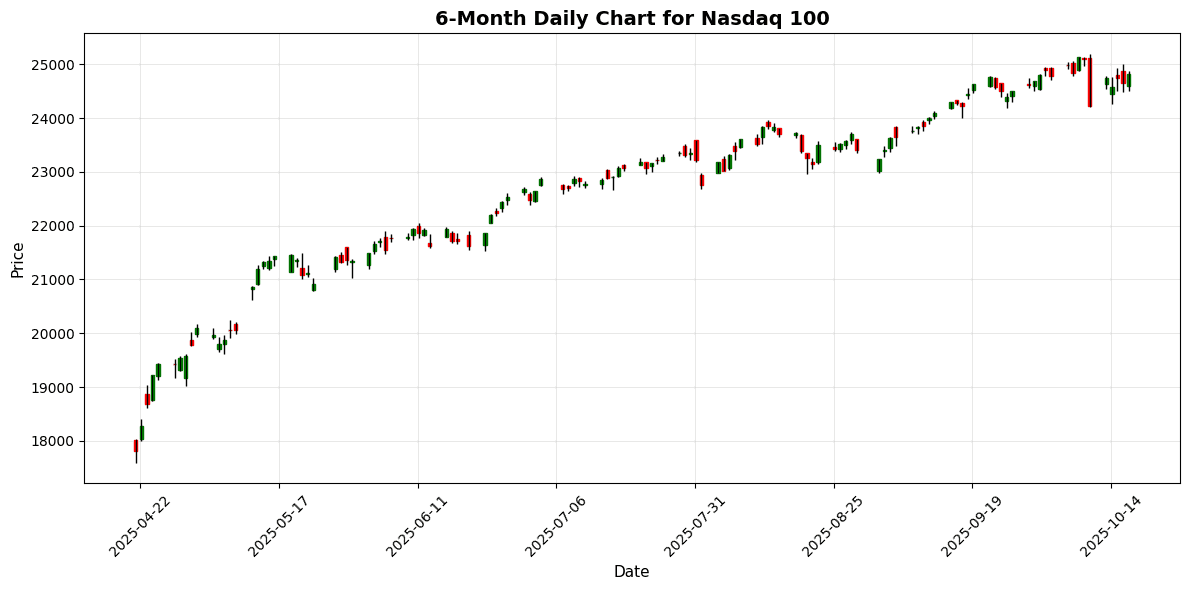

In today’s trading session, US markets opened with a cautiously optimistic sentiment, buoyed by a rebound in regional bank stocks and a slight easing in trade tensions. Throughout the day, the major indices demonstrated a steady upward trajectory, with the S&P 500 gaining 0.53%, the Dow Jones rising 0.52%, and the Nasdaq 100 leading the charge with a 0.65% increase. This performance comes amid ongoing discussions regarding potential rate cuts by the Federal Reserve and concerns about the banking sector’s exposure to non-depository financial institutions (NDFIs).

The S&P 500 closed at 6,664.01, driven by gains in technology and financial sectors. Notably, Oracle’s stock fell 7% after skepticism arose regarding its ambitious AI targets, which weighed on the tech-heavy Nasdaq. Conversely, regional banks showed resilience, recovering from recent volatility as investors reassessed their exposure to credit risks.

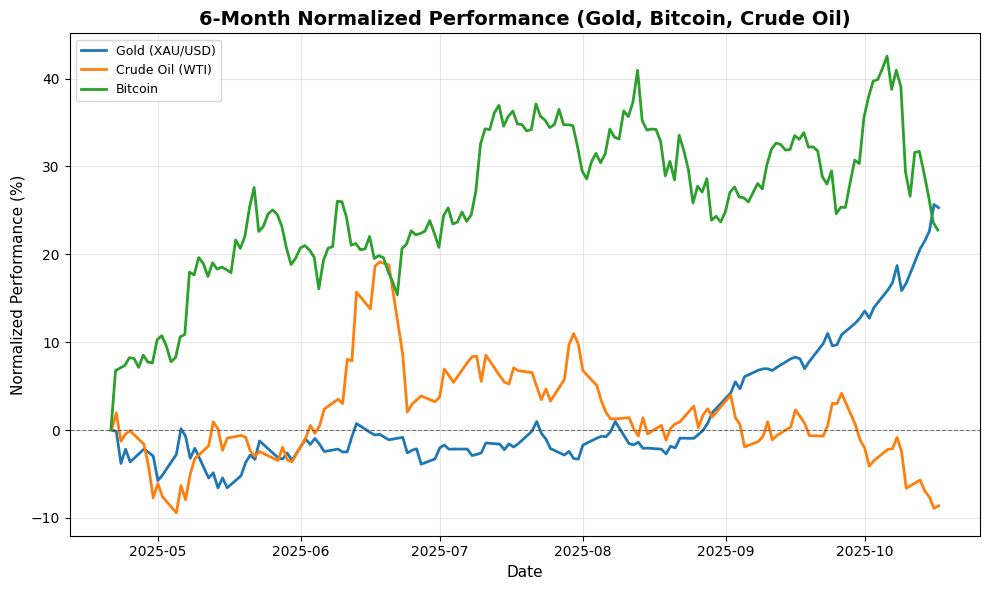

Sector performance was varied, with technology stocks experiencing mixed results. The financial sector benefited from the broader market rebound, while energy stocks saw a modest uptick, supported by a slight increase in crude oil prices, which rose by 0.31% to $57.64 per barrel. The healthcare sector faced headwinds, reflecting broader concerns about regulatory changes and cost pressures.

Market breadth indicators reflected a positive sentiment, with advancing stocks outpacing decliners on major exchanges. Volume remained robust as traders reacted to the day’s news, particularly around the evolving narrative concerning tariffs and trade relations with China, which have been a focal point for market participants.

In the currency markets, the US dollar regained some strength, particularly against the euro and British pound. The EUR/USD pair slipped 0.36% to 1.1655, while GBP/USD edged down 0.09% to 1.3426. The USD/JPY pair saw a slight increase of 0.22%, trading at 150.58, reflecting the dollar’s recovery. This movement was largely influenced by President Trump’s softened rhetoric on tariffs, which alleviated some immediate trade concerns.

In commodities, gold prices experienced a notable decline, falling 0.29% to $4,267.90, after reaching record highs earlier in the week. The drop was attributed to easing fears surrounding trade tariffs, which had previously driven investors towards safe-haven assets. Bitcoin also faced a downturn, decreasing by 0.70% to $107,432.27.

Globally, markets were mixed, with the EuroStoxx 50 down 0.79%, the Nikkei 225 declining 1.44%, and the FTSE 100 dropping 0.86%. The Shanghai Composite fell 1.95%, reflecting broader concerns over economic stability in the region.

In summary, today’s market session highlighted a complex interplay of optimism and caution among investors, as they navigated through evolving narratives related to trade

US Market Indices

| Name | Price | Daily (%) |

|---|---|---|

| S&P 500 | 6664.01 | +0.53 |

| Dow Jones | 46190.61 | +0.52 |

| Nasdaq 100 | 24817.95 | +0.65 |

Global Markets

| Name | Price | Daily (%) |

|---|---|---|

| EuroStoxx 50 | 5607.39 | -0.79 |

| Nikkei 225 | 47582.15 | -1.44 |

| FTSE 100 | 9354.57 | -0.86 |

| Shanghai Composite | 3839.76 | -1.95 |

FX & Commodities

| Name | Price | Daily (%) |

|---|---|---|

| EUR/USD | 1.17 | -0.36 |

| USD/JPY | 150.58 | +0.22 |

| GBP/USD | 1.34 | -0.09 |

| Gold (XAU/USD) | 4267.90 | -0.29 |

| Crude Oil (WTI) | 57.64 | +0.31 |

| Bitcoin | 107432.27 | -0.70 |

🌍 Geopolitics and Markets

**Geopolitics and Markets Analysis**

Recent geopolitical developments are significantly impacting market sentiment, particularly with ongoing tensions surrounding U.S.-China trade relations. President Trump’s recent comments suggesting that triple-digit tariffs on China are “not sustainable” have led to a notable drop in gold prices, which had reached record highs earlier in the week. This shift reflects a broader market reassessment of the potential for trade resolution, influencing investor strategies and risk appetite.

Central bank activities are also pivotal this week, with the Federal Reserve signaling a potential rate cut amid concerns over credit quality, particularly in the banking sector. The focus on bad loans to non-depository financial institutions (NDFIs) has raised alarms about systemic risks, prompting investors to scrutinize the stability of financial markets. Moody’s has attempted to assuage fears by asserting that the banking system remains sound, but the volatility in regional bank stocks suggests that investor sentiment is fragile.

Economic data releases, including the recent U.S. budget deficit figures, have implications for fiscal policy and market dynamics. The deficit’s slight reduction may provide some breathing room for the government, yet ongoing tariff costs projected to hit $1.2 trillion this year signal persistent inflationary pressures that could stifle economic growth.

Internationally, the Swiss economy faces challenges due to U.S. tariffs, which have been characterized as burdensome. This underscores the interconnectedness of global markets and the ripple effects of U.S. policy decisions.

As geopolitical tensions persist, including unresolved conflicts in the Middle East and the implications of Russia’s proposals regarding the Ukraine war, investor sentiment remains cautious. Overall, markets are navigating a complex landscape where geopolitical uncertainty and central bank signals are intricately linked, shaping investment strategies and economic forecasts.

📅 Today’s Economic Calendar

All times are in US Eastern Time (ET)

| Date | Time | Cur | Imp | Event | Actual | Forecast |

|---|---|---|---|---|---|---|

| 2025-10-17 | 02:45 | 🇪🇺 | Medium | German Buba Balz Speaks | ||

| 2025-10-17 | 02:45 | 🇪🇺 | Medium | German Buba President Nagel Speaks | ||

| 2025-10-17 | 05:00 | 🇪🇺 | Medium | Core CPI (YoY) (Sep) | 2.4% | 2.3% |

| 2025-10-17 | 05:00 | 🇪🇺 | Medium | CPI (MoM) (Sep) | 0.1% | 0.1% |

| 2025-10-17 | 05:00 | 🇪🇺 | High | CPI (YoY) (Sep) | 2.2% | 2.2% |

| 2025-10-17 | 05:35 | 🇬🇧 | Medium | BoE MPC Member Pill Speaks | ||

| 2025-10-17 | 08:30 | 🇨🇦 | Medium | Foreign Securities Purchases (Aug) | 25.92B | 11.61B |

| 2025-10-17 | 08:45 | 🇪🇺 | Medium | German Buba Mauderer Speaks | ||

| 2025-10-17 | 08:45 | 🇪🇺 | Medium | German Buba President Nagel Speaks | ||

| 2025-10-17 | 13:00 | 🇺🇸 | Medium | U.S. Baker Hughes Oil Rig Count | 418 | 417 |

| 2025-10-17 | 13:00 | 🇺🇸 | Medium | U.S. Baker Hughes Total Rig Count | 548 |

Today’s economic calendar features several high-impact events, primarily focused on the Eurozone and the U.S., which could significantly influence market sentiment and currency valuations.

**Key Releases:**

1. **Eurozone CPI Data (Sep)**: The Core CPI came in at 2.4%, surpassing the forecast of 2.3%, indicating stronger-than-expected inflation pressures. The headline CPI and CPI MoM both met forecasts at 2.2% and 0.1%, respectively, suggesting stability in consumer prices.

2. **Foreign Securities Purchases (CAD)**: Canada reported a substantial increase in foreign securities purchases at 25.92B, well above the forecast of 11.61B, signaling strong foreign interest and potential CAD strengthening.

**Market Impact:**

The positive surprise in Eurozone Core CPI may bolster the euro (EUR) as it raises speculation about potential shifts in European Central Bank policy. Conversely, the Canadian dollar (CAD) is likely to appreciate following the robust foreign securities data, reflecting increased investor confidence.

Overall, the market sentiment appears cautiously optimistic for the EUR and CAD, while the U.S. dollar (USD) remains steady following the Baker Hughes Oil Rig Count, which slightly exceeded expectations. Investors will be closely monitoring comments from central bank officials later in the day for further cues.

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.