US Markets Closing Bell: Job Openings Decline Sends Stocks Lower, Nasdaq Drops 2.1%

📊 Market Recap

**Market Recap: Closing Session Analysis**

In today’s trading session, U.S. markets opened with a cautious sentiment, reflecting ongoing concerns about the economy and recent job market data. The day began with investors digesting a report indicating that job openings in October had dropped to their lowest level since February 2021. This news contributed to a risk-off mood, leading to a broad sell-off across major indices.

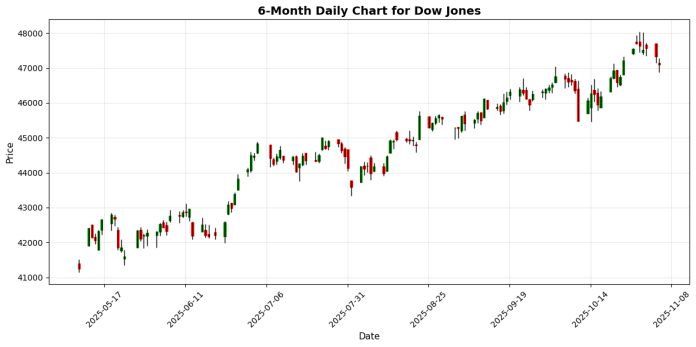

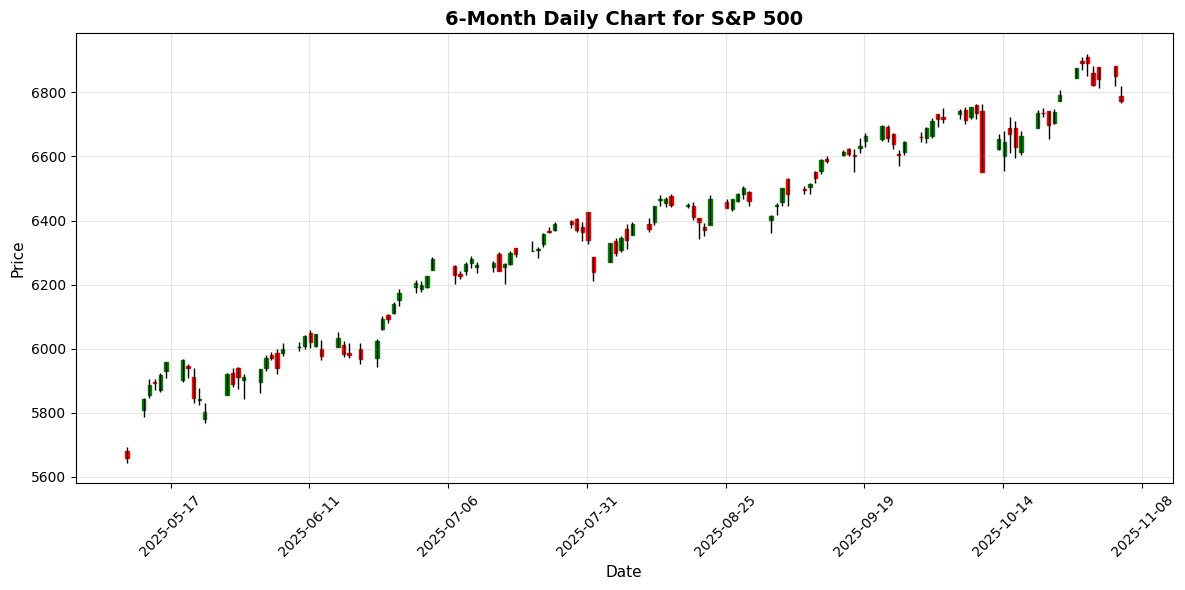

By the close, the S&P 500 fell by 1.17% to finish at 6,771.55, while the Dow Jones Industrial Average declined by 0.53% to settle at 47,085.24. The Nasdaq 100 was hit hardest, plunging 2.07% to close at 25,435.70, primarily driven by significant declines in tech stocks like Palantir, which reported disappointing earnings. The overall market performance was further influenced by fears surrounding the ongoing government shutdown, which is poised to become the longest in U.S. history after yet another failed Senate vote.

Sector-wise, technology stocks led the decline, with notable falls in companies such as AMD, which, despite reporting better-than-expected results, issued margin guidance that only met estimates. Conversely, the energy sector faced pressure as crude oil prices dropped by 1.06%, reflecting broader economic concerns. The financial and consumer discretionary sectors also struggled, with major layoffs announced by companies like Amazon, Target, and UPS.

Market breadth was notably weak, with declining stocks outnumbering advancing ones by a significant margin, indicating a lack of confidence among investors. Trading volume was above average, suggesting a heightened level of activity as traders reacted to the day’s developments.

In the currency markets, the US Dollar continued its ascent, pushing the EUR/USD down by 0.29% to 1.1485, marking its fifth consecutive day of losses. The USD/JPY pair saw a slight drop of 0.35%, trading at 153.67, while the GBP/USD fell by 0.84% to 1.3021, reflecting the dollar’s strength amid ongoing economic uncertainties.

In commodities, gold prices weakened, closing at $3,940.40 per ounce, down 1.50%, as investors preferred to hold onto cash during this period of market volatility. Crude oil also faced downward pressure, influenced by economic fears, while Bitcoin fell sharply by 6.54%, dropping below $100,000 for the first time since late June, as risk appetite waned among investors.

Globally, markets reflected similar trends, with the EuroStoxx 50 down by 0.34% and the Nikkei 225 falling by 1.74%. The FTSE 100 managed a slight gain of 0.14%, showcasing the mixed sentiment across international markets.

In summary, today’s market session was characterized by a pronounced risk-off sentiment, driven by economic data and ongoing political uncertainties, leading to declines across all major indices

US Market Indices

| Name | Price | Daily (%) |

|---|---|---|

| S&P 500 | 6771.55 | -1.17 |

| Dow Jones | 47085.24 | -0.53 |

| Nasdaq 100 | 25435.70 | -2.07 |

Global Markets

| Name | Price | Daily (%) |

|---|---|---|

| EuroStoxx 50 | 5660.20 | -0.34 |

| Nikkei 225 | 51497.20 | -1.74 |

| FTSE 100 | 9714.96 | +0.14 |

| Shanghai Composite | 3960.19 | -0.41 |

FX & Commodities

| Name | Price | Daily (%) |

|---|---|---|

| EUR/USD | 1.15 | -0.29 |

| USD/JPY | 153.67 | -0.35 |

| GBP/USD | 1.30 | -0.84 |

| Gold (XAU/USD) | 3940.40 | -1.50 |

| Crude Oil (WTI) | 60.40 | -1.06 |

| Bitcoin | 99584.12 | -6.54 |

🌍 Geopolitics and Markets

### Geopolitics and Markets Analysis

Recent geopolitical developments have contributed to heightened market volatility, with the U.S. government shutdown potentially becoming the longest in history, following yet another failed Senate vote. This uncertainty is likely to dampen investor sentiment, particularly in sectors that rely on government contracts. Meanwhile, the ongoing tensions between the U.S. and China are underscored by President Trump’s recent meeting with Xi Jinping, which may further complicate trade relations and impact market dynamics.

Central banks are also in focus, with the Federal Reserve’s recent signals suggesting a pause in rate hikes, contributing to a stronger U.S. dollar. The Fed’s cautious stance is echoed by the Bank of Japan, which hinted at potential rate hikes, leading to a strengthening of the yen. These monetary policy shifts are influencing currency markets, notably causing the euro to weaken against the dollar, which is trading at three-month lows against the EUR.

Economic data releases are drawing attention as well, particularly the slump in job openings to the lowest level since February 2021. This could indicate a cooling labor market, prompting concerns about consumer spending and overall economic growth. Additionally, major corporations like IBM and AMD have reported mixed results, with IBM exceeding earnings expectations yet announcing significant job cuts, highlighting the ongoing trend of layoffs across various sectors.

Investor sentiment is further affected by the recent volatility in tech stocks, particularly as retail traders experienced their worst day since April amid a tech-led selloff. This reflects broader concerns about overvaluation in the tech sector and the sustainability of the recent AI-driven market rally. As geopolitical tensions, central bank policies, and economic indicators converge, market participants remain on edge, navigating a complex landscape of risks and opportunities.

📅 Today’s Economic Calendar

All times are in US Eastern Time (ET)

| Date | Time | Cur | Imp | Event | Actual | Forecast |

|---|---|---|---|---|---|---|

| 2025-11-04 | 02:40 | 🇪🇺 | Medium | ECB President Lagarde Speaks | ||

| 2025-11-04 | 03:00 | 🇪🇺 | Medium | Spanish Unemployment Change (Oct) | 22.1K | 5.2K |

| 2025-11-04 | 03:00 | 🇳🇿 | Medium | RBNZ Financial Stability Report | ||

| 2025-11-04 | 04:00 | 🇧🇷 | Medium | IPC-Fipe Inflation Index (MoM) (Oct) | 0.27% | |

| 2025-11-04 | 05:00 | 🇪🇺 | Medium | ECB President Lagarde Speaks | ||

| 2025-11-04 | 06:35 | 🇺🇸 | Medium | FOMC Member Bowman Speaks | ||

| 2025-11-04 | 07:00 | 🇪🇺 | Medium | German Buba Balz Speaks | ||

| 2025-11-04 | 07:00 | 🇧🇷 | Medium | Industrial Production (YoY) (Sep) | 2.0% | 1.7% |

| 2025-11-04 | 12:00 | 🇪🇺 | Medium | German Buba President Nagel Speaks | ||

| 2025-11-04 | 15:00 | 🇳🇿 | Medium | RBNZ Financial Stability Report | ||

| 2025-11-04 | 16:30 | 🇺🇸 | Medium | API Weekly Crude Oil Stock | 6.500M | -2.400M |

| 2025-11-04 | 17:00 | 🇳🇿 | Medium | RBNZ Gov Orr Speaks | ||

| 2025-11-04 | 18:50 | 🇯🇵 | Medium | Monetary Policy Meeting Minutes | ||

| 2025-11-04 | 19:00 | 🇳🇿 | Medium | RBNZ Press Conference | ||

| 2025-11-04 | 20:45 | 🇨🇳 | Medium | Caixin Services PMI (Oct) | 52.5 | |

| 2025-11-04 | 22:35 | 🇯🇵 | Medium | 10-Year JGB Auction |

**Overview:**

Today’s economic calendar features several high-impact events that could significantly influence currency markets, particularly for the Euro (EUR), New Zealand Dollar (NZD), and Brazilian Real (BRL). Notably, the speeches from ECB President Lagarde and various RBNZ officials are crucial for market sentiment.

**Key Releases:**

1. **Spanish Unemployment Change (Oct)**: The actual figure of 22.1K far exceeded the forecast of 5.2K, indicating a deterioration in the labor market. This could weigh on the EUR, suggesting potential dovish shifts in ECB policy.

2. **Industrial Production (YoY) (Sep) for Brazil**: The actual growth of 2.0% surpassed the forecast of 1.7%, reflecting stronger-than-expected economic activity, which may bolster the BRL.

3. **API Weekly Crude Oil Stock**: A significant build of 6.5M barrels against a forecast of a 2.4M draw could negatively impact USD and oil prices, suggesting oversupply concerns.

**Market Impact:**

The disappointing unemployment data from Spain may lead to bearish sentiment for the EUR, while the positive industrial production figures could support the BRL. The API report’s bearish oil data may also create downward pressure on the USD. Overall, traders will closely monitor central bank communications for further insights into monetary policy direction.

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.