US Markets Closing Bell: Netflix Miss Earnings ,S&P 500 Slightly Up

📊 Market Recap

**Market Recap: US Market Closing Session**

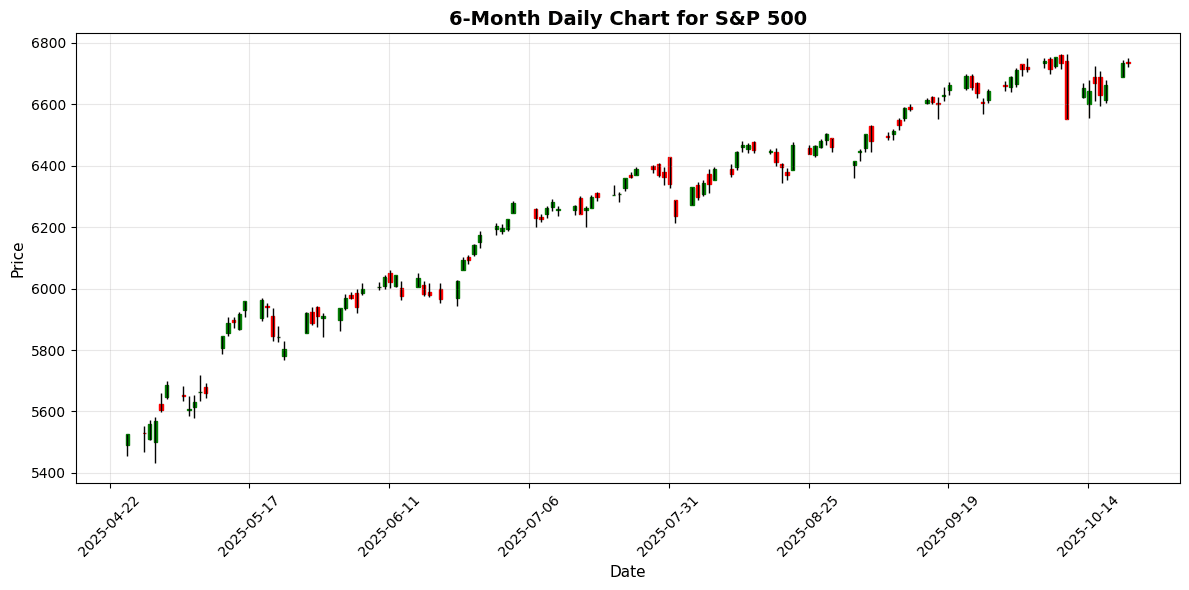

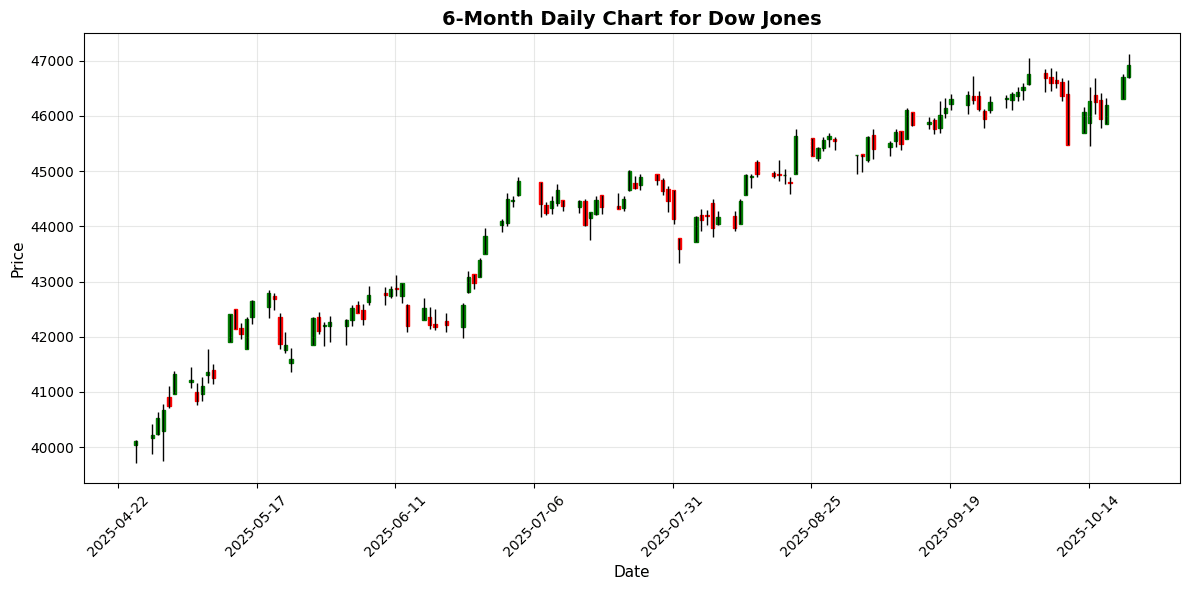

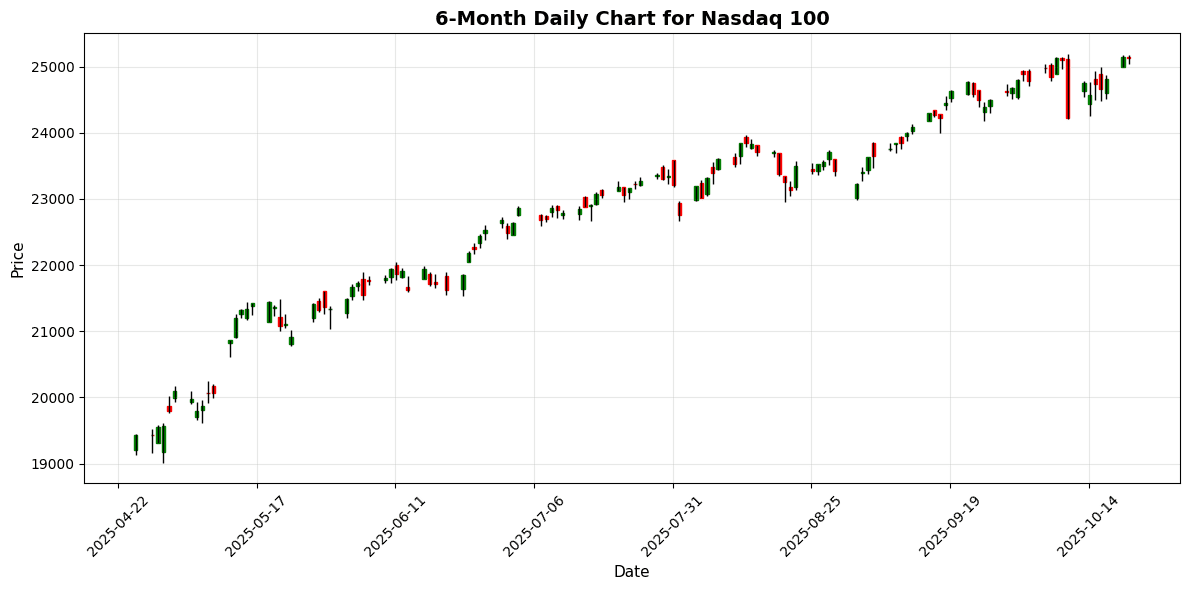

Today’s trading session opened with a mixed sentiment as investors awaited the critical September Consumer Price Index (CPI) report, which is anticipated to provide insights into inflation trends. The market experienced fluctuations throughout the day, with the Dow Jones Industrial Average ultimately closing at 46,924.74, marking a 0.47% gain. Conversely, the S&P 500 edged up slightly by 0.0033%, while the Nasdaq 100 slipped by 0.0552%, reflecting a divergence in performance among the indices.

Key drivers of the indices included earnings reports and sector-specific news. The Dow was buoyed by strong performances from traditional sectors, particularly after Capital One reported a surge in profits and announced a significant $16 billion stock buyback. In contrast, Netflix shares fell sharply after the company missed earnings estimates due to a tax dispute with Brazilian authorities, which negatively impacted market sentiment in tech stocks.

Sector movements were notable, with the consumer discretionary sector experiencing volatility. Beyond Meat saw a remarkable 146% surge following its inclusion in a meme ETF and a distribution deal with Walmart, highlighting the potential for speculative trading in the current market environment. Meanwhile, companies linked to the rare earth supply chain gained traction amid ongoing concerns about China’s dominance in this sector.

Market breadth showed mixed signals, with advancing issues slightly outpacing decliners. However, overall trading volume reflected a cautious approach as investors positioned themselves ahead of the CPI data release.

In the currency markets, the US Dollar strengthened against major currencies, with the EUR/USD pair falling 0.37% to 1.1604, while the GBP/USD dipped 0.28% to 1.3367. The USD/JPY rose 0.76% to 151.8720, indicating a robust performance of the dollar amid easing trade tensions between the US and China, which contributed to a more favorable outlook for the Greenback.

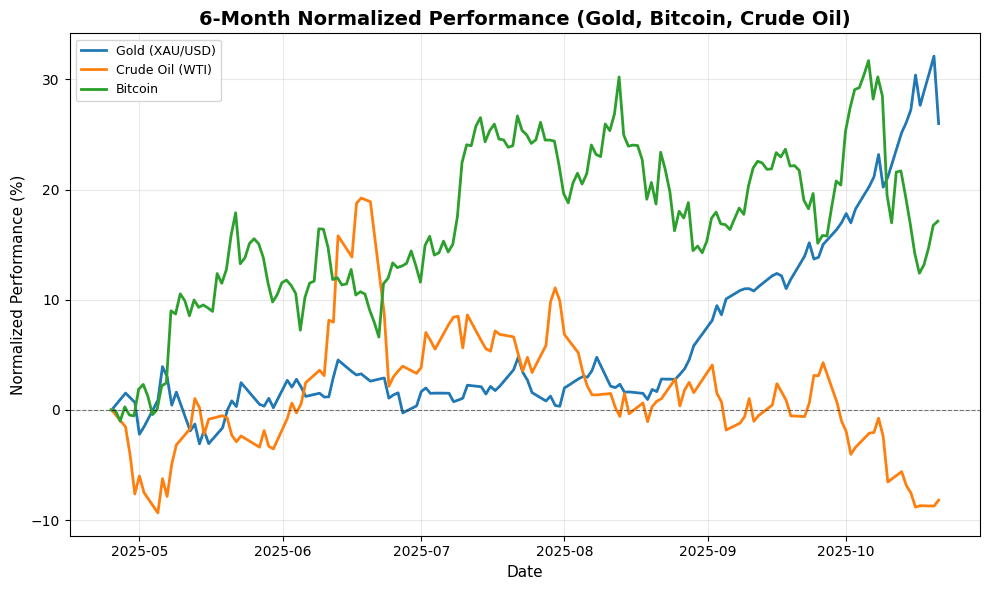

Commodities also faced significant movements today. Gold prices plummeted over 4.63%, closing at $4,135.50, marking one of the largest single-day declines in over a decade as traders booked profits ahead of the inflation report. Meanwhile, crude oil prices inched up 0.59% to $57.86, reflecting ongoing supply concerns. Bitcoin managed a modest gain of 0.33%, closing at $110,951.66, as it continues to navigate a volatile market landscape.

Globally, Asian and European markets showed resilience, with the EuroStoxx 50 and Nikkei 225 both posting gains. The Shanghai Composite led the way with a robust 1.36% increase, reflecting a generally optimistic tone in the global markets despite the challenges faced domestically.

As the market looks ahead, all eyes will remain on the upcoming CPI report, which is expected to significantly influence trading strategies and sentiment in the days to come.

US Market Indices

| Name | Price | Daily (%) |

|---|---|---|

| S&P 500 | 6735.35 | +0.00 |

| Dow Jones | 46924.74 | +0.47 |

| Nasdaq 100 | 25127.13 | -0.06 |

FX & Commodities

| Name | Price | Daily (%) |

|---|---|---|

| EUR/USD | 1.16 | -0.37 |

| USD/JPY | 151.87 | +0.76 |

| GBP/USD | 1.34 | -0.28 |

| Gold (XAU/USD) | 4135.50 | -4.63 |

| Crude Oil (WTI) | 57.86 | +0.59 |

| Bitcoin | 110951.66 | +0.33 |

🌍 Geopolitics and Markets

### Geopolitics and Markets Analysis

Recent geopolitical developments are significantly influencing market dynamics, particularly in light of ongoing trade tensions and economic uncertainties. The notable drop in Netflix shares due to a tax dispute in Brazil highlights the fragility of international business operations amid local regulatory challenges. This situation underscores the importance of stable trade relations, especially for companies heavily reliant on international markets.

Investor sentiment is also being shaped by the upcoming U.S. Consumer Price Index (CPI) report, which is anticipated with skepticism. As inflation data becomes a focal point for central bank policy, any unexpected results could lead to heightened market volatility. The Federal Reserve’s stance on interest rates will be closely monitored, especially as the U.S. dollar has shown renewed strength, driven by easing trade tensions and a robust economic outlook.

In the context of global economic trends, the recent surge in rare earth stocks reflects a strategic shift as nations seek to reduce dependence on China for critical materials. This could have long-term implications for supply chains and manufacturing costs, particularly in technology and green energy sectors.

Political events, such as Argentina’s peso decline amid U.S. intervention attempts, are indicative of broader instability that could affect investor confidence in emerging markets. The anticipated visit of Saudi Crown Prince Mohammed bin Salman to the White House may also signal shifts in Middle Eastern geopolitics, particularly concerning defense and normalization efforts with Israel.

Overall, these developments illustrate a complex interplay of geopolitical risks and economic indicators that are likely to shape market trajectories in the near term. Investors should remain vigilant as both domestic and international events unfold, potentially impacting asset valuations across various sectors.

📅 Today’s Economic Calendar

All times are in US Eastern Time (ET)

| Date | Time | Cur | Imp | Event | Actual | Forecast |

|---|---|---|---|---|---|---|

| 2025-10-21 | 00:00 | 🇪🇺 | Medium | German Buba President Nagel Speaks | ||

| 2025-10-21 | 03:00 | 🇪🇺 | Medium | ECB’s Lane Speaks | ||

| 2025-10-21 | 06:30 | 🇬🇧 | Medium | BoE Gov Bailey Speaks | ||

| 2025-10-21 | 07:00 | 🇪🇺 | Medium | ECB President Lagarde Speaks | ||

| 2025-10-21 | 08:30 | 🇨🇦 | Medium | Core CPI (MoM) (Sep) | 0.2% | |

| 2025-10-21 | 08:30 | 🇨🇦 | Medium | Core CPI (YoY) (Sep) | 2.8% | |

| 2025-10-21 | 08:30 | 🇨🇦 | Medium | CPI (MoM) (Sep) | 0.1% | -0.1% |

| 2025-10-21 | 09:00 | 🇺🇸 | Medium | Fed Waller Speaks | ||

| 2025-10-21 | 13:00 | 🇪🇺 | Medium | German Buba Balz Speaks | ||

| 2025-10-21 | 15:30 | 🇺🇸 | Medium | Fed Waller Speaks | ||

| 2025-10-21 | 16:30 | 🇺🇸 | Medium | API Weekly Crude Oil Stock | ||

| 2025-10-21 | 17:00 | 🇺🇸 | Medium | TIC Net Long-Term Transactions (Aug) | ||

| 2025-10-21 | 18:00 | 🇪🇺 | Medium | German Buba President Nagel Speaks | ||

| 2025-10-21 | 19:50 | 🇯🇵 | Medium | Adjusted Trade Balance | -0.11T | |

| 2025-10-21 | 19:50 | 🇯🇵 | Medium | Exports (YoY) (Sep) | 4.6% | |

| 2025-10-21 | 19:50 | 🇯🇵 | Medium | Trade Balance (Sep) | 22.0B |

Today’s economic calendar features several key events that could significantly influence market sentiment and currency valuations. Notably, there are multiple speeches from central bank officials, alongside critical inflation data from Canada and trade figures from Japan.

**Key Releases:**

1. **Core CPI (MoM & YoY) for Canada**: The Core CPI (MoM) came in at 0.2%, while the YoY figure was reported at 2.8%. These results are slightly above expectations, indicating persistent inflationary pressures, which may bolster the Canadian dollar (CAD) as traders anticipate a potential tightening from the Bank of Canada.

2. **CPI (MoM)**: The CPI (MoM) showed a surprising increase of 0.1% against a forecast of -0.1%, further supporting the CAD’s strength.

3. **Japanese Trade Balance**: The Adjusted Trade Balance reported at -0.11T, with exports rising by 4.6%. This could lead to a positive sentiment towards the Japanese yen (JPY) as it reflects a resilient export sector.

**Market Impact:**

The stronger-than-expected Canadian inflation data likely supports the CAD, while the JPY may see a boost from positive trade figures. Market reactions are expected to reflect a cautious optimism, particularly in CAD and JPY pairs, as traders digest these developments alongside central bank speeches throughout the day.

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.