US Markets Closing Bell: Palantir Boosts Outlook Amid AI Surge, Nasdaq Up 0.4%

📊 Market Recap

**Market Recap: US Market Closing Session**

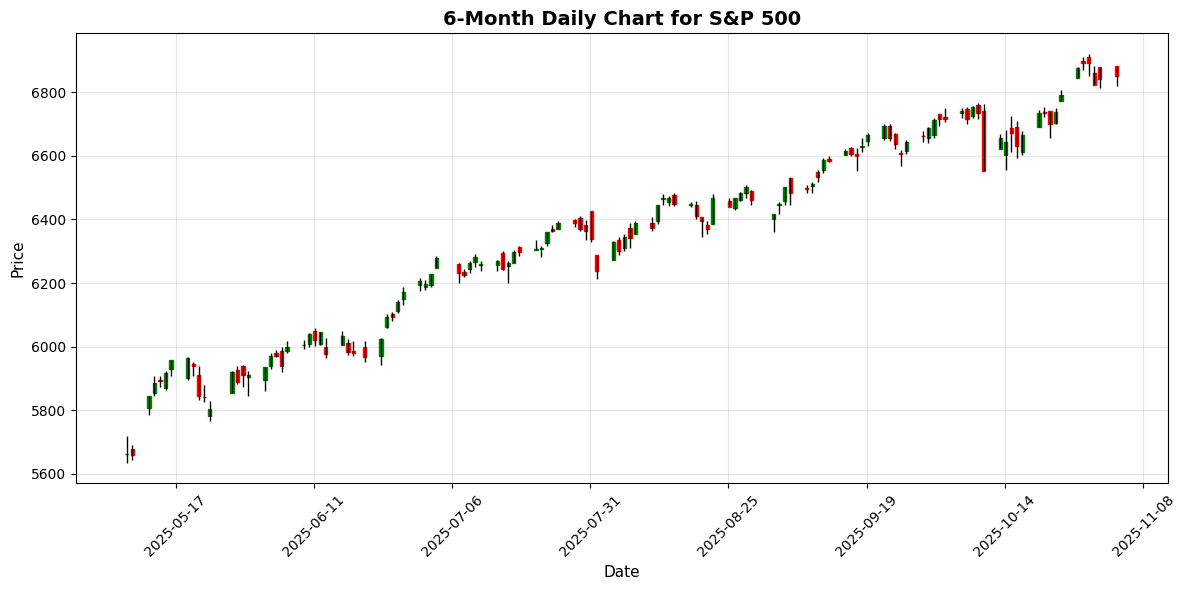

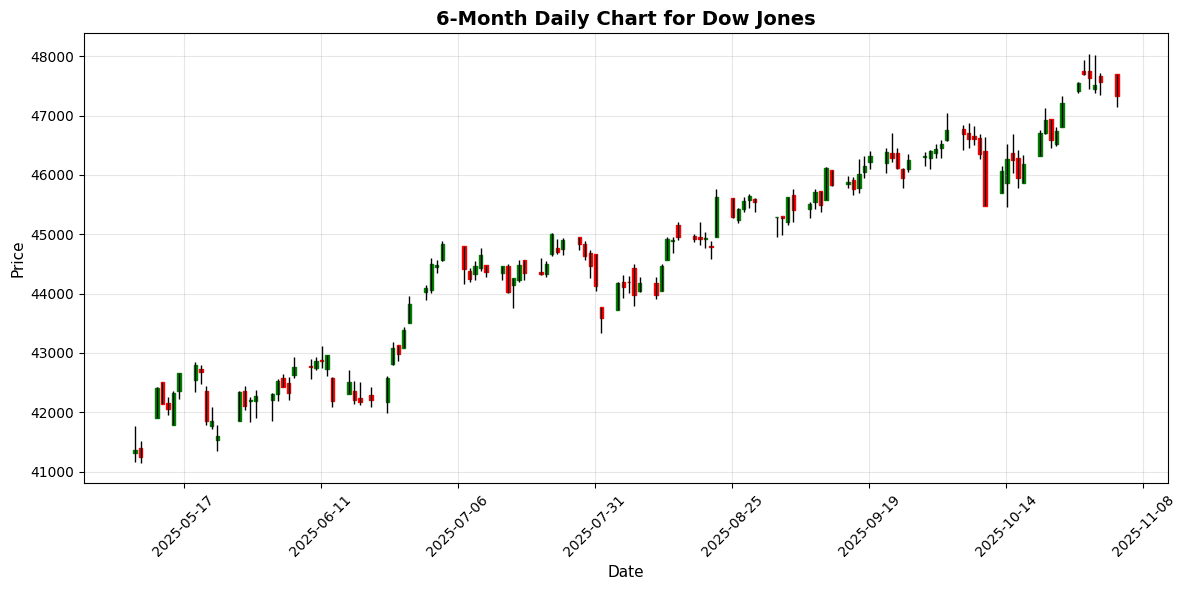

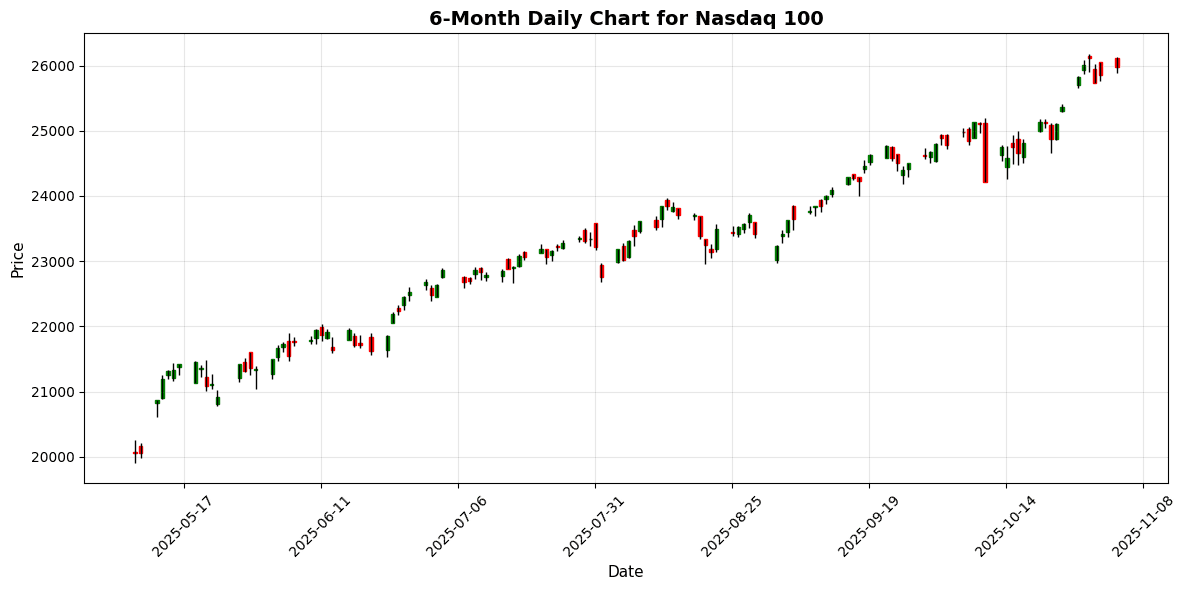

The US equity markets opened today with a cautiously optimistic sentiment, buoyed by strong earnings reports and ongoing enthusiasm for artificial intelligence (AI) investments. As the session progressed, the S&P 500 and Nasdaq 100 recorded gains, while the Dow Jones Industrial Average faced pressure, reflecting a divergence in performance among the major indices.

The S&P 500 closed at 6,851.97, up 0.17%, while the Nasdaq 100 gained 0.44% to finish at 25,972.94. In contrast, the Dow Jones dipped 0.48% to 47,336.68. The disparity in performance was largely driven by the tech sector, with Amazon’s announcement of a $38 billion deal with OpenAI significantly boosting investor sentiment. This transaction is expected to enhance AI capabilities through Amazon Web Services, further solidifying the tech sector’s growth narrative.

Sector movements were notable, particularly in technology, where stocks like Amazon and Palantir surged on positive earnings and guidance. Palantir reported earnings that exceeded expectations, attributing its growth to AI adoption, which further fueled investor interest in tech stocks. However, consumer staples and industrials lagged, with declines in companies like Kimberly-Clark, which announced plans to acquire Kenvue, leading to mixed reactions in the market.

Market breadth was relatively balanced, though declining stocks slightly outnumbered advancers on the NYSE, indicating some caution among investors. Trading volume was moderate, reflecting a wait-and-see attitude as participants digested earnings reports and economic indicators.

In the currency markets, the US dollar showed strength against the euro, with the EUR/USD pair trading at 1.1523, down 0.09%. The dollar maintained its position against the yen at 154.19, while the GBP/USD edged up slightly to 1.3141. The strength of the dollar can be attributed to ongoing hawkish sentiment from the Federal Reserve, particularly following remarks from Fed Governor Lisa Cook about maintaining a focus on lowering inflation pressures.

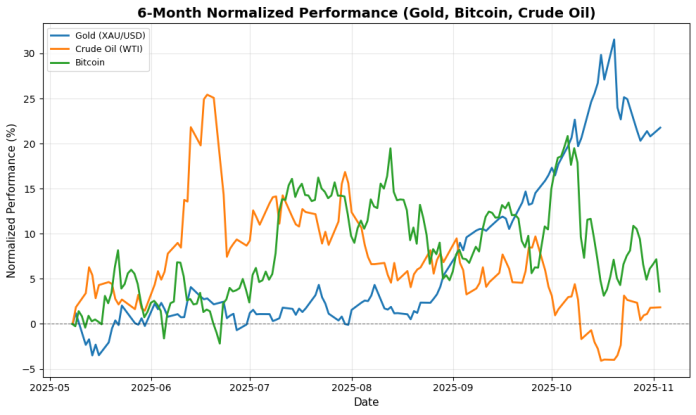

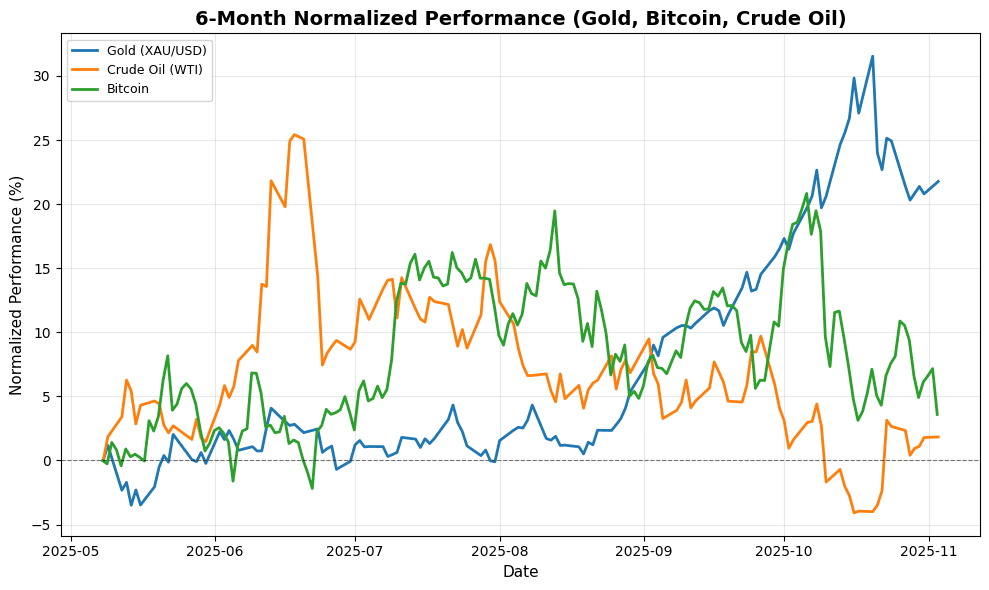

In commodities, gold prices held steady around $4,014 per ounce, up 0.80%, as traders assessed the impact of a recent end to tax rebates for retailers in China, which could affect demand. Crude oil prices remained stable at $61.01 per barrel, reflecting a slight increase of 0.05%. However, Bitcoin fell sharply by 3.33%, closing at $106,951.80, following a multimillion-dollar hack of a decentralized finance protocol that raised concerns about security in the crypto space.

Globally, markets showed mixed performance, with the EuroStoxx 50 up 0.30% and the Nikkei 225 gaining 2.11%, indicating a positive sentiment in Asian markets. However, the FTSE 100 declined by 0.16%, reflecting local economic concerns.

In summary, today’s trading session highlighted a strong performance in tech

US Market Indices

| Name | Price | Daily (%) |

|---|---|---|

| S&P 500 | 6851.97 | +0.17 |

| Dow Jones | 47336.68 | -0.48 |

| Nasdaq 100 | 25972.94 | +0.44 |

Global Markets

| Name | Price | Daily (%) |

|---|---|---|

| EuroStoxx 50 | 5679.25 | +0.30 |

| Nikkei 225 | 52411.34 | +2.12 |

| FTSE 100 | 9701.37 | -0.16 |

| Shanghai Composite | 3976.52 | +0.55 |

FX & Commodities

| Name | Price | Daily (%) |

|---|---|---|

| EUR/USD | 1.15 | -0.09 |

| USD/JPY | 154.19 | -0.01 |

| GBP/USD | 1.31 | +0.04 |

| Gold (XAU/USD) | 4014.00 | +0.80 |

| Crude Oil (WTI) | 61.01 | +0.05 |

| Bitcoin | 106951.80 | -3.33 |

🌍 Geopolitics and Markets

**Geopolitics and Markets Analysis**

In recent weeks, significant geopolitical developments have influenced market dynamics, particularly in the technology and commodities sectors. The $38 billion partnership between Amazon and OpenAI has propelled tech stocks, particularly the “Magnificent Seven,” driving a rally in the Nasdaq and S&P 500. This surge is indicative of a robust investor sentiment towards artificial intelligence, which is seen as a key growth driver. However, the broader market remains cautious due to ongoing geopolitical tensions, notably between the U.S. and China, as highlighted by President Trump’s recent tariff adjustments and discussions on fentanyl cooperation.

Central banks are also navigating a complex landscape. The European Central Bank (ECB) has held interest rates steady, signaling an end to its easing cycle amid resilient economic data. Conversely, Fed Governor Lisa Cook’s indecision regarding a potential December rate cut reflects uncertainty in U.S. monetary policy, particularly in the context of inflation pressures and the ongoing government shutdown. This uncertainty has resulted in mixed signals for investors, with the Dow Jones Industrial Average experiencing declines as tech-led gains in other indexes diverge.

Trade relations remain a focal point, particularly with Trump’s decision to reduce tariffs on Chinese fentanyl and the postponement of rare earths curbs by Beijing. These moves could ease some trade tensions but also raise questions about the sustainability of cooperation between the two nations.

Economic data releases are critical as markets assess the implications of these geopolitical developments. With inflationary pressures persisting, particularly in consumer prices as tariffs begin to impact holiday shopping, investor sentiment is likely to remain volatile. Overall, the convergence of these factors suggests a cautious outlook, with markets poised for fluctuations as geopolitical events unfold and economic indicators are released.

📅 Today’s Economic Calendar

All times are in US Eastern Time (ET)

| Date | Time | Cur | Imp | Event | Actual | Forecast |

|---|---|---|---|---|---|---|

| 2025-11-03 | 02:30 | 🇨🇭 | Medium | CPI (MoM) (Oct) | -0.3% | -0.1% |

| 2025-11-03 | 03:15 | 🇪🇺 | Medium | HCOB Spain Manufacturing PMI (Oct) | 52.1 | 51.8 |

| 2025-11-03 | 03:30 | 🇨🇭 | Medium | procure.ch Manufacturing PMI (Oct) | 48.2 | 47.7 |

| 2025-11-03 | 03:45 | 🇪🇺 | Medium | HCOB Italy Manufacturing PMI (Oct) | 49.9 | 49.3 |

| 2025-11-03 | 03:50 | 🇪🇺 | Medium | HCOB France Manufacturing PMI (Oct) | 48.8 | 48.3 |

| 2025-11-03 | 03:55 | 🇪🇺 | Medium | HCOB Germany Manufacturing PMI (Oct) | 49.6 | 49.6 |

| 2025-11-03 | 04:00 | 🇪🇺 | Medium | HCOB Eurozone Manufacturing PMI (Oct) | 50.0 | 50.0 |

| 2025-11-03 | 04:30 | 🇬🇧 | Medium | S&P Global Manufacturing PMI (Oct) | 49.7 | 49.6 |

| 2025-11-03 | 07:00 | 🇪🇺 | Medium | ECB’s Lane Speaks | ||

| 2025-11-03 | 09:45 | 🇺🇸 | High | S&P Global Manufacturing PMI (Oct) | 52.5 | 52.2 |

| 2025-11-03 | 10:00 | 🇺🇸 | Medium | ISM Manufacturing Employment (Oct) | 46.0 | |

| 2025-11-03 | 10:00 | 🇺🇸 | High | ISM Manufacturing PMI (Oct) | 48.7 | 49.4 |

| 2025-11-03 | 10:00 | 🇺🇸 | High | ISM Manufacturing Prices (Oct) | 58.0 | 62.4 |

| 2025-11-03 | 12:00 | 🇺🇸 | Medium | FOMC Member Daly Speaks | ||

| 2025-11-03 | 12:20 | 🇪🇺 | Medium | German Buba Balz Speaks | ||

| 2025-11-03 | 13:30 | 🇨🇦 | Medium | BoC Gov Macklem Speaks | ||

| 2025-11-03 | 22:30 | 🇦🇺 | High | RBA Interest Rate Decision (Nov) | 3.60% | |

| 2025-11-03 | 22:30 | 🇦🇺 | Medium | RBA Rate Statement | ||

| 2025-11-03 | 23:30 | 🇦🇺 | Medium | RBA Monetary Policy Statement |

**Overview:**

Today’s economic calendar features several high-impact events, particularly from the Eurozone, the US, and Switzerland, with a total of 12 key releases. These data points are crucial for market participants, as they provide insights into economic health and central bank policy directions.

**Key Releases:**

1. **CPI (MoM) for CHF**: The Swiss CPI fell by 0.3% in October, significantly worse than the forecast of -0.1%. This unexpected drop may signal deflationary pressures, potentially leading to a weaker CHF.

2. **HCOB Spain Manufacturing PMI**: The index came in at 52.1, surpassing expectations of 51.8, indicating a stronger manufacturing sector in Spain, which could bolster the EUR.

3. **ISM Manufacturing PMI for USD**: The PMI registered at 48.7, below the forecast of 49.4, suggesting a contraction in the US manufacturing sector, which may weigh on the USD.

**Market Impact:**

The unexpected decline in Swiss CPI could lead to a depreciation of the CHF as deflation concerns rise. Conversely, the stronger Spanish PMI may support the EUR, enhancing its appeal against weaker currencies. The disappointing US manufacturing data likely contributed to a bearish sentiment for the USD, potentially leading to shifts in trading strategies as investors reassess growth expectations. Overall, these releases are shaping market sentiment and influencing currency pairs throughout the day.

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.