US Markets Closing Bell: Regional Bank Concerns Weigh Down Indices, S&P 500 Falls 0.6%

📊 Market Recap

**Market Recap: US Market Closing Session**

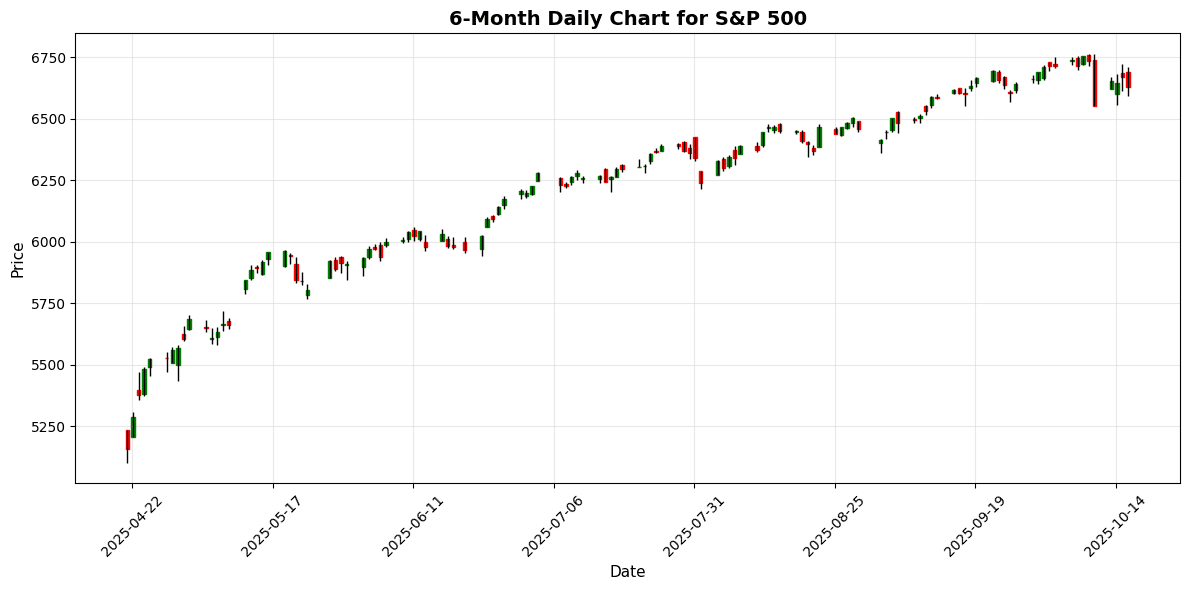

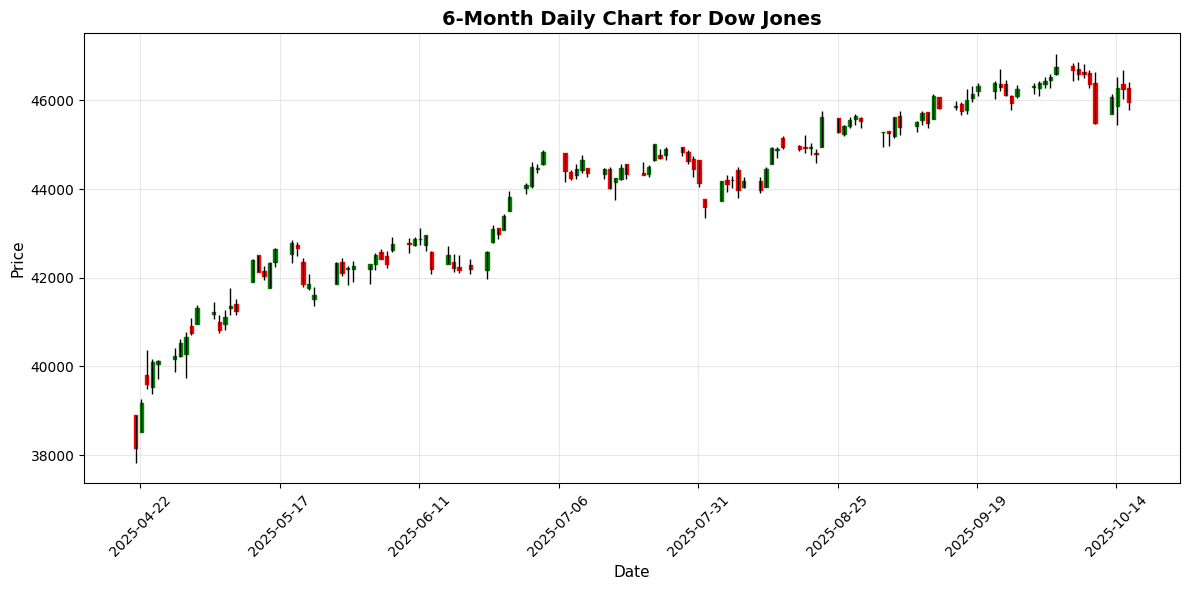

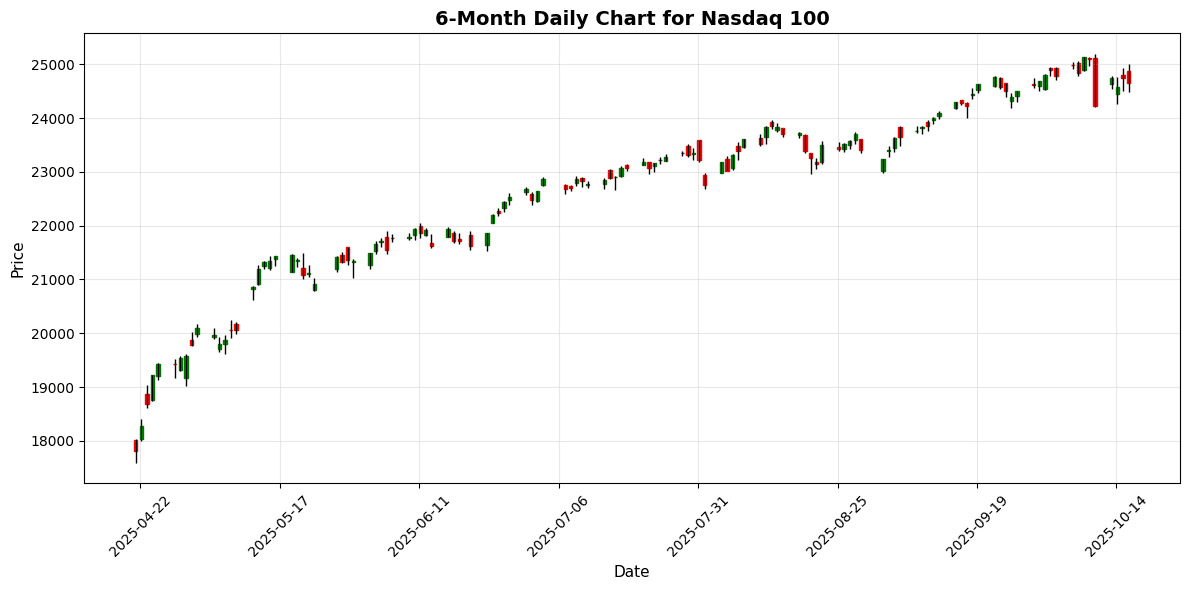

The US equity markets faced a challenging session today, reflecting a cautious sentiment among investors amid rising concerns over the health of regional banks and the broader implications of increasing tariff costs on corporate earnings. The major indices opened lower and maintained a downward trajectory throughout the day, with the Dow Jones Industrial Average falling 330 points, or approximately 0.65%, closing at 45,952.24. The S&P 500 and Nasdaq 100 also experienced declines of 0.63% and 0.36%, respectively, closing at 6,629.07 and 24,657.24.

The primary drivers of today’s market performance included heightened fears regarding the stability of regional lenders, particularly following reports of significant losses at Jefferies and other institutions. The regional bank index suffered its worst day since April, contributing to the overall bearish sentiment. Additionally, concerns about escalating tariff costs, projected to reach $1.2 trillion this year, weighed on investor confidence, as S&P Global noted that these expenses would likely hit consumers the hardest.

Sector performance was mixed, with notable weakness in financials, particularly among regional banks. Conversely, technology stocks provided some support, with Salesforce showing resilience amid its earnings report. The broader market breadth reflected the negative sentiment, with declining stocks outpacing advancers significantly.

In terms of trading volume, the day was marked by heightened activity, with retail traders contributing to the largest options volume day in market history, surpassing 108 million contracts traded. This surge in options activity indicates a robust engagement from retail investors, even as the broader market faced headwinds.

In the currency markets, the US Dollar continued to soften, impacting major pairs. The EUR/USD rose to 1.1690, gaining 0.33%, while GBP/USD climbed to 1.3441, up 0.28%. The USD/JPY, however, saw a slight decline, trading at 150.36, down 0.36%. This softness in the dollar can be attributed to market expectations of potential rate cuts by the Federal Reserve, further influencing investor sentiment.

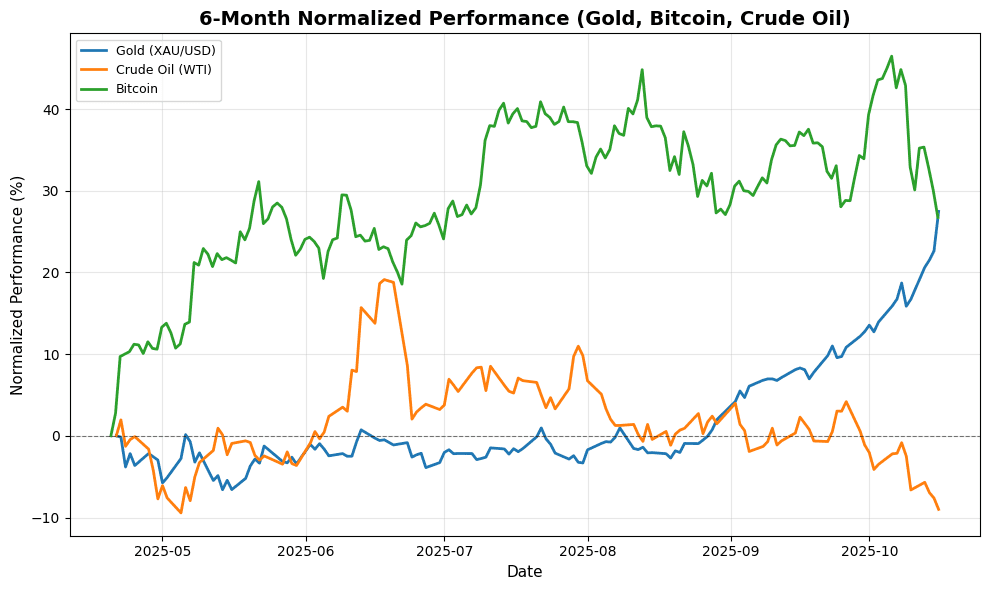

Commodity markets exhibited mixed results. Gold prices surged nearly 4% to close at $4,341.80, driven by safe-haven demand amid geopolitical tensions and market uncertainty. Conversely, crude oil prices dropped to $57.40, declining by 1.49%, as concerns over oversupply continued to plague the sector. Bitcoin also faced selling pressure, down 2.55% to $107,953.17.

Globally, markets displayed a contrasting picture, with the EuroStoxx 50 gaining 0.84% and the Nikkei 225 rising by 1.27%. These movements suggest a divergence in sentiment between US markets and their international counterparts, potentially influenced by varying economic outlooks and geopolitical factors.

In summary, today’s session reflected a complex interplay of regional banking concerns, tariff implications, and shifting investor sentiment

US Market Indices

| Name | Price | Daily (%) |

|---|---|---|

| S&P 500 | 6629.07 | -0.63 |

| Dow Jones | 45952.24 | -0.65 |

| Nasdaq 100 | 24657.24 | -0.36 |

Global Markets

| Name | Price | Daily (%) |

|---|---|---|

| EuroStoxx 50 | 5652.01 | +0.84 |

| Nikkei 225 | 48277.74 | +1.27 |

| FTSE 100 | 9436.09 | +0.12 |

| Shanghai Composite | 3916.23 | +0.10 |

FX & Commodities

| Name | Price | Daily (%) |

|---|---|---|

| EUR/USD | 1.17 | +0.33 |

| USD/JPY | 150.36 | -0.36 |

| GBP/USD | 1.34 | +0.28 |

| Gold (XAU/USD) | 4341.80 | +3.95 |

| Crude Oil (WTI) | 57.40 | -1.49 |

| Bitcoin | 107953.17 | -2.55 |

🌍 Geopolitics and Markets

### Geopolitics and Markets Analysis

Recent geopolitical developments are exerting significant pressure on global markets, particularly in the context of rising concerns about sour loans within regional banks. This has sparked fears about the broader health of the financial sector, leading to a notable decline in stock indices, including a 330-point drop in the Dow Jones Industrial Average. The increased scrutiny on banks, particularly following the indictment of former national security advisor John Bolton, adds to the volatility as political events shape investor sentiment.

Central bank activities are also pivotal in the current landscape. Federal Reserve Governor Miran has advocated for a half-point rate cut, while Waller supports a more cautious quarter-point reduction, reflecting divergent views within the Fed. This uncertainty surrounding monetary policy is compounded by the ongoing discussions about the U.S. budget deficit, which, despite a slight decrease, remains at a staggering $1.78 trillion, influenced heavily by record tariff payments.

Trade relations are under scrutiny as tariff costs are projected to reach $1.2 trillion, with consumers bearing the brunt of these expenses. The Swiss economy has been particularly affected by punitive U.S. tariffs, highlighting the interconnectedness of global trade dynamics. Additionally, geopolitical tensions, such as the anticipated meeting between Trump and Putin regarding the Ukraine conflict, could further sway market trajectories, especially if they lead to shifts in U.S. defense policy.

Amid these complexities, gold has emerged as a favored safe haven, nearing $4,300 as demand surges in response to market uncertainties. This reflects a broader trend of investors seeking stability amidst geopolitical and economic upheaval, indicating a potential shift in asset allocation strategies going forward. As markets navigate these turbulent waters, the interplay between political events, central bank policies, and international trade developments will remain crucial in shaping investor sentiment and market performance.

📅 Today’s Economic Calendar

All times are in US Eastern Time (ET)

| Date | Time | Cur | Imp | Event | Actual | Forecast |

|---|---|---|---|---|---|---|

| 2025-10-16 | 02:00 | 🇬🇧 | High | GDP (MoM) (Aug) | 0.1% | 0.1% |

| 2025-10-16 | 02:00 | 🇬🇧 | Medium | Industrial Production (MoM) (Aug) | 0.4% | 0.2% |

| 2025-10-16 | 02:00 | 🇬🇧 | Medium | Manufacturing Production (MoM) (Aug) | 0.7% | 0.2% |

| 2025-10-16 | 02:00 | 🇬🇧 | Medium | Monthly GDP 3M/3M Change (Aug) | 0.3% | 0.3% |

| 2025-10-16 | 02:00 | 🇬🇧 | Medium | Trade Balance (Aug) | -21.18B | -21.80B |

| 2025-10-16 | 02:00 | 🇬🇧 | Medium | Trade Balance Non-EU (Aug) | -8.29B | |

| 2025-10-16 | 04:30 | 🇬🇧 | Medium | BOE Credit Conditions Survey | ||

| 2025-10-16 | 05:00 | 🇪🇺 | Medium | Trade Balance (Aug) | 1.0B | 6.9B |

| 2025-10-16 | 06:10 | 🇬🇧 | Medium | NIESR Monthly GDP Tracker | 0.3% | |

| 2025-10-16 | 08:15 | 🇨🇦 | Medium | Housing Starts (Sep) | 279.2K | 258.0K |

| 2025-10-16 | 08:30 | 🇺🇸 | High | Philadelphia Fed Manufacturing Index (Oct) | -12.8 | 8.6 |

| 2025-10-16 | 08:30 | 🇺🇸 | Medium | Philly Fed Employment (Oct) | 4.6 | |

| 2025-10-16 | 09:00 | 🇬🇧 | Medium | BoE MPC Member Mann Speaks | ||

| 2025-10-16 | 09:00 | 🇺🇸 | Medium | Fed Vice Chair for Supervision Barr Speaks | ||

| 2025-10-16 | 09:00 | 🇺🇸 | Medium | Fed Waller Speaks | ||

| 2025-10-16 | 10:00 | 🇺🇸 | Medium | FOMC Member Bowman Speaks | ||

| 2025-10-16 | 10:45 | 🇬🇧 | Medium | BoE Deputy Governor Woods Speaks | ||

| 2025-10-16 | 10:45 | 🇬🇧 | Medium | BoE MPC Member Mann Speaks | ||

| 2025-10-16 | 11:45 | 🇪🇺 | Medium | ECB’s Lane Speaks | ||

| 2025-10-16 | 12:00 | 🇺🇸 | High | Crude Oil Inventories | 3.524M | 0.300M |

| 2025-10-16 | 12:00 | 🇺🇸 | Medium | Cushing Crude Oil Inventories | -0.703M | |

| 2025-10-16 | 12:00 | 🇪🇺 | Medium | ECB President Lagarde Speaks | ||

| 2025-10-16 | 13:00 | 🇺🇸 | Medium | API Weekly Crude Oil Stock | 3.524M | 0.120M |

| 2025-10-16 | 13:30 | 🇨🇦 | Medium | BoC Gov Macklem Speaks | ||

| 2025-10-16 | 14:00 | 🇺🇸 | Medium | Federal Budget Balance (Sep) | 198.0B | |

| 2025-10-16 | 16:30 | 🇺🇸 | Medium | Fed’s Balance Sheet | 6,596B | |

| 2025-10-16 | 18:00 | 🇺🇸 | Medium | FOMC Member Kashkari Speaks |

Today features several high-impact economic releases, particularly from the UK, which could significantly influence market sentiment and currency valuations.

Key releases include the UK GDP for August, which matched forecasts at 0.1%, indicating stability in economic growth. However, more notably, Industrial Production and Manufacturing Production both exceeded expectations, coming in at 0.4% and 0.7%, respectively, against forecasts of 0.2%. This stronger-than-expected performance may bolster the GBP as it reflects resilience in the manufacturing sector. Additionally, the Trade Balance showed a smaller deficit than anticipated at -21.18B, compared to a forecast of -21.80B, further supporting GBP strength.

In the US, the Philadelphia Fed Manufacturing Index reported a surprising contraction at -12.8, far below the forecast of 8.6, which may weigh on the USD. The negative sentiment from this release could lead to increased volatility in USD pairs.

Overall, the stronger UK data is likely to support GBP against USD, while the disappointing US manufacturing data may lead to a bearish outlook for the USD. Market participants will be closely watching subsequent speeches from central bank officials for further insights into monetary policy direction.

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.