US Markets Closing Bell: S&P 500 Edges Higher Ahead of Inflation Report, Sentiment Steady

📊 Market Recap

**Market Recap: US Market Closing Session**

In today’s trading session, US markets exhibited a positive sentiment, with investors recouping some losses from previous days. The anticipation of Friday’s critical inflation report loomed large, influencing trading behavior throughout the day. The major indices closed higher, bolstered by earnings reports from key companies and a resilient consumer outlook.

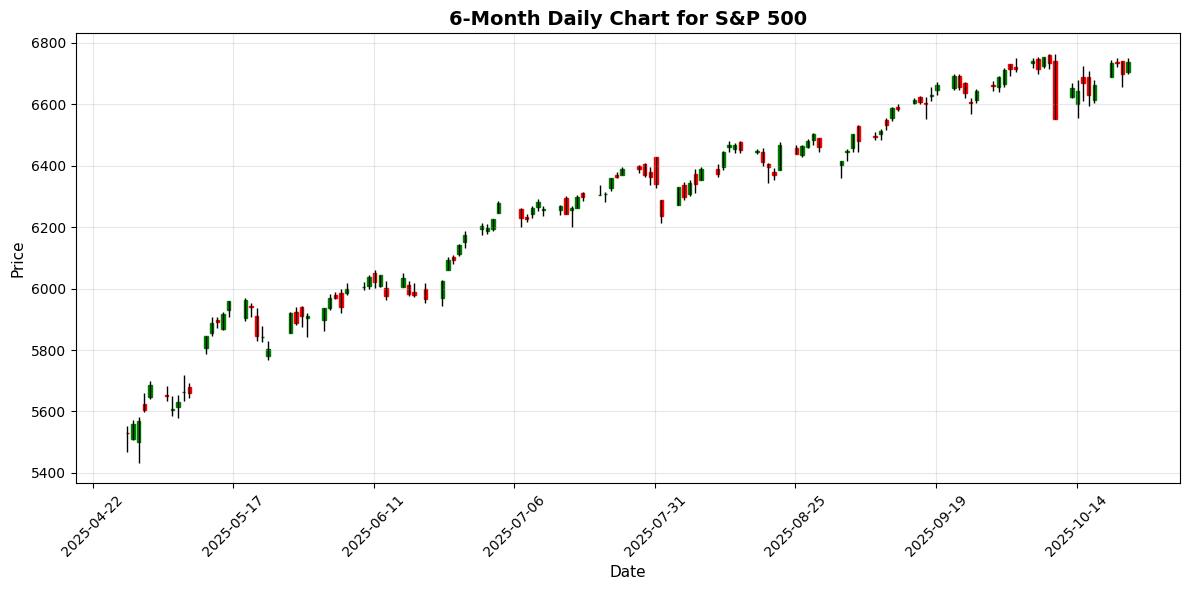

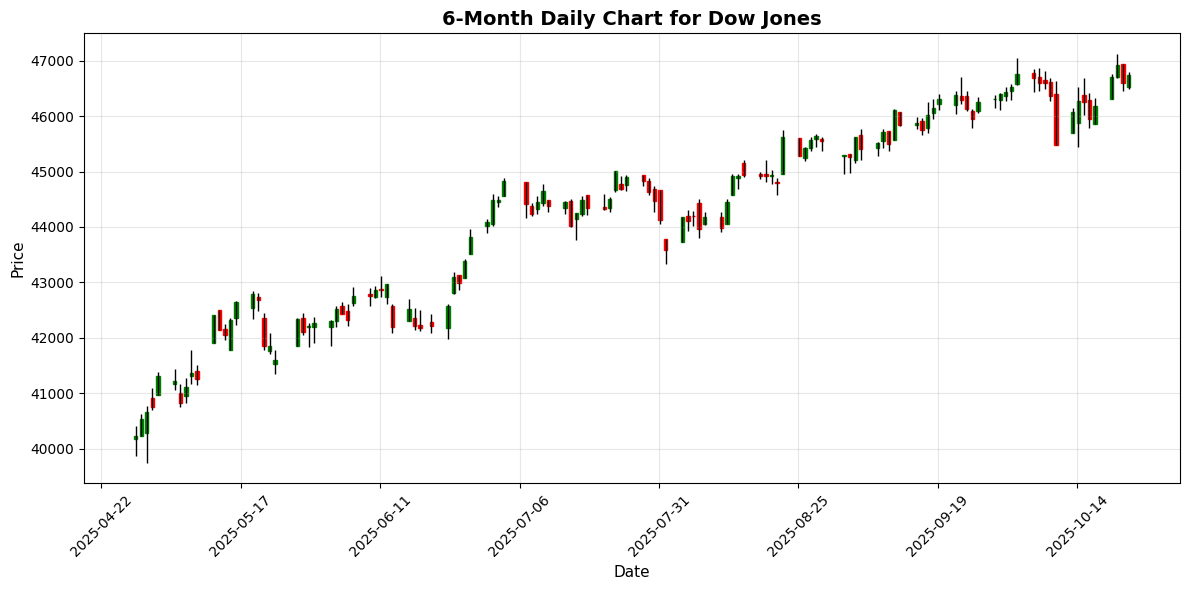

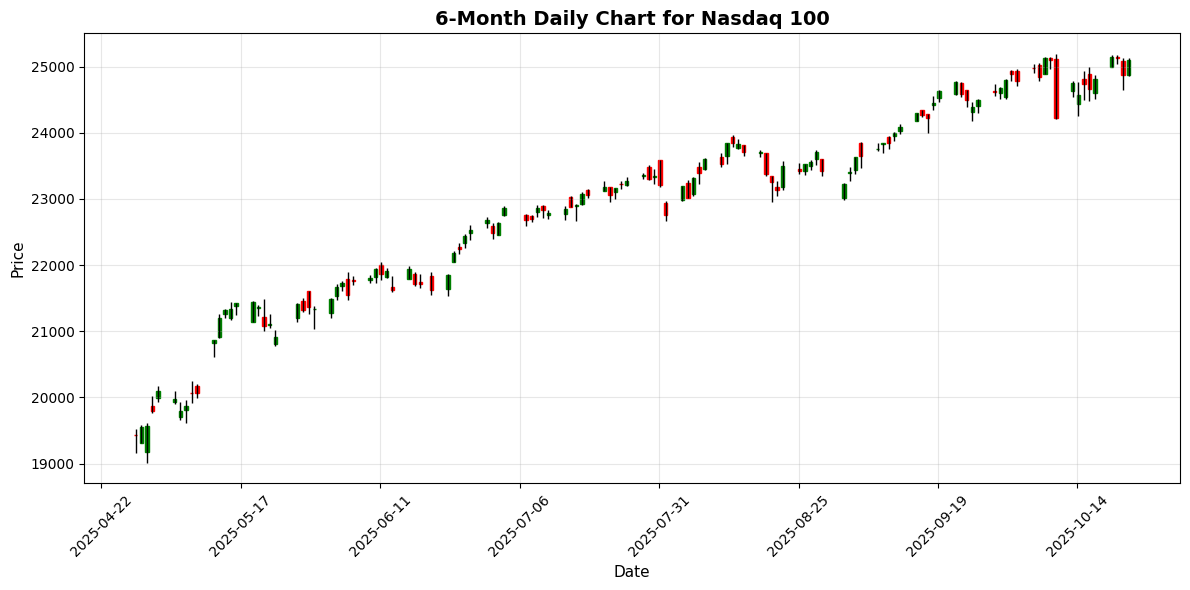

The S&P 500 rose by 0.58% to close at 6,738.44, while the Dow Jones Industrial Average increased by 0.31% to 46,734.61. The tech-heavy Nasdaq 100 outperformed, gaining 0.88% to finish at 25,097.42. Key drivers of this upward momentum included strong earnings from major corporations, which many investors believe are pivotal for sustaining the current bull market rally.

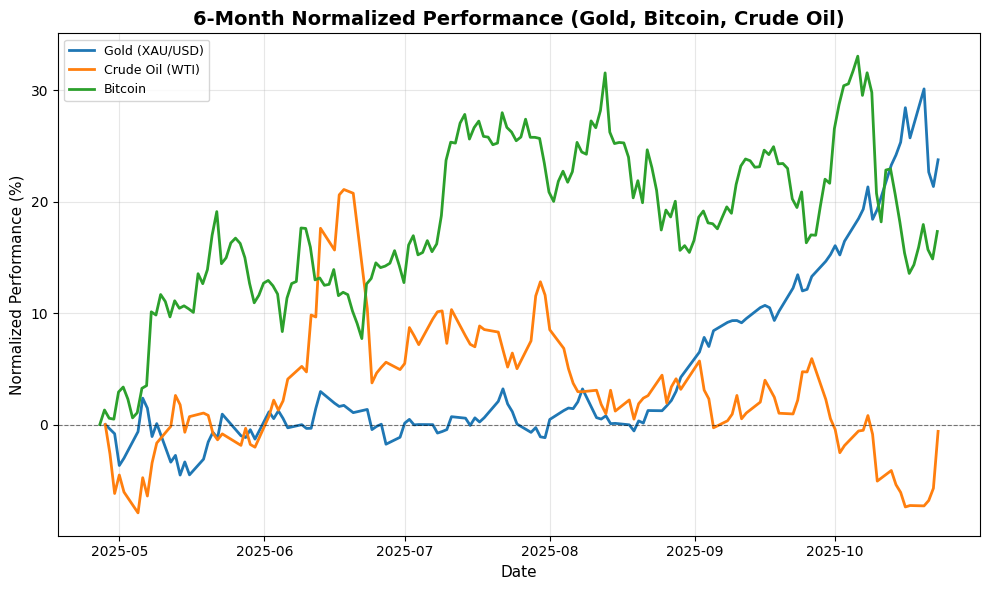

Sector performance was mixed, with energy and materials leading the charge due to rising commodity prices. Crude oil surged over 5% as the market reacted to US sanctions on Russian oil producers, raising concerns about supply constraints. Notable stocks included Ford, which reported better-than-expected earnings but revised its 2025 guidance lower due to operational challenges. Conversely, the consumer discretionary sector faced pressure as concerns over consumer spending emerged, reflecting ongoing economic uncertainties.

Market breadth was moderately positive, with advancing stocks outpacing decliners, indicating a broad-based rally. Trading volume was robust, suggesting heightened investor engagement as the market reacts to upcoming economic indicators.

In the currency markets, the US Dollar remained firm, with the EUR/USD trading at 1.1620, up marginally by 0.05%. The USD/JPY pair rose to 152.57, reflecting a 0.44% increase, while the GBP/USD slipped 0.24% to 1.3324. The dollar’s strength was attributed to the anticipation surrounding the inflation data, which is expected to influence future monetary policy decisions.

Commodity markets reflected significant movements, particularly in oil and gold. Gold prices rose nearly 2% to $4,124.40, benefiting from a weaker dollar and safe-haven demand ahead of the inflation report. Bitcoin also saw a notable increase of over 2% to $110,000.84, as investor sentiment in the cryptocurrency market remained buoyant.

Globally, markets showed varied performance. The EuroStoxx 50 gained 0.52%, while the FTSE 100 rose 0.67%. In contrast, the Nikkei 225 fell by 1.35%, reflecting ongoing concerns over Japan’s economic outlook.

Overall, today’s market session reflected a cautious optimism as investors prepared for the upcoming inflation report, which is expected to provide critical insights into the economic landscape and potential Federal Reserve actions.

US Market Indices

| Name | Price | Daily (%) |

|---|---|---|

| S&P 500 | 6738.44 | +0.58 |

| Dow Jones | 46734.61 | +0.31 |

| Nasdaq 100 | 25097.42 | +0.88 |

Global Markets

| Name | Price | Daily (%) |

|---|---|---|

| EuroStoxx 50 | 5668.33 | +0.52 |

| Nikkei 225 | 48641.61 | -1.35 |

| FTSE 100 | 9578.57 | +0.67 |

| Shanghai Composite | 3922.41 | +0.22 |

FX & Commodities

| Name | Price | Daily (%) |

|---|---|---|

| EUR/USD | 1.16 | +0.05 |

| USD/JPY | 152.57 | +0.44 |

| GBP/USD | 1.33 | -0.24 |

| Gold (XAU/USD) | 4124.40 | +1.98 |

| Crude Oil (WTI) | 61.67 | +5.42 |

| Bitcoin | 110000.84 | +2.15 |

🌍 Geopolitics and Markets

**Geopolitics and Markets Analysis**

Current geopolitical dynamics are significantly influencing market sentiment and investor behavior. The impending release of September’s Consumer Price Index (CPI) report is a focal point for market participants, with expectations running high amid skepticism about the data’s accuracy due to the recent government shutdown. This report will likely dictate short-term market movements, especially for equities, as investors gauge inflation trends that could impact Federal Reserve policy.

In the backdrop, U.S.-China relations remain tense, particularly concerning technology trade. The White House is considering broader restrictions on software exports to China, which could exacerbate existing trade tensions and affect U.S. tech stocks’ performance. This situation is compounded by China’s recent commitment to bolster domestic consumption and technology development, signaling a strategic pivot that may further strain bilateral relations.

On the economic front, Ford’s earnings report, while beating expectations, included a lowered guidance for 2025, raising concerns about supply chain vulnerabilities and inflationary pressures. This reflects broader trends of corporate caution amidst rising operational costs, which may lead to a “K-shaped” economic recovery where some sectors prosper while others lag.

Additionally, geopolitical events such as U.S. sanctions on Russian oil producers are contributing to volatility in energy markets, with WTI prices experiencing upward pressure. This situation underscores the fragility of global supply chains and the potential for heightened inflationary pressures.

As investors navigate these complexities, the focus on cash, precious metals, and cryptocurrencies as alternative hedges against market concentration risks is growing. The current environment is marked by a cautious investor sentiment as geopolitical uncertainties, coupled with domestic economic challenges, continue to shape market trajectories.

📅 Today’s Economic Calendar

All times are in US Eastern Time (ET)

| Date | Time | Cur | Imp | Event | Actual | Forecast |

|---|---|---|---|---|---|---|

| 2025-10-23 | 01:00 | Medium | Core CPI (YoY) (Sep) | 0.40% | 0.20% | |

| 2025-10-23 | 01:00 | Medium | CPI (YoY) (Sep) | 0.7% | 0.6% | |

| 2025-10-23 | 03:25 | 🇨🇭 | Medium | SNB Monetary Policy Assessment | ||

| 2025-10-23 | 08:30 | 🇨🇦 | Medium | Core Retail Sales (MoM) (Aug) | 0.7% | 1.3% |

| 2025-10-23 | 08:30 | 🇨🇦 | Medium | Retail Sales (MoM) (Aug) | 1.0% | 1.0% |

| 2025-10-23 | 08:31 | 🇨🇦 | Medium | Retail Sales (MoM) (Sep) | -0.7% | |

| 2025-10-23 | 09:30 | 🇪🇺 | Medium | ECB’s Lane Speaks | ||

| 2025-10-23 | 10:00 | 🇺🇸 | Medium | Existing Home Sales (MoM) (Sep) | 1.5% | |

| 2025-10-23 | 10:00 | 🇺🇸 | High | Existing Home Sales (Sep) | 4.06M | 4.06M |

| 2025-10-23 | 10:00 | 🇺🇸 | Medium | FOMC Member Bowman Speaks | ||

| 2025-10-23 | 10:25 | 🇺🇸 | Medium | Fed Vice Chair for Supervision Barr Speaks | ||

| 2025-10-23 | 13:00 | 🇺🇸 | Medium | 5-Year TIPS Auction | 1.182% | |

| 2025-10-23 | 16:30 | 🇺🇸 | Medium | Fed’s Balance Sheet | 6,590B | |

| 2025-10-23 | 19:30 | 🇯🇵 | Medium | National Core CPI (YoY) (Sep) | 2.9% | |

| 2025-10-23 | 19:30 | 🇯🇵 | Medium | National CPI (MoM) (Sep) | ||

| 2025-10-23 | 20:30 | 🇯🇵 | Medium | au Jibun Bank Services PMI (Oct) |

Today’s economic calendar features several high-impact events that could significantly influence currency markets. Key releases include the Singapore Core CPI and CPI data, the Canadian Retail Sales figures, and U.S. Existing Home Sales.

At 01:00 ET, Singapore’s Core CPI rose to 0.40%, surpassing the forecast of 0.20%, indicating stronger inflationary pressures. The overall CPI also exceeded expectations at 0.7% versus a forecast of 0.6%, likely supporting the Singapore Dollar (SGD) and reflecting a more hawkish outlook for monetary policy.

In Canada, Retail Sales for August matched expectations at 1.0%, but September’s preliminary data showed a surprising decline of 0.7%, which could weaken the Canadian Dollar (CAD) as it suggests cooling consumer spending.

The U.S. Existing Home Sales report at 10:00 ET revealed a robust increase of 1.5%, aligning with the forecast of 4.06 million units sold. This positive data may bolster the U.S. Dollar (USD) as it reflects resilience in the housing market.

Overall, the market sentiment appears cautiously optimistic for the SGD and USD, while the CAD faces potential downward pressure due to mixed retail sales data.

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.