US Markets Closing Bell: Strong Earnings Drive Rally, Dow Up 1.0% and Nasdaq Surges 1.0%

📊 Market Recap

**Market Recap: US Market Closing Session**

The US markets experienced a robust session today, buoyed by a softer-than-expected inflation report for September, which revealed an annual inflation rate of 3.0%, slightly below the anticipated 3.1%. This data raised optimism surrounding potential interest rate cuts from the Federal Reserve later this year. The opening sentiment was decidedly positive, with investors emboldened by the prospect of easing monetary policy.

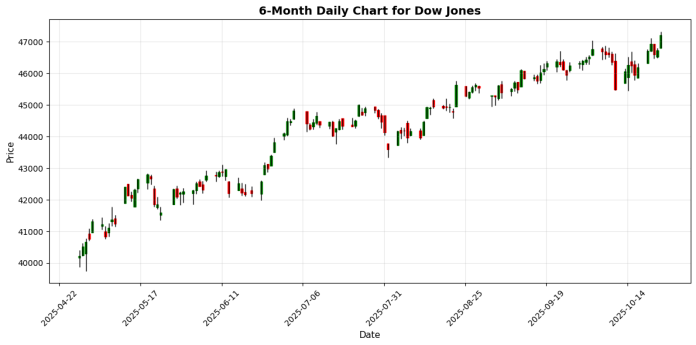

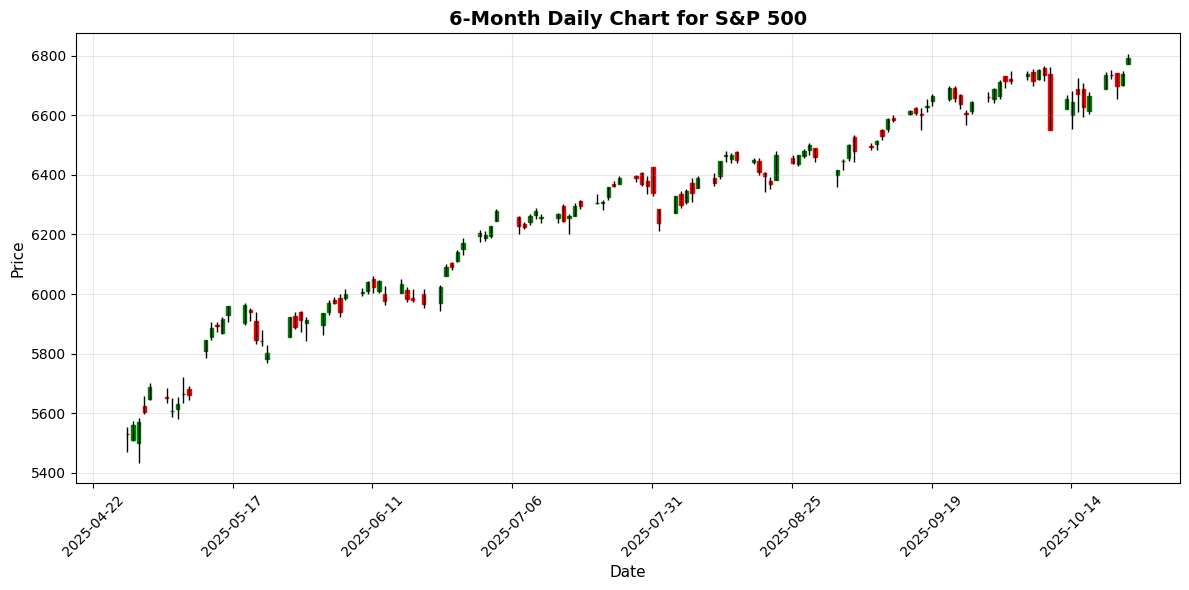

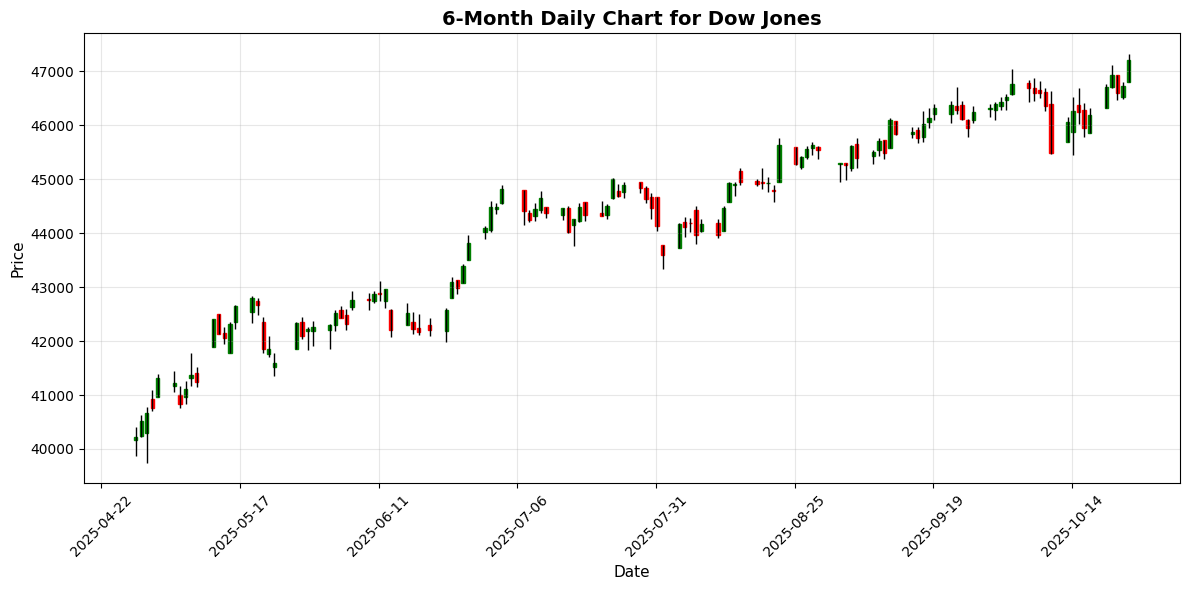

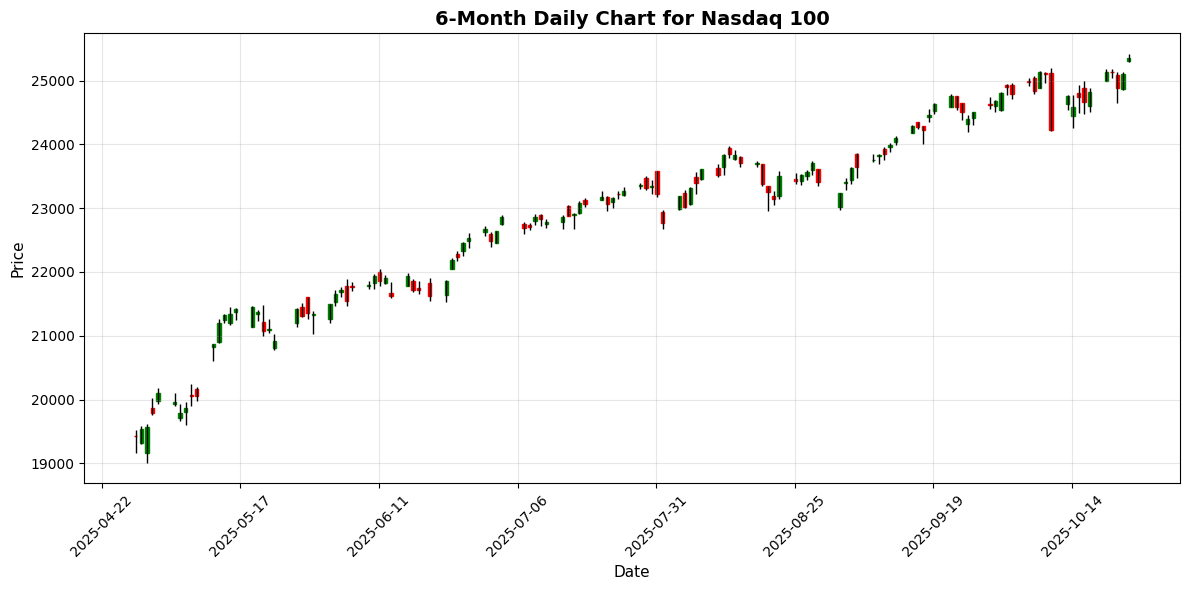

By market close, the Dow Jones Industrial Average surged by 1.01%, finishing at 47,207.12, marking its first close above 47,000. The S&P 500 followed suit, climbing 0.79% to settle at 6,791.69, while the Nasdaq 100 led the gains with a 1.04% increase, closing at 25,358.16. Key drivers of this rally included investor confidence in the Fed’s potential actions, alongside strong earnings reports from several major corporations.

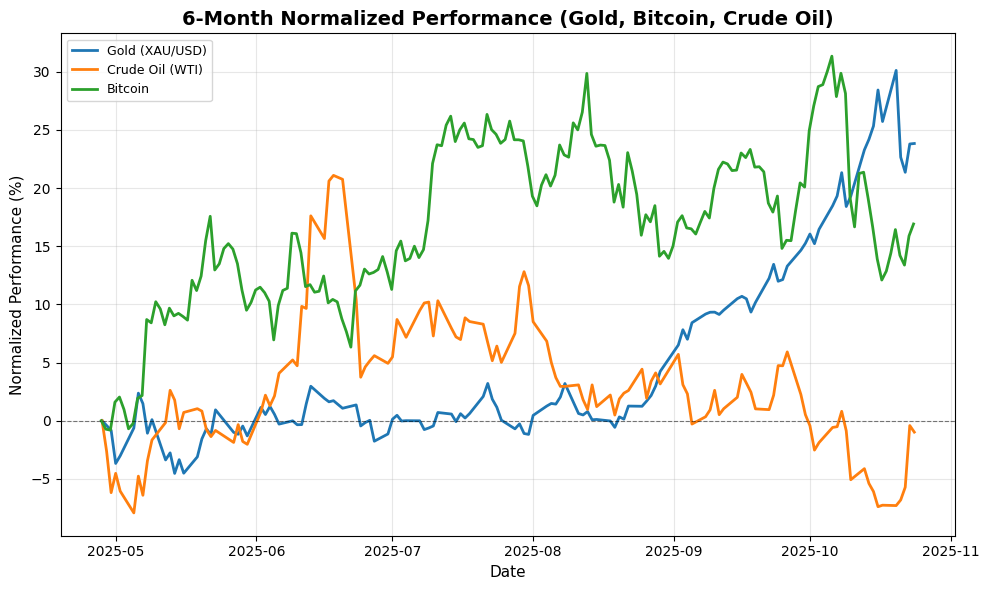

Sector performance was mixed but highlighted by significant gains in consumer discretionary and technology stocks. Notably, Ford Motor Company saw a remarkable 12% jump, reflecting strong investor sentiment following its earnings release. Other notable movers included Alphabet and Alaska Air, which also contributed to the day’s positive momentum. Conversely, the energy sector faced headwinds, with crude oil prices declining by 0.57%, impacting related stocks.

Market breadth was favorable, with advancing stocks outpacing decliners, indicative of broad-based buying. Trading volume was robust, suggesting strong participation from investors capitalizing on the favorable economic data.

In the currency markets, the US Dollar exhibited slight fluctuations. The EUR/USD pair edged up 0.09% to 1.1632, while the GBP/USD dipped by 0.10% to 1.3314. The USD/JPY maintained a modest gain of 0.15%, closing at 152.81. These movements reflect the market’s cautious optimism, as traders digest the implications of the inflation report on future Fed policy.

In commodities, gold prices managed a slight uptick of 0.03%, closing at $4,126.90, as investors reassessed their positions following the CPI data. Meanwhile, crude oil prices continued their downward trend, settling at $61.44. Bitcoin also showed resilience, rising by 0.89% to $111,046.23, driven by ongoing interest in digital assets.

Globally, markets reflected a similar upbeat sentiment, with the EuroStoxx 50 gaining 0.11%, the Nikkei 225 rising by 1.35%, and the FTSE 100 up 0.70%. This positive global backdrop underscores the interconnected nature of financial markets, particularly as traders remain attentive to central bank policies and geopolitical developments.

Overall, today’s session highlighted a significant turning point for US markets, driven by encouraging economic data, strong corporate earnings, and an optimistic outlook on monetary policy.

US Market Indices

| Name | Price | Daily (%) |

|---|---|---|

| S&P 500 | 6791.69 | +0.79 |

| Dow Jones | 47207.12 | +1.01 |

| Nasdaq 100 | 25358.16 | +1.04 |

Global Markets

| Name | Price | Daily (%) |

|---|---|---|

| EuroStoxx 50 | 5674.50 | +0.11 |

| Nikkei 225 | 49299.65 | +1.35 |

| FTSE 100 | 9645.62 | +0.70 |

| Shanghai Composite | 3950.31 | +0.71 |

FX & Commodities

| Name | Price | Daily (%) |

|---|---|---|

| EUR/USD | 1.16 | +0.09 |

| USD/JPY | 152.81 | +0.15 |

| GBP/USD | 1.33 | -0.10 |

| Gold (XAU/USD) | 4126.90 | +0.03 |

| Crude Oil (WTI) | 61.44 | -0.57 |

| Bitcoin | 111046.23 | +0.89 |

🌍 Geopolitics and Markets

**Geopolitics and Markets Analysis**

Recent geopolitical developments and central bank activities have created a complex landscape for global markets. The U.S. inflation rate rose to 3.0% in September, slightly below expectations, which has buoyed investor sentiment and led to a significant rally in the Dow Jones Industrial Average, closing above 47,000 for the first time. This softer inflation reading has increased speculation about potential interest rate cuts by the Federal Reserve, influencing market behavior positively.

On the international front, tensions are escalating in U.S.-Canada trade relations, particularly following President Trump’s abrupt termination of trade talks, which Ontario Premier Doug Ford has publicly criticized through an ad campaign featuring Ronald Reagan. This incident highlights the fragility of trade negotiations and could lead to increased volatility in related markets, particularly in commodities and sectors heavily reliant on cross-border trade.

Additionally, geopolitical tensions are underscored by the U.S. imposing sanctions on Colombia’s President Gustavo Petro amid drug-trafficking accusations, further complicating U.S.-Latin America relations. The Pentagon’s decision to dispatch an aircraft carrier to the Caribbean signals a potential escalation in military operations against drug trafficking, which could have broader implications for regional stability and trade routes.

Economic data releases indicate a bifurcated economic recovery in the U.S., with wealthier consumers maintaining spending while lower-income groups pull back. This divergence could influence consumer-driven sectors and complicate the Fed’s policy decisions moving forward. As central banks globally prepare for key announcements, investor focus will remain on how these dynamics interact with inflationary pressures and trade relations, shaping market trajectories in the coming weeks.

📅 Today’s Economic Calendar

All times are in US Eastern Time (ET)

| Date | Time | Cur | Imp | Event | Actual | Forecast |

|---|---|---|---|---|---|---|

| 2025-10-24 | 02:00 | 🇬🇧 | Medium | Core Retail Sales (YoY) (Sep) | 2.3% | 0.7% |

| 2025-10-24 | 02:00 | 🇬🇧 | Medium | Core Retail Sales (MoM) (Sep) | 0.6% | |

| 2025-10-24 | 02:00 | 🇬🇧 | Medium | Retail Sales (YoY) (Sep) | 1.5% | 0.6% |

| 2025-10-24 | 02:00 | 🇬🇧 | Medium | Retail Sales (MoM) (Sep) | 0.5% | -0.2% |

| 2025-10-24 | 03:15 | 🇪🇺 | Medium | HCOB France Manufacturing PMI (Oct) | 48.3 | 48.2 |

| 2025-10-24 | 03:15 | 🇪🇺 | Medium | HCOB France Services PMI (Oct) | 47.1 | 48.7 |

| 2025-10-24 | 03:30 | 🇪🇺 | Medium | HCOB Germany Manufacturing PMI (Oct) | 49.6 | 49.5 |

| 2025-10-24 | 03:30 | 🇪🇺 | Medium | HCOB Germany Services PMI (Oct) | 54.5 | 51.1 |

| 2025-10-24 | 04:00 | 🇪🇺 | Medium | HCOB Eurozone Manufacturing PMI (Oct) | 50.0 | 49.8 |

| 2025-10-24 | 04:00 | 🇪🇺 | Medium | HCOB Eurozone Composite PMI (Oct) | 52.2 | 51.0 |

| 2025-10-24 | 04:00 | 🇪🇺 | Medium | HCOB Eurozone Services PMI (Oct) | 52.6 | 51.2 |

| 2025-10-24 | 04:30 | 🇬🇧 | Medium | S&P Global Composite PMI (Oct) | 51.1 | 50.6 |

| 2025-10-24 | 04:30 | 🇬🇧 | Medium | S&P Global Manufacturing PMI (Oct) | 49.6 | 46.6 |

| 2025-10-24 | 04:30 | 🇬🇧 | Medium | S&P Global Services PMI (Oct) | 51.1 | 51.0 |

| 2025-10-24 | 05:15 | 🇬🇧 | Medium | BoE Deputy Governor Woods Speaks | ||

| 2025-10-24 | 06:30 | 🇷🇺 | Medium | Interest Rate Decision (Oct) | 16.50% | 17.00% |

| 2025-10-24 | 08:00 | 🇷🇺 | Medium | CBR Press Conference | ||

| 2025-10-24 | 08:30 | 🇺🇸 | High | Core CPI (MoM) (Sep) | 0.2% | 0.3% |

| 2025-10-24 | 08:30 | 🇺🇸 | Medium | Core CPI (YoY) (Sep) | 3.0% | 3.1% |

| 2025-10-24 | 08:30 | 🇺🇸 | High | CPI (YoY) (Sep) | 3.0% | 3.1% |

| 2025-10-24 | 08:30 | 🇺🇸 | High | CPI (MoM) (Sep) | 0.3% | 0.4% |

| 2025-10-24 | 08:30 | 🇨🇦 | Medium | New Housing Price Index (MoM) (Sep) | -0.2% | 0.2% |

| 2025-10-24 | 08:45 | 🇪🇺 | Medium | German Buba President Nagel Speaks | ||

| 2025-10-24 | 09:45 | 🇺🇸 | High | S&P Global Manufacturing PMI (Oct) | 52.2 | 51.9 |

| 2025-10-24 | 09:45 | 🇺🇸 | Medium | S&P Global Composite PMI (Oct) | 54.8 | 53.5 |

| 2025-10-24 | 09:45 | 🇺🇸 | High | S&P Global Services PMI (Oct) | 55.2 | 53.5 |

| 2025-10-24 | 10:00 | 🇺🇸 | Medium | Michigan 1-Year Inflation Expectations (Oct) | 4.6% | 4.6% |

| 2025-10-24 | 10:00 | 🇺🇸 | Medium | Michigan 5-Year Inflation Expectations (Oct) | 3.9% | 3.7% |

| 2025-10-24 | 10:00 | 🇺🇸 | Medium | Michigan Consumer Expectations (Oct) | 50.3 | 51.2 |

| 2025-10-24 | 10:00 | 🇺🇸 | Medium | Michigan Consumer Sentiment (Oct) | 53.6 | 55.0 |

| 2025-10-24 | 13:00 | 🇺🇸 | Medium | U.S. Baker Hughes Oil Rig Count | 420 | |

| 2025-10-24 | 13:00 | 🇺🇸 | Medium | U.S. Baker Hughes Total Rig Count | 550 |

Today’s economic calendar features several high-impact events that could significantly influence market sentiment and currency valuations. Key releases include UK retail sales data, Eurozone PMIs, and U.S. inflation metrics, all scheduled for early morning ET.

The standout release is the UK’s Core Retail Sales (YoY) for September, which came in at 2.3%, vastly outperforming the forecast of 0.7%. This positive surprise, alongside Retail Sales (MoM) at 0.5% versus a forecasted decline of -0.2%, suggests robust consumer spending in the UK, potentially bolstering the GBP against its peers.

In the Eurozone, the HCOB Germany Services PMI exceeded expectations at 54.5, compared to a forecast of 51.1, indicating stronger service sector activity. However, the HCOB France Services PMI fell short at 47.1, below the anticipated 48.7, reflecting mixed economic signals.

In the U.S., Core CPI data showed a slight miss, with the YoY figure at 3.0% against a forecast of 3.1%. This could temper expectations for aggressive monetary policy tightening, leading to a weaker USD sentiment.

Overall, the GBP showed strength, while the USD faced headwinds from inflation data, and mixed signals from the Eurozone contributed to cautious trading in EUR.

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.