💱 USD/CAD Surges as

📊 US Dollar Index (DXY)

Current Level: 100.14 (+0.27%)

In the forex market, the US Dollar Index (DXY) has softened, trading around 100.15 amid ongoing concerns regarding the US government shutdown, which has created uncertainty and contributed to a risk-off sentiment. This backdrop has influenced several currency pairs, with the GBP/USD finding modest gains near 1.3025, although potential upside may be limited by anticipated tax increases in the UK budget.

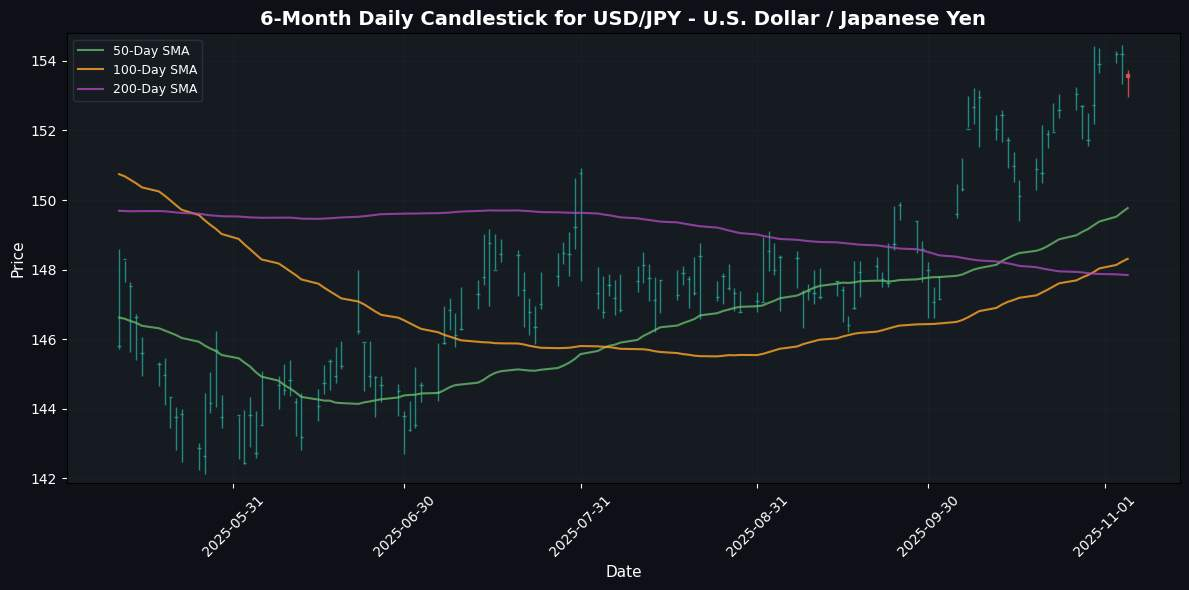

The Japanese Yen (JPY) is benefiting from safe-haven demand, pushing USD/JPY lower to around 153.50 as global risk assets decline. Similarly, gold prices have seen upward movement, driven by increased safe-haven flows amid geopolitical tensions and economic anxieties.

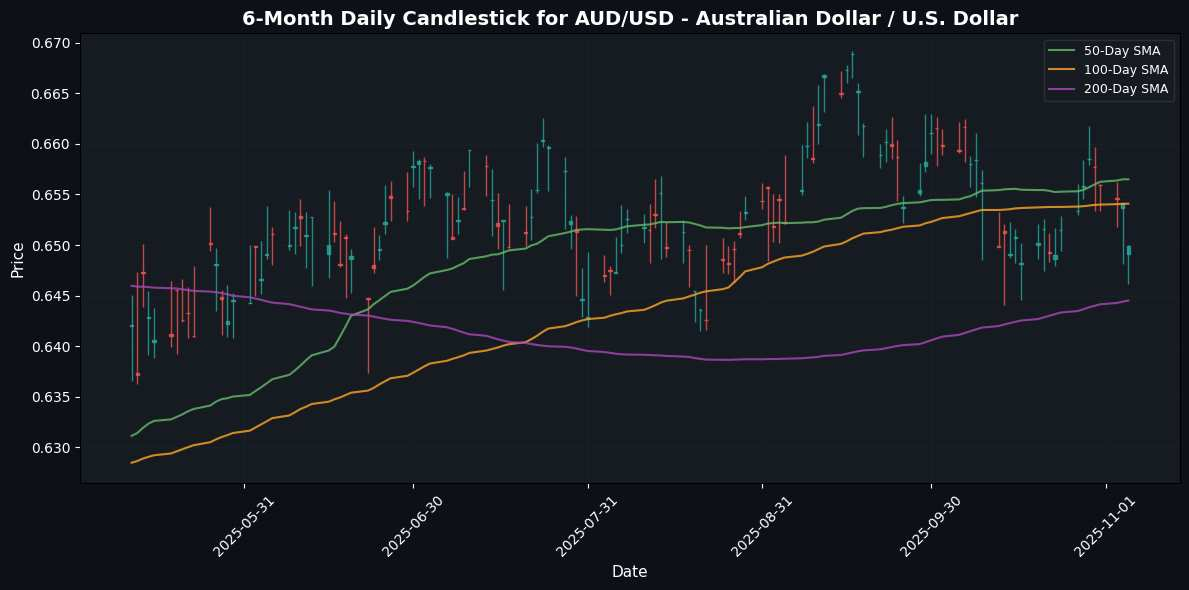

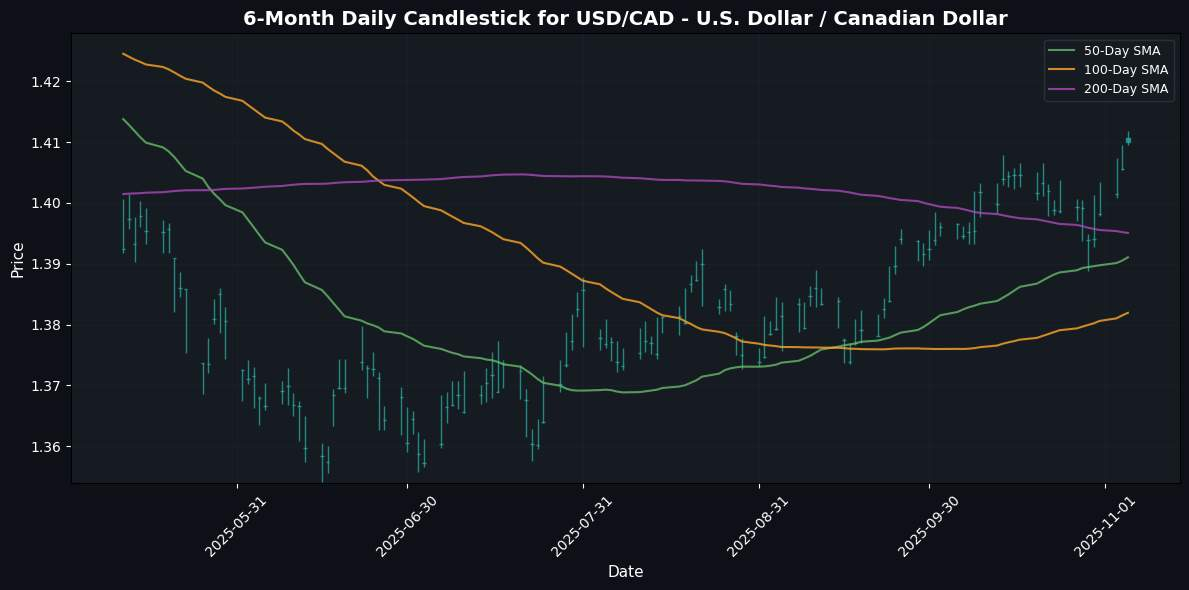

The Australian Dollar (AUD) has rebounded against the USD following China’s announcement to lift tariffs on US agricultural goods, which is expected to bolster trade relations. Conversely, the Canadian Dollar (CAD) has faced pressure, with USD/CAD reaching seven-month highs above 1.4100 due to declining crude oil prices, as WTI trades near $60.

Meanwhile, the USD/INR remains stable above 88.50 amid thin trading conditions due to a bank holiday in India. Overall, the currency markets are navigating a complex landscape shaped by geopolitical tensions, domestic economic policies, and commodity price fluctuations, with safe-haven currencies gaining traction in the current environment.

📅 Today’s Economic Calendar

No significant economic events scheduled for today.

💱 Major Currency Pairs

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

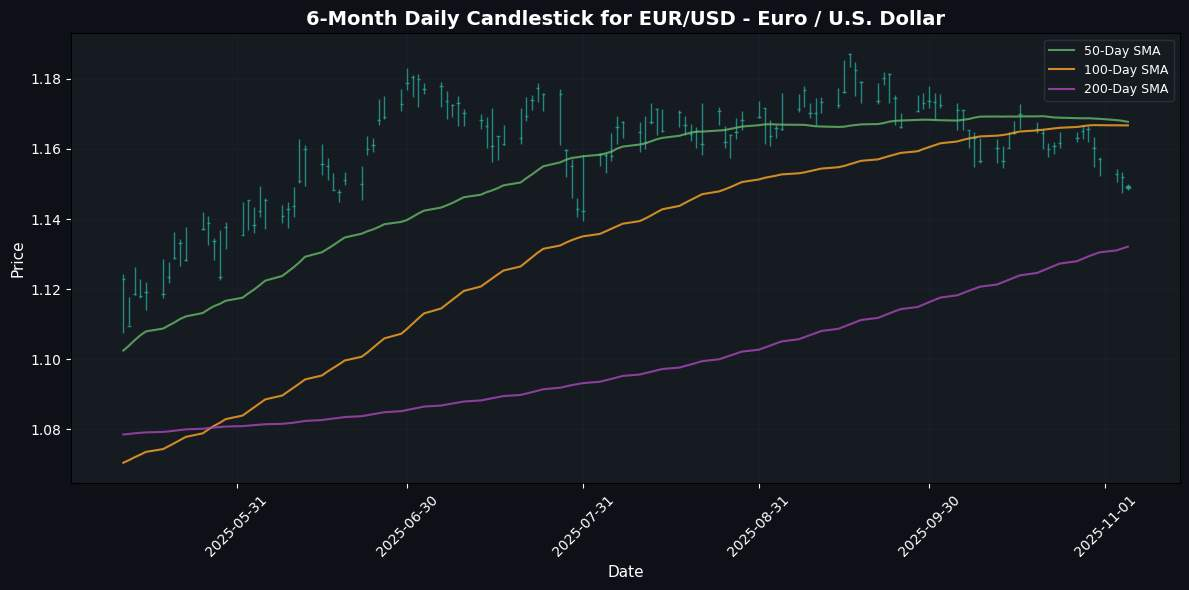

| EUR/USD – Euro / U.S. Dollar | EURUSD | 1.1496 | -0.20% | -1.39% | -1.17% | -2.70% | -2.63% | +9.74% | +2.96% | +5.52% | 1.1677 | 1.1667 | 1.1321 | 29.75 | -0.00 |

| USD/JPY – U.S. Dollar / Japanese Yen | USDJPY | 153.5270 | -0.44% | +1.18% | +0.30% | +4.01% | +7.06% | +2.77% | +6.24% | -1.39% | 149.7709 | 148.3120 | 147.8449 | 64.97 | 1.14 |

| GBP/USD – British Pound / U.S. Dollar | GBPUSD | 1.3030 | -0.80% | -1.88% | -2.19% | -3.65% | -5.22% | +3.01% | -1.22% | +1.85% | 1.3418 | 1.3457 | 1.3247 | 12.17 | -0.01 |

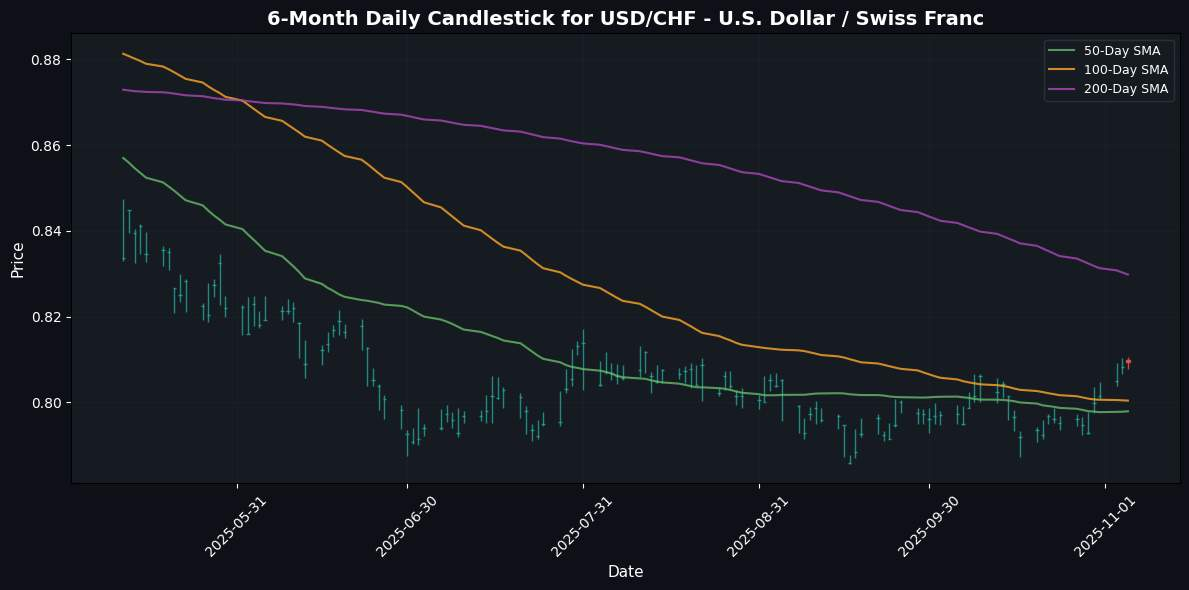

| USD/CHF – U.S. Dollar / Swiss Franc | USDCHF | 0.8094 | +0.15% | +2.09% | +1.67% | +2.27% | +2.36% | -9.91% | -4.45% | -9.03% | 0.7979 | 0.8004 | 0.8298 | 68.69 | 0.00 |

| AUD/USD – Australian Dollar / U.S. Dollar | AUDUSD | 0.6499 | -0.65% | -1.31% | -0.54% | -1.50% | -1.28% | +2.01% | -4.05% | -2.56% | 0.6565 | 0.6541 | 0.6445 | 48.24 | -0.00 |

| USD/CAD – U.S. Dollar / Canadian Dollar | USDCAD | 1.4106 | +0.36% | +1.20% | +0.80% | +1.93% | +3.38% | -0.74% | +4.63% | +3.20% | 1.3911 | 1.3819 | 1.3951 | 59.32 | 0.00 |

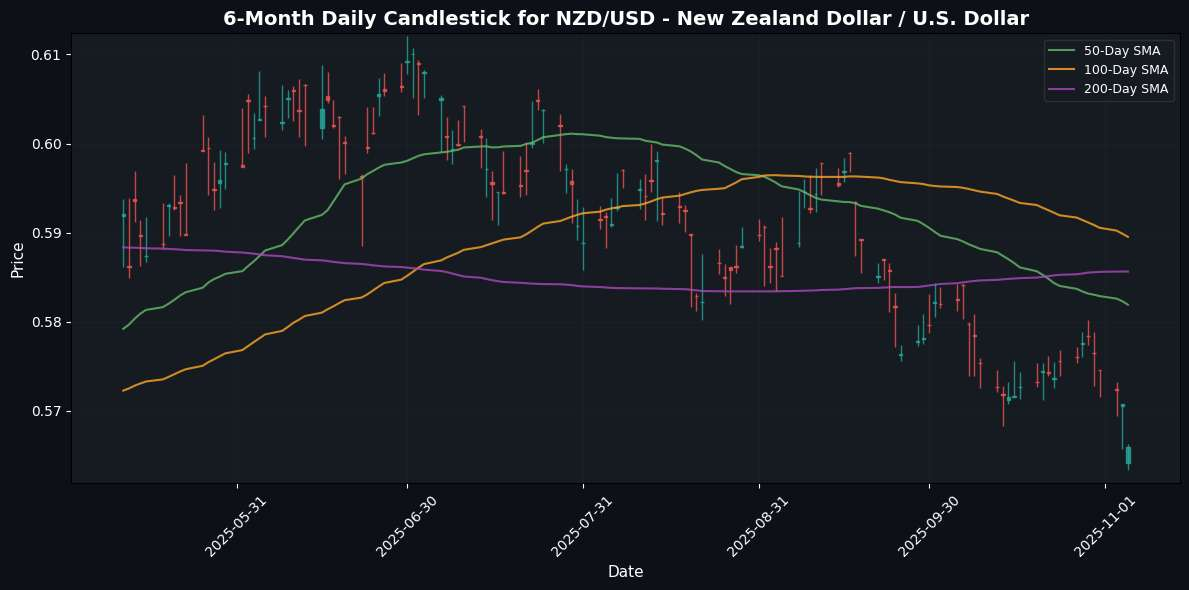

| NZD/USD – New Zealand Dollar / U.S. Dollar | NZDUSD | 0.5660 | -0.83% | -2.14% | -1.75% | -3.37% | -7.23% | -1.59% | -8.80% | -8.67% | 0.5819 | 0.5895 | 0.5856 | 36.33 | -0.00 |

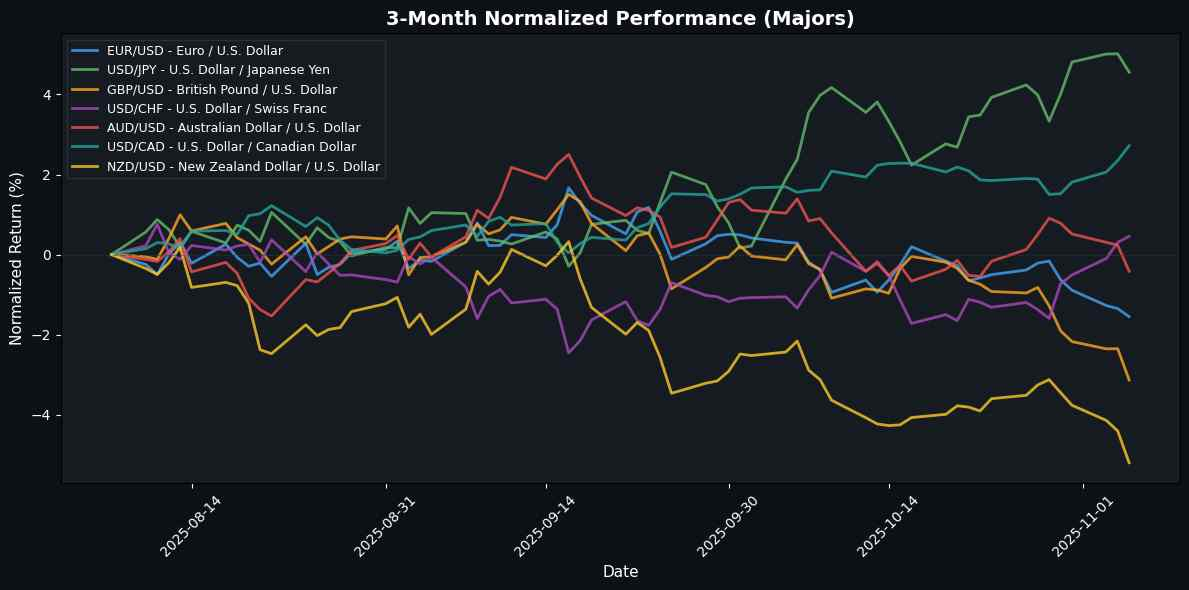

In the recent trading session, USD/CAD showed strength, advancing by +0.36%, supported by robust U.S. economic data that bolstered the dollar’s appeal against the loonie. Similarly, USD/CHF saw a modest gain of +0.15%, indicating a steady demand for the U.S. dollar amidst ongoing geopolitical uncertainties. Conversely, EUR/USD experienced a slight decline of -0.20%, reflecting investor caution as the Eurozone grapples with economic challenges. The weakest performers, NZD/USD, GBP/USD, and AUD/USD, all faced significant downward pressures, dropping -0.83%, -0.80%, and -0.65% respectively, likely due to risk-off sentiment and a strengthening dollar overshadowing commodity-linked currencies. Overall, the trend indicates a strong U.S. dollar driving the market, with commodity currencies underperforming amid global economic concerns.

🔀 Cross Currency Pairs

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EUR/GBP | EURGBP | 0.8820 | +0.58% | +0.47% | +1.03% | +0.96% | +2.70% | +6.52% | +4.22% | +3.59% | 0.8703 | 0.8670 | 0.8543 | 78.42 | 0.00 |

| EUR/JPY | EURJPY | 176.4450 | -0.66% | -0.24% | -0.89% | +1.18% | +4.22% | +12.77% | +9.38% | +4.05% | 174.8673 | 173.0167 | 167.3077 | 54.27 | 0.73 |

| EUR/CHF | EURCHF | 0.9302 | -0.07% | +0.66% | +0.47% | -0.51% | -0.34% | -1.15% | -1.64% | -4.00% | 0.9317 | 0.9337 | 0.9377 | 56.54 | -0.00 |

| EUR/AUD | EURAUD | 1.7690 | +0.42% | -0.07% | -0.62% | -1.20% | -1.39% | +7.59% | +7.31% | +8.32% | 1.7787 | 1.7837 | 1.7559 | 35.63 | -0.00 |

| GBP/JPY | GBPJPY | 200.0390 | -1.24% | -0.71% | -1.90% | +0.22% | +1.49% | +5.86% | +4.94% | +0.44% | 200.9172 | 199.5421 | 195.7723 | 38.14 | 0.22 |

| GBP/CHF | GBPCHF | 1.0546 | -0.64% | +0.19% | -0.54% | -1.45% | -2.96% | -7.20% | -5.61% | -7.32% | 1.0705 | 1.0770 | 1.0979 | 34.02 | -0.00 |

| AUD/JPY | AUDJPY | 99.7410 | -1.07% | -0.17% | -0.26% | +2.42% | +5.71% | +4.82% | +1.91% | -3.94% | 98.3075 | 96.9943 | 95.2642 | 61.95 | 0.65 |

| AUD/NZD | AUDNZD | 1.1481 | +0.22% | +0.84% | +1.22% | +1.92% | +6.45% | +3.66% | +5.20% | +6.68% | 1.1282 | 1.1097 | 1.1007 | 65.86 | 0.00 |

| CHF/JPY | CHFJPY | 189.6660 | -0.58% | -0.88% | -1.34% | +1.70% | +4.59% | +14.09% | +11.19% | +8.39% | 187.6754 | 185.2784 | 178.4470 | 51.13 | 0.97 |

| NZD/JPY | NZDJPY | 86.8620 | -1.27% | -1.00% | -1.46% | +0.49% | -0.70% | +1.13% | -3.12% | -9.96% | 87.1136 | 87.3868 | 86.5327 | 55.53 | 0.23 |

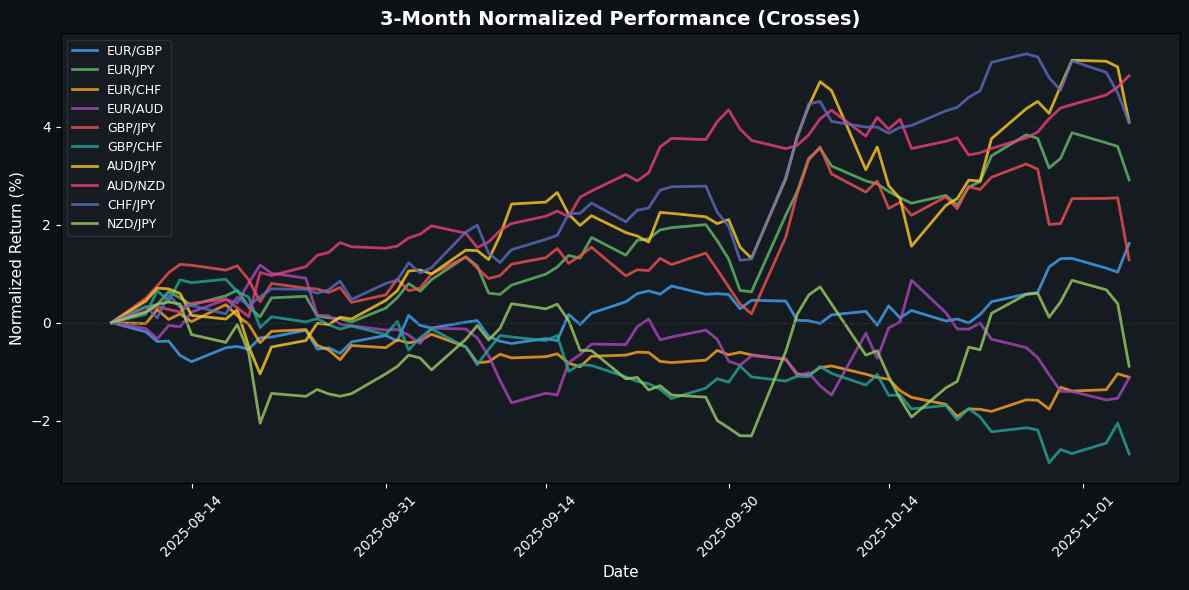

In the recent trading session, the EUR/GBP pair showcased significant strength, rising by 0.58%, indicating robust demand for the euro against the pound, potentially driven by positive economic data from the Eurozone. Similarly, the EUR/AUD and AUD/NZD pairs followed suit with gains of 0.42% and 0.22%, respectively, suggesting a favorable sentiment towards the euro and a stabilizing Australian dollar. Conversely, the NZD/JPY, GBP/JPY, and AUD/JPY pairs exhibited notable weakness, particularly NZD/JPY with a decline of 1.27%, which may reflect risk-off sentiment affecting commodity-linked currencies amid global uncertainties. Overall, the divergence in performance suggests a strengthening euro against key currencies while the yen appears to attract safe-haven flows, leading to downward pressure on the antipodean currencies.

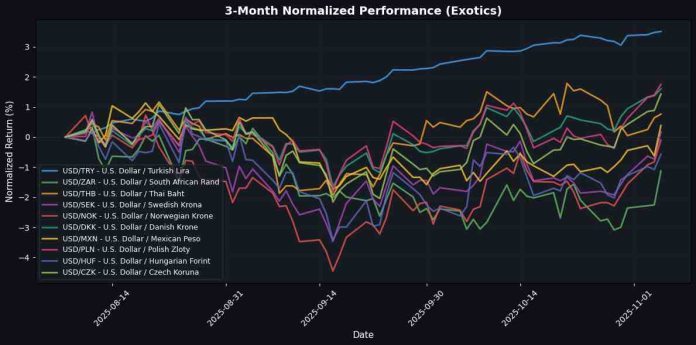

🌍 Exotic and Emerging Market Currencies

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| USD/TRY – U.S. Dollar / Turkish Lira | USDTRY | 42.0822 | +0.03% | +0.32% | +0.21% | +1.60% | +5.63% | +15.46% | +23.68% | +30.33% | 41.5990 | 40.9839 | 39.3566 | 73.06 | 0.14 |

| USD/ZAR – U.S. Dollar / South African Rand | USDZAR | 17.4938 | +1.15% | +2.02% | +1.71% | +1.54% | -0.56% | -4.76% | -1.15% | -7.70% | 17.3680 | 17.5582 | 17.9606 | 57.26 | -0.01 |

| USD/THB – U.S. Dollar / Thai Baht | USDTHB | 32.5300 | +0.12% | +0.59% | -0.46% | +2.04% | +0.29% | -2.99% | -4.24% | -10.62% | 32.2885 | 32.3808 | 32.9160 | 50.00 | 0.03 |

| USD/SEK – U.S. Dollar / Swedish Krona | USDSEK | 9.5711 | +0.91% | +2.14% | +2.01% | +2.53% | +1.04% | -9.90% | -6.27% | -7.83% | 9.4104 | 9.4955 | 9.7785 | 63.65 | 0.02 |

| USD/NOK – U.S. Dollar / Norwegian Krone | USDNOK | 10.1995 | +0.74% | +2.24% | +2.13% | +3.23% | +1.35% | -8.23% | -3.20% | -3.32% | 9.9935 | 10.0732 | 10.3474 | 62.60 | 0.03 |

| USD/DKK – U.S. Dollar / Danish Krone | USDDKK | 6.4950 | +0.23% | +1.38% | +1.15% | +2.82% | +2.77% | -8.79% | -2.80% | -5.16% | 6.3937 | 6.3979 | 6.6024 | 70.23 | 0.02 |

| USD/MXN – U.S. Dollar / Mexican Peso | USDMXN | 18.6796 | +1.02% | +1.38% | +1.42% | +1.82% | -0.31% | -8.36% | -3.59% | +4.47% | 18.4731 | 18.6063 | 19.2735 | 66.49 | 0.03 |

| USD/PLN – U.S. Dollar / Polish Zloty | USDPLN | 3.7055 | +0.35% | +2.14% | +1.66% | +2.83% | +3.02% | -6.67% | -3.35% | -5.75% | 3.6415 | 3.6455 | 3.7473 | 66.38 | 0.01 |

| USD/HUF – U.S. Dollar / Hungarian Forint | USDHUF | 337.7400 | +0.52% | +1.49% | +0.97% | +2.41% | +0.06% | -12.02% | -4.31% | -5.57% | 334.5270 | 338.0833 | 352.8278 | 58.82 | 0.39 |

| USD/CZK – U.S. Dollar / Czech Koruna | USDCZK | 21.2246 | +0.54% | +1.78% | +1.70% | +3.54% | +1.59% | -11.34% | -5.27% | -5.80% | 20.8297 | 20.9629 | 21.8703 | 77.70 | 0.08 |

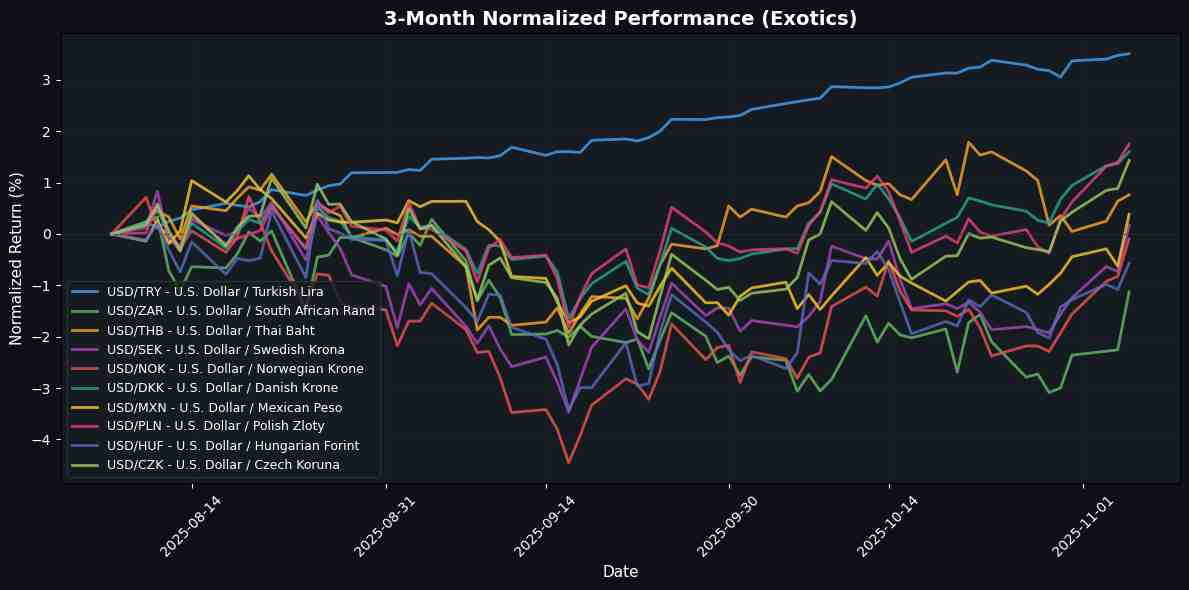

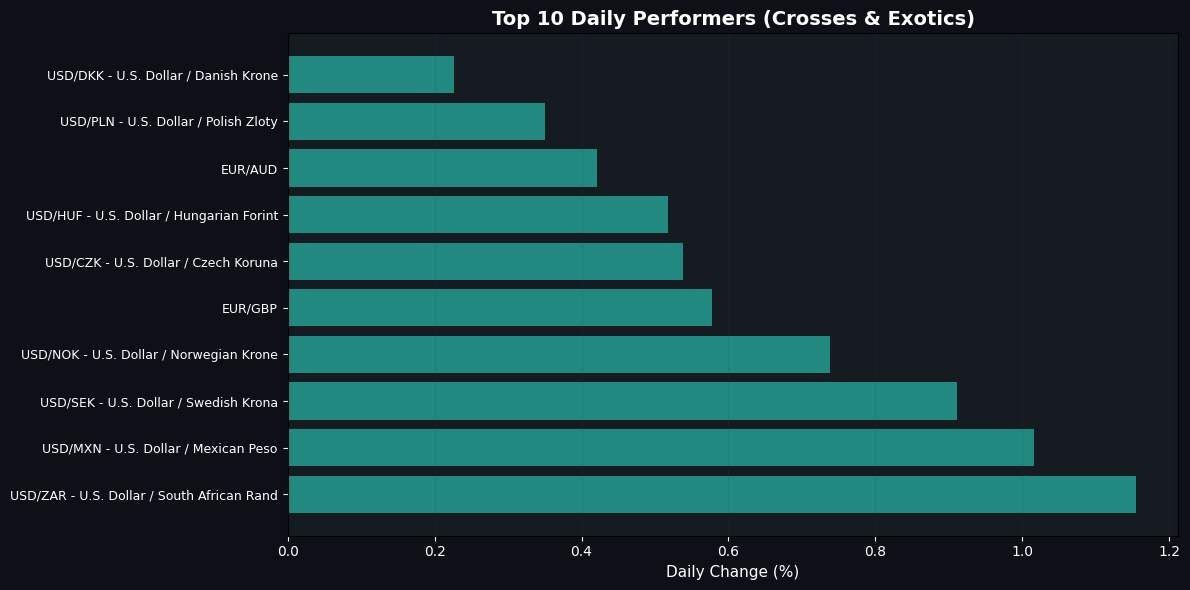

In the recent trading session, the U.S. Dollar (USD) showed strong performance against several exotic currency pairs, particularly with the USD/ZAR, which gained 1.15%, indicating robust demand as investors seek safety amid global uncertainties. The USD/MXN and USD/SEK also exhibited positive momentum, rising by 1.02% and 0.91%, respectively, suggesting confidence in the U.S. economy relative to these currencies.

Conversely, the USD/TRY, USD/THB, and USD/DKK lagged significantly, with minimal gains of 0.03%, 0.12%, and 0.23%, respectively. This underperformance may reflect localized economic challenges or geopolitical risks impacting these currencies, suggesting a divergence in investor sentiment between stronger and weaker exotic currencies. Overall, the trend indicates a flight to safety in the USD, particularly against emerging market currencies.

🏆 Top Daily Performers (Crosses & Exotics)

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.