💱 USD/CHF Surges as U.S. Dollar Strengthens; EUR/USD Faces Downturn Amidst Market Stability

📊 US Dollar Index (DXY)

Current Level: 99.73 (-0.07%)

The foreign exchange market is currently influenced by a mix of central bank policies, geopolitical events, and investor sentiment towards risk. The US Dollar Index (DXY) is trading around 99.73, bolstered by a hawkish outlook from the Federal Reserve, which has alleviated speculation about imminent rate cuts. This strength in the USD is evident against several currencies, including the Japanese Yen (JPY), which remains under pressure due to uncertainty surrounding the Bank of Japan’s (BoJ) policy direction.

The Australian Dollar (AUD) has seen a rebound against the USD, supported by a cautious outlook from the Reserve Bank of Australia (RBA), which has halted its recent losing streak. In contrast, the JPY continues to weaken, exacerbated by Japan’s holiday trading conditions and the BoJ’s restrained stance on interest rates. The EUR/JPY remains stable as the JPY’s depreciation weighs on the cross.

Gold prices have surged beyond the $4,000 mark, reflecting a renewed demand for safe-haven assets amid geopolitical tensions, notably comments from former President Trump. Additionally, the USD/CHF pair is trading near a two-week high, as the Swiss Franc struggles against the USD’s strength.

Overall, the FX market is navigating a complex landscape influenced by shifting monetary policy expectations and external uncertainties, with the USD gaining traction as a safe haven amidst fluctuating risk sentiment.

📅 Today’s Economic Calendar

No significant economic events scheduled for today.

💱 Major Currency Pairs

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

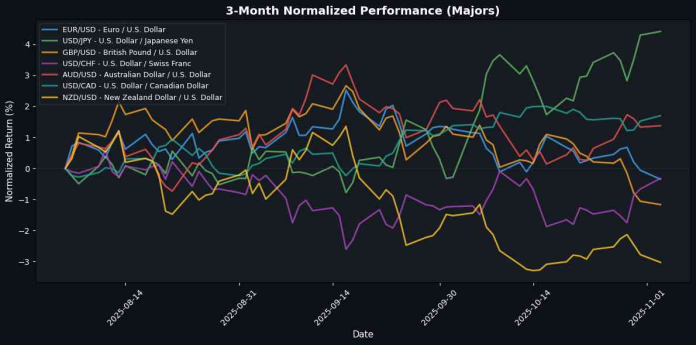

| EUR/USD – Euro / U.S. Dollar | EURUSD | 1.1539 | -0.29% | -0.79% | -0.60% | -1.68% | -1.60% | +10.73% | +3.36% | +6.04% | 1.1682 | 1.1668 | 1.1311 | 46.63 | -0.00 |

| USD/JPY – U.S. Dollar / Japanese Yen | USDJPY | 154.0730 | +0.11% | +0.66% | +1.39% | +4.04% | +6.61% | +1.89% | +6.61% | -0.68% | 149.5195 | 148.1345 | 147.8651 | 58.93 | 1.11 |

| GBP/USD – British Pound / U.S. Dollar | GBPUSD | 1.3145 | -0.11% | -1.33% | -1.55% | -2.38% | -4.19% | +4.45% | -0.36% | +2.91% | 1.3433 | 1.3465 | 1.3240 | 30.14 | -0.01 |

| USD/CHF – U.S. Dollar / Swiss Franc | USDCHF | 0.8044 | +0.34% | +1.04% | +1.04% | +1.02% | +0.76% | -11.08% | -5.05% | -9.62% | 0.7978 | 0.8005 | 0.8308 | 50.08 | 0.00 |

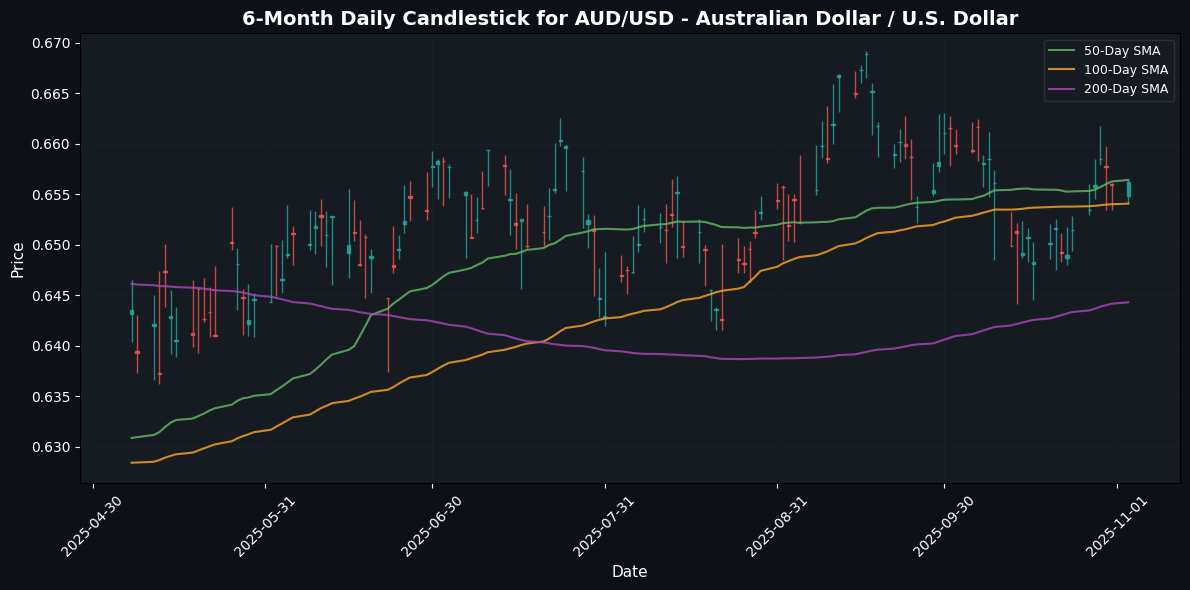

| AUD/USD – Australian Dollar / U.S. Dollar | AUDUSD | 0.6562 | +0.04% | +0.43% | +1.11% | -0.41% | +0.44% | +3.48% | -3.11% | -1.27% | 0.6564 | 0.6541 | 0.6443 | 60.24 | -0.00 |

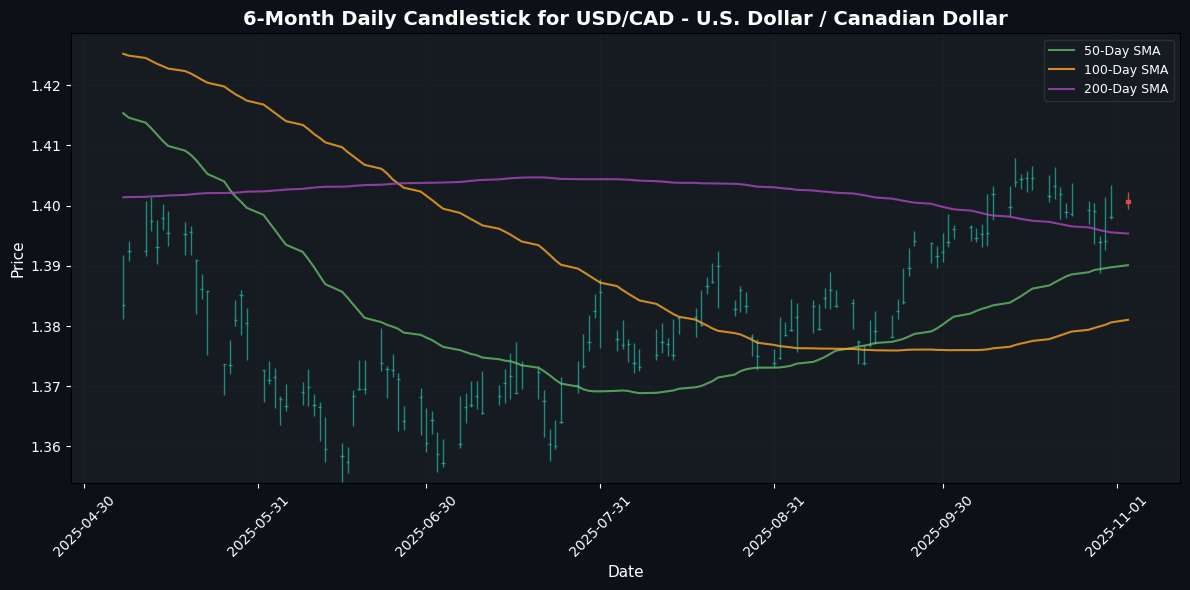

| USD/CAD – U.S. Dollar / Canadian Dollar | USDCAD | 1.4005 | +0.17% | +0.08% | +0.12% | +1.62% | +2.37% | -1.65% | +3.88% | +2.40% | 1.3901 | 1.3810 | 1.3954 | 42.54 | 0.00 |

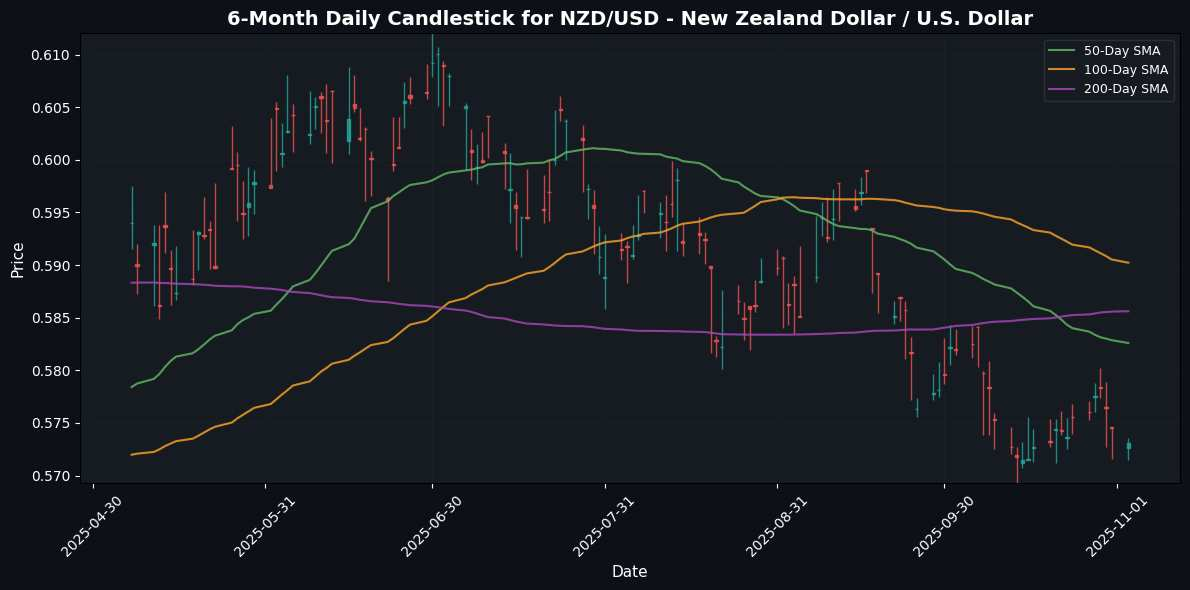

| NZD/USD – New Zealand Dollar / U.S. Dollar | NZDUSD | 0.5731 | -0.26% | -0.51% | -0.11% | -2.06% | -5.50% | +0.52% | -7.65% | -7.19% | 0.5826 | 0.5902 | 0.5856 | 54.73 | -0.00 |

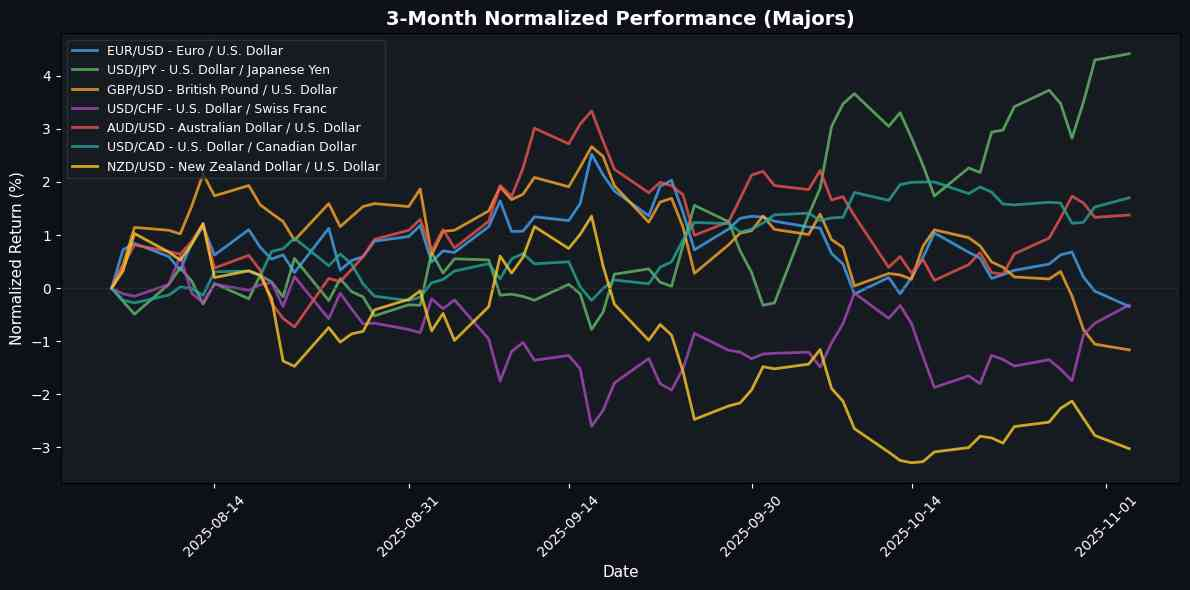

In today’s forex market, the U.S. Dollar is exhibiting strength against several major currencies, notably the Swiss Franc (USD/CHF) which has gained 0.34%, indicating a bullish trend supported by potential safe-haven flows. The U.S. Dollar also shows resilience against the Canadian Dollar (USD/CAD) and Japanese Yen (USD/JPY), with slight gains of 0.17% and 0.11%, respectively, suggesting a steady demand for USD amid global economic uncertainties.

Conversely, the Euro (EUR/USD) and New Zealand Dollar (NZD/USD) are underperforming, with losses of 0.29% and 0.26%, respectively, reflecting market concerns about their economic outlooks. The British Pound (GBP/USD) also shows weakness, down 0.11%, as traders assess the impact of ongoing economic challenges in the UK. Overall, the market dynamics favor the U.S. Dollar, indicating a potential shift in risk sentiment.

🔀 Cross Currency Pairs

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EUR/GBP | EURGBP | 0.8776 | -0.20% | +0.52% | +0.94% | +0.68% | +2.68% | +5.97% | +3.70% | +3.01% | 0.8696 | 0.8664 | 0.8539 | 71.90 | 0.00 |

| EUR/JPY | EURJPY | 177.7480 | -0.20% | -0.16% | +0.77% | +2.26% | +4.89% | +12.80% | +10.18% | +5.30% | 174.6520 | 172.8168 | 167.1656 | 61.02 | 0.87 |

| EUR/CHF | EURCHF | 0.9279 | +0.04% | +0.22% | +0.42% | -0.70% | -0.87% | -1.55% | -1.88% | -4.19% | 0.9319 | 0.9339 | 0.9378 | 43.99 | -0.00 |

| EUR/AUD | EURAUD | 1.7585 | -0.32% | -1.21% | -1.71% | -1.27% | -2.03% | +7.00% | +6.67% | +7.40% | 1.7797 | 1.7838 | 1.7549 | 38.86 | -0.00 |

| GBP/JPY | GBPJPY | 202.5280 | +0.01% | -0.68% | -0.17% | +1.57% | +2.16% | +6.44% | +6.24% | +2.22% | 200.8174 | 199.4317 | 195.6939 | 45.96 | 0.48 |

| GBP/CHF | GBPCHF | 1.0573 | +0.24% | -0.29% | -0.52% | -1.34% | -3.45% | -7.10% | -5.38% | -6.98% | 1.0715 | 1.0778 | 1.0986 | 28.27 | -0.00 |

| AUD/JPY | AUDJPY | 101.0790 | +0.13% | +1.08% | +2.53% | +3.59% | +7.09% | +5.43% | +3.28% | -1.95% | 98.1309 | 96.8740 | 95.2427 | 64.70 | 0.71 |

| AUD/NZD | AUDNZD | 1.1449 | +0.28% | +0.94% | +1.24% | +1.67% | +6.28% | +2.95% | +4.91% | +6.37% | 1.1267 | 1.1083 | 1.1003 | 59.45 | 0.00 |

| CHF/JPY | CHFJPY | 191.5370 | -0.23% | -0.36% | +0.36% | +2.99% | +5.83% | +14.58% | +12.29% | +9.91% | 187.4019 | 185.0315 | 178.2636 | 66.73 | 1.28 |

| NZD/JPY | NZDJPY | 88.2730 | -0.14% | +0.14% | +1.28% | +1.89% | +0.76% | +2.41% | -1.55% | -7.83% | 87.0738 | 87.3884 | 86.5450 | 62.05 | 0.33 |

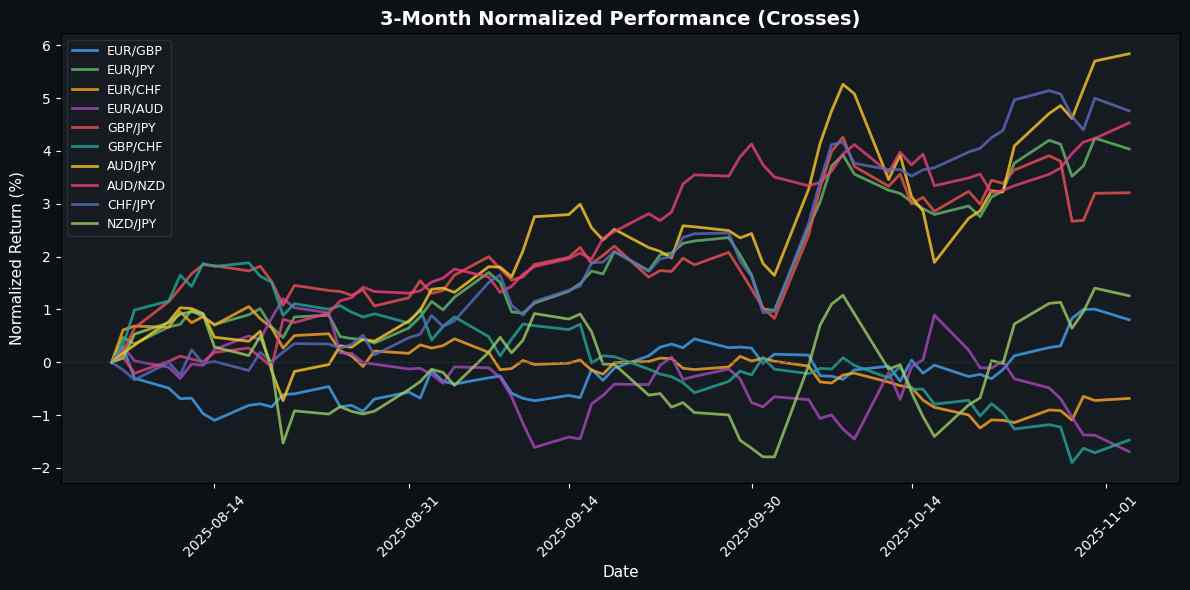

In the latest trading session, the AUD/NZD pair emerged as the top performer with a modest gain of 0.28%, indicating a strengthening of the Australian dollar relative to the New Zealand dollar, possibly buoyed by favorable economic indicators from Australia. Similarly, GBP/CHF and AUD/JPY followed suit with gains of 0.24% and 0.13%, respectively, suggesting a positive sentiment towards both the British pound and the Australian dollar against their respective counterparts.

Conversely, the weakest performers included EUR/AUD, which declined by 0.32%, reflecting the Euro’s vulnerability amid ongoing economic concerns within the Eurozone. The CHF/JPY and EUR/GBP pairs also experienced downward pressure, with losses of 0.23% and 0.20%, respectively, indicating a general risk-off sentiment that may be impacting the Euro and Swiss franc in the current market environment. Overall, the trends suggest a consolidation phase for the Australian dollar and the British pound, while the Euro faces

🌍 Exotic and Emerging Market Currencies

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| USD/TRY – U.S. Dollar / Turkish Lira | USDTRY | 42.0492 | +0.05% | +0.14% | +0.17% | +1.55% | +5.41% | +15.82% | +23.58% | +28.85% | 41.5569 | 40.9316 | 39.2922 | 73.37 | 0.14 |

| USD/ZAR – U.S. Dollar / South African Rand | USDZAR | 17.2951 | +0.11% | +0.56% | -0.69% | -0.14% | -2.68% | -6.57% | -2.27% | -7.57% | 17.3770 | 17.5684 | 17.9716 | 48.65 | -0.03 |

| USD/THB – U.S. Dollar / Thai Baht | USDTHB | 32.3500 | +0.15% | -1.01% | -1.31% | +1.47% | -0.88% | -4.09% | -4.77% | -11.50% | 32.2860 | 32.3810 | 32.9291 | 42.86 | 0.03 |

| USD/SEK – U.S. Dollar / Swedish Krona | USDSEK | 9.4834 | +0.50% | +1.08% | +0.79% | +0.73% | +0.16% | -11.57% | -7.13% | -8.99% | 9.4120 | 9.4952 | 9.7929 | 46.74 | -0.00 |

| USD/NOK – U.S. Dollar / Norwegian Krone | USDNOK | 10.1102 | +0.60% | +1.24% | +0.88% | +1.90% | +0.41% | -9.17% | -4.05% | -4.18% | 9.9921 | 10.0679 | 10.3581 | 52.66 | 0.01 |

| USD/DKK – U.S. Dollar / Danish Krone | USDDKK | 6.4721 | +0.29% | +0.79% | +0.60% | +1.78% | +1.74% | -9.57% | -3.14% | -5.58% | 6.3909 | 6.3976 | 6.6089 | 53.87 | 0.02 |

| USD/MXN – U.S. Dollar / Mexican Peso | USDMXN | 18.5466 | +0.11% | +0.69% | +0.58% | +0.69% | -1.34% | -9.32% | -4.27% | +4.12% | 18.4764 | 18.6139 | 19.2917 | 58.52 | 0.01 |

| USD/PLN – U.S. Dollar / Polish Zloty | USDPLN | 3.6892 | +0.68% | +1.22% | +1.27% | +1.60% | +2.12% | -7.92% | -3.77% | -6.77% | 3.6399 | 3.6457 | 3.7506 | 51.79 | 0.01 |

| USD/HUF – U.S. Dollar / Hungarian Forint | USDHUF | 335.8000 | +0.14% | +0.39% | +0.28% | +1.00% | -1.29% | -13.01% | -4.86% | -7.02% | 334.6803 | 338.3373 | 353.3693 | 41.14 | 0.06 |

| USD/CZK – U.S. Dollar / Czech Koruna | USDCZK | 21.0790 | +0.31% | +1.00% | +0.82% | +1.91% | -0.05% | -12.43% | -5.92% | -7.09% | 20.8260 | 20.9699 | 21.8988 | 54.33 | 0.05 |

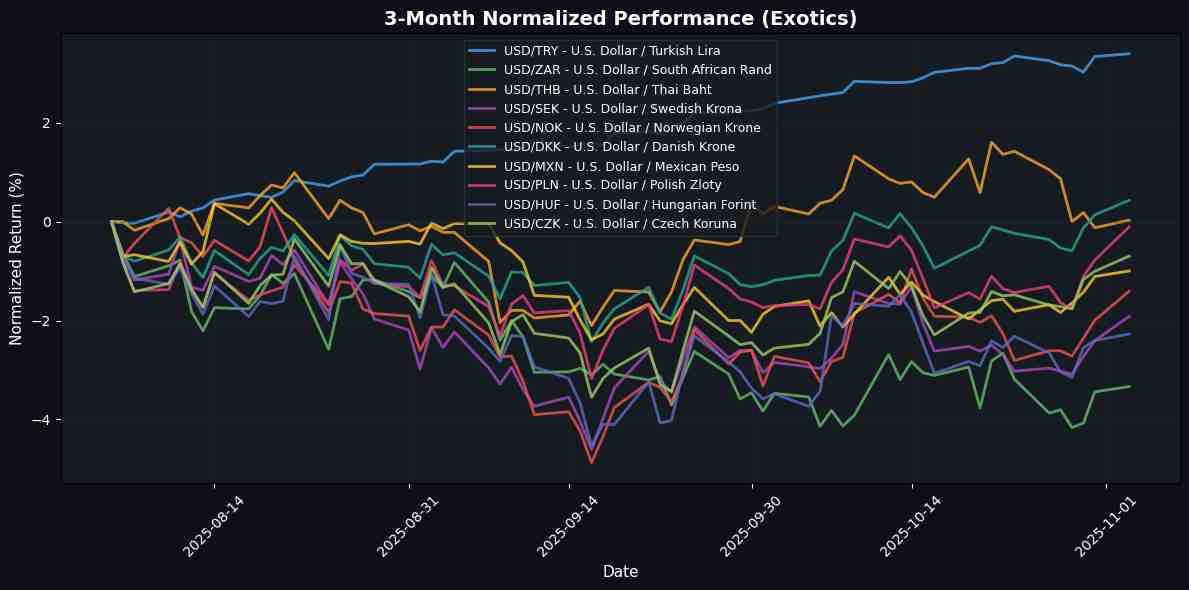

In the exotic currency pairs market, the U.S. Dollar has shown relative strength against the Polish Zloty (USD/PLN), Norwegian Krone (USD/NOK), and Swedish Krona (USD/SEK), with gains of 0.68%, 0.60%, and 0.50%, respectively. This upward momentum suggests a robust demand for the dollar, likely driven by positive economic data or market sentiment favoring the U.S. economy. Conversely, the USD/TRY, USD/ZAR, and USD/MXN pairs have exhibited minimal gains, with increases of only 0.05% and 0.11%, indicating weaker performance and potentially reflecting local economic challenges or geopolitical risks affecting the Turkish Lira, South African Rand, and Mexican Peso. Overall, the contrast between the top and weakest performers highlights a divergence in investor confidence across these currencies.

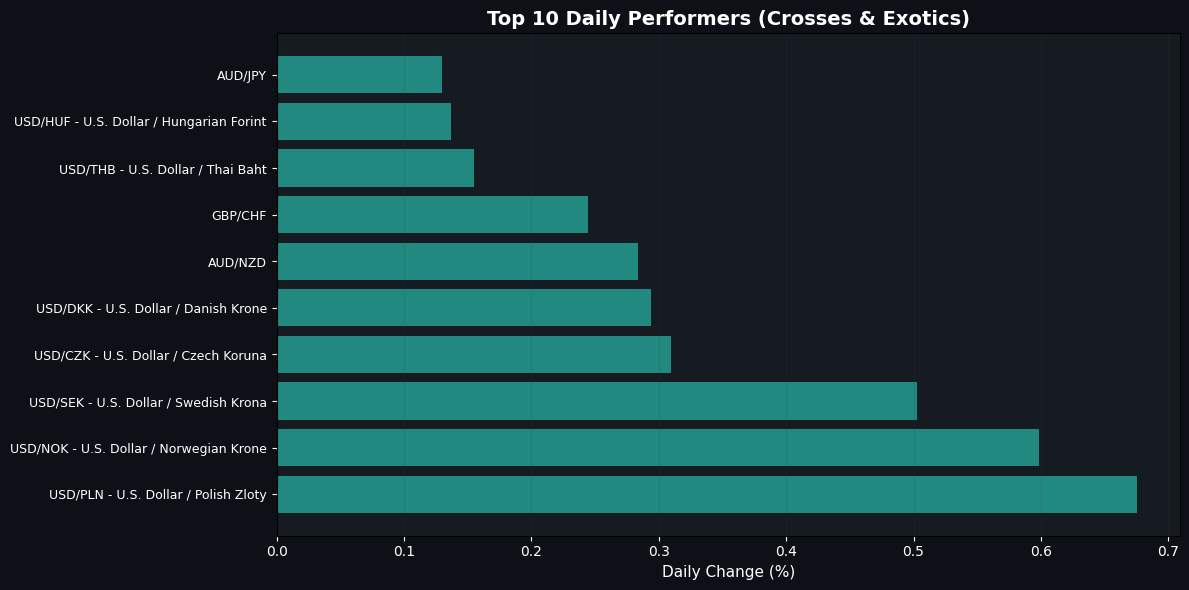

🏆 Top Daily Performers (Crosses & Exotics)

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.