💱 USD Gains Ground Against CHF; NZD Struggles Amidst Steady DXY Performance

📊 US Dollar Index (DXY)

Current Level: 99.96 (+0.09%)

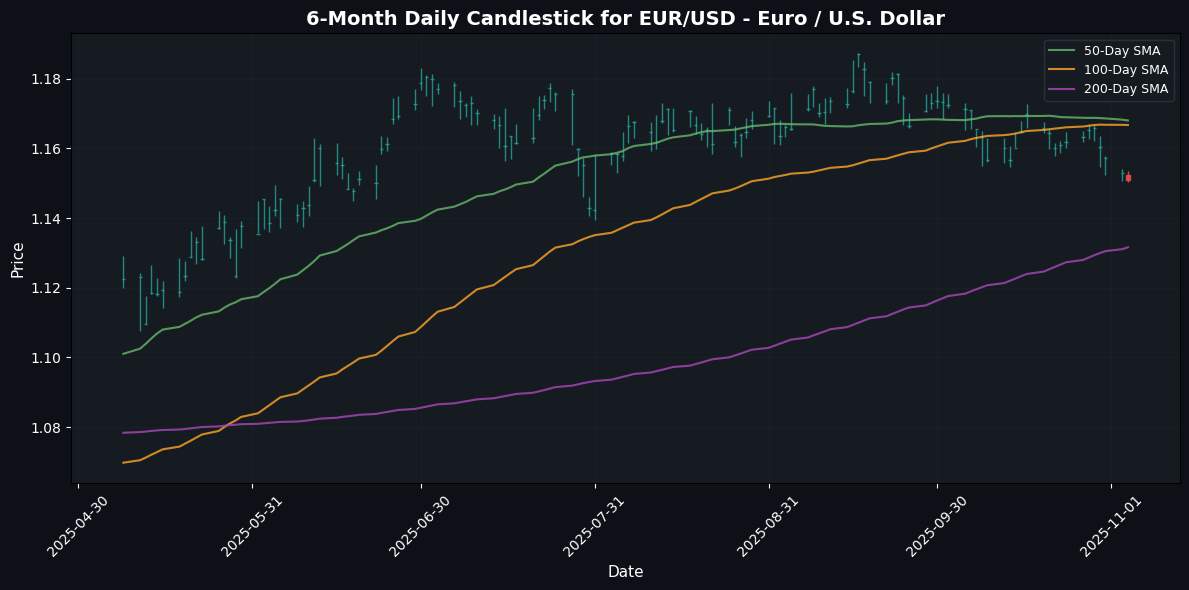

In the current forex market landscape, the US Dollar Index (DXY) is showing resilience, trading at 99.96, influenced by a divisive Federal Reserve stance which continues to drive investor sentiment towards the dollar. The Euro (EUR) is facing downward pressure, with the EUR/USD retreating below 1.1510 after failing to maintain gains, while analysts suggest potential testing of the 1.1490 support level.

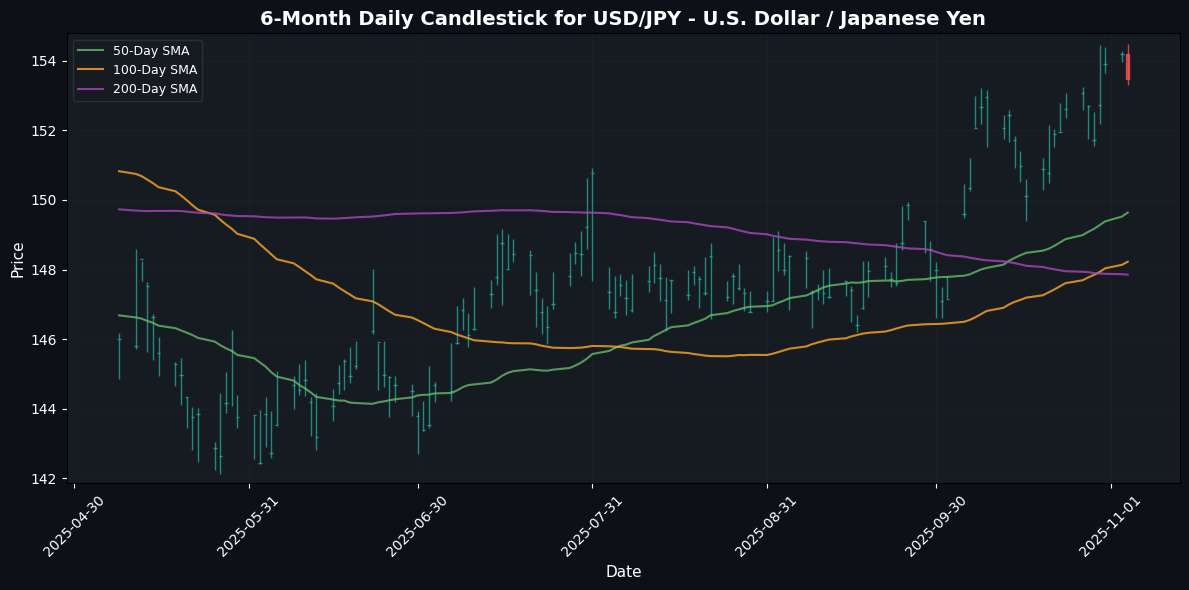

Meanwhile, the Japanese Yen (JPY) is experiencing volatility, currently at 154.53 against the USD. This follows comments from Prime Minister Takaichi regarding a forthcoming growth strategy, which, combined with a risk-off environment, has prompted a decline in USD/JPY as safe-haven demand for the Yen increases. Additionally, the Turkish Lira (TRY) is under scrutiny as inflation remains persistently high, with CPI marginally easing to 32.9% but failing to show significant improvement, impacting investor confidence.

In other developments, the AUD/NZD pair is gaining traction, testing 2022 highs after breaking through consolidation, while the GBP is underperforming against its peers amid concerns over high public borrowing costs in the UK. Overall, the forex market is characterized by risk aversion, with the dollar maintaining strength against a backdrop of divergent economic indicators and geopolitical uncertainties.

📅 Today’s Economic Calendar

No significant economic events scheduled for today.

💱 Major Currency Pairs

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EUR/USD – Euro / U.S. Dollar | EURUSD | 1.1509 | -0.17% | -1.23% | -0.94% | -2.48% | -2.36% | +9.60% | +3.08% | +5.83% | 1.1680 | 1.1667 | 1.1316 | 38.41 | -0.00 |

| USD/JPY – U.S. Dollar / Japanese Yen | USDJPY | 153.4810 | -0.46% | +0.52% | +0.58% | +3.90% | +6.73% | +2.73% | +6.20% | -1.57% | 149.6352 | 148.2232 | 147.8523 | 59.40 | 1.11 |

| GBP/USD – British Pound / U.S. Dollar | GBPUSD | 1.3069 | -0.50% | -2.04% | -1.94% | -3.30% | -4.82% | +3.15% | -0.93% | +2.15% | 1.3425 | 1.3460 | 1.3244 | 26.53 | -0.01 |

| USD/CHF – U.S. Dollar / Swiss Franc | USDCHF | 0.8085 | +0.45% | +1.75% | +1.69% | +2.04% | +2.00% | -9.97% | -4.55% | -9.41% | 0.7978 | 0.8005 | 0.8303 | 59.11 | 0.00 |

| AUD/USD – Australian Dollar / U.S. Dollar | AUDUSD | 0.6498 | -0.73% | -0.93% | -0.26% | -1.58% | -1.22% | +1.46% | -4.06% | -2.40% | 0.6564 | 0.6540 | 0.6444 | 51.13 | -0.00 |

| USD/CAD – U.S. Dollar / Canadian Dollar | USDCAD | 1.4071 | +0.40% | +0.57% | +0.60% | +1.78% | +3.42% | -0.74% | +4.37% | +2.78% | 1.3906 | 1.3815 | 1.3952 | 54.55 | 0.00 |

| NZD/USD – New Zealand Dollar / U.S. Dollar | NZDUSD | 0.5663 | -1.04% | -1.95% | -1.60% | -3.50% | -7.05% | -1.75% | -8.74% | -8.60% | 0.5822 | 0.5898 | 0.5856 | 37.30 | -0.00 |

In the current market analysis, the USD/CHF and USD/CAD pairs are demonstrating strength, with the U.S. Dollar gaining 0.45% and 0.40% respectively, indicating bullish sentiment towards the USD against these currencies. Conversely, the EUR/USD is slightly bearish, down 0.17%, suggesting a minor consolidation phase for the Euro against the Dollar. On the weaker side, both the NZD/USD and AUD/USD are facing significant downward pressure, with declines of 1.04% and 0.73%, respectively, reflecting a broader trend of U.S. Dollar strength that is impacting commodity-linked currencies. The GBP/USD is also underperforming, down 0.50%, indicating that the British Pound is struggling to maintain its value against the robust U.S. Dollar in the current environment.

🔀 Cross Currency Pairs

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EUR/GBP | EURGBP | 0.8803 | +0.31% | +0.81% | +1.00% | +0.83% | +2.56% | +6.23% | +4.03% | +3.58% | 0.8700 | 0.8667 | 0.8541 | 71.07 | 0.00 |

| EUR/JPY | EURJPY | 176.5820 | -0.65% | -0.74% | -0.40% | +1.29% | +4.20% | +12.56% | +9.46% | +4.14% | 174.7500 | 172.9110 | 167.2354 | 53.64 | 0.77 |

| EUR/CHF | EURCHF | 0.9302 | +0.26% | +0.48% | +0.71% | -0.51% | -0.45% | -1.35% | -1.64% | -4.16% | 0.9318 | 0.9338 | 0.9378 | 50.94 | -0.00 |

| EUR/AUD | EURAUD | 1.7707 | +0.55% | -0.32% | -0.70% | -0.95% | -1.20% | +7.97% | +7.41% | +8.37% | 1.7793 | 1.7838 | 1.7555 | 39.05 | -0.00 |

| GBP/JPY | GBPJPY | 200.5810 | -0.96% | -1.53% | -1.37% | +0.47% | +1.59% | +5.98% | +5.22% | +0.55% | 200.8516 | 199.4743 | 195.7324 | 41.87 | 0.29 |

| GBP/CHF | GBPCHF | 1.0567 | -0.03% | -0.31% | -0.27% | -1.31% | -2.93% | -7.13% | -5.43% | -7.47% | 1.0709 | 1.0774 | 1.0982 | 31.69 | -0.00 |

| AUD/JPY | AUDJPY | 99.7170 | -1.20% | -0.42% | +0.30% | +2.27% | +5.45% | +4.25% | +1.89% | -3.88% | 98.2062 | 96.9278 | 95.2500 | 59.34 | 0.64 |

| AUD/NZD | AUDNZD | 1.1473 | +0.30% | +1.03% | +1.36% | +2.01% | +6.29% | +3.30% | +5.12% | +6.82% | 1.1275 | 1.1090 | 1.1005 | 67.40 | 0.00 |

| CHF/JPY | CHFJPY | 189.7990 | -0.91% | -1.21% | -1.10% | +1.82% | +4.66% | +14.11% | +11.27% | +8.66% | 187.5315 | 185.1513 | 178.3524 | 53.42 | 1.09 |

| NZD/JPY | NZDJPY | 86.9020 | -1.50% | -1.43% | -1.03% | +0.28% | -0.79% | +0.93% | -3.08% | -10.04% | 87.0821 | 87.3820 | 86.5362 | 52.00 | 0.24 |

The recent performance of cross currency pairs shows a strong upward trend for the Euro, particularly against the Australian Dollar and the British Pound, with EUR/AUD rising by 0.55% and EUR/GBP by 0.31%. This strength in the Euro suggests positive sentiment or economic data supporting the Eurozone. Conversely, the Japanese Yen appears to be under pressure, with the weakest performers including NZD/JPY, AUD/JPY, and GBP/JPY, all experiencing declines of over 0.90%. This trend may indicate a risk-off sentiment in the market, leading to a flight from higher-yielding currencies to the perceived safety of the Yen.

🌍 Exotic and Emerging Market Currencies

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| USD/TRY – U.S. Dollar / Turkish Lira | USDTRY | 42.0839 | +0.11% | +0.30% | +0.13% | +1.67% | +5.67% | +15.66% | +23.68% | +30.39% | 41.5784 | 40.9584 | 39.3242 | 74.75 | 0.14 |

| USD/ZAR – U.S. Dollar / South African Rand | USDZAR | 17.4572 | +0.97% | +1.43% | +0.78% | +0.73% | -1.40% | -4.70% | -1.35% | -7.80% | 17.3738 | 17.5647 | 17.9663 | 53.49 | -0.02 |

| USD/THB – U.S. Dollar / Thai Baht | USDTHB | 32.5000 | +0.42% | -0.37% | -0.91% | +2.36% | +0.25% | -3.10% | -4.33% | -11.13% | 32.2867 | 32.3814 | 32.9218 | 47.25 | 0.03 |

| USD/SEK – U.S. Dollar / Swedish Krona | USDSEK | 9.5410 | +0.50% | +1.75% | +1.76% | +1.96% | +0.95% | -10.24% | -6.57% | -8.13% | 9.4112 | 9.4959 | 9.7857 | 49.95 | 0.01 |

| USD/NOK – U.S. Dollar / Norwegian Krone | USDNOK | 10.2044 | +0.88% | +2.18% | +2.38% | +2.96% | +1.24% | -8.01% | -3.15% | -3.43% | 9.9936 | 10.0713 | 10.3528 | 55.03 | 0.02 |

| USD/DKK – U.S. Dollar / Danish Krone | USDDKK | 6.4880 | +0.16% | +1.22% | +0.92% | +2.57% | +2.51% | -8.66% | -2.91% | -5.41% | 6.3922 | 6.3980 | 6.6056 | 61.72 | 0.02 |

| USD/MXN – U.S. Dollar / Mexican Peso | USDMXN | 18.6394 | +0.46% | +1.36% | +1.34% | +1.53% | -0.53% | -8.15% | -3.79% | +6.49% | 18.4756 | 18.6112 | 19.2830 | 61.95 | 0.02 |

| USD/PLN – U.S. Dollar / Polish Zloty | USDPLN | 3.6996 | +0.27% | +1.84% | +1.63% | +2.61% | +2.81% | -6.59% | -3.50% | -6.15% | 3.6407 | 3.6457 | 3.7489 | 57.65 | 0.01 |

| USD/HUF – U.S. Dollar / Hungarian Forint | USDHUF | 337.5080 | +0.34% | +1.30% | +0.55% | +2.39% | -0.36% | -11.87% | -4.37% | -5.99% | 334.6029 | 338.2369 | 353.0931 | 50.55 | 0.31 |

| USD/CZK – U.S. Dollar / Czech Koruna | USDCZK | 21.1662 | +0.30% | +1.46% | +1.21% | +3.11% | +0.98% | -11.23% | -5.53% | -6.42% | 20.8273 | 20.9671 | 21.8843 | 63.71 | 0.06 |

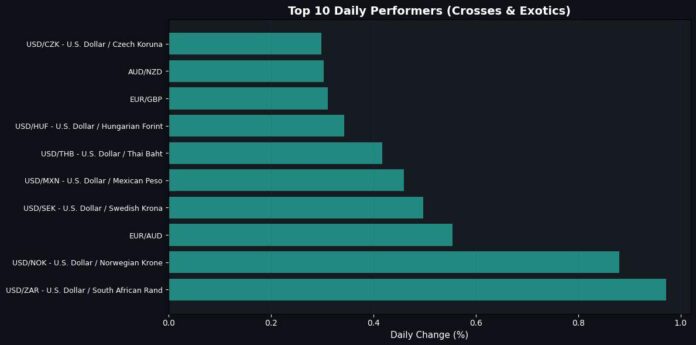

In the recent trading session, the USD/ZAR and USD/NOK have emerged as top performers, gaining 0.97% and 0.88% respectively, indicating a strengthening of the U.S. dollar against these currencies amid heightened geopolitical tensions and fluctuating commodity prices. Conversely, the weaker performance of USD/TRY, USD/DKK, and USD/PLN, with gains of only 0.11%, 0.16%, and 0.27%, respectively, suggests a lack of bullish momentum for the dollar against these pairs, potentially influenced by domestic economic conditions and central bank policies in Turkey, Denmark, and Poland. Overall, the divergence in performance among these exotics reflects varying levels of market sentiment and economic stability across the respective countries.

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.