💱 USD/JPY Soars as Fed Maintains Hawkish Stance; NZD/USD Faces Downward Pressure

📊 US Dollar Index (DXY)

Current Level: 99.55 (+0.02%)

In the current forex market landscape, several key themes are influencing currency movements. The US Dollar Index (DXY) remains stable at 99.55, supported by a hawkish tone from Federal Reserve Chair Powell and improving US-China trade relations, which have helped to alleviate dovish sentiment surrounding the USD. However, analysts suggest that further gains for the dollar may be increasingly difficult to justify.

In Turkey, inflation expectations are rising sharply, with the 12-month forward rate accelerating to 54.4%. This puts pressure on the Turkish central bank to reconsider ongoing rate cuts, adding volatility to the Turkish Lira (TRY) as market participants weigh the risks of a weakening currency amid high inflation.

The Eurozone’s Harmonized Index of Consumer Prices (HICP) showed moderate growth at 2.1% in October, slightly down from September’s 2.2%. However, strong core inflation data suggests underlying price pressures remain, which could influence European Central Bank policy.

For the British Pound (GBP), support levels are under scrutiny as analysts note a potential retest of 1.3120, while major support at 1.3100 appears less likely. Political dynamics surrounding Chancellor Reeves also pose risks to market stability.

In Japan, officials are expressing concern over the rapid depreciation of the Yen, signaling potential intervention, while the Japanese central bank’s lack of commitment to further rate hikes raises uncertainty. Overall, these factors are creating a complex environment for forex traders as they navigate inflationary pressures, geopolitical developments, and monetary policy shifts.

📅 Today’s Economic Calendar

No significant economic events scheduled for today.

💱 Major Currency Pairs

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EUR/USD – Euro / U.S. Dollar | EURUSD | 1.1574 | -0.25% | -0.38% | -0.23% | -1.84% | -1.01% | +10.77% | +4.04% | +6.11% | 1.1686 | 1.1668 | 1.1305 | 46.53 | -0.00 |

| USD/JPY – U.S. Dollar / Japanese Yen | USDJPY | 154.1130 | +0.91% | +0.99% | +1.46% | +4.17% | +6.51% | +1.44% | +6.70% | -1.26% | 149.3866 | 148.0368 | 147.8780 | 60.72 | 1.05 |

| GBP/USD – British Pound / U.S. Dollar | GBPUSD | 1.3130 | -0.50% | -1.48% | -1.76% | -3.14% | -4.33% | +3.99% | -0.48% | +2.50% | 1.3440 | 1.3469 | 1.3236 | 29.01 | -0.01 |

| USD/CHF – U.S. Dollar / Swiss Franc | USDCHF | 0.8023 | +0.31% | +0.90% | +0.70% | +1.23% | +0.17% | -11.22% | -4.70% | -10.36% | 0.7977 | 0.8006 | 0.8313 | 49.92 | -0.00 |

| AUD/USD – Australian Dollar / U.S. Dollar | AUDUSD | 0.6543 | -0.52% | +0.43% | +0.78% | -1.13% | -0.05% | +2.99% | -3.54% | -2.20% | 0.6562 | 0.6540 | 0.6441 | 58.12 | -0.00 |

| USD/CAD – U.S. Dollar / Canadian Dollar | USDCAD | 1.4013 | +0.51% | +0.19% | -0.05% | +1.60% | +2.71% | -1.25% | +3.97% | +2.82% | 1.3898 | 1.3806 | 1.3956 | 52.54 | 0.00 |

| NZD/USD – New Zealand Dollar / U.S. Dollar | NZDUSD | 0.5724 | -0.69% | -0.53% | -0.32% | -2.83% | -5.52% | +0.34% | -8.37% | -7.58% | 0.5828 | 0.5905 | 0.5856 | 49.24 | -0.00 |

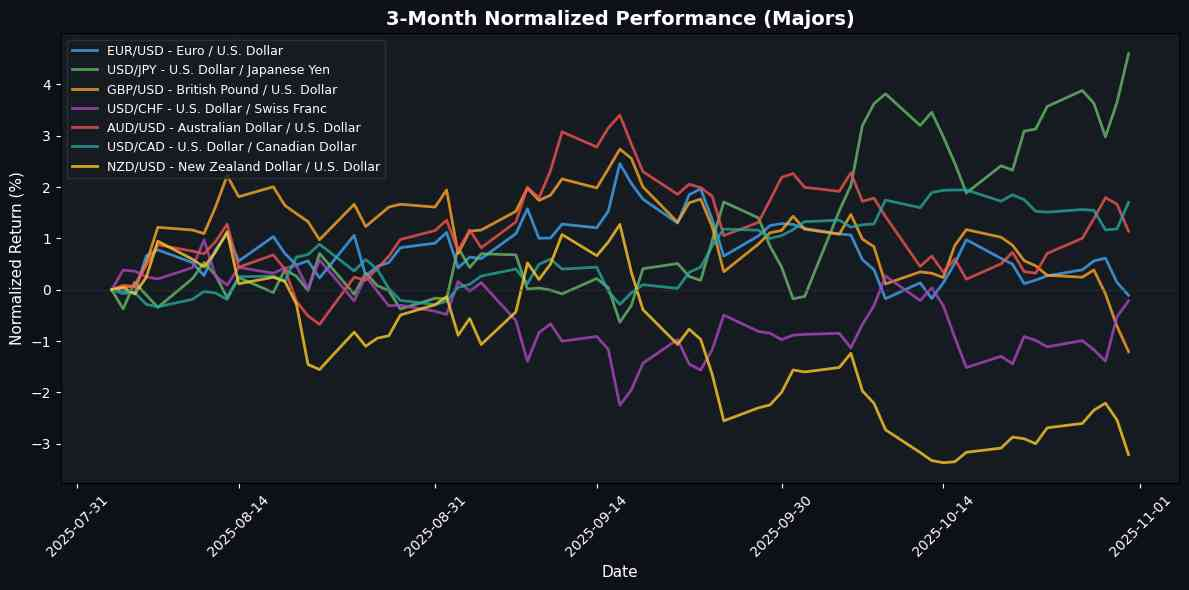

In the recent trading session, the U.S. Dollar demonstrated strong performance against major currencies, particularly the Japanese Yen (USD/JPY), which surged by 0.91%, indicating a bullish sentiment likely driven by rising U.S. interest rates and economic data. Similarly, USD/CAD and USD/CHF saw gains of 0.51% and 0.31%, respectively, suggesting a robust demand for the dollar amid ongoing market volatility.

Conversely, the New Zealand Dollar (NZD/USD) and Australian Dollar (AUD/USD) faced downward pressure, declining by 0.69% and 0.52%, respectively, likely influenced by weaker commodity prices and concerns over global growth. The British Pound (GBP/USD) also slipped by 0.50%, reflecting ongoing uncertainties surrounding the UK economy and monetary policy. Overall, the dollar’s strength appears to be a dominant trend, overshadowing the weakness in these commodity-linked currencies.

🔀 Cross Currency Pairs

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EUR/GBP | EURGBP | 0.8812 | +0.21% | +1.09% | +1.53% | +1.33% | +3.45% | +6.48% | +4.51% | +3.50% | 0.8694 | 0.8662 | 0.8538 | 71.91 | 0.00 |

| EUR/JPY | EURJPY | 178.3350 | +0.64% | +0.59% | +1.21% | +2.24% | +5.43% | +12.35% | +11.00% | +4.76% | 174.5492 | 172.7064 | 167.0922 | 64.76 | 0.89 |

| EUR/CHF | EURCHF | 0.9283 | -0.00% | +0.50% | +0.45% | -0.64% | -0.86% | -1.67% | -0.88% | -4.91% | 0.9321 | 0.9340 | 0.9379 | 43.02 | -0.00 |

| EUR/AUD | EURAUD | 1.7688 | +0.27% | -0.80% | -1.00% | -0.70% | -0.95% | +7.56% | +7.86% | +8.50% | 1.7807 | 1.7841 | 1.7544 | 40.61 | -0.00 |

| GBP/JPY | GBPJPY | 202.3640 | +0.43% | -0.50% | -0.31% | +0.91% | +1.91% | +5.50% | +6.20% | +1.22% | 200.7419 | 199.3724 | 195.6437 | 47.71 | 0.50 |

| GBP/CHF | GBPCHF | 1.0534 | -0.21% | -0.58% | -1.06% | -1.94% | -4.16% | -7.66% | -5.15% | -8.12% | 1.0720 | 1.0782 | 1.0989 | 26.71 | -0.00 |

| AUD/JPY | AUDJPY | 100.8070 | +0.37% | +1.40% | +2.24% | +2.96% | +6.44% | +4.45% | +2.90% | -3.45% | 98.0157 | 96.7977 | 95.2272 | 65.66 | 0.63 |

| AUD/NZD | AUDNZD | 1.1427 | +0.16% | +0.96% | +1.09% | +1.81% | +5.86% | +2.63% | +5.25% | +5.89% | 1.1259 | 1.1076 | 1.1001 | 61.82 | 0.00 |

| CHF/JPY | CHFJPY | 192.1180 | +0.65% | +0.11% | +0.79% | +2.91% | +6.36% | +14.27% | +11.98% | +10.19% | 187.2434 | 184.8930 | 178.1696 | 72.61 | 1.34 |

| NZD/JPY | NZDJPY | 88.2130 | +0.23% | +0.46% | +1.16% | +1.23% | +0.67% | +1.80% | -2.22% | -8.73% | 87.0310 | 87.3731 | 86.5456 | 62.88 | 0.29 |

In the recent trading session, the top performers among the crosses are led by CHF/JPY, which saw a solid gain of +0.65%, indicating a strengthening of the Swiss franc against the Japanese yen. Similarly, EUR/JPY and GBP/JPY also showed positive momentum, with increases of +0.64% and +0.43%, respectively, reflecting a bullish outlook for the euro and pound versus the yen. On the downside, GBP/CHF and EUR/CHF slightly underperformed, with GBP/CHF declining by -0.21%, suggesting potential weakness in the pound against the Swiss franc. Overall, the JPY appears to be under pressure, while the CHF shows resilience against the weaker GBP.

🌍 Exotic and Emerging Market Currencies

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| USD/TRY – U.S. Dollar / Turkish Lira | USDTRY | 42.0448 | +0.35% | +0.03% | +0.18% | +1.56% | +5.50% | +15.85% | +23.16% | +30.66% | 41.5355 | 40.9049 | 39.2603 | 73.04 | 0.14 |

| USD/ZAR – U.S. Dollar / South African Rand | USDZAR | 17.3386 | +1.02% | +0.10% | -0.28% | -0.01% | -2.92% | -5.74% | -2.74% | -6.36% | 17.3810 | 17.5754 | 17.9779 | 46.59 | -0.03 |

| USD/THB – U.S. Dollar / Thai Baht | USDTHB | 32.2900 | -0.34% | -1.55% | -1.73% | +1.25% | -0.74% | -4.01% | -5.15% | -11.71% | 32.2860 | 32.3812 | 32.9367 | 40.12 | 0.05 |

| USD/SEK – U.S. Dollar / Swedish Krona | USDSEK | 9.4440 | +0.42% | +0.72% | +0.18% | +1.07% | -0.67% | -11.87% | -7.36% | -9.24% | 9.4126 | 9.4952 | 9.8006 | 40.28 | -0.01 |

| USD/NOK – U.S. Dollar / Norwegian Krone | USDNOK | 10.0866 | +0.74% | +1.20% | +0.27% | +2.21% | +0.30% | -9.55% | -3.97% | -3.45% | 9.9919 | 10.0664 | 10.3641 | 48.09 | 0.01 |

| USD/DKK – U.S. Dollar / Danish Krone | USDDKK | 6.4531 | +0.26% | +0.38% | +0.24% | +1.93% | +1.13% | -9.60% | -3.75% | -5.62% | 6.3889 | 6.3974 | 6.6124 | 53.82 | 0.01 |

| USD/MXN – U.S. Dollar / Mexican Peso | USDMXN | 18.5560 | +0.49% | +0.88% | +0.66% | +1.04% | -1.71% | -8.31% | -5.64% | +4.83% | 18.4779 | 18.6183 | 19.3015 | 52.84 | 0.00 |

| USD/PLN – U.S. Dollar / Polish Zloty | USDPLN | 3.6779 | +0.70% | +1.04% | +0.70% | +1.78% | +1.42% | -7.30% | -4.71% | -6.03% | 3.6391 | 3.6459 | 3.7525 | 51.04 | 0.00 |

| USD/HUF – U.S. Dollar / Hungarian Forint | USDHUF | 335.1600 | +0.09% | -0.15% | -0.05% | +1.71% | -1.94% | -12.66% | -5.22% | -6.32% | 334.6965 | 338.4604 | 353.6619 | 41.72 | -0.06 |

| USD/CZK – U.S. Dollar / Czech Koruna | USDCZK | 21.0166 | +0.18% | +0.50% | +0.43% | +2.03% | -0.60% | -12.35% | -6.64% | -7.00% | 20.8235 | 20.9739 | 21.9141 | 54.94 | 0.04 |

The recent performance of exotic currency pairs highlights a strengthening U.S. Dollar, particularly against the South African Rand (USD/ZAR), which saw a notable increase of +1.02%. This trend may indicate increased investor confidence in the U.S. economy or concerns surrounding emerging market stability in South Africa. Meanwhile, the USD/NOK and USD/PLN also reflected a bullish sentiment for the Dollar, with gains of +0.74% and +0.70%, respectively, suggesting a broader trend of USD appreciation in the face of fluctuating commodity prices and regional economic dynamics. Conversely, the USD/THB showed a decline of -0.34%, signaling potential weakness in the Dollar against the Thai Baht, possibly driven by local economic factors or capital flows.

🏆 Top Daily Performers (Crosses & Exotics)

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.