💱 USD Soars Against JPY Amid Fed’s Hawkish Stance; NZD Struggles Against USD

📊 US Dollar Index (DXY)

Current Level: 99.72 (+0.19%)

The forex market is experiencing heightened volatility, primarily driven by the Federal Reserve’s hawkish stance and its implications for interest rates. The US Dollar (USD) has strengthened significantly, with the DXY rising to 99.72, buoyed by a recent 25-basis-point rate cut that has led to reduced expectations for further easing. This strength is evident in the EUR/USD, which has slid to a three-month low, and GBP/USD, reaching a seven-month low amid ongoing fiscal concerns in the UK. Investors are favoring the USD as uncertainties surrounding the fiscal landscape in Europe and the UK intensify.

In the commodities sector, gold has dipped below $4,000, reflecting investor reassessment of the Fed’s policy direction and its impact on safe-haven assets. Meanwhile, oil prices are rebounding, with WTI rising to $60.50 per barrel, highlighting a modest recovery in the energy market amid OPEC+ output modifications.

Additionally, the Japanese Yen (JPY) shows signs of fatigue against the USD, with intervention concerns emerging as Japanese officials issue verbal warnings. The EUR/GBP pair is also under pressure, as the European Central Bank (ECB) maintains rates while UK fiscal challenges persist. Overall, the USD’s strength remains the predominant theme, reshaping the currency landscape amid mixed economic signals globally.

💱 Major Currency Pairs

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EUR/USD – Euro / U.S. Dollar | EURUSD | 1.1543 | -0.52% | -0.64% | -0.49% | -2.10% | -1.27% | +10.48% | +3.76% | +5.83% | 1.1685 | 1.1667 | 1.1305 | 43.28 | -0.00 |

| USD/JPY – U.S. Dollar / Japanese Yen | USDJPY | 153.9400 | +0.80% | +0.88% | +1.35% | +4.05% | +6.39% | +1.32% | +6.58% | -1.37% | 149.3832 | 148.0351 | 147.8771 | 60.00 | 1.04 |

| GBP/USD – British Pound / U.S. Dollar | GBPUSD | 1.3154 | -0.31% | -1.30% | -1.58% | -2.96% | -4.16% | +4.18% | -0.30% | +2.68% | 1.3440 | 1.3470 | 1.3236 | 30.51 | -0.01 |

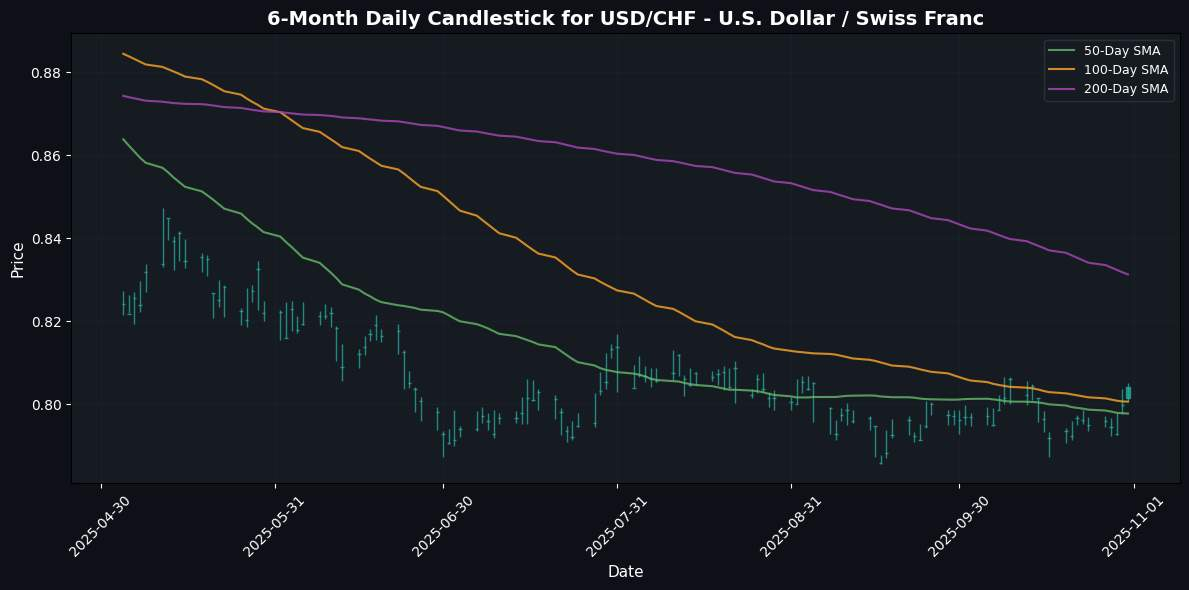

| USD/CHF – U.S. Dollar / Swiss Franc | USDCHF | 0.8042 | +0.55% | +1.15% | +0.94% | +1.47% | +0.41% | -11.00% | -4.47% | -10.15% | 0.7978 | 0.8006 | 0.8313 | 52.41 | 0.00 |

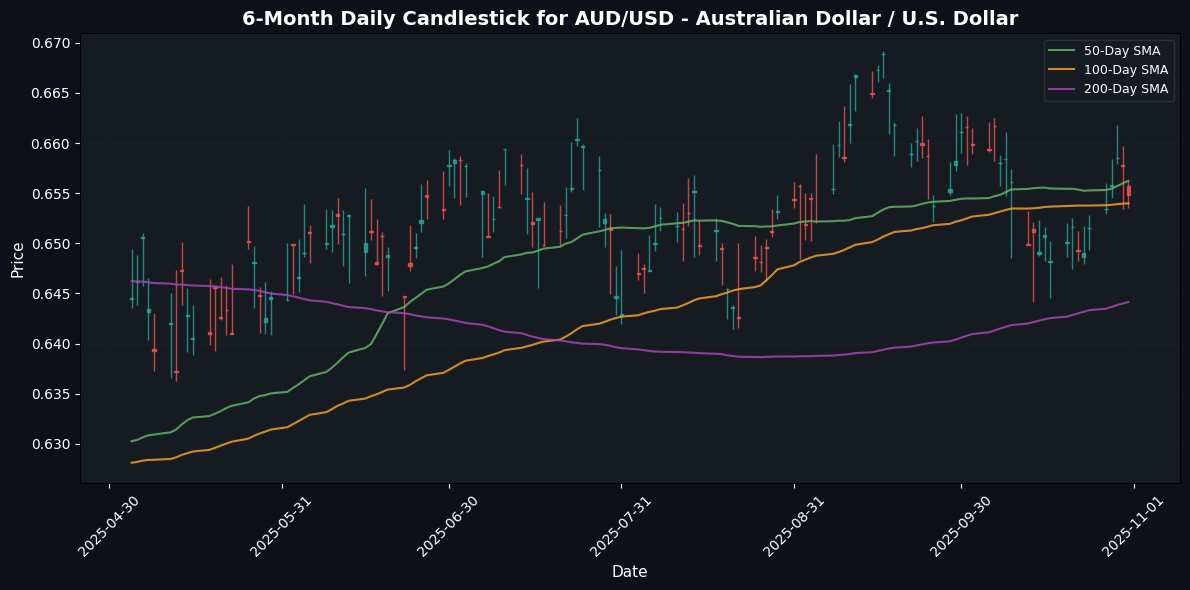

| AUD/USD – Australian Dollar / U.S. Dollar | AUDUSD | 0.6548 | -0.44% | +0.51% | +0.86% | -1.06% | +0.02% | +3.07% | -3.47% | -2.12% | 0.6562 | 0.6540 | 0.6441 | 59.23 | -0.00 |

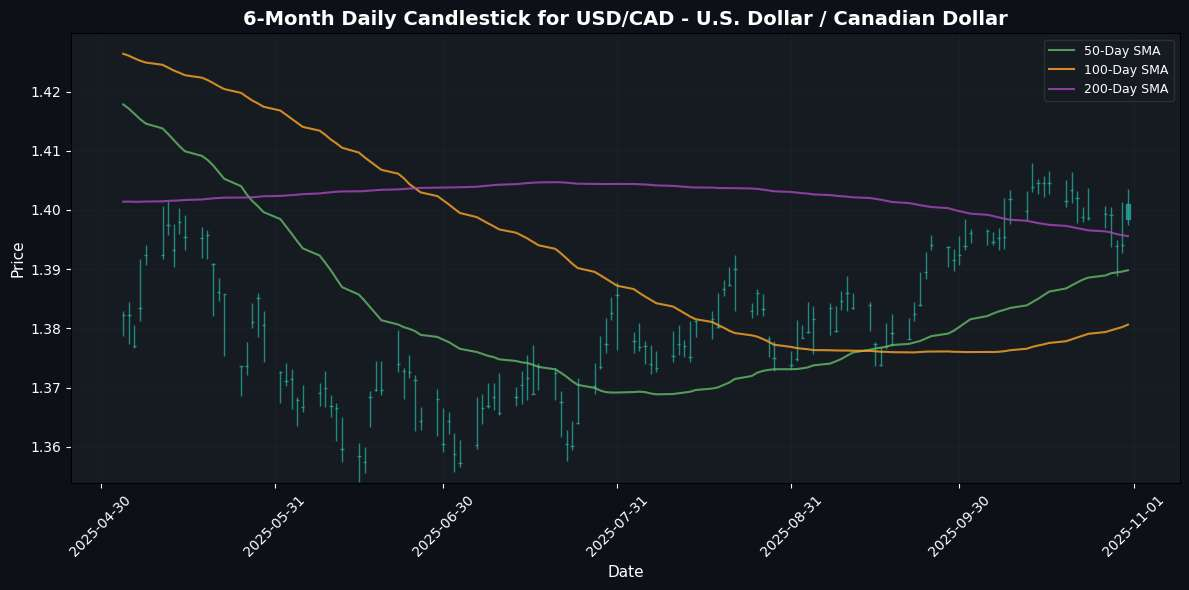

| USD/CAD – U.S. Dollar / Canadian Dollar | USDCAD | 1.4010 | +0.49% | +0.17% | -0.07% | +1.58% | +2.69% | -1.26% | +3.95% | +2.80% | 1.3898 | 1.3806 | 1.3956 | 52.10 | 0.00 |

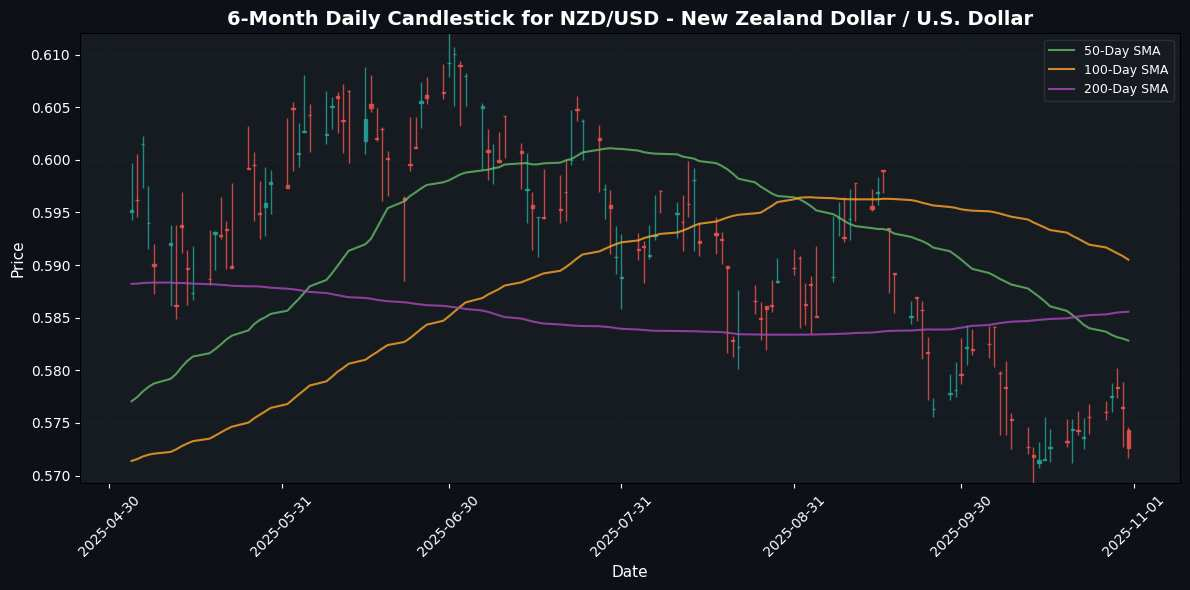

| NZD/USD – New Zealand Dollar / U.S. Dollar | NZDUSD | 0.5726 | -0.67% | -0.51% | -0.29% | -2.81% | -5.50% | +0.36% | -8.35% | -7.55% | 0.5828 | 0.5905 | 0.5856 | 49.66 | -0.00 |

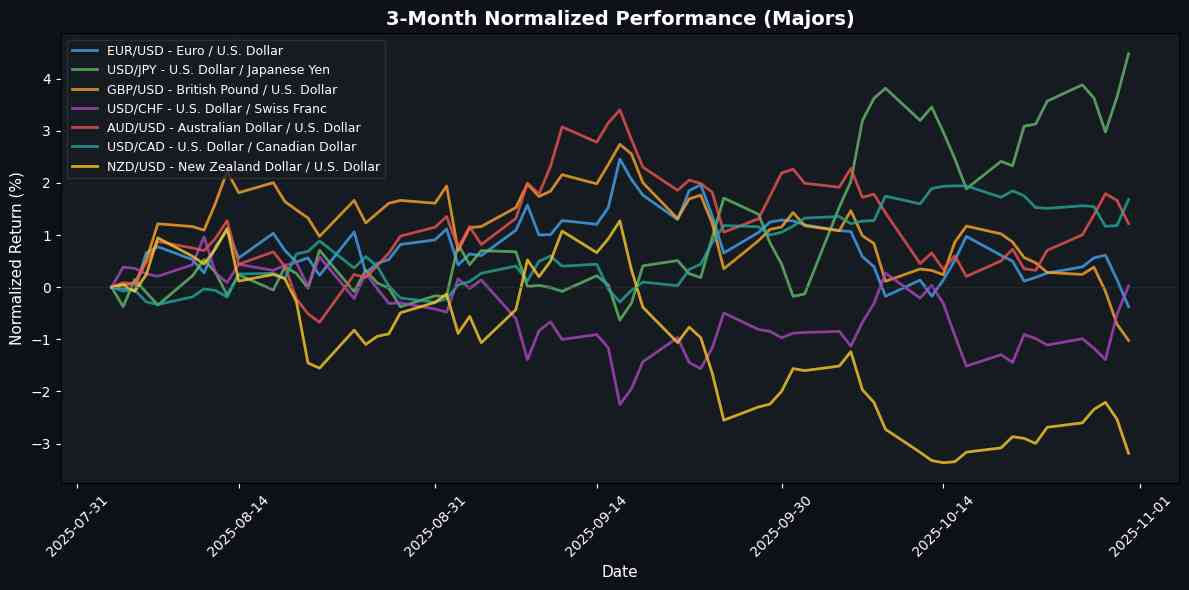

In the current trading environment, the U.S. Dollar shows strong performance against the Japanese Yen, Swiss Franc, and Canadian Dollar, with USD/JPY leading the gains at +0.80%. This strength suggests a robust bullish sentiment for the USD, possibly driven by favorable economic indicators or interest rate expectations. Conversely, the New Zealand Dollar, Euro, and Australian Dollar have weakened against the USD, with NZD/USD declining the most at -0.67%. This shift indicates a risk-off sentiment, where investors may be favoring the safety of the USD amid global uncertainties, impacting the commodity-linked currencies negatively. Overall, the trend suggests a strengthening U.S. Dollar, likely influenced by diverging economic outlooks between the U.S. and other major economies.

🔀 Cross Currency Pairs

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EUR/GBP | EURGBP | 0.8771 | -0.25% | +0.63% | +1.06% | +0.86% | +2.97% | +6.00% | +4.03% | +3.02% | 0.8694 | 0.8662 | 0.8538 | 63.87 | 0.00 |

| EUR/JPY | EURJPY | 177.6910 | +0.28% | +0.23% | +0.85% | +1.87% | +5.05% | +11.94% | +10.60% | +4.38% | 174.5364 | 172.6999 | 167.0890 | 60.89 | 0.84 |

| EUR/CHF | EURCHF | 0.9277 | -0.07% | +0.44% | +0.38% | -0.70% | -0.92% | -1.74% | -0.94% | -4.97% | 0.9321 | 0.9340 | 0.9379 | 41.68 | -0.00 |

| EUR/AUD | EURAUD | 1.7623 | -0.10% | -1.17% | -1.37% | -1.07% | -1.32% | +7.16% | +7.45% | +8.09% | 1.7806 | 1.7840 | 1.7544 | 36.41 | -0.00 |

| GBP/JPY | GBPJPY | 202.5720 | +0.53% | -0.39% | -0.21% | +1.01% | +2.02% | +5.61% | +6.31% | +1.33% | 200.7461 | 199.3745 | 195.6447 | 48.90 | 0.52 |

| GBP/CHF | GBPCHF | 1.0576 | +0.19% | -0.18% | -0.66% | -1.54% | -3.77% | -7.29% | -4.76% | -7.75% | 1.0721 | 1.0783 | 1.0989 | 32.63 | -0.00 |

| AUD/JPY | AUDJPY | 100.7980 | +0.36% | +1.39% | +2.23% | +2.95% | +6.43% | +4.44% | +2.89% | -3.46% | 98.0155 | 96.7976 | 95.2272 | 65.61 | 0.63 |

| AUD/NZD | AUDNZD | 1.1431 | +0.19% | +0.99% | +1.12% | +1.85% | +5.89% | +2.66% | +5.28% | +5.92% | 1.1259 | 1.1076 | 1.1001 | 62.25 | 0.00 |

| CHF/JPY | CHFJPY | 191.4420 | +0.29% | -0.25% | +0.44% | +2.55% | +5.99% | +13.87% | +11.58% | +9.80% | 187.2299 | 184.8863 | 178.1662 | 68.98 | 1.29 |

| NZD/JPY | NZDJPY | 88.1400 | +0.15% | +0.38% | +1.07% | +1.15% | +0.58% | +1.72% | -2.31% | -8.81% | 87.0296 | 87.3724 | 86.5452 | 62.26 | 0.28 |

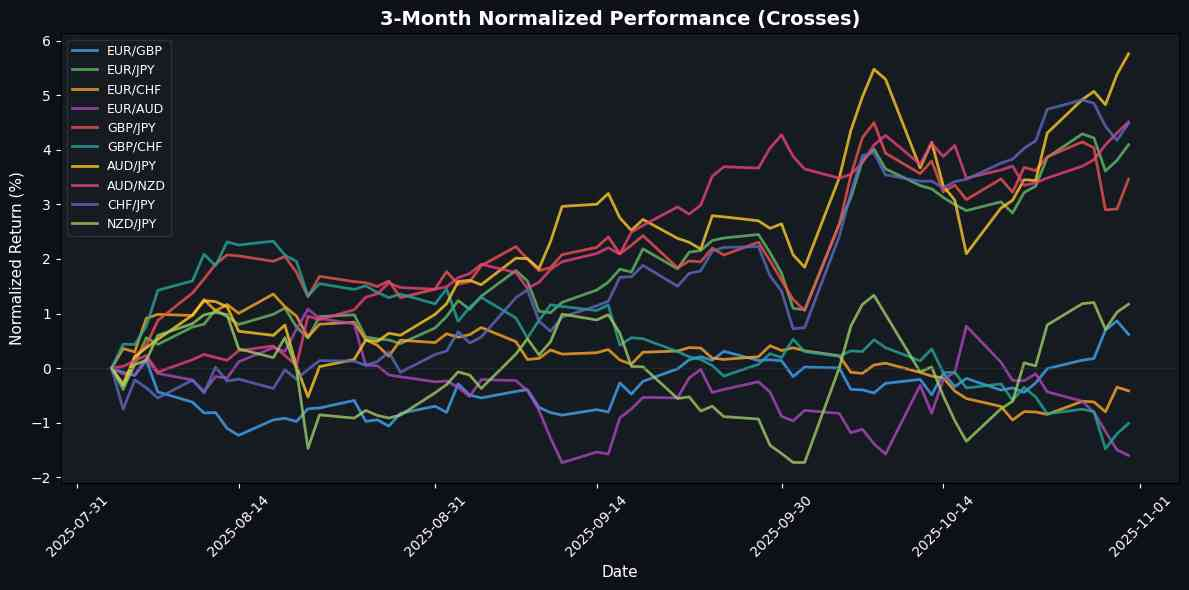

In the recent trading session, GBP/JPY emerged as the top performer, gaining 0.53%, which suggests a strengthening of the British pound against the yen, likely driven by positive sentiment or economic indicators from the UK. Similarly, AUD/JPY and CHF/JPY posted gains of 0.36% and 0.29%, respectively, reflecting a broader trend of JPY weakness as investor appetite for riskier assets grows. Conversely, the weakest performers, including EUR/GBP (-0.25%) and EUR/AUD (-0.10%), indicate a decline in the euro’s value against both the British pound and the Australian dollar, which may signal ongoing concerns about the eurozone’s economic outlook. Overall, the market appears to favor currencies associated with stronger economic resilience, particularly in the face of JPY depreciation.

🌍 Exotic and Emerging Market Currencies

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| USD/TRY – U.S. Dollar / Turkish Lira | USDTRY | 42.0171 | +0.29% | -0.03% | +0.12% | +1.50% | +5.43% | +15.77% | +23.08% | +30.57% | 41.5350 | 40.9047 | 39.2602 | 71.46 | 0.14 |

| USD/ZAR – U.S. Dollar / South African Rand | USDZAR | 17.3143 | +0.88% | -0.04% | -0.42% | -0.15% | -3.06% | -5.88% | -2.87% | -6.49% | 17.3805 | 17.5751 | 17.9778 | 45.34 | -0.04 |

| USD/THB – U.S. Dollar / Thai Baht | USDTHB | 32.3500 | -0.15% | -1.37% | -1.55% | +1.44% | -0.55% | -3.83% | -4.97% | -11.55% | 32.2872 | 32.3818 | 32.9370 | 41.61 | 0.05 |

| USD/SEK – U.S. Dollar / Swedish Krona | USDSEK | 9.4819 | +0.82% | +1.12% | +0.58% | +1.48% | -0.27% | -11.52% | -6.99% | -8.88% | 9.4134 | 9.4956 | 9.8008 | 46.39 | -0.00 |

| USD/NOK – U.S. Dollar / Norwegian Krone | USDNOK | 10.1028 | +0.90% | +1.36% | +0.43% | +2.37% | +0.46% | -9.40% | -3.82% | -3.29% | 9.9922 | 10.0665 | 10.3642 | 49.91 | 0.01 |

| USD/DKK – U.S. Dollar / Danish Krone | USDDKK | 6.4700 | +0.53% | +0.64% | +0.50% | +2.20% | +1.40% | -9.37% | -3.50% | -5.38% | 6.3892 | 6.3976 | 6.6125 | 57.08 | 0.01 |

| USD/MXN – U.S. Dollar / Mexican Peso | USDMXN | 18.5450 | +0.43% | +0.82% | +0.60% | +0.98% | -1.77% | -8.36% | -5.69% | +4.77% | 18.4777 | 18.6182 | 19.3015 | 51.95 | 0.00 |

| USD/PLN – U.S. Dollar / Polish Zloty | USDPLN | 3.6818 | +0.81% | +1.14% | +0.80% | +1.89% | +1.53% | -7.20% | -4.61% | -5.93% | 3.6391 | 3.6459 | 3.7525 | 52.08 | 0.00 |

| USD/HUF – U.S. Dollar / Hungarian Forint | USDHUF | 336.3300 | +0.44% | +0.20% | +0.30% | +2.07% | -1.60% | -12.36% | -4.89% | -5.99% | 334.7199 | 338.4721 | 353.6677 | 45.81 | 0.04 |

| USD/CZK – U.S. Dollar / Czech Koruna | USDCZK | 21.0780 | +0.47% | +0.79% | +0.72% | +2.33% | -0.31% | -12.09% | -6.37% | -6.73% | 20.8247 | 20.9745 | 21.9144 | 58.24 | 0.04 |

In the recent trading session, the Exotics currency pairs displayed a mixed performance, with the U.S. Dollar showing strength against the Norwegian Krone (USD/NOK), South African Rand (USD/ZAR), and Swedish Krona (USD/SEK), reflecting a bullish trend and increased demand for the dollar amidst global economic uncertainties. The notable gains of +0.90%, +0.88%, and +0.82% respectively suggest a strong risk-off sentiment, driving investors toward the dollar as a safe haven.

Conversely, the Thai Baht (USD/THB) experienced slight weakness, declining by -0.15%, indicating potential localized economic pressures. The Turkish Lira (USD/TRY) and Mexican Peso (USD/MXN) showed moderate resilience with positive movements of +0.29% and +0.43%, respectively, though they lag behind the top performers, highlighting ongoing volatility in emerging market currencies. Overall, the dollar’s strength against these exotic pairs signals a

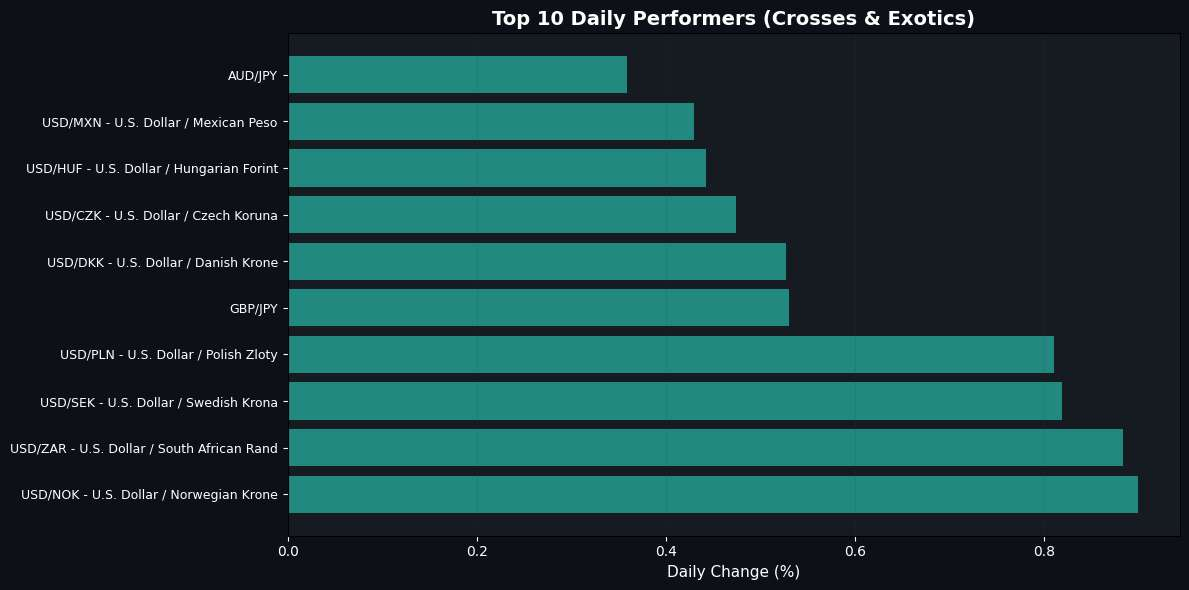

🏆 Top Daily Performers (Crosses & Exotics)

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.