**Week of October 17 – October 24, 2025**

## Weekly Market Overview

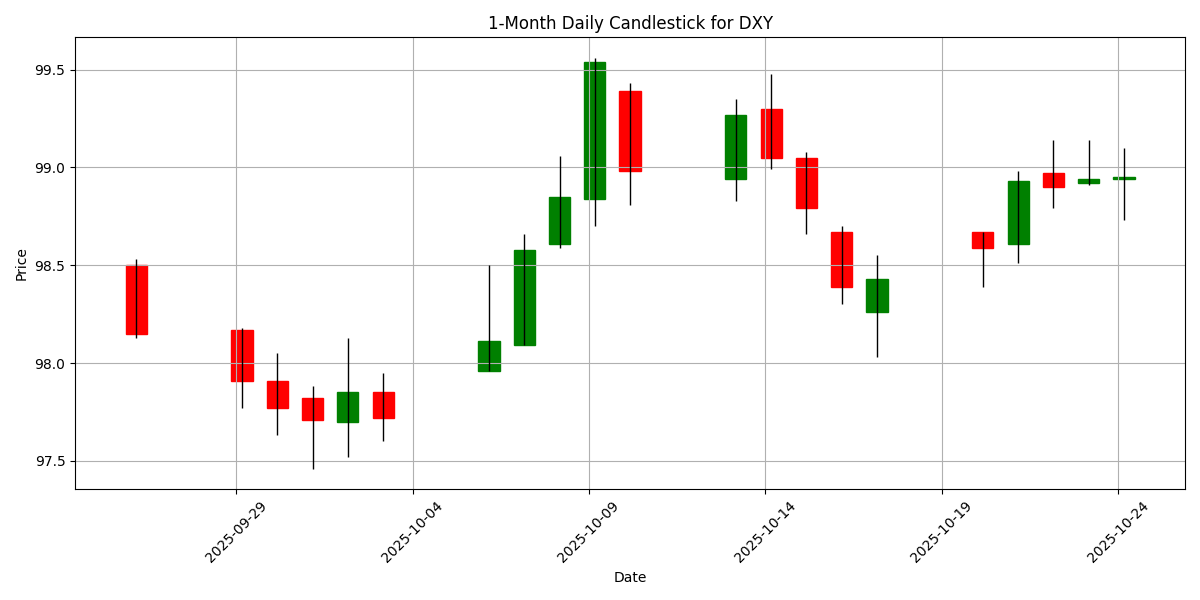

The week of October 17 to October 24, 2025, witnessed significant movements in the foreign exchange markets, heavily influenced by a mix of economic data releases, central bank discourse, and geopolitical developments. The US Dollar Index (DXY) closed at 98.94, reflecting a weekly increase of 0.5590%, as traders reacted to a series of mixed economic indicators from both sides of the Atlantic.

In Europe, the release of German inflation data on October 17, which showed the Core Consumer Price Index (CPI) rising to 2.4% year-over-year against a forecast of 2.3%, provided a boost to the euro initially. However, the overall sentiment was tempered by the European Central Bank’s (ECB) cautious stance on future rate hikes, articulated by President Christine Lagarde during her speech that week. The ECB’s focus on maintaining economic stability amid rising inflationary pressures kept the euro under pressure, particularly against the strengthening US dollar.

Across the Atlantic, the Atlanta Fed’s GDPNow forecast for Q3 came in slightly above expectations at 3.9%, compared to the anticipated 3.8%. This positive economic outlook, coupled with ongoing discussions regarding the Federal Reserve’s monetary policy, helped the dollar maintain its upward trajectory. The juxtaposition of resilient US economic indicators against softer European data contributed to the EUR/USD pair falling, marking a significant shift in market sentiment.

Geopolitical tensions also played a critical role in shaping market dynamics. President Donald Trump’s announcement of a 10% additional tariff on Canadian imports over a controversial advertisement further strained US-Canada relations. This news led to a depreciation of the Canadian dollar, which struggled to find footing amid fears of escalating trade tensions. The broader implications of such tariffs raised concerns about potential ripple effects on the North American economy, influencing trader sentiment towards the Canadian dollar.

In Asia, China’s GDP growth for Q3 was reported at 4.8%, slightly above expectations but marking a deceleration from previous quarters. The mixed economic signals from China, particularly a disappointing fixed asset investment figure, heightened concerns about the sustainability of its recovery, impacting the Australian dollar, a currency closely tied to commodity prices and Chinese demand.

As the week progressed, market participants remained vigilant, weighing the implications of economic data against the backdrop of central bank policies and geopolitical uncertainties. The combination of robust US economic indicators and geopolitical friction ultimately favored the dollar, while the euro and Canadian dollar faced downward pressure, illustrating the intricate interplay between economic fundamentals and market sentiment in shaping currency movements.

## Major FX Group

| Name | Symbol | Price | Weekly (%) | YTD (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|

| EUR/USD – Euro / U.S. Dollar | EURUSD | 1.1632 | -0.5812 | 11.78 | 1.1689 | 1.1660 | 1.1273 | 41.63 | -0.0023 |

| USD/JPY – U.S. Dollar / Japanese Yen | USDJPY | 152.81 | 1.7919 | -2.6657 | 148.88 | 147.61 | 147.95 | 66.18 | 0.9579 |

| GBP/USD – British Pound / U.S. Dollar | GBPUSD | 1.3314 | -0.9817 | 6.0953 | 1.3463 | 1.3484 | 1.3211 | 38.72 | -0.0032 |

| USD/CHF – U.S. Dollar / Swiss Franc | USDCHF | 0.7951 | 0.4168 | -11.97 | 0.7985 | 0.8014 | 0.8335 | 49.35 | -0.0009 |

| AUD/USD – Australian Dollar / U.S. Dollar | AUDUSD | 0.6515 | 0.5091 | 4.7428 | 0.6553 | 0.6538 | 0.6435 | 32.44 | -0.0020 |

| USD/CAD – U.S. Dollar / Canadian Dollar | USDCAD | 1.3987 | -0.4200 | -2.5283 | 1.3889 | 1.3794 | 1.3964 | 60.10 | 0.0037 |

| NZD/USD – New Zealand Dollar / U.S. Dollar | NZDUSD | 0.5755 | 0.4889 | 2.0442 | 0.5836 | 0.5917 | 0.5853 | 25.62 | -0.0031 |

No significant technical comments available for the past week.

## Cross FX Group

| Name | Symbol | Price | Weekly (%) | YTD (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|

| EUR/GBP | EURGBP | 0.8734 | 0.3793 | 5.3317 | 0.8682 | 0.8647 | 0.8529 | 53.46 | 0.0003 |

| EUR/JPY | EURJPY | 177.74 | 1.2037 | 8.7878 | 174.01 | 172.11 | 166.68 | 67.89 | 0.7699 |

| EUR/CHF | EURCHF | 0.9244 | -0.2051 | -1.6491 | 0.9335 | 0.9346 | 0.9383 | 21.48 | -0.0028 |

| EUR/AUD | EURAUD | 1.7848 | -1.1027 | 6.6699 | 1.7839 | 1.7836 | 1.7516 | 54.34 | 0.0023 |

| GBP/JPY | GBPJPY | 203.49 | 0.8185 | 3.2949 | 200.41 | 199.03 | 195.36 | 61.90 | 0.8146 |

| GBP/CHF | GBPCHF | 1.0583 | -0.5918 | -6.6220 | 1.0752 | 1.0809 | 1.1003 | 29.62 | -0.0036 |

| AUD/JPY | AUDJPY | 99.56 | 2.3102 | 1.9801 | 97.54 | 96.49 | 95.15 | 55.57 | 0.3002 |

| AUD/NZD | AUDNZD | 1.1319 | 0.0000 | 2.6485 | 1.1227 | 1.1051 | 1.0994 | 49.96 | 0.0025 |

| CHF/JPY | CHFJPY | 192.18 | 1.3798 | 10.58 | 186.38 | 184.12 | 177.66 | 82.89 | 1.3860 |

| NZD/JPY | NZDJPY | 87.86 | 2.2245 | -0.7467 | 86.91 | 87.33 | 86.54 | 56.53 | 0.0483 |

No significant technical comments available for the past week.

## Exotics and Emerging

| Name | Symbol | Price | Weekly (%) | YTD (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|

| USD/TRY – U.S. Dollar / Turkish Lira | USDTRY | 42.03 | 0.3217 | 19.05 | 41.45 | 40.80 | 39.13 | 75.45 | 0.1617 |

| USD/ZAR – U.S. Dollar / South African Rand | USDZAR | 17.32 | -0.0779 | -7.6894 | 17.42 | 17.60 | 17.99 | 53.63 | -0.0208 |

| USD/THB – U.S. Dollar / Thai Baht | USDTHB | 32.63 | 0.4000 | -4.4202 | 32.29 | 32.38 | 32.98 | 57.06 | 0.1406 |

| USD/SEK – U.S. Dollar / Swedish Krona | USDSEK | 9.3764 | -0.4163 | -14.94 | 9.4277 | 9.5004 | 9.8342 | 49.41 | -0.0049 |

| USD/NOK – U.S. Dollar / Norwegian Krone | USDNOK | 9.9668 | -0.9097 | -12.01 | 10.01 | 10.07 | 10.39 | 57.33 | 0.0096 |

| USD/DKK – U.S. Dollar / Danish Krone | USDDKK | 6.4211 | 0.5906 | -10.40 | 6.3865 | 6.4011 | 6.6321 | 58.98 | 0.0137 |

| USD/MXN – U.S. Dollar / Mexican Peso | USDMXN | 18.44 | 0.0526 | -10.63 | 18.51 | 18.65 | 19.36 | 50.47 | -0.0133 |

| USD/PLN – U.S. Dollar / Polish Zloty | USDPLN | 3.6440 | 0.4216 | -11.27 | 3.6388 | 3.6493 | 3.7642 | 53.79 | 0.0026 |

| USD/HUF – U.S. Dollar / Hungarian Forint | USDHUF | 335.28 | 0.6623 | -15.12 | 335.13 | 339.23 | 355.26 | 62.02 | 0.1280 |

| USD/CZK – U.S. Dollar / Czech Koruna | USDCZK | 20.91 | 0.8283 | -13.43 | 20.83 | 21.00 | 21.98 | 57.83 | 0.0294 |

No significant technical comments available for the past week.