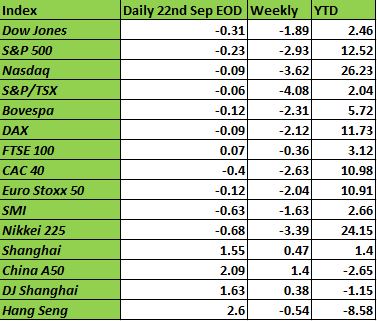

Risk appetite has decreased last week, where the negative performance of indices lifted the CBOE VIX index, as it jumped by 24.73% to 17.2. The “fear index” has increased by 35% from both its multiple bottoms and 2023 low made on September 15.

Equity Indices are confirming, or in some cases have confirmed already, a lower highs-lower lows pattern, suggesting that current market environment is a correction from the year high reached during the summer.

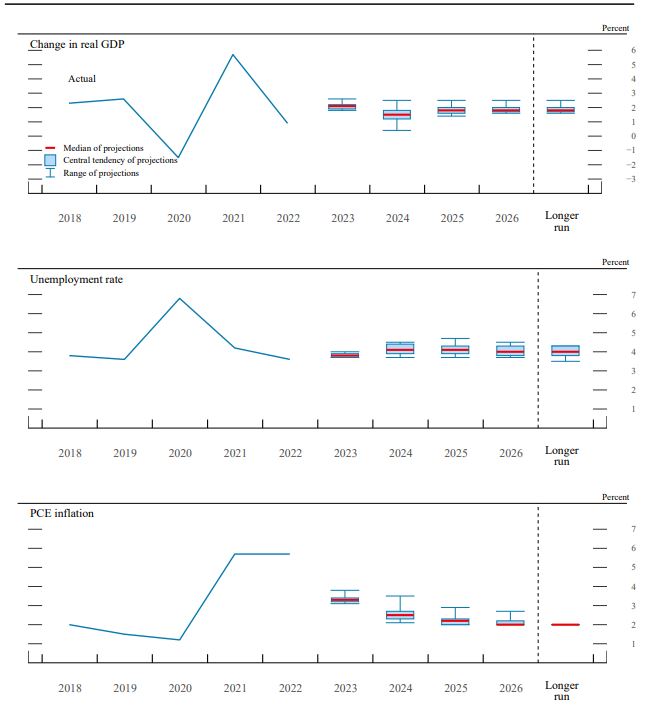

In the FX market the British Pound was among the weakest as lower than expected inflation suggested the Bank of England to keep unchanged rates at 5.25%, despite the financial community was convinced for another 25bp rate hike. EUR/USD almost flat, as the Federal Reserve delivered on Wednesday what market participants were expecting, while more deeper analysis emerged for macro projections released for the next years.

The Real economic growth in the United stated for the next three years looks like capped while deflationary forces seems are going to pull rates down to its target rates. Positive expectations regarding employment but the market seems has temporary lost appetite, focused more on when rates will start to decrease. The Monetary Statement released last week reiterated inflationary risks , suggesting that the era of persisted ultra low rates has ended.

The Japanese Yen discounted a dovish approach in monetary policy by the BOJ, confirmed by the statement of Monetary Policy released last Friday night.

Yield curve control was kept unchanged in the plus/minus 0.5 range while in the long term the QE to keep rates to zero was planned without upper limit. The purchase of ETFs was specified with upper limits.

Next week most relevant data would be the US durable goods orders on Wednesday and US GDP figures on Thursday. Several macro data in Japan would be resealed at the beginning of the Asian session next Friday while during the European session will be the turn for UK GDP data.

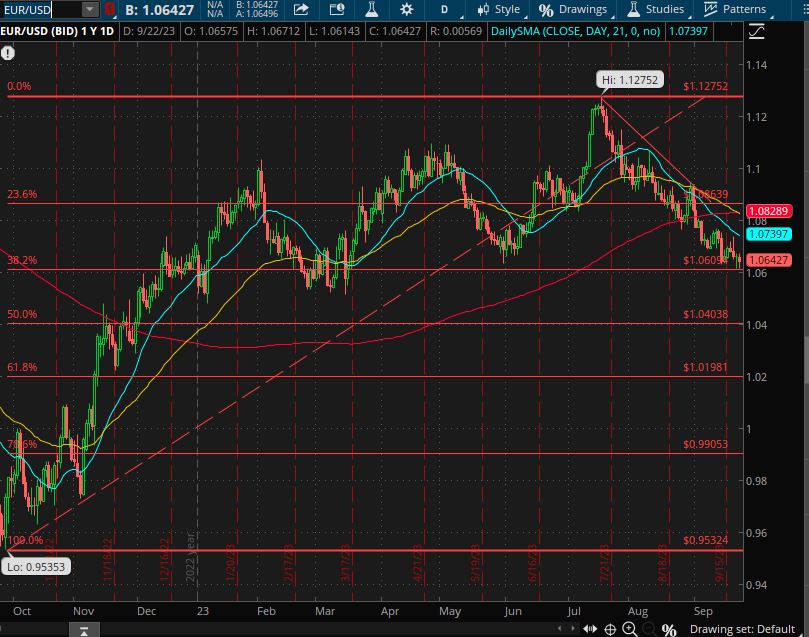

EUR/USD

The pair seems that has reached a quite interesting support in area 1.06, the 38.2% Fibonacci level of the uptrend from October 2022 to July 2023.

The sign of a possible uptrend would be the breakout above the supply line that links lower lows and the rise above the most relevant moving averages. This would require a 250 pips rate increase from current levels. In case bearish forces would drag EUR/USD below 1.06 the next relevant support would be near area 1.04.

USDJPY

The pair keeps making 2023 highs and has to rise above 148.84 and then to 150 before to test the multiyear high 151.93. Below 147.2 possible a retracement to 145. The trend is clearly bullish and long term trades on the long side would need to risk more if they want to avoid timing precisely for the reason that the distance from the 200 day SMA is of 1,000 pips circa.

SPX Index (S&P500 index)

The index is making lower highs and lower lows, as it went below the 23.6% Fibonacci last Thursday. Next key support is in area 4,190 where there are both the 200 day SMA and the demand line connecting higher lows. Beneath this level is likely a test of 3,900, the 61.8% Fibonacci retracement.

In case of positive market sentiment, is needed a breakout of 4,500 area to lift bring confidence to test again the 2023 high at 4,607.

XAU/USD Gold Futures

The commodity is trading between the supply line linking lower highs and the 200 day SMA. Below 1,900 $/oz a bearish leg is likely to materialize while above 2,000 the shiny metal should find the energy to reach its record high at 2,085. The least probable scenario is a continued price compression but given intermarket volatility contagion this is quite unlikely.

NDX , NASDAQ100 Index

The gauge is still above last August lows thus if this is a lagging path that has to follow other indices pattern is expected to see an acceleration of bearish activity. In case the index has higher relative strenght it is even possible to see a rebound near 14,500.

Below 1,500 NDX may test 13,800 and then area 13,500.

Above 15,250 possible a test of dynamic resistance near 15,500 and then area 16,000.