Seth Klarman’s “Margin of Safety: Risk-Averse Value Investing Strategies for the Thoughtful Investor” is a profound exploration into the intricacies of value investing. The book delves into the pitfalls of various investment strategies and advocates for a disciplined approach to value investing. Klarman’s emphasis on the ‘margin of safety’, a concept deeply rooted in the principles of Benjamin Graham and David Dodd, forms the cornerstone of his investment philosophy.

The book has become notably expensive and sought after for several reasons:

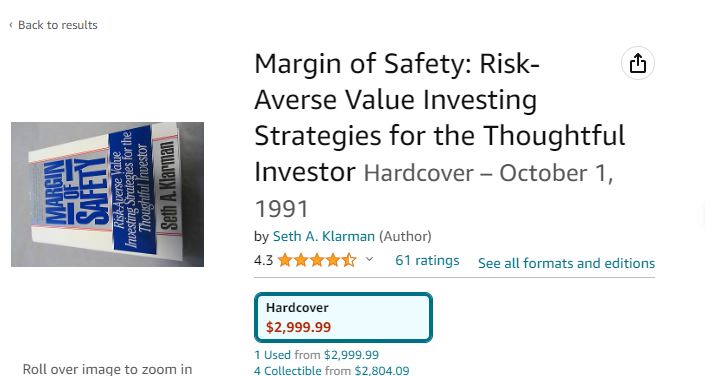

Limited Print Run: The book had a relatively small initial print run when it was first published in 1991. This scarcity inherently drives up the price as there are fewer copies available for those who want to own it.

Cult Status Among Investors: Seth Klarman, the author, is a highly respected figure in the world of investing, known for his value investing approach similar to that of Warren Buffett. His success as an investor has contributed to the book achieving a sort of cult status among finance professionals and investors, making it a sought-after resource.

Endorsements from Prominent Figures: The book has been endorsed and recommended by several prominent figures in the investment community, which has increased its popularity and demand.

Practical Investment Wisdom: “Margin of Safety” is renowned for providing practical, timeless wisdom on value investing and risk management. Its focus on fundamental principles rather than short-term trends makes it continually relevant in the ever-changing financial world.

Refusal to Reprint: Klarman has consistently refused to allow a reprint of the book, maintaining its scarcity in the market. This decision has only added to the book’s mystique and desirability.

Here a summary of key themes and concepts of the book:

Pitfalls of Mainstream Investment Strategies: Klarman begins by identifying common mistakes in popular investment approaches, many of which mirror speculation or gambling more than coherent investment programs. He highlights the lure of quick gains, warning of the dangers inherent in following market fads.

The Value Investment Philosophy: Central to Klarman’s thesis is the concept of value investing—buying securities at a significant discount to their underlying value. This strategy, he argues, has historically delivered excellent results with limited downside risk. The book not only outlines the philosophy of value investing but also illuminates its practical applications and the rationale behind its success.

Implementation of Value Investing: Klarman details the value investment process, covering everything from research and analysis to specific investment opportunities such as corporate liquidations, spinoffs, and risk arbitrage. He also discusses investing in distressed and bankrupt securities, underscoring the importance of sound portfolio management and thoughtful trading strategies.

Discipline and Long-term Horizon: A recurring theme is the need for strict discipline and a long-term investment horizon. Klarman stresses that value investing is not a concept that can be gradually adopted; it requires an immediate and total commitment to its principles.

Distinguishing Investing from Speculating: The book concludes by urging investors to understand the crucial difference between speculating and investing. Klarman warns against the emotional pitfalls of the financial markets, especially in the face of volatile market prices, and advises investors to remain disciplined and focused on fundamental values.

While the insights and the knowledge from this book are very precious its price however remain not affordable for the majority of the people interested in value investing.