Advanced Micro Devices Inc. Shares drops 0.7% After Earnings Report

Advanced Micro Devices, Inc. (AMD) is a leading semiconductor company headquartered in Santa Clara, CA, founded in 1969 by W. J. Sanders III. AMD specializes in a diverse range of products across four key segments: Data Center, Client, Gaming, and Embedded. The company is renowned for its innovative CPUs, GPUs, and AI solutions, catering to various computing needs and enhancing performance in multiple applications.

📰 Recent Developments

Advanced Micro Devices Inc. (AMD) unveiled significant product advancements during its Advancing AI 2024 event, introducing the 5th Generation AMD EPYC processors featuring up to 192 cores optimized for AI and cloud workloads. The company also launched the Radeon RX 8000 series graphics cards, enhancing gaming and content creation capabilities with improved ray tracing and AI acceleration. In parallel, AMD announced the forthcoming Instinct MI325X AI accelerator, set for production in the fourth quarter, designed to deliver superior performance in large language model training.

On the strategic front, AMD expanded its collaboration with major cloud providers to integrate these new offerings into hyperscale data centers. Additionally, the company revealed plans for an operational expansion in Ireland, establishing a new European headquarters to bolster R&D in AI and high-performance computing. No management changes were reported during this period.

📊 Earnings Report Summary

AMD (NASDAQ: AMD) reported robust Q3 2025 financial results, with record revenue of $9.2 billion, up 36% year-over-year and 20% sequentially. Gross profit reached $4.8 billion, a 40% increase from Q3 2024, leading to a gross margin of 52%. Operating income surged to $1.3 billion, marking a 75% growth year-over-year and a significant turnaround from a loss in the previous quarter. Net income also rose to $1.2 billion, up 61% from last year, with diluted EPS increasing 60% to $0.75. The data center segment drove $4.3 billion in revenue, while the client and gaming segment saw a remarkable 73% growth. AMD established partnerships with OpenAI and Oracle, enhancing its AI capabilities. Looking ahead, Q4 2025 revenue is projected at approximately $9.6 billion, reflecting continued strong demand. The company repurchased $89 million in stock during the quarter.

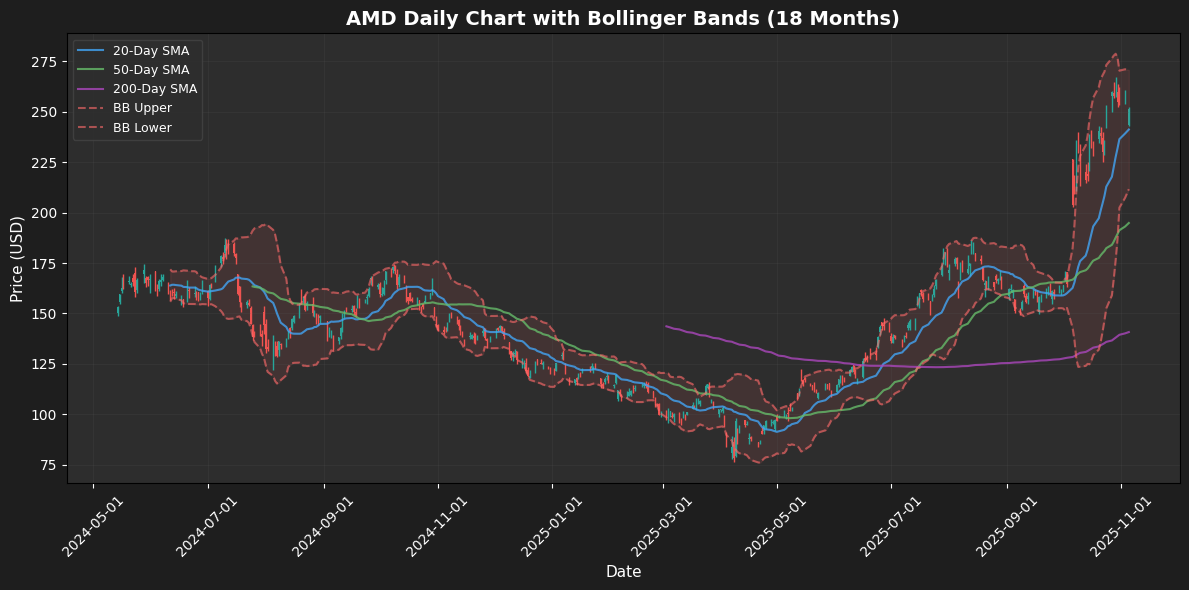

📈 Technical Analysis

Technical Indicators

| Metric | Value |

|---|---|

| MA20 | $241.23 |

| MA50 | $194.86 |

| MA200 | $140.77 |

| YTD % | 108.22% |

| BB Position | 66.82% |

| RSI | 63.32 |

| MACD | 18.61 |

The current price of $251.18 indicates a strong upward momentum, significantly above the 20-day moving average (MA20) of $241.23, suggesting bullish short-term sentiment. Furthermore, the price is well above the 50-day (MA50) and 200-day moving averages (MA200) of $194.86 and $140.77, respectively, indicating a robust long-term trend.

The Relative Strength Index (RSI) at 63.32 signals that the asset is nearing overbought territory, which could imply a potential pullback. However, the MACD value of 18.61 remains positive, reinforcing the bullish trend. The Bollinger Bands show the price is approaching the upper band at $270.80, with the lower band at $211.66, indicating potential volatility ahead. With a year-to-date change of 108.22%, the asset is experiencing strong growth, but caution is warranted as it approaches overbought conditions.

💰 Earnings History

| Earnings Date | EPS Estimate | Reported EPS | Surprise(%) | Event Type |

|---|---|---|---|---|

| 2025-05-06 | 0.94 | 0.96 | 1.81 | Earnings |

| 2025-02-04 | 1.08 | 1.09 | 1.14 | Earnings |

| 2024-10-29 | 0.92 | 0.92 | 0.5 | Earnings |

| 2024-07-30 | 0.68 | 0.69 | 2.04 | Earnings |

| 2024-04-30 | 0.61 | 0.62 | 1.75 | Earnings |

| 2024-01-30 | 0.77 | 0.77 | -0.32 | Earnings |

| 2023-10-31 | 0.68 | 0.7 | 3.44 | Earnings |

| 2023-08-01 | 0.57 | 0.58 | 1.49 | Earnings |

Analyzing the earnings per share (EPS) trends from the provided data reveals a generally positive trajectory, characterized by consistent earnings surprises. Over the last four quarters, the reported EPS has either met or exceeded estimates, indicating a strong operational performance. Notably, the most recent quarter (May 2025) reported an EPS of 0.96 against an estimate of 0.94, reflecting a 1.81% surprise, which is consistent with the previous quarter’s performance.

The data shows a gradual increase in EPS, with the lowest reported EPS at 0.57 in August 2023, steadily rising to 0.96 by May 2025. This upward trend suggests improved profitability and possibly effective cost management strategies. The company has demonstrated resilience, especially in challenging market conditions, as evidenced by positive surprises in the majority of the quarters. Overall, the EPS trends indicate a robust financial outlook, likely contributing to investor confidence and potential stock price appreciation.

⭐ Analyst Ratings

| Date | Status | Outer | Rating | Price |

|---|---|---|---|---|

| 2025-11-05 | Reiterated | TD Cowen | Buy | $270 → $290 |

| 2025-10-14 00:00:00 | Upgrade | Wolfe Research | Peer Perform → Outperform | $300 |

| 2025-10-13 00:00:00 | Reiterated | Mizuho | Outperform | $205 → $275 |

| 2025-10-08 00:00:00 | Upgrade | DZ Bank | Hold → Buy | $250 |

Recent rating changes reflect a positive outlook among analysts for certain stocks, indicating a potential bullish trend in the market. Notably, TD Cowen reiterated its “Buy” rating while increasing the price target from $270 to $290, suggesting confidence in the stock’s performance. Similarly, Wolfe Research upgraded its rating from “Peer Perform” to “Outperform,” with a price target set at $300, indicating a significant shift in sentiment towards this stock.

Mizuho also maintained an “Outperform” rating but raised its price target considerably from $205 to $275, suggesting a strong belief in the company’s growth potential. Additionally, DZ Bank upgraded its rating from “Hold” to “Buy” with a price target of $250, signaling a more optimistic view on the stock’s future.

Overall, these rating changes illustrate an increasingly favorable perspective among analysts, likely driven by positive market conditions, strong company fundamentals, or anticipated growth in the respective sectors.

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.