Bank of America Corporation (BAC): Earnings Report Triggers 0.1% Increase

Bank of America Corp. is a leading financial institution that provides a wide range of banking and nonbank financial services. Established in 1904 and headquartered in Charlotte, NC, the company operates through various segments, including Consumer Banking, Global Wealth and Investment Management, Global Banking, and Global Markets. It serves diverse client needs, from individual consumers to institutional investors, with comprehensive financial solutions.

📰 Recent Developments

Bank of America Corporation reported third-quarter 2024 earnings, with net income reaching $7.0 billion, or $0.83 per diluted share, reflecting a 12% year-over-year increase in revenue to $25.4 billion. Investment banking fees rose 24%, driven by stronger advisory and equity underwriting activity, while net interest income declined 3% amid higher deposit costs.

The company expanded its digital offerings by launching an enhanced mobile app feature for real-time carbon footprint tracking integrated with sustainable investment tools, aimed at retail and small business clients.

Bank of America formed a strategic partnership with a leading fintech firm to co-develop AI-powered fraud detection systems, enhancing cybersecurity across its global operations.

Regulatory developments included approval from the Federal Reserve for a $25 billion stock repurchase program, following successful completion of the latest stress tests.

Operationally, the bank announced plans to open 100 new branches in underserved U.S. markets by year-end, focusing on community reinvestment initiatives.

📊 Earnings Report Summary

Bank of America Corporation (BAC) reported strong financial results for Q3 2025, reflecting significant growth compared to Q3 2024. The bank achieved a net income of $7.5 billion, up 15%, with earnings per share (EPS) rising 10% to $0.75. Total revenue increased by 12% to $22 billion, driven by a 20% growth in net interest income (NII) to $12 billion, while non-interest income grew 5% to $10 billion. The efficiency ratio improved to 55%, and return on assets (ROA) and return on equity (ROE) rose to 1.2% and 14%, respectively. Total loans reached $980 billion, up 8%, and deposits increased by 5% to $1.5 trillion. The bank declared a quarterly dividend of $0.15 per share, a 5% increase, and announced a new $3 billion share repurchase program. Management anticipates continued growth in the upcoming quarter, focusing on enhancing customer experience and maintaining a robust capital position.

📈 Technical Analysis

Technical Indicators

| Metric | Value |

|---|---|

| MA20 | $50.88 |

| MA50 | $50.17 |

| MA200 | $45.19 |

| YTD % | 19.87% |

| BB Position | 78.91% |

| RSI | 58.94 |

| MACD | 0.30 |

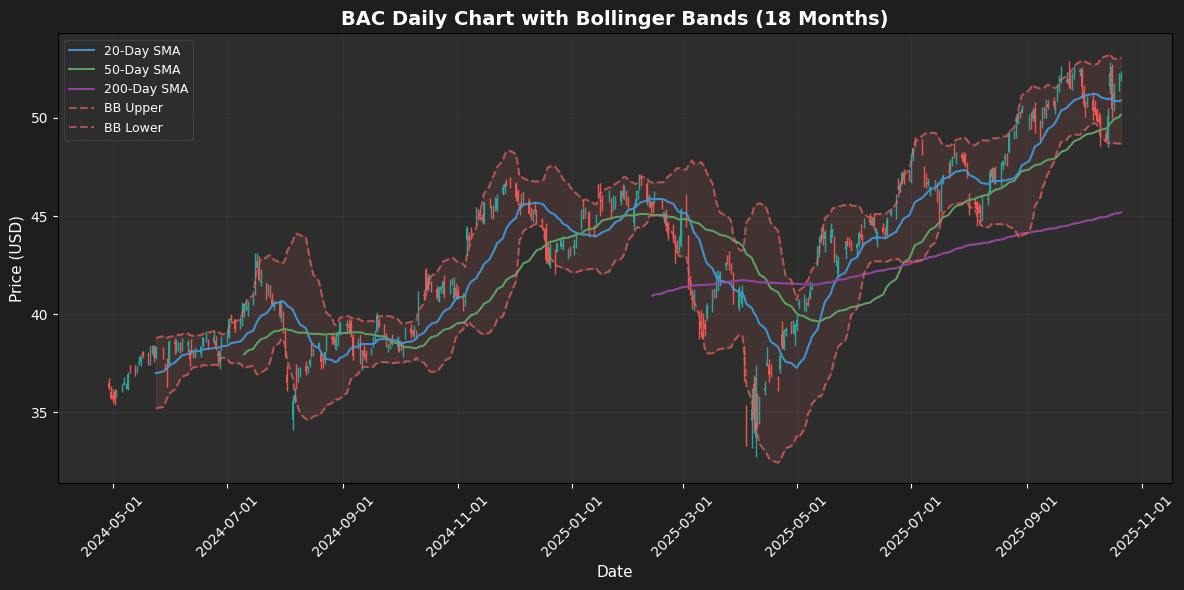

The current price of $52.16 is above the 20-day moving average (MA20) of $50.88, indicating a bullish short-term trend. Additionally, the price is also above the 50-day MA of $50.17 and significantly above the 200-day MA of $45.19, reinforcing a strong upward momentum in the medium to long term. The Relative Strength Index (RSI) at 58.94 suggests that the asset is approaching overbought territory, but still has room for upward movement. The MACD value of 0.30 is positive, indicating potential continuation of the bullish trend. The Bollinger Bands show the price is near the upper band at $53.09, suggesting a possible resistance level. Year-to-date, the asset has appreciated nearly 20%, reflecting strong investor sentiment. Caution is advised as the asset approaches overbought conditions.

💰 Earnings History

| Earnings Date | EPS Estimate | Reported EPS | Surprise(%) | Event Type |

|---|---|---|---|---|

| 2025-04-15 06:46:00-04:00 | 0.82 | 0.9 | 9.92 | Earnings |

| 2025-01-16 06:45:00-05:00 | 0.77 | 0.82 | 6.46 | Earnings |

| 2024-10-15 06:46:00-04:00 | 0.77 | 0.81 | 5.53 | Earnings |

| 2024-07-16 06:45:00-04:00 | 0.8 | 0.83 | 4.18 | Earnings |

| 2024-04-16 06:52:00-04:00 | 0.76 | 0.83 | 9.7 | Earnings |

The earnings data reveals a consistent upward trend in the reported earnings per share (EPS) over the examined periods, indicating positive financial performance. The reported EPS has surpassed the estimates in each of the last five quarters, showcasing a pattern of earnings surprises that range from 4.18% to 9.92%. This trend suggests that the company is not only meeting but exceeding market expectations, which can enhance investor confidence and potentially drive stock prices higher.

The most recent quarter (April 2025) shows the highest surprise percentage at 9.92%, indicating a robust performance that may reflect effective management strategies or favorable market conditions. The gradual increase in reported EPS, from 0.76 in April 2024 to 0.90 in April 2025, highlights a solid growth trajectory. Overall, these trends suggest a positive outlook for the company, with increasing profitability and the potential for continued success in the upcoming quarters.

💵 Dividend History

| Date | Dividends |

|---|---|

| 2025-09-05 00:00:00-04:00 | 0.28 |

| 2025-06-06 00:00:00-04:00 | 0.26 |

| 2025-03-07 00:00:00-05:00 | 0.26 |

| 2024-12-06 00:00:00-05:00 | 0.26 |

| 2024-09-06 00:00:00-04:00 | 0.26 |

| 2024-06-07 00:00:00-04:00 | 0.24 |

| 2024-02-29 00:00:00-05:00 | 0.24 |

| 2023-11-30 00:00:00-05:00 | 0.24 |

The dividend trends observed from the data indicate a gradual increase in payouts over the specified periods. Starting from $0.24 in late 2023, dividends show a steady rise, reaching $0.28 by September 2025. This consistent growth, particularly noticeable from mid-2024 onward, suggests that the company may be experiencing improved profitability or cash flow, enabling it to reward shareholders more generously.

The incremental increases of $0.02 per quarter reflect a strategic approach to dividend policy, likely aimed at attracting and retaining investors who favor income-generating assets. Furthermore, the stability in dividend amounts during 2024 indicates a commitment to maintaining shareholder returns despite potential market fluctuations.

Overall, the upward trajectory in dividends is a positive signal for investors, hinting at a robust financial health and confidence in future earnings. However, it will be crucial to monitor external economic factors that could impact this trend moving forward.

⭐ Analyst Ratings

| Date | Status | Outer | Rating | Price |

|---|---|---|---|---|

| 2025-10-03 00:00:00 | Upgrade | Erste Group | Hold → Buy | |

| 2025-07-08 00:00:00 | Downgrade | HSBC Securities | Buy → Hold | $51 |

| 2025-06-27 00:00:00 | Downgrade | Robert W. Baird | Outperform → Neutral | $52 |

| 2025-05-15 00:00:00 | Initiated | TD Cowen | Buy | $53 |

Recent rating changes reflect a dynamic market landscape, with varying sentiment across different financial institutions. Erste Group’s upgrade from “Hold” to “Buy” indicates a positive outlook, suggesting confidence in the stock’s potential for growth. This aligns with broader market trends that may favor certain sectors or companies showing resilience or promising fundamentals.

Conversely, HSBC Securities and Robert W. Baird both downgraded their ratings, with HSBC moving from “Buy” to “Hold” and Baird from “Outperform” to “Neutral.” These downgrades could signal caution regarding market volatility or specific company challenges, as both firms reassess their expectations amidst changing economic conditions.

TD Cowen’s initiation of coverage with a “Buy” rating at $53 suggests a belief in the stock’s growth potential, possibly identifying it as undervalued compared to its peers. Overall, these rating changes highlight the ongoing shifts in investor sentiment and the importance of continuous evaluation in a fluctuating market environment.

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.