Forex Update: Soft U.S. Inflation Moves Markets, USD/JPY Gains 0.15%

📰 Forex and Global Market News

**Market Overview:**

Today’s forex market was characterized by mixed sentiment influenced by a softer-than-expected U.S. inflation report, which raised expectations for potential Federal Reserve rate cuts. The U.S. Dollar Index (DXY) traded at 98.94, down 0.0747%, reflecting a cautious market outlook.

**Key News Items:**

The annual U.S. inflation rate ticked up to 3.0% in September, slightly below forecasts, bolstering hopes for two more rate cuts this year. This contributed to a rally in the Dow Jones Industrial Average, which surged over 400 points, reaching record highs. The softer CPI data supported gold prices, which rebounded by over 0.10%, as investors anticipated a dovish Fed stance. Meanwhile, the Australian Dollar (AUD) held steady against the U.S. Dollar (USD) amid mixed economic data, while the Euro (EUR) and British Pound (GBP) faced downward pressure, with EUR/USD ending the week around 1.1620 and GBP/USD retreating to 1.3300.

Geopolitical tensions continued to loom, particularly with the U.S. imposing sanctions on Colombian President Gustavo Petro, which may have broader implications for regional stability. Additionally, ongoing trade tensions between the U.S. and Canada were highlighted by Ontario’s pause on an anti-tariff ad following the termination of trade talks by Trump.

**Closing:**

As the week concludes, the forex market remains

📅 Economic Calendar Events Today

All times are in US Eastern Time (ET)

| Date | Time | Cur | Imp | Event | Actual | Forecast |

|---|---|---|---|---|---|---|

| 2025-10-24 | 02:00 | 🇬🇧 | Medium | Core Retail Sales (YoY) (Sep) | 2.3% | 0.7% |

| 2025-10-24 | 02:00 | 🇬🇧 | Medium | Core Retail Sales (MoM) (Sep) | 0.6% | |

| 2025-10-24 | 02:00 | 🇬🇧 | Medium | Retail Sales (YoY) (Sep) | 1.5% | 0.6% |

| 2025-10-24 | 02:00 | 🇬🇧 | Medium | Retail Sales (MoM) (Sep) | 0.5% | -0.2% |

| 2025-10-24 | 03:15 | 🇪🇺 | Medium | HCOB France Manufacturing PMI (Oct) | 48.3 | 48.2 |

| 2025-10-24 | 03:15 | 🇪🇺 | Medium | HCOB France Services PMI (Oct) | 47.1 | 48.7 |

| 2025-10-24 | 03:30 | 🇪🇺 | Medium | HCOB Germany Manufacturing PMI (Oct) | 49.6 | 49.5 |

| 2025-10-24 | 03:30 | 🇪🇺 | Medium | HCOB Germany Services PMI (Oct) | 54.5 | 51.1 |

| 2025-10-24 | 04:00 | 🇪🇺 | Medium | HCOB Eurozone Manufacturing PMI (Oct) | 50.0 | 49.8 |

| 2025-10-24 | 04:00 | 🇪🇺 | Medium | HCOB Eurozone Composite PMI (Oct) | 52.2 | 51.0 |

| 2025-10-24 | 04:00 | 🇪🇺 | Medium | HCOB Eurozone Services PMI (Oct) | 52.6 | 51.2 |

| 2025-10-24 | 04:30 | 🇬🇧 | Medium | S&P Global Composite PMI (Oct) | 51.1 | 50.6 |

| 2025-10-24 | 04:30 | 🇬🇧 | Medium | S&P Global Manufacturing PMI (Oct) | 49.6 | 46.6 |

| 2025-10-24 | 04:30 | 🇬🇧 | Medium | S&P Global Services PMI (Oct) | 51.1 | 51.0 |

| 2025-10-24 | 05:15 | 🇬🇧 | Medium | BoE Deputy Governor Woods Speaks | ||

| 2025-10-24 | 06:30 | 🇷🇺 | Medium | Interest Rate Decision (Oct) | 16.50% | 17.00% |

| 2025-10-24 | 08:00 | 🇷🇺 | Medium | CBR Press Conference | ||

| 2025-10-24 | 08:30 | 🇺🇸 | High | Core CPI (MoM) (Sep) | 0.2% | 0.3% |

| 2025-10-24 | 08:30 | 🇺🇸 | Medium | Core CPI (YoY) (Sep) | 3.0% | 3.1% |

| 2025-10-24 | 08:30 | 🇺🇸 | High | CPI (YoY) (Sep) | 3.0% | 3.1% |

| 2025-10-24 | 08:30 | 🇺🇸 | High | CPI (MoM) (Sep) | 0.3% | 0.4% |

| 2025-10-24 | 08:30 | 🇨🇦 | Medium | New Housing Price Index (MoM) (Sep) | -0.2% | 0.2% |

| 2025-10-24 | 08:45 | 🇪🇺 | Medium | German Buba President Nagel Speaks | ||

| 2025-10-24 | 09:45 | 🇺🇸 | High | S&P Global Manufacturing PMI (Oct) | 52.2 | 51.9 |

| 2025-10-24 | 09:45 | 🇺🇸 | Medium | S&P Global Composite PMI (Oct) | 54.8 | 53.5 |

| 2025-10-24 | 09:45 | 🇺🇸 | High | S&P Global Services PMI (Oct) | 55.2 | 53.5 |

| 2025-10-24 | 10:00 | 🇺🇸 | Medium | Michigan 1-Year Inflation Expectations (Oct) | 4.6% | 4.6% |

| 2025-10-24 | 10:00 | 🇺🇸 | Medium | Michigan 5-Year Inflation Expectations (Oct) | 3.9% | 3.7% |

| 2025-10-24 | 10:00 | 🇺🇸 | Medium | Michigan Consumer Expectations (Oct) | 50.3 | 51.2 |

| 2025-10-24 | 10:00 | 🇺🇸 | Medium | Michigan Consumer Sentiment (Oct) | 53.6 | 55.0 |

| 2025-10-24 | 13:00 | 🇺🇸 | Medium | U.S. Baker Hughes Oil Rig Count | 420 | |

| 2025-10-24 | 13:00 | 🇺🇸 | Medium | U.S. Baker Hughes Total Rig Count | 550 |

**Overview:**

Today’s economic calendar features several high-impact events that could significantly influence forex markets, particularly for GBP, EUR, and USD. Key data releases include retail sales and PMI figures, with notable surprises that may alter market expectations.

**Key Releases:**

1. **GBP Retail Sales (YoY)**: Actual 1.5% vs. Forecast 0.6% – A strong performance indicating consumer resilience.

2. **GBP Core Retail Sales (YoY)**: Actual 2.3% vs. Forecast 0.7% – A notable upside surprise that may bolster GBP strength.

3. **EUR HCOB Eurozone Composite PMI**: Actual 52.2 vs. Forecast 51.0 – A positive reading suggesting economic expansion.

4. **USD Core CPI (MoM)**: Actual 0.2% vs. Forecast 0.3% – A slight miss that could affect Fed policy outlook.

**FX Impact:**

The GBP is likely to appreciate against the USD and EUR following robust retail sales data. The EUR may see mixed reactions due to strong PMI figures, while the USD could weaken on the CPI miss, influencing pairs like EUR/USD and GBP/USD. Traders should watch for volatility in these pairs as market participants digest the implications of today’s data.

💱 Major Currency Pairs

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EUR/USD – Euro / U.S. Dollar | EURUSD | 1.1632 | +0.0947 | -0.5778 | -0.5778 | -1.5444 | -1.0559 | +2.2872 | +11.78 | +7.8984 | 1.1689 | 1.1660 | 1.1273 | 41.63 | -0.0023 |

| USD/JPY – U.S. Dollar / Japanese Yen | USDJPY | 152.81 | +0.1507 | +1.7919 | +1.7919 | +3.5207 | +3.9488 | +6.9506 | -2.6657 | +0.0268 | 148.88 | 147.61 | 147.95 | 66.18 | 0.9579 |

| GBP/USD – British Pound / U.S. Dollar | GBPUSD | 1.3314 | -0.0975 | -0.9785 | -0.9785 | -1.5563 | -1.4511 | -0.0917 | +6.0953 | +3.0996 | 1.3463 | 1.3484 | 1.3211 | 38.72 | -0.0032 |

| USD/CHF – U.S. Dollar / Swiss Franc | USDCHF | 0.7944 | -0.0880 | +0.3246 | +0.3246 | +0.3753 | -0.0591 | -4.1436 | -12.05 | -8.3462 | 0.7985 | 0.8014 | 0.8335 | 49.35 | -0.0009 |

| AUD/USD – Australian Dollar / U.S. Dollar | AUDUSD | 0.6516 | -0.0153 | +0.5184 | +0.5184 | -1.2398 | -1.2305 | +1.7571 | +4.7588 | -1.8083 | 0.6553 | 0.6538 | 0.6433 | 37.53 | -0.0022 |

| USD/CAD – U.S. Dollar / Canadian Dollar | USDCAD | 1.3993 | +0.0357 | -0.3773 | -0.3773 | +1.1121 | +2.5835 | +0.9742 | -2.4864 | +1.1296 | 1.3886 | 1.3791 | 1.3966 | 55.49 | 0.0041 |

| NZD/USD – New Zealand Dollar / U.S. Dollar | NZDUSD | 0.5750 | -0.0869 | +0.4013 | +0.4013 | -1.8268 | -4.7558 | -3.9744 | +1.9555 | -4.2654 | 0.5840 | 0.5919 | 0.5852 | 30.63 | -0.0034 |

**Overview:**

The Majors FX group is currently exhibiting mixed signals, with a general bearish sentiment in several pairs. The USD shows strength against most currencies, yet some pairs are approaching neutral territory.

**Key Pairs:**

1. **USD/JPY**: This pair is showing bullish momentum with a MACD of 0.9579 and an RSI of 66.18, indicating potential continuation towards overbought territory.

2. **EUR/USD**: Currently neutral-bearish with an RSI of 41.63 and a MACD of -0.0023, suggesting a lack of momentum and potential for further downside.

3. **GBP/USD**: This pair is also in a bearish phase, with an RSI of 38.72 and a MACD of -0.0032, indicating weakness in the British Pound.

**Trading Implications:**

– **USD/JPY**: Watch for a breakout above recent highs around 153.00, which could confirm further bullish momentum. Support is found around 152.00.

– **EUR/USD**: Resistance at 1.1700 remains critical; a break below 1.1600 could trigger further selling pressure.

– **GBP/USD**: A break below 1.3300 may

🔀 Cross Currency Pairs

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EUR/GBP | EURGBP | 0.8734 | +0.1950 | +0.3770 | +0.3770 | -0.0217 | +0.3677 | +2.3616 | +5.3317 | +4.6276 | 0.8682 | 0.8647 | 0.8529 | 53.46 | 0.0003 |

| EUR/JPY | EURJPY | 177.74 | +0.2674 | +1.2037 | +1.2037 | +1.9279 | +2.8564 | +9.4058 | +8.7878 | +7.9290 | 174.01 | 172.11 | 166.68 | 67.89 | 0.7699 |

| EUR/CHF | EURCHF | 0.9244 | +0.0758 | -0.2105 | -0.2105 | -1.1305 | -1.0713 | -1.9048 | -1.6491 | -1.0490 | 0.9335 | 0.9346 | 0.9383 | 21.48 | -0.0028 |

| EUR/AUD | EURAUD | 1.7848 | +0.0897 | -1.1010 | -1.1010 | -0.3178 | +0.1414 | +0.4695 | +6.6699 | +9.8535 | 1.7839 | 1.7836 | 1.7516 | 54.34 | 0.0023 |

| GBP/JPY | GBPJPY | 203.49 | +0.0777 | +0.8185 | +0.8185 | +1.9448 | +2.4689 | +6.8795 | +3.2949 | +3.1515 | 200.41 | 199.03 | 195.36 | 61.90 | 0.8146 |

| GBP/CHF | GBPCHF | 1.0583 | -0.1133 | -0.5899 | -0.5899 | -1.1082 | -1.4416 | -4.1690 | -6.6220 | -5.4448 | 1.0752 | 1.0809 | 1.1003 | 29.62 | -0.0036 |

| AUD/JPY | AUDJPY | 99.56 | +0.1610 | +2.3102 | +2.3102 | +2.2251 | +2.6869 | +8.8734 | +1.9801 | -1.7750 | 97.54 | 96.49 | 95.15 | 55.57 | 0.3002 |

| AUD/NZD | AUDNZD | 1.1326 | +0.0265 | +0.0636 | +0.0636 | +0.5460 | +3.6743 | +5.9673 | +2.7120 | +2.5256 | 1.1220 | 1.1046 | 1.0993 | 50.94 | 0.0028 |

| CHF/JPY | CHFJPY | 192.18 | +0.1600 | +1.3798 | +1.3798 | +3.0489 | +3.9312 | +11.49 | +10.58 | +9.0458 | 186.38 | 184.12 | 177.66 | 82.89 | 1.3860 |

| NZD/JPY | NZDJPY | 87.86 | +0.1208 | +2.2245 | +2.2245 | +1.6521 | -0.9727 | +2.7217 | -0.7467 | -4.2219 | 86.91 | 87.33 | 86.54 | 56.53 | 0.0483 |

**Overview:** The Crosses FX group exhibits a generally bullish trend, with several pairs showing positive momentum. However, caution is warranted as some pairs are approaching overbought conditions.

**Key Pairs:**

1. **CHF/JPY:** Currently at 192.1820, with an RSI of 82.89 indicating overbought conditions and a MACD of 1.3860, signaling strong bullish momentum.

2. **EUR/JPY:** Priced at 177.7440, it has an RSI of 67.89, nearing overbought territory, and a positive MACD of 0.7699, suggesting continued bullish momentum.

3. **GBP/JPY:** At 203.4900, with an RSI of 61.90 and a MACD of 0.8146, this pair shows solid bullish momentum but is still within a neutral range.

**Trading Implications:** Watch for potential resistance in CHF/JPY around 193.00. Support levels in EUR/JPY may be found

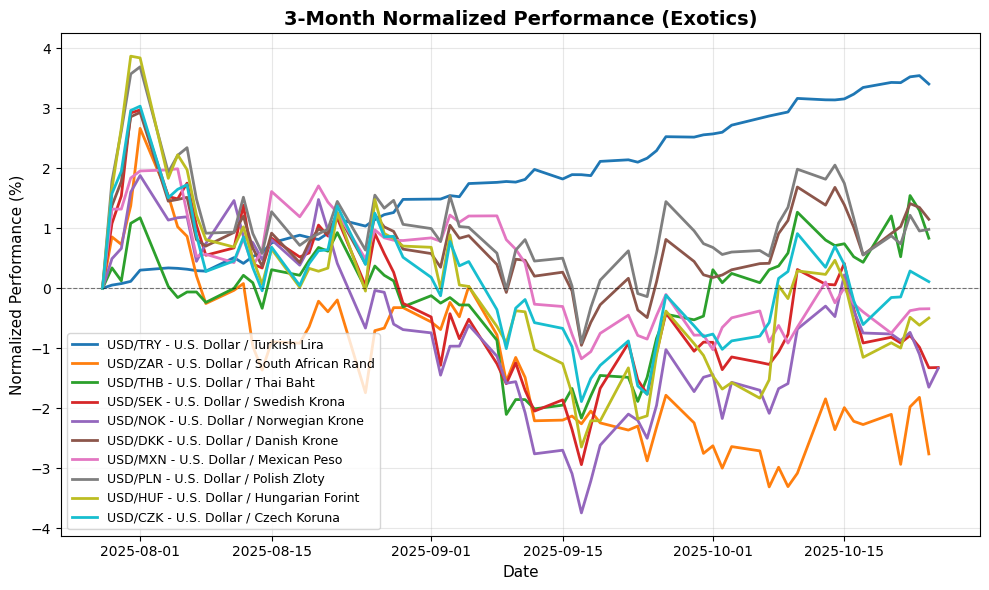

🌍 Exotic and Emerging Market Currencies

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| USD/TRY – U.S. Dollar / Turkish Lira | USDTRY | 41.92 | -0.2116 | +0.0558 | +0.0558 | +1.2096 | +3.4135 | +9.1233 | +18.74 | +22.33 | 41.43 | 40.77 | 39.10 | 81.43 | 0.1613 |

| USD/ZAR – U.S. Dollar / South African Rand | USDZAR | 17.25 | -0.3507 | -0.5005 | -0.5005 | +0.1196 | -2.0689 | -8.0035 | -8.0800 | -2.9674 | 17.42 | 17.60 | 18.00 | 49.64 | -0.0201 |

| USD/THB – U.S. Dollar / Thai Baht | USDTHB | 32.63 | -0.5486 | +0.4000 | +0.4000 | +2.3526 | +1.0843 | -2.2761 | -4.4202 | -3.3987 | 32.29 | 32.38 | 32.98 | 57.06 | 0.1406 |

| USD/SEK – U.S. Dollar / Swedish Krona | USDSEK | 9.3768 | +0.0096 | -0.4124 | -0.4124 | +0.4525 | -1.5732 | -2.4997 | -14.94 | -11.49 | 9.4277 | 9.5004 | 9.8342 | 49.41 | -0.0049 |

| USD/NOK – U.S. Dollar / Norwegian Krone | USDNOK | 9.9986 | +0.3291 | -0.5935 | -0.5935 | +1.1948 | -1.1941 | -4.0331 | -11.73 | -8.9895 | 10.01 | 10.07 | 10.39 | 57.33 | 0.0096 |

| USD/DKK – U.S. Dollar / Danish Krone | USDDKK | 6.4211 | -0.1105 | +0.5906 | +0.5906 | +1.6452 | +1.1292 | -2.2010 | -10.40 | -7.1932 | 6.3865 | 6.4011 | 6.6321 | 58.98 | 0.0137 |

| USD/MXN – U.S. Dollar / Mexican Peso | USDMXN | 18.44 | +0.2653 | +0.0526 | +0.0526 | +0.5096 | -0.5316 | -5.9184 | -10.63 | -7.0211 | 18.51 | 18.65 | 19.36 | 50.47 | -0.0133 |

| USD/PLN – U.S. Dollar / Polish Zloty | USDPLN | 3.6440 | +0.1236 | +0.4219 | +0.4219 | +1.1217 | +0.7632 | -2.9217 | -11.27 | -9.5704 | 3.6388 | 3.6493 | 3.7642 | 53.79 | 0.0026 |

| USD/HUF – U.S. Dollar / Hungarian Forint | USDHUF | 335.28 | -0.0983 | +0.6623 | +0.6623 | +1.6644 | -0.7842 | -6.0706 | -15.12 | -10.28 | 335.13 | 339.23 | 355.26 | 62.02 | 0.1280 |

| USD/CZK – U.S. Dollar / Czech Koruna | USDCZK | 20.89 | -0.1090 | +0.7189 | +0.7189 | +1.9094 | +0.1553 | -4.7337 | -13.52 | -10.75 | 20.83 | 21.01 | 22.00 | 59.10 | 0.0272 |

**Overview:**

The Exotics FX group shows mixed signals, with a general bearish sentiment as several pairs exhibit negative daily movements. However, the USD/TRY is distinctly overbought, indicating potential volatility.

**Key Pairs:**

1. **USD/TRY:** Price at 41.9197, RSI at 81.43 (overbought), MACD at 0.1613 (positive momentum). This pair is the strongest, suggesting a potential correction or pullback.

2. **USD/ZAR:** Price at 17.2487, RSI at 49.64 (neutral), MACD at -0.0201 (negative momentum). This pair shows weakness and may face downward pressure.

3. **USD/THB:** Price at 32.6300, RSI at 57.06 (neutral-bullish), MACD at 0.1406 (positive momentum). This pair is stable, indicating potential for upward movement.

**Trading Implications:**

Watch for resistance near 42.

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.