KOSPI Soars 2.49% as Asian Markets Show Strong Upward Momentum

Note: This analysis covers the Asian trading session close for October 16, 2025. All times are in US Eastern Time (ET).

📊 Asian Indices Performance

| Index | Price | Daily Change (%) |

|---|---|---|

| Shanghai Composite | 3916.23 | +0.10 |

| Nikkei 225 | 48277.74 | +1.27 |

| Hang Seng Index | 25888.51 | -0.09 |

| Shenzhen Component | 13086.41 | -0.25 |

| KOSPI | 3748.37 | +2.49 |

| S&P/ASX 200 | 9068.40 | +0.86 |

| NIFTY 50 | 25585.30 | +1.03 |

| Straits Times Index | 4356.20 | -0.28 |

| S&P/NZX 50 | 13389.10 | +0.78 |

| Thailand SET Index | 1291.46 | +0.37 |

| FTSE Bursa Malaysia KLCI | 1612.29 | +0.05 |

| TAIEX | 27647.87 | +1.36 |

📰 Market Commentary

On October 16, 2025, Asian markets exhibited a mixed performance, influenced by various regional economic developments and corporate news. The Nikkei 225 in Japan led the gains, rising by 1.27% to close at 48,277.74, buoyed by investor optimism surrounding corporate earnings and economic resilience. Conversely, the Hang Seng Index in Hong Kong experienced a slight decline of 0.09% to 25,888.51, reflecting ongoing concerns about local economic challenges and regulatory scrutiny.

Key events impacting market sentiment included Sapporo Holdings Ltd.’s decision to grant KKR preferential rights to negotiate the sale of its Yebisu Garden Place and other properties. This strategic move is seen as a potential shift in the real estate landscape, which may influence investor confidence in the Japanese market. Meanwhile, the KOSPI in South Korea surged by 2.49% to 3,748.37, driven by strong performances in technology stocks and positive investor sentiment regarding the global economic outlook.

In Hong Kong, healthcare spending as a proportion of GDP has surged by nearly 50% over the past decade, reflecting the city’s ageing population. The Health Bureau’s recent report, detailing HK$130 billion in public healthcare expenditure, underscores the growing financial burden on the economy, which could have implications for public policy and investment in healthcare infrastructure.

Additionally, law enforcement agencies in Hong Kong and mainland China arrested three individuals linked to a money laundering syndicate, further highlighting ongoing regulatory efforts to combat financial crimes. This crackdown may contribute to a cautious market sentiment as investors weigh the implications of increased scrutiny on financial operations.

Overall, Asian indices reflected a complex interplay of local economic conditions, corporate developments, and regulatory actions. While some markets showed resilience and upward momentum, others faced headwinds, suggesting a cautious yet optimistic outlook among investors as they navigate the evolving economic landscape.

📅 Economic Calendar – Asian Session

All times are in US Eastern Time (ET)

| Date | Time | Cur | Imp | Event | Actual | Forecast |

|---|---|---|---|---|---|---|

| 2025-10-15 | 00:30 | 🇯🇵 | Medium | Industrial Production (MoM) (Aug) | -1.5% | -1.2% |

| 2025-10-15 | 05:00 | 🇨🇳 | Medium | New Loans (Sep) | 1,290.0B | 1,460.0B |

| 2025-10-15 | 07:30 | 🇮🇳 | Medium | RBI MPC Meeting Minutes |

On October 16, 2025, key economic data from Asia revealed mixed results, impacting market sentiment for traders.

In Japan, the August Industrial Production (MoM) fell by 1.5%, significantly worse than the forecasted decline of 1.2%. This sharper contraction raises concerns about Japan’s manufacturing sector and may lead to downward pressure on the Nikkei 225 index as investors reassess growth prospects.

China’s New Loans for September were reported at 1,290.0 billion CNY, falling short of the anticipated 1,460.0 billion CNY. This shortfall suggests weaker credit demand and could signal a slowdown in economic activity, potentially affecting the Hang Seng Index and overall market confidence in Chinese equities.

Additionally, the Reserve Bank of India (RBI) released the minutes from its Monetary Policy Committee meeting, which did not provide specific forecasts or actual data but may influence market expectations regarding future interest rate decisions and economic outlook in India.

Overall, the disappointing industrial production data from Japan and lower-than-expected new loans in China are likely to weigh on Asian indices, prompting traders to remain cautious in their positions.

📈 Individual Index Charts

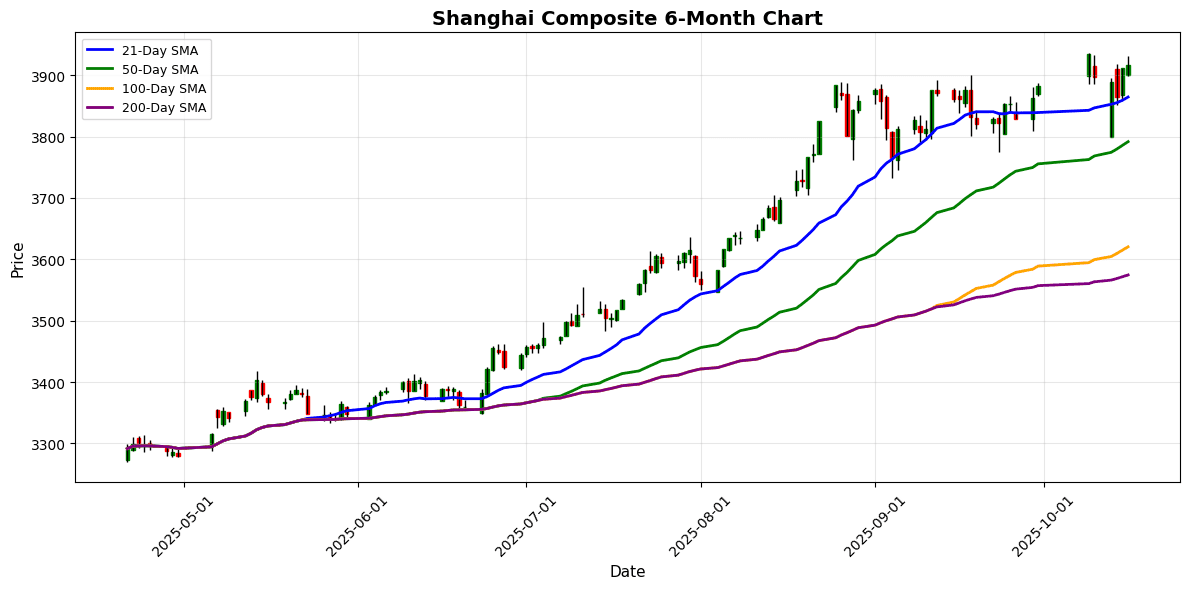

Shanghai Composite

Nikkei 225

Hang Seng Index

Shenzhen Component

KOSPI

S&P/ASX 200

NIFTY 50

Straits Times Index

S&P/NZX 50

Thailand SET Index

FTSE Bursa Malaysia KLCI

TAIEX

💱 FX, Commodities & Crypto

In the foreign exchange market, the USD/JPY pair experienced a slight decline of 0.12%, while the USD/CNY and USD/SGD also showed minor decreases. Notably, the NZD/USD rose by 0.26%, reflecting positive sentiment in New Zealand’s economic outlook. The USD/INR edged up by 0.10%, driven by domestic inflation concerns.

In commodities, gold prices increased by 1.76%, potentially influenced by safe-haven demand amid geopolitical tensions. Crude oil remained relatively stable with a minimal change of 0.03%.

In the cryptocurrency market, Bitcoin saw a slight decline of 0.24%, possibly due to profit-taking after recent gains. Conversely, Ethereum rose by 0.36%, likely buoyed by ongoing developments in decentralized finance and increased adoption. Overall, market movements were shaped by economic data releases and geopolitical factors impacting investor sentiment.

Currency Pairs

| Currency Pair | Price | Daily Change (%) |

|---|---|---|

| USD/JPY | 150.86 | -0.12 |

| USD/CNY | 7.12 | -0.03 |

| USD/SGD | 1.29 | -0.15 |

| AUD/USD | 0.65 | -0.20 |

| NZD/USD | 0.57 | +0.26 |

| USD/INR | 87.86 | +0.10 |

Commodities

| Commodity | Price | Daily Change (%) |

|---|---|---|

| Gold | 4274.50 | +1.76 |

| Crude Oil | 58.30 | +0.03 |

Cryptocurrencies

| Crypto | Price | Daily Change (%) |

|---|---|---|

| Bitcoin | 110530.58 | -0.24 |

| Ethereum | 4001.63 | +0.36 |

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.