Northrop Grumman Corporation Stock Following Earnings Report: Insights on NOC

Northrop Grumman Corporation, founded in 1939 and headquartered in Falls Church, VA, is a leading provider of advanced aircraft systems and solutions. The company operates across four key segments: Aeronautics, Defense, Mission, and Space Systems, delivering innovative technologies for the U.S. military, government agencies, and international clients. Northrop Grumman is dedicated to enhancing national security through cutting-edge aerospace and defense capabilities.

📰 Recent Developments

Northrop Grumman Corporation reported third-quarter 2023 financial results, achieving sales of $9.8 billion, a 4.7% increase year-over-year, driven by strong performance in aeronautics and space segments. Net earnings reached $627 million, reflecting operational efficiencies despite supply chain challenges. The company raised its full-year sales guidance to between $39.2 billion and $39.7 billion.

In product updates, Northrop Grumman advanced its Next Generation Jammer program, completing critical design reviews for enhanced electronic warfare capabilities on the EA-18G Growler aircraft. The firm also progressed testing on the Ground Based Strategic Deterrent, aligning with U.S. Air Force modernization goals.

Strategically, Northrop Grumman secured a $3.3 billion contract modification from the U.S. Navy for Virginia-class submarine production, expanding its undersea warfare portfolio. Additionally, the company formed a partnership with a defense technology firm to integrate AI-driven analytics into missile defense systems.

Operationally, Northrop Grumman expanded its manufacturing footprint in Alabama with a new facility for solid rocket motor production, supporting increased demand for space launch vehicles. No major management changes were announced during this period.

📊 Earnings Report Summary

Northrop Grumman Corporation (NYSE: NOC) reported robust Q3 2025 financial results, with sales rising 4% to $10.4 billion and a book-to-bill ratio of 1.17. Organic sales also grew by 5%. The operating margin improved to 11.9%, while diluted earnings per share (EPS) increased by 10% to $7.67. The company raised its 2025 MTM-adjusted EPS guidance to a range of $25.65 to $26.05. Notably, net cash provided by operating activities surged 43% to $1.557 billion, and free cash flow climbed 72% to $1.256 billion. Northrop Grumman’s backlog reached $91.4 billion, bolstered by significant new awards totaling $4.5 billion. The company returned value to shareholders through $1.168 billion in stock repurchases and $964 million in dividends. Overall, Northrop Grumman demonstrated strong financial health and operational performance in the third quarter.

📈 Technical Analysis

Technical Indicators

| Metric | Value |

|---|---|

| MA20 | $608.80 |

| MA50 | $592.52 |

| MA200 | $517.58 |

| YTD % | 29.76% |

| BB Position | 34.01% |

| RSI | 48.32 |

| MACD | 4.68 |

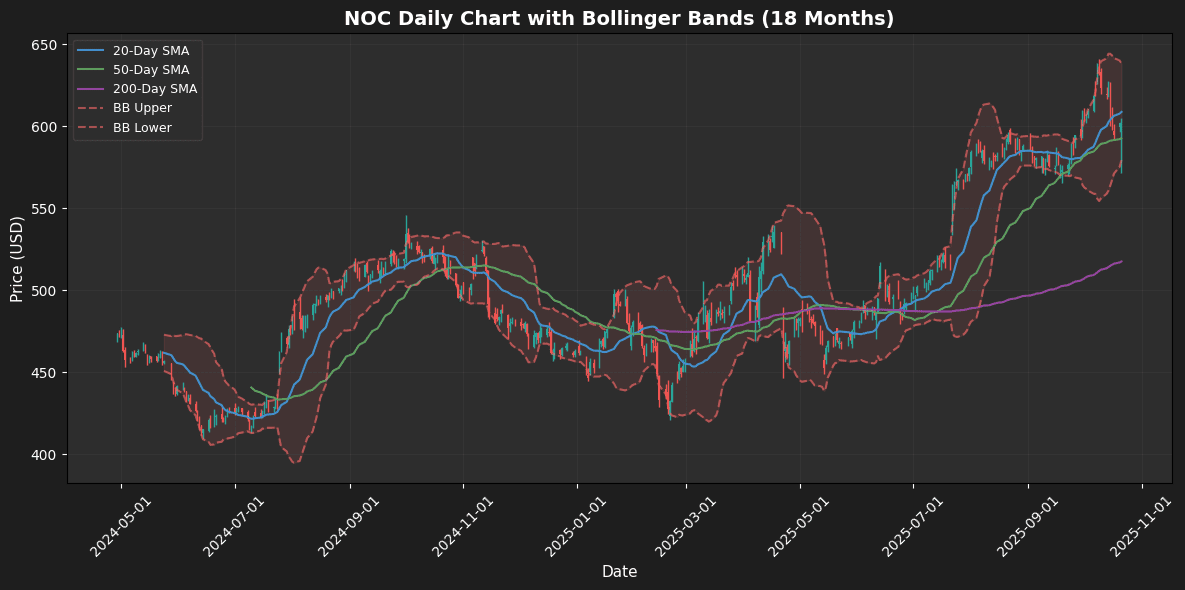

The current price of the asset stands at $599.35, slightly below the 20-day moving average (MA20) of $608.80, indicating potential bearish sentiment in the short term. However, the price is above the 50-day MA of $592.52, suggesting a bullish trend in the medium term. The RSI at 48.32 indicates the asset is neither overbought nor oversold, reflecting a neutral momentum.

The MACD value of 4.68 shows positive momentum, although it may require further confirmation. Bollinger Bands reveal the upper band at $638.35 and the lower band at $579.25, with the price currently positioned at 34% within the bands, indicating potential for volatility. Year-to-date, the asset has appreciated by approximately 29.76%, showcasing strong overall performance despite recent fluctuations. Monitoring these indicators will be crucial for future trading strategies.

💰 Earnings History

| Earnings Date | EPS Estimate | Reported EPS | Surprise(%) | Event Type |

|---|---|---|---|---|

| 2025-04-22 | 6.25 | 6.06 | -3.07 | Earnings |

| 2025-01-30 | 6.35 | 6.39 | 0.7 | Earnings |

| 2024-10-24 | 6.07 | 7.0 | 15.29 | Earnings |

| 2024-07-25 | 5.93 | 6.36 | 7.29 | Earnings |

| 2024-04-25 | 5.79 | 6.32 | 9.11 | Earnings |

| 2024-01-25 | 5.8 | 6.27 | 8.04 | Earnings |

| 2023-10-26 | 5.81 | 6.18 | 6.41 | Earnings |

| 2023-07-27 | 5.33 | 5.34 | 0.27 | Earnings |

The earnings per share (EPS) trends from the provided data illustrate a generally positive trajectory over recent quarters, despite some fluctuations. Starting from Q3 2023, the reported EPS shows a gradual increase from 5.34 to 6.18 in Q4 2023, indicating a solid growth momentum. The company exceeded EPS estimates in several quarters, particularly in Q4 2024 where it reported an impressive 7.00 against an estimate of 6.07, resulting in a significant positive surprise of 15.29%.

However, the most recent quarter (Q1 2025) saw a decline, with the reported EPS of 6.06 falling short of the estimate of 6.25, marking a negative surprise of -3.07%. This dip suggests potential challenges or market conditions impacting performance. Overall, while the company demonstrates strong earnings growth, the latest quarter’s underperformance could signal caution for investors, warranting close monitoring of future earnings trends and market conditions.

💵 Dividend History

| Date | Dividends |

|---|---|

| 2025-09-02 | 2.31 |

| 2025-06-02 | 2.31 |

| 2025-03-03 | 2.06 |

| 2024-12-02 | 2.06 |

| 2024-09-03 | 2.06 |

| 2024-05-24 | 2.06 |

| 2024-02-23 | 1.87 |

| 2023-11-24 | 1.87 |

The dividend trends observed from late 2023 to 2025 indicate a steady upward trajectory, reflecting a positive sentiment in the market. Starting from $1.87 in late 2023, dividends have increased incrementally, reaching $2.31 by September 2025. This consistent increase suggests that companies are not only generating robust profits but are also committed to returning value to shareholders, which is a promising sign for investors seeking income stability.

The plateau at $2.06 in mid-2024 indicates a possible consolidation phase, where companies may have been assessing their financial health amid economic uncertainties. However, the subsequent rise to $2.31 signals a renewed confidence in growth prospects and profitability.

Overall, the trend illustrates a resilient market where dividends are increasingly becoming a focal point for investors, especially in uncertain economic climates, as they look for reliable income streams amidst market volatility. This trend is likely to continue, encouraging further investments in dividend-paying stocks.

⭐ Analyst Ratings

| Date | Status | Outer | Rating | Price |

|---|---|---|---|---|

| 2025-10-08 00:00:00 | Upgrade | Deutsche Bank | Hold → Buy | $700 |

| 2025-07-08 00:00:00 | Downgrade | Deutsche Bank | Buy → Hold | $542 |

| 2025-04-11 00:00:00 | Upgrade | Goldman | Sell → Neutral | $521 |

| 2025-03-27 00:00:00 | Upgrade | RBC Capital Mkts | Sector Perform → Outperform | $500 → $575 |

Recent rating changes for Deutsche Bank and Goldman Sachs reflect a dynamic market environment and varying analyst sentiments. Deutsche Bank experienced a notable upgrade from “Hold” to “Buy” on October 8, 2025, despite a prior downgrade from “Buy” to “Hold” just three months earlier. This volatility suggests a reassessment of the bank’s growth potential or market conditions that could favor its stock performance. The price increase from $542 to $700 indicates a strong bullish outlook following the upgrade.

Conversely, Goldman Sachs received an upgrade from “Sell” to “Neutral” in April 2025, signaling a shift in analyst perspectives as the bank’s valuation likely improved. RBC Capital Markets also upgraded its rating for an unspecified entity from “Sector Perform” to “Outperform,” with a price target increase from $500 to $575, indicating optimism about future performance. Overall, these changes highlight the fluid nature of market evaluations, influenced by both company-specific developments and broader economic factors.

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.