# Oracle Corporation (ORCL) Post Earning Analysis

Oracle Corp., founded in 1977 and headquartered in Austin, Texas, is a prominent technology company that offers a broad range of products and services tailored to corporate IT environments. Its operations are divided into three main segments: Cloud and License, Hardware, and Services. Oracle provides enterprise applications, cloud solutions, engineered systems, servers, and consulting services, catering to the complex needs of modern businesses.

Oracle Corporation has experienced a significant surge in its stock value following a series of positive developments in its AI and cloud computing segments. Recent reports highlight Oracle’s “astonishing quarter” fueled by AI, leading to its stock heading for its best day since 1999. The company has secured massive AI deals, which have propelled its shares to skyrocket, despite missing Q1 top and bottom lines. Analysts are particularly optimistic, noting Oracle’s potential to outshine competitors like Microsoft and Amazon in cloud computing.

Oracle’s AI-driven growth is also underscored by its strategic moves, such as launching an AI Center of Excellence for Healthcare and enhancing AI capabilities in its patient portal. These initiatives are expected to maximize the value of AI across various workflows, boosting Oracle’s position in the tech sector. The company’s focus on AI and cloud services is not only reshaping its revenue streams but also positioning it as a leader in the next wave of tech innovation, potentially leading to sustained long-term growth in its stock value.

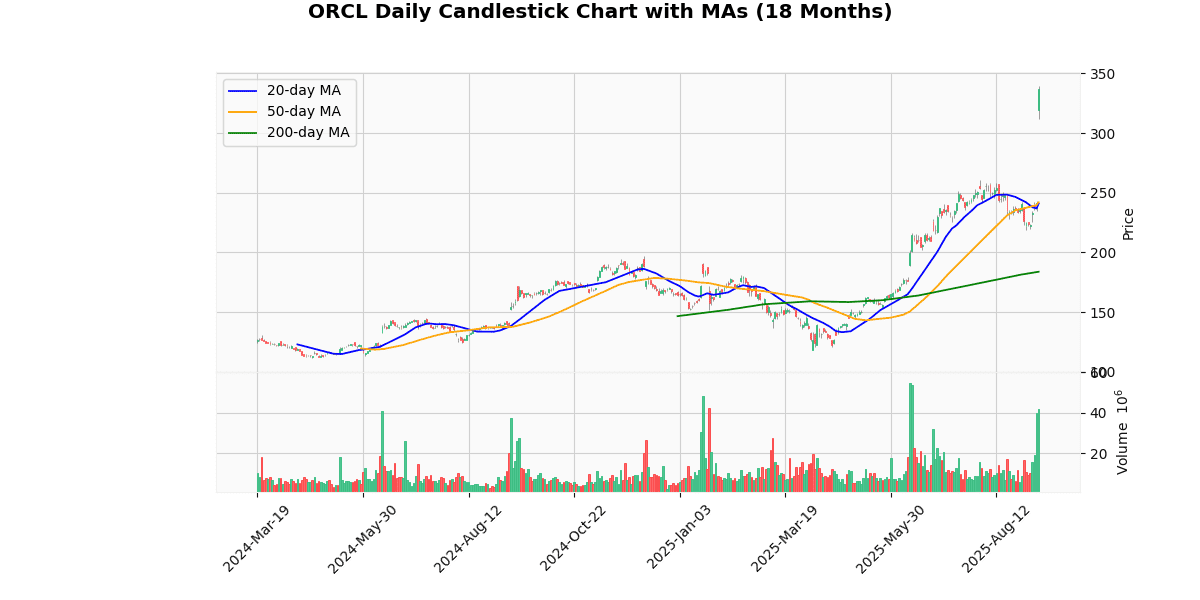

The current price of the asset at $337.14, with today’s substantial increase of 38.79%, indicates a strong upward momentum. This price is just shy of its 52-week and year-to-date high of $339.69, suggesting a potential resistance near this level. The significant rise from both the 52-week and year-to-date low of $118.18, with an increase of over 185%, highlights a robust bullish trend over the longer term.

The asset’s price is considerably above all key moving averages (20-day, 50-day, and 200-day), with percentage differences of approximately 39.91%, 39.33%, and 83.41% respectively, reinforcing the strong uptrend. The week’s low at $234.56 also shows a sharp weekly gain of 43.73%.

However, the RSI at 84.09 indicates an overbought condition, which could suggest a potential pullback or consolidation in the near term. The MACD value of 6.57 supports the current bullish momentum but warrants caution due to the high RSI. Investors should watch for any signs of reversal or consolidation, especially given the proximity to the 52-week high and the overbought market conditions.

Oracle Corporation reported robust financial results for the first quarter of 2026 on September 9, 2025. The company achieved a total revenue of $14.9 billion, marking a 12% increase year-over-year. Notably, cloud revenue soared to $7.2 billion, up 28% from the previous year, driven by significant growth in Cloud Infrastructure (IaaS) which surged 55% to $3.3 billion. Cloud Application (SaaS) revenue also grew, reaching $3.8 billion, an 11% increase.

Despite the overall growth, software revenue slightly declined by 1% to $5.7 billion. The Total Remaining Performance Obligations (RPO) impressively increased by 359% to $455 billion, reflecting strong future revenue potential.

Oracle reported a GAAP Earnings Per Share (EPS) of $1.01, a slight decrease of 2%, while Non-GAAP EPS rose by 6% to $1.47. Operating income on a GAAP basis was $4.3 billion, and Non-GAAP operating income increased by 9% to $6.2 billion. The company maintained a stable GAAP net income of $2.9 billion.

The board declared a quarterly dividend of $0.50 per share, with significant share repurchases amounting to $95 million during the quarter. Looking forward, Oracle anticipates exceeding $18 billion in Cloud Infrastructure revenue for the fiscal year, highlighting strong growth prospects in its cloud segments. Additionally, Oracle announced the upcoming launch of the Oracle AI Database, aiming to enhance AI capabilities for customers.

## Earnings Trend Table

| Date | Estimate EPS | Reported EPS | Surprise % | |

|---|---|---|---|---|

| 0 | 2025-09-09 | 1.48 | 1.47 | -0.68 |

| 1 | 2025-06-11 | 1.64 | 1.70 | 3.41 |

| 2 | 2025-03-10 | 1.49 | 1.47 | -1.52 |

| 3 | 2024-12-09 | 1.48 | 1.47 | -0.71 |

| 4 | 2024-09-09 | 1.32 | 1.39 | 4.92 |

| 5 | 2024-06-11 | 1.65 | 1.63 | -1.03 |

| 6 | 2024-03-11 | 1.38 | 1.41 | 2.51 |

| 7 | 2023-12-11 | 1.32 | 1.34 | 1.24 |

Over the last eight quarters, the EPS (Earnings Per Share) trends reveal a generally stable performance with occasional fluctuations. The company consistently met or slightly exceeded estimates in five out of eight quarters, indicating a robust earnings management strategy.

Notably, the company exceeded EPS estimates significantly in Q2 2024 and Q3 2024, with surprise percentages of 4.92% and 2.51%, respectively. These quarters highlight periods of strong performance, potentially driven by effective operational efficiencies or increased revenue streams. Conversely, the company underperformed against estimates in Q1 2025, Q3 2025, and Q2 2024, with the most considerable negative surprise occurring in Q1 2025 at -1.52%. These instances of underperformance could be attributed to unforeseen expenses or market downturns impacting earnings.

The EPS estimates were relatively stable, with minor fluctuations indicating consistent analyst expectations based on past performance and future outlook. The trend of reported EPS closely aligns with these estimates, suggesting predictable financial outcomes and effective guidance provided by the company to the market analysts.

Overall, the EPS trends over the past two years demonstrate a company capable of maintaining financial stability with periodic excellence, though not without occasional setbacks. This pattern suggests a well-managed company with the potential for strategic adjustments to enhance shareholder value.

## Dividend Payments Table

| Date | Dividend |

|---|---|

| 2025-07-10 | 0.5 |

| 2025-04-10 | 0.5 |

| 2025-01-10 | 0.4 |

| 2024-10-10 | 0.4 |

| 2024-07-11 | 0.4 |

| 2024-04-09 | 0.4 |

| 2024-01-10 | 0.4 |

| 2023-10-11 | 0.4 |

The dividend data over the last eight quarters exhibits a stable trend with a recent increase. From October 2023 to April 2025, dividends were consistently disbursed at $0.4. This period of stability suggests a cautious but steady approach to shareholder returns, possibly reflecting a consistent cash flow or a conservative payout policy by the company during these quarters.

Starting from July 2025, there is a noticeable increment in the dividend to $0.5, which has been maintained in the subsequent quarter as well. This increase could indicate an improvement in the company’s profitability or a positive adjustment in its dividend policy, reflecting stronger financial health or a strategic move to attract and retain investors by enhancing shareholder value.

Overall, the trend shows prudent financial management with a recent positive adjustment, likely signaling confidence in ongoing financial stability and future earnings prospects.

On September 10, 2025, there were significant rating changes and target price adjustments for the stock by various financial institutions. Citigroup upgraded its rating from ‘Neutral’ to ‘Buy,’ setting a new target price at $410. This substantial increase in the target price suggests a strong confidence in the stock’s future performance and potential market growth.

On the same day, Bank of America Securities also shifted its stance from ‘Neutral’ to ‘Buy,’ albeit with a slightly lower target price of $368 compared to Citigroup. This upgrade indicates a consensus of improved outlook among major analysts, although the variation in target prices reflects differing assessments of the stock’s valuation and growth prospects.

BMO Capital Markets, on September 10, reiterated its ‘Outperform’ rating but increased its target price from $275 to $345. This adjustment reflects an optimistic view on the stock’s earnings potential and market position, suggesting that the stock might outperform the general market expectations.

A day earlier, on September 9, BMO Capital Markets had also reiterated an ‘Outperform’ rating but with a target price increase from $245 to $275. This sequential increase in the target price within a short span indicates a rapidly improving outlook for the stock, possibly due to new market data or internal analysis revealing stronger than anticipated fundamentals.

Overall, these rating changes and target price adjustments suggest a robust positive sentiment towards the stock among analysts, driven by expected improvements in performance and market conditions.

The current price of the stock is $337.14. Recent analyst ratings suggest a positive outlook with upgrades and reiterated outperform statuses. Citigroup upgraded their rating from Neutral to Buy, setting a target price of $410, which is significantly higher than the current price. BofA Securities also upgraded from Neutral to Buy, with a target price of $368. BMO Capital Markets reiterated their Outperform rating, recently adjusting their target price from $275 to $345, closely aligning with the current market price. Previously, BMO had a lower target of $245, which they had raised to $275 before the latest adjustment.

These target prices and upgrades indicate a bullish sentiment from analysts, suggesting potential growth in the stock’s value beyond its current price. The average target price from these analysts stands at approximately $374.33, offering a potential upside based on the current assessments.