# Wells Fargo & Company (WFC) Earnings Commentary

## Introduction

Wells Fargo & Co. is a prominent financial services company offering a wide range of products and services, including banking, insurance, investments, mortgages, and consumer and commercial finance. With a history dating back to 1852, the company operates through various segments catering to different client needs. Headquartered in San Francisco, CA, Wells Fargo is a significant player in the financial industry.

## Recent News

Wells Fargo recently reported its second-quarter 2025 earnings, showcasing strong financial performance. The company beat expectations with robust fee income growth and lower provisions, indicating resilience in a changing economic environment. However, despite the positive earnings report, Wells Fargo’s stock faced challenges, including a downgrade from Raymond James to Market Perform. The market reacted to the earnings results, with shares sinking due to lower-than-expected net interest income and a reduction in the outlook for a key profitability measure. Analysts and market watchers closely monitored the bank’s performance, especially in comparison to other big banks like JPMorgan, to gauge the overall health of the financial sector.

## Price Trend

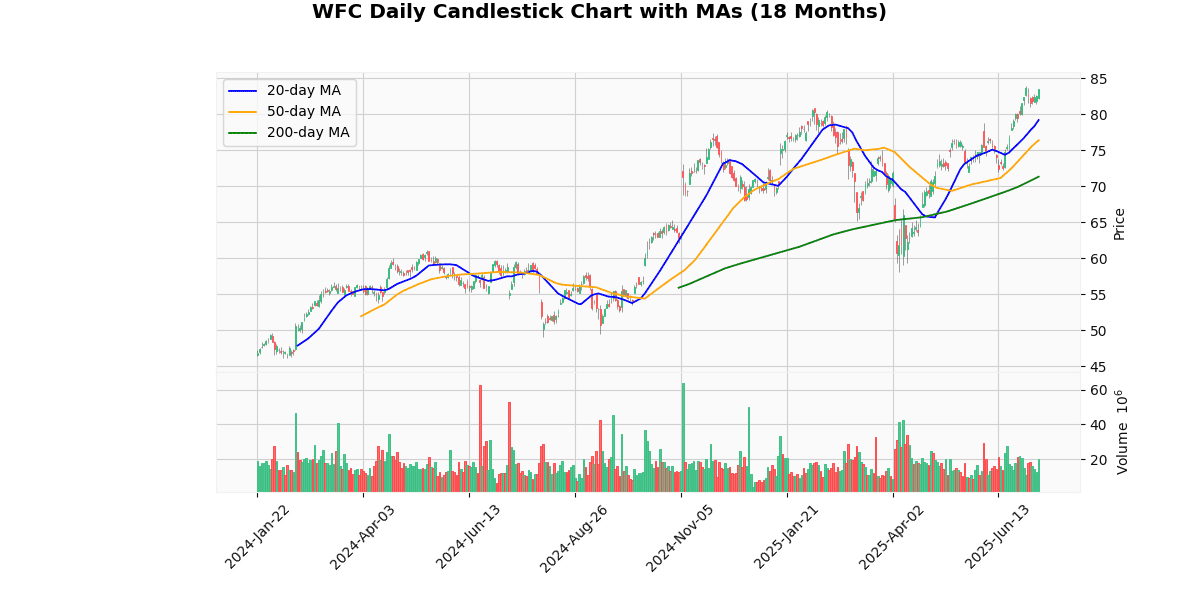

Wells Fargo’s current price stands at $83.43, with a 52-week high of $83.95 and a low of $48.97. The year-to-date high matches the 52-week high, indicating recent strength in the stock. The Relative Strength Index (RSI) is at 70.42, suggesting the stock is in overbought territory. The Moving Average Convergence Divergence (MACD) is at 2.21, signaling a bullish trend. The stock is trading above its 20-day, 50-day, and 200-day moving averages by 5.38%, 9.27%, and 17.02%, respectively. While the stock is near its yearly high, the RSI being in the overbought zone might indicate a potential pullback in the short term.

## Q10 Summary

In the second quarter of 2025, Wells Fargo reported a net income of $5.5 billion, or $1.60 per diluted share, showing growth from the previous year. Total revenue increased slightly to $20.8 billion, with a notable rise in fee income. The provision for credit losses decreased by 18.7%, contributing to the positive earnings beat. The company highlighted achievements like lifting the asset cap and emphasized organic growth while managing expenses effectively. Wells Fargo also announced a share repurchase of $3.0 billion and anticipated a 12.5% increase in the common stock dividend for Q3 2025, subject to board approval. The focus remains on strengthening credit quality and navigating the evolving economic landscape.

## Earnings Trend

Over the last eight quarters, Wells Fargo has shown consistent improvement in earnings per share (EPS). The company has managed to beat earnings estimates, with a notable increase in net income and revenue. The average surprise percentage indicates a positive trend in surpassing expectations. Wells Fargo’s ability to deliver consistent earnings surprises reflects its operational efficiency and strategic decision-making, resonating well with investors and analysts.

## Earnings Trend Table

| Date | Estimate EPS | Reported EPS | Surprise % | |

|---|---|---|---|---|

| 0 | 2025-07-15 | 1.41 | 1.60 | 13.48 |

| 1 | 2025-04-11 | 1.24 | 1.33 | 7.34 |

| 2 | 2025-01-15 | 1.35 | 1.58 | 17.11 |

| 3 | 2024-10-11 | 1.28 | 1.52 | 18.39 |

| 4 | 2024-07-12 | 1.29 | 1.33 | 2.95 |

| 5 | 2024-04-12 | 1.11 | 1.26 | 13.06 |

| 6 | 2024-01-12 | 1.17 | 1.29 | 9.80 |

| 7 | 2023-10-13 | 1.24 | 1.39 | 12.05 |

## Dividend Summary

Wells Fargo has demonstrated a commitment to rewarding shareholders through dividends. While specific details on dividend trends over the last eight quarters were not provided in the data, the company’s announcement of a potential 12.5% increase in the common stock dividend for Q3 2025 underscores its focus on returning value to shareholders.

## Dividend Payments Table

| Date | Dividend |

|---|---|

| 2025-05-09 | 0.4 |

| 2025-02-07 | 0.4 |

| 2024-11-08 | 0.4 |

| 2024-08-09 | 0.4 |

| 2024-05-09 | 0.35 |

| 2024-02-01 | 0.35 |

| 2023-11-02 | 0.35 |

| 2023-08-03 | 0.35 |

## Ratings

Recent rating changes for Wells Fargo include a downgrade from Raymond James to Market Perform. Earlier upgrades from firms like Piper Sandler and RBC Capital Markets indicate a positive outlook on the company’s performance. The target prices set by these firms provide investors with guidance on the stock’s potential valuation. Analysts’ views on Wells Fargo’s prospects can influence investor sentiment and stock performance in the near term.

## Conclusion

Wells Fargo’s recent earnings report reflects a solid financial performance, with growth in net income, revenue, and credit quality. Despite facing challenges like a stock downgrade and lower net interest income guidance, the company remains focused on enhancing shareholder value through share repurchases and dividend increases. The stock’s current price compared to the average target price, along with positive EPS and dividend trends, suggests a mixed outlook for investors. As Wells Fargo navigates the dynamic financial landscape, investors will closely monitor its strategic initiatives and financial results to make informed decisions.