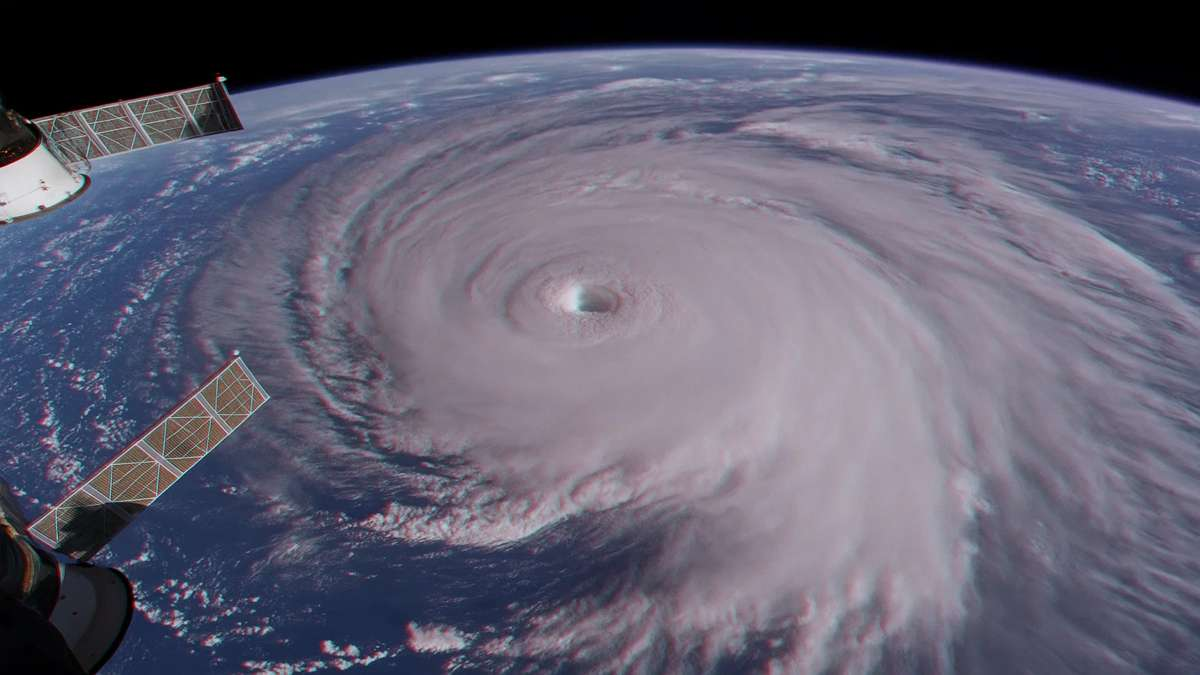

Picture this: a hurricane barrels toward Miami, winds howling at 150 mph. While homeowners board up windows and insurers brace for billions in claims, a group of investors in London and New York lean forward at their screens—rooting, in a way, for the storm to stay on script.

Welcome to the world of catastrophe bonds, or “cat bonds”—the $45 billion corner of the capital markets where natural disasters are packaged, priced, and traded like any other asset.

What Exactly Is a Cat Bond?

A cat bond is a high-yield debt security whose principal and interest payments depend on whether a predefined natural disaster occurs. Think of it as insurance for insurance companies—reinsurance on steroids, backed by investors willing to gamble on the weather.

Here’s the basic structure:

- Sponsor: A reinsurance company (e.g., Swiss Re, Munich Re) or a government (e.g., Mexico for earthquakes).

- Special Purpose Vehicle (SPV): A bankruptcy-remote entity issues the bonds and holds collateral (usually U.S. Treasuries) in a trust.

- Trigger: A specific event—say, a Category 5 hurricane making landfall in Florida with wind speeds >120 mph, or a Japanese earthquake >7.5 magnitude.

- Investors: Pension funds, hedge funds, and specialty funds buy the bonds, earning juicy coupons (often 5–12% above Treasuries).

If the trigger is not met, investors get their principal back plus interest. If the trigger is met, the SPV liquidates the collateral and pays the sponsor—investors lose some or all of their money.

A Brief History: From Hurricane Andrew to Today

The modern cat bond market was born from the ashes of Hurricane Andrew in 1992, which caused $27 billion in insured losses and nearly bankrupted several insurers. Traditional reinsurance was too slow, too expensive, and too correlated.

In 1997, Winterthur Re issued the first cat bond—$150 million covering Japanese earthquake risk. The market has since exploded:

| Year | Issuance Volume | Key Milestone |

|---|---|---|

| 2000 | ~$1 billion | Niche product |

| 2010 | ~$4 billion | Post-financial crisis growth |

| 2024 | $13.2 billion | Record year (Property Claim Services) |

| 2025 | $11.8 billion YTD | Despite high hurricane activity |

Today, over 400 cat bonds are outstanding, covering hurricanes, earthquakes, wildfires, and even pandemics (briefly, post-COVID).

How Triggers Work: The Devil in the Details

Triggers come in three flavors:

| Type | How It Works | Pros | Cons |

|---|---|---|---|

| Indemnity | Pays based on sponsor’s actual losses | Aligns incentives | Slow settlement, moral hazard |

| Parametric | Pays if objective metrics are hit (e.g., wind speed >130 mph at NOAA buoy #41002) | Fast payout (days, not months) | Basis risk (event happens, but trigger not met) |

| Industry Loss | Pays if total industry losses exceed $X billion (per PCS or PERILS) | Transparent | Sponsor may suffer but not get paid |

Parametric triggers now dominate new issuances—investors love the speed and clarity.

Why Investors Love (and Fear) Cat Bonds

The Bull Case

- Uncertainty premium: 7–10% spreads over Treasuries for risks uncorrelated with stocks or recessions.

- Portfolio diversification: When the S&P 500 tanks, a Florida hurricane doesn’t care.

- ESG appeal: Capital protects vulnerable regions (e.g., World Bank pandemic bonds, Caribbean hurricane funds).

The Bear Case

- Binary risk: One bad season wipes out years of coupons.

- Climate change: Rising sea levels and storm intensity = higher expected losses.

- Modeling risk: If the risk model is wrong (looking at you, Hurricane Ian 2022), investors get smoked.

“It’s like buying a lottery ticket in reverse,” says Dr. Maya Patel, head of ILS at Nephila Capital. “You win if nothing happens.”

Real-World Example: Hurricane Milton 2025

In August 2025, Florida Re Ltd. issued a $300 million cat bond (Series 2025-1) covering named storms in the Gulf of Mexico.

- Trigger: Sustained winds >115 mph within 50 miles of Tampa and industry losses >$12 billion.

- Coupon: LIBOR + 8.5%.

- Outcome (as of Oct 31): Milton made landfall as a Cat 4, but industry losses estimated at $9.8 billion—below trigger. → Investors paid in full. The sponsor? Out of luck.

The Future: Climate, Tech, and Tokenization

- Climate risk pricing: Insurers now bake in CMIP6 projections—expect higher spreads.

- Satellite + IoT triggers: Real-time data from weather buoys, seismic sensors, and drones.

- Tokenized cat bonds: In 2024, Artex launched the first blockchain-settled cat bond on Ethereum—settlement in 48 hours.

Should You Invest?

For retail investors: Mostly no—cat bonds trade in $100,000+ denominations via private funds (e.g., Pioneer ILS Fund, Twelve Capital). Minimums start at $1 million.

For institutions: A 3–5% portfolio sleeve can reduce volatility. Historical expected loss: ~1.5% annually. Realized loss (1998–2024): ~1.2%.

The Bottom Line

Cat bonds are capital markets judo—turning the terror of nature into a predictable, tradable risk. They’ve transferred over $100 billion in disaster risk from insurers to investors since 1997.

But as storms grow fiercer and models strain, the question remains:

Are we insuring the uninsurable—or just kicking the can down a warming road?

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.