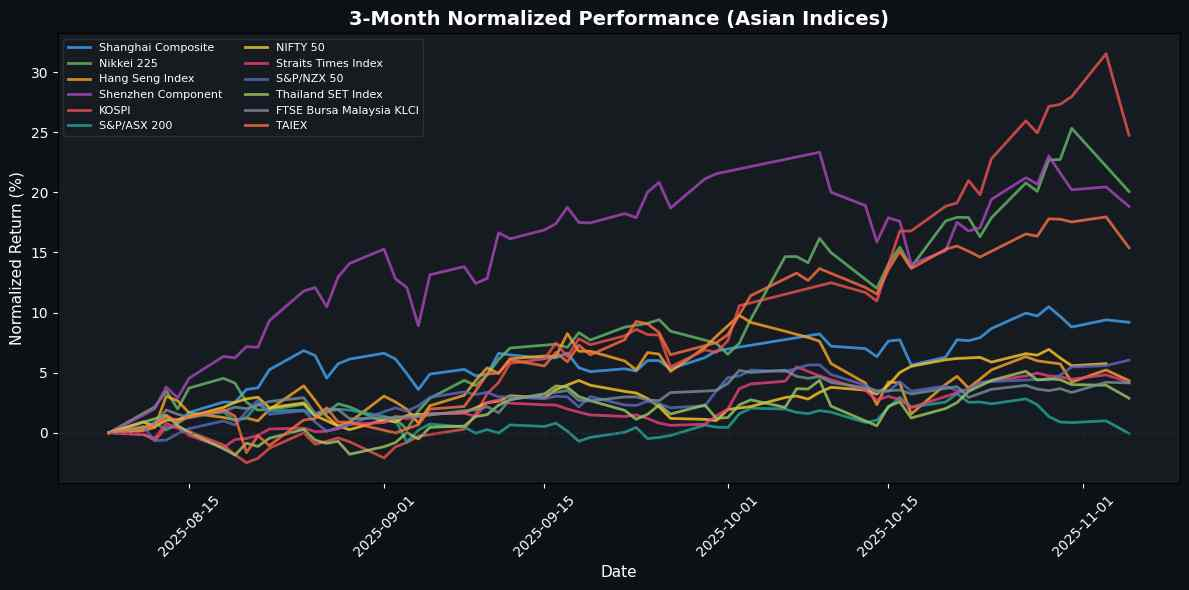

Asian Markets Decline as Nikkei 225 Drops Over 2% on Tech Weakness

Note: This analysis covers the Asian trading session close for November 05, 2025. All times are in US Eastern Time (ET).

📰 Market Commentary

On November 05, 2025, Asian markets experienced a tumultuous session influenced by a variety of macroeconomic factors and corporate developments. Key drivers included geopolitical tensions, particularly regarding technology and trade, as well as varying economic outlooks across the region.

The Nikkei index faced significant pressure, ending down over 2%, primarily due to a sharp decline in technology stocks that had recently reached new highs. This downturn reflects broader concerns regarding valuation in the tech sector, exacerbated by SoftBank’s 10% plunge, which resulted in a staggering $23 billion loss in market capitalization amid valuation jitters surrounding AI stocks. In contrast, Toyota’s decision to lift its fiscal year 2025 net profit outlook, despite the looming impact of US tariffs, provided some positive sentiment, highlighting resilience in the automotive sector.

In China, the government set a GDP benchmark target of 4.17% annual growth through 2035, signaling a long-term commitment to economic stability that has attracted renewed interest from private equity funds bullish on China’s tech-focused economic plan. However, tensions surrounding foreign investment, particularly in the semiconductor sector, were reignited by the Nexperia fallout, which has prompted renewed debates within the EU regarding Chinese investments.

Hong Kong’s financial landscape was affected by legal troubles in the cryptocurrency space, as police charged individuals involved in a significant fraud case. Meanwhile, Franklin Templeton’s introduction of a tokenized money market fund in Hong Kong represents a notable trend towards digital finance in the region.

Overall, Asian markets are navigating a complex landscape characterized by corporate earnings, regulatory challenges, and strategic investments, reflecting a mix of optimism and caution among investors.

📈 Main Index Charts

Nikkei 225

Hang Seng Index

Shanghai Composite

Shenzhen Component

KOSPI

S&P/ASX 200

NIFTY 50

Straits Times Index

💱 FX, Commodities & Crypto

In the foreign exchange market, the USD/JPY pair showed a slight increase of 0.05%, reflecting ongoing investor sentiment towards the Japanese yen amid interest rate considerations. Conversely, the USD/CNY and USD/SGD pairs experienced minor declines of 0.04% and 0.02%, respectively, influenced by China’s economic outlook and Singapore’s monetary policy stance. The AUD/USD pair fell by 0.22%, likely impacted by weaker commodity prices and economic data from Australia, while the NZD/USD saw a modest gain of 0.02%, possibly supported by positive market sentiment. The USD/INR pair decreased by 0.08%, reflecting fluctuations in India’s economic indicators.

Currently, there is no available data on commodities or cryptocurrencies to assess their performance. Overall, FX movements are primarily driven by macroeconomic factors, including interest rates, economic growth prospects, and geopolitical developments.

Currency Pairs

| Currency Pair | Price | Daily Change (%) |

|---|---|---|

| USD/JPY | 153.70 | +0.05 |

| USD/CNY | 7.13 | -0.04 |

| USD/SGD | 1.31 | -0.02 |

| AUD/USD | 0.65 | -0.22 |

| NZD/USD | 0.56 | +0.02 |

| USD/INR | 88.64 | -0.08 |

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.