European Indices Decline Amid Mixed Currency Performance

European Trading Session Report | November 05, 2025 | Markets analysis during European hours (8:00 AM – 5:00 PM UTC)

📊 Market Commentary

### European Market Commentary: Cautious Open Amid US Election Ripples and Tech Pressures

European markets opened lower on Thursday, extending the risk-off tone from a turbulent overnight session in the US and Asia. The Euro Stoxx 50 dipped 0.76%, dragged down by a sharp sell-off in technology stocks, which mirrored the Nasdaq 100’s 2.07% decline in the previous US close. Broader indices followed suit: Germany’s DAX fell 1.23%, reflecting sensitivity to global trade uncertainties, while France’s CAC 40 shed 0.64%. The FTSE 100 bucked the trend marginally, closing down just 0.01%, buoyed by defensive sectors like consumer staples amid sterling’s relative strength.

The US session’s downside, with the S&P 500 dropping 1.17% and Dow Jones easing 0.53%, was amplified by political developments across the Atlantic. A Democratic sweep in key US races, including New York, has heightened expectations for policy shifts under a potential Harris administration, pressuring cyclical sectors and contributing to cautious Wall Street sentiment. Asian markets echoed this wariness, with tech-heavy indices in Tokyo and Seoul underperforming, setting a subdued tone for Europe.

Key drivers remain centered on the ECB’s policy path and Eurozone data. With inflation metrics softening, markets are pricing in a 25-basis-point rate cut at the December meeting, supporting bond yields but weighing on banks. Political headwinds, including budget standoffs in major economies, have bolstered fixed-income assets, as evidenced by winning bond positions amid fiscal debates. Sector-wise, tech led losses across the region, down over 2% in the Stoxx 600, while energy held firmer on steady oil prices.

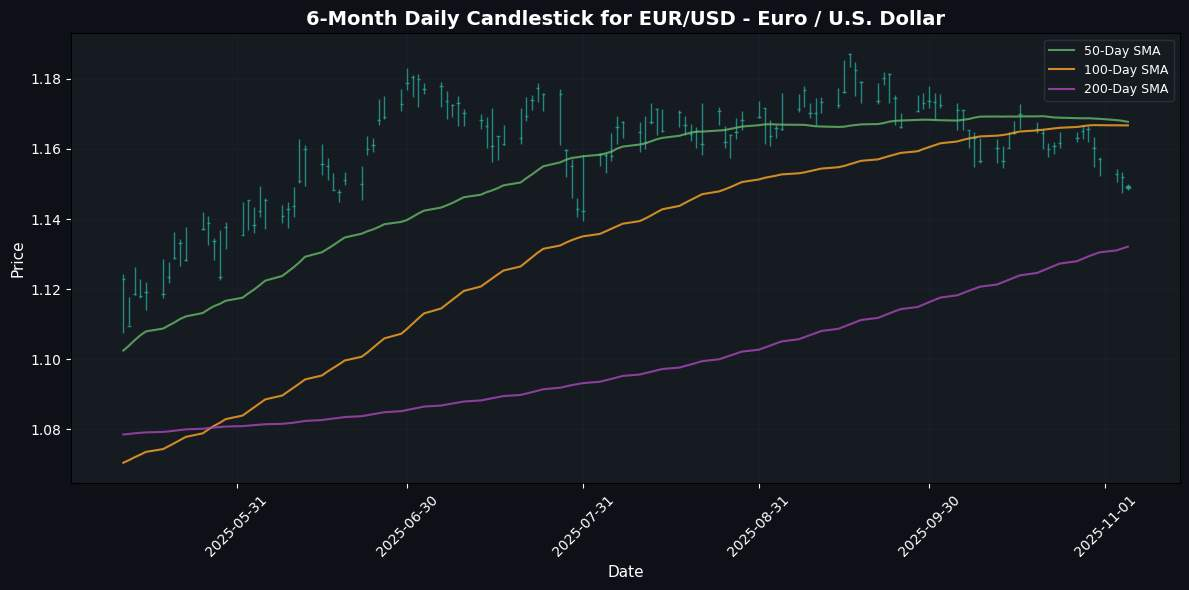

In FX, the euro edged up 0.03% against the dollar to 1.0825, stabilizing after probing support levels, though EUR/GBP weakened 0.16% to 0.8350 as the pound gained 0.22% on USD amid UK fiscal resilience. The Swiss franc strengthened modestly, with USD/CHF down 0.04%, acting as a safe-haven amid geopolitical noise. Sterling’s outperformance underscores investor bets on UK growth relative to the eurozone.

Sentiment is guarded, with funds amplifying warnings on private credit risks and elite bankers forecasting crisis vulnerabilities in leveraged assets. Positioning shows reduced exposure to high-beta names, favoring quality defensives. Blackstone’s push for alternative strategies highlights diversification appeals

🇪🇺 European Indices Performance

Performance: (Today Last – Yesterday Close) / Yesterday Close × 100

| Index | Price | Daily (%) |

|---|---|---|

| Euro Stoxx 50 | 5636.34 | -0.76 |

| DAX | 23835.60 | -1.23 |

| CAC 40 | 8058.13 | -0.64 |

| FTSE 100 | 9713.99 | -0.01 |

🇺🇸 US Markets (Previous Close)

Performance: (Yesterday – 2 Days Ago) / 2 Days Ago × 100

| Index | Price | Daily (%) |

|---|---|---|

| S&P 500 | 6771.55 | -1.17 |

| Dow Jones | 47085.24 | -0.53 |

| Nasdaq 100 | 25435.70 | -2.07 |

💱 Currency Pairs Performance

Performance: (Today Last – Today Open) / Today Open × 100

| Pair | Price | Daily (%) |

|---|---|---|

| EUR/USD | 1.15 | +0.03 |

| GBP/USD | 1.30 | +0.22 |

| USD/JPY | 153.50 | -0.03 |

| EUR/GBP | 0.88 | -0.16 |

| USD/CHF | 0.81 | -0.04 |

| AUD/USD | 0.65 | +0.11 |

| USD/CAD | 1.41 | +0.12 |

🛢️ Commodities Performance

Performance: (Close – Previous Close) / Previous Close × 100

| Commodity | Price | Daily (%) |

|---|---|---|

| Natural Gas | 4.22 | -2.79 |

₿ Cryptocurrency Performance

Performance: (Close – Previous Close) / Previous Close × 100

No crypto data available.

📅 Today’s Economic Calendar

High and medium importance events. Times in US Eastern Time (ET).

| Date | Time | Cur | Imp | Event | Actual | Forecast |

|---|---|---|---|---|---|---|

| 2025-11-05 | 02:00 | 🇪🇺 | Medium | German Factory Orders (MoM) (Sep) | 1.1% | 0.9% |

| 2025-11-05 | 03:15 | 🇪🇺 | Medium | HCOB Spain Services PMI (Oct) | 56.6 | 54.8 |

| 2025-11-05 | 03:30 | 🇸🇪 | Medium | Interest Rate Decision | 1.75% | 1.75% |

| 2025-11-05 | 03:45 | 🇪🇺 | Medium | HCOB Italy Services PMI (Oct) | 54.0 | 53.0 |

| 2025-11-05 | 03:50 | 🇪🇺 | Medium | HCOB France Services PMI (Oct) | 48.0 | 47.1 |

| 2025-11-05 | 03:55 | 🇪🇺 | Medium | HCOB Germany Services PMI (Oct) | 54.6 | 54.5 |

| 2025-11-05 | 04:00 | 🇪🇺 | Medium | HCOB Eurozone Composite PMI (Oct) | 52.5 | 52.2 |

| 2025-11-05 | 04:00 | 🇪🇺 | Medium | HCOB Eurozone Services PMI (Oct) | 53.0 | 52.6 |

| 2025-11-05 | 04:30 | 🇬🇧 | Medium | S&P Global Composite PMI (Oct) | 51.1 | |

| 2025-11-05 | 04:30 | 🇬🇧 | Medium | S&P Global Services PMI (Oct) | 51.1 | |

| 2025-11-05 | 05:00 | 🇪🇺 | Medium | German Buba President Nagel Speaks | ||

| 2025-11-05 | 08:15 | 🇺🇸 | High | ADP Nonfarm Employment Change (Oct) | 32K | |

| 2025-11-05 | 08:30 | 🇨🇦 | Medium | Trade Balance (Sep) | ||

| 2025-11-05 | 09:45 | 🇺🇸 | Medium | S&P Global Composite PMI (Oct) | 54.8 | |

| 2025-11-05 | 09:45 | 🇺🇸 | High | S&P Global Services PMI (Oct) | 55.2 | |

| 2025-11-05 | 10:00 | 🇺🇸 | Medium | Factory Orders (MoM) | 1.4% | |

| 2025-11-05 | 10:00 | 🇺🇸 | Medium | ISM Non-Manufacturing Employment (Oct) | ||

| 2025-11-05 | 10:00 | 🇺🇸 | High | ISM Non-Manufacturing PMI (Oct) | 50.7 | |

| 2025-11-05 | 10:00 | 🇺🇸 | High | ISM Non-Manufacturing Prices (Oct) | ||

| 2025-11-05 | 10:00 | 🇺🇸 | High | JOLTS Job Openings (Sep) | ||

| 2025-11-05 | 10:30 | 🇺🇸 | High | Crude Oil Inventories | -2.500M | |

| 2025-11-05 | 10:30 | 🇺🇸 | Medium | Cushing Crude Oil Inventories | ||

| 2025-11-05 | 13:00 | 🇺🇸 | High | U.S. President Trump Speaks | ||

| 2025-11-05 | 16:30 | 🇨🇦 | Medium | BoC Gov Macklem Speaks | ||

| 2025-11-05 | 16:30 | 🇧🇷 | Medium | Interest Rate Decision | 15.00% | |

| 2025-11-05 | 19:30 | 🇦🇺 | Medium | Trade Balance (Sep) | 3.860B | |

| 2025-11-05 | 19:30 | 🇯🇵 | Medium | au Jibun Bank Services PMI (Oct) | 52.4 |

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.