October 29, 2025 – The Bank of Canada (BoC) announced a 25 basis point reduction in its policy interest rate on Wednesday, bringing the target for the overnight rate to 2.25%. The Bank Rate now stands at 2.5%, while the deposit rate is set at 2.20%. This marks the latest in a series of easing measures as the central bank navigates heightened uncertainty from U.S. trade policies and a softening domestic economy.

The decision, detailed in the October 2025 Monetary Policy Report (MPR), reflects a return to the BoC’s standard practice of providing economic projections after a period of elevated unpredictability due to U.S. tariffs. Governor Tiff Macklem emphasized during the accompanying press conference that while the impacts of these trade actions are becoming clearer, risks remain “wider than usual.”

Global and Domestic Economic Outlook

Globally, the economy has shown resilience to sharp U.S. tariff increases, but effects are increasingly apparent. Trade relationships are shifting, investment is cooling in many nations, and the MPR projects global growth to decelerate from about 3.25% in 2025 to roughly 3% in both 2026 and 2027.

- United States: Robust activity fueled by AI investment boom, though employment growth has slowed and tariffs are elevating consumer prices.

- Euro Area: Growth slowing due to weaker exports and domestic demand.

- China: Exports to the U.S. down but redirected elsewhere; business investment weakened.

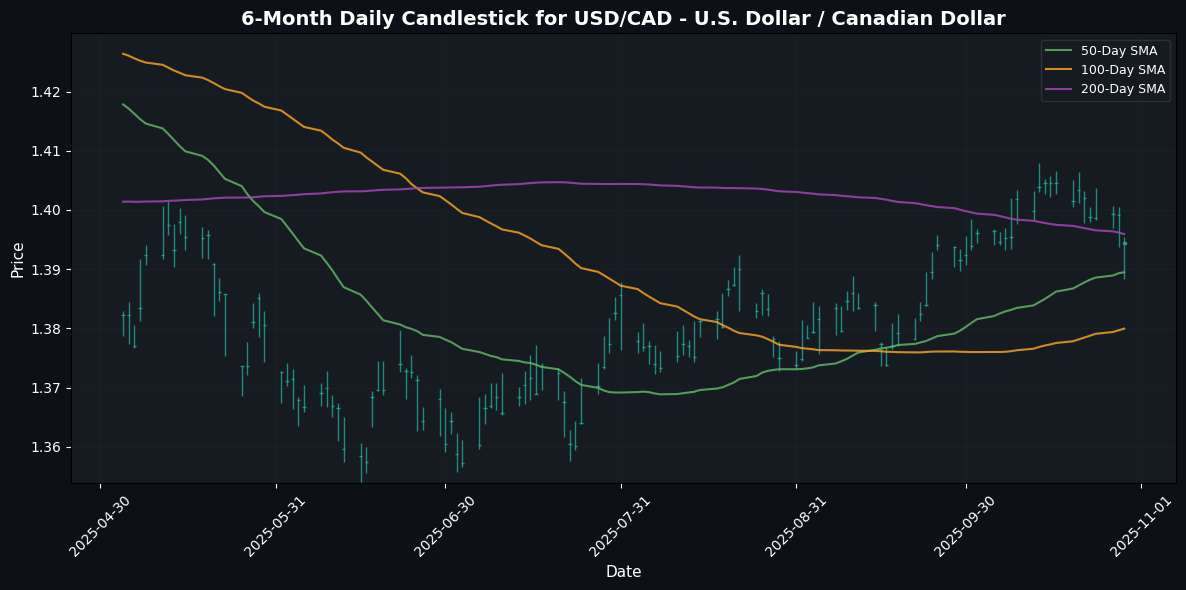

- Financial conditions have eased since July, oil prices stable, and the Canadian dollar has slightly depreciated against the U.S. dollar.

In Canada, the economy contracted by 1.6% in Q2 2025, driven by export drops and subdued business investment amid uncertainty. Household spending remained solid, providing some offset. Sectors like autos, steel, aluminum, and lumber are hit hardest by U.S. trade actions.

The labor market is soft: September saw employment gains after two months of losses, but job cuts persist in trade-sensitive areas, hiring is weak overall, and the unemployment rate held at 7.1%. Wage growth has moderated, and slower population increases reduce the need for new jobs to stabilize employment rates.

BoC projections:

- GDP growth: 1.2% in 2025, 1.1% in 2026, 1.6% in 2027.

- Quarterly growth strengthens in 2026 following a weak H2 2025.

- Excess economic capacity persists but absorbs gradually.

Inflation Dynamics and Policy Rationale

CPI inflation rose to 2.4% in September (slightly above expectations), with core measures sticky around 3% and inflation excluding taxes at 2.9%. Broader indicators suggest underlying inflation near 2.5%. The Bank anticipates easing pressures, keeping CPI near the 2% target over the horizon.

With economic weakness and inflation aligned near target, the Governing Council opted for the cut. If the outlook holds, the current rate is seen as appropriate to sustain low inflation during structural adjustments. The BoC remains data-dependent and ready to adjust.

Macklem noted the “difficult transition” from trade conflicts, which inflict structural damage, raise costs, and limit monetary policy’s demand-boosting role without inflating prices. The focus is maintaining public confidence in price stability amid global upheaval.

Key Takeaways from the MPR

- Core Message: Canada adjusts to tariffs, export demand plunge, and global trade reconfiguration, leading to higher costs.

- Inflation Summary: Total around 2%; underlying ~2.5%.

The next rate announcement is scheduled for December 10, 2025, with the following MPR on January 28, 2026. A press conference with Governor Macklem and Senior Deputy Governor Carolyn Rogers followed the release at approximately 10:30 ET.

For the full announcement, visit the Bank of Canada press release.

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.