💱 Forex Volatility: USD/CHF Rallies Post Fed Rate Cut; GBP/USD Sees Decline

📊 US Dollar Index (DXY)

Current Level: 99.14 (+0.46%)

The currency markets experienced notable volatility following the Federal Reserve’s widely anticipated decision to cut interest rates by 25 basis points, bringing the Federal Funds Target Range to 3.75%–4.00%. This move was seen as a pivotal moment, with Fed Chair Jerome Powell suggesting that this could be the last cut for the foreseeable future, which contributed to a temporary rebound in the US Dollar Index (DXY), currently at 99.14.

The Euro (EUR) and British Pound (GBP) both faced downward pressure against the USD, with EUR/USD trading within a tight range and GBP/USD dipping further as traders reacted to the Fed’s decision and its implications for future monetary policy. The Bank of Canada’s recent hawkish stance added to the GBP’s woes, causing GBP/CAD to tumble to its lowest levels since August.

Meanwhile, optimism surrounding a potential US-China trade deal provided a supportive backdrop for the USD, even as some analysts noted the uncertainty stemming from mixed signals from the Fed. Precious metals, particularly gold, showed volatility, stabilizing near $4,000 as market participants adjusted to the Fed’s dovish pivot.

Overall, the FX market is currently shaped by central bank policies, trade negotiations, and shifting investor sentiment, creating an environment of cautious trading as participants await further clarity on monetary policy direction and global economic conditions.

📅 Today’s Economic Calendar

No significant economic events scheduled for today.

💱 Major Currency Pairs

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EUR/USD – Euro / U.S. Dollar | EURUSD | 1.1604 | -0.41% | +0.03% | -0.46% | -2.26% | -0.07% | +10.62% | +4.30% | +7.09% | 1.1687 | 1.1666 | 1.1293 | 46.98 | -0.00 |

| USD/JPY – U.S. Dollar / Japanese Yen | USDJPY | 152.6390 | -0.03% | +0.49% | +1.15% | +4.25% | +5.30% | +0.41% | +5.68% | -2.75% | 149.1822 | 147.8515 | 147.9035 | 49.73 | 1.01 |

| GBP/USD – British Pound / U.S. Dollar | GBPUSD | 1.3192 | -1.12% | -1.30% | -1.74% | -3.38% | -3.11% | +4.83% | -0.01% | +3.63% | 1.3449 | 1.3477 | 1.3227 | 31.21 | -0.00 |

| USD/CHF – U.S. Dollar / Swiss Franc | USDCHF | 0.7994 | +0.61% | +0.34% | +0.73% | +1.72% | -0.71% | -11.16% | -5.04% | -11.50% | 0.7981 | 0.8009 | 0.8324 | 47.34 | -0.00 |

| AUD/USD – Australian Dollar / U.S. Dollar | AUDUSD | 0.6576 | +0.27% | +1.30% | +1.15% | -1.68% | +1.24% | +3.46% | -3.05% | -0.81% | 0.6557 | 0.6539 | 0.6438 | 48.68 | -0.00 |

| USD/CAD – U.S. Dollar / Canadian Dollar | USDCAD | 1.3944 | -0.34% | -0.54% | -0.52% | +1.49% | +1.58% | -1.69% | +3.46% | +1.90% | 1.3895 | 1.3799 | 1.3959 | 48.05 | 0.00 |

| NZD/USD – New Zealand Dollar / U.S. Dollar | NZDUSD | 0.5763 | -0.22% | +0.36% | +0.54% | -3.78% | -4.13% | +0.52% | -7.75% | -5.78% | 0.5831 | 0.5911 | 0.5855 | 43.47 | -0.00 |

In the recent trading session, the USD/CHF pair led the Majors with a gain of +0.61%, indicating a strengthening of the U.S. dollar against the Swiss franc, likely driven by safe-haven demand amidst global uncertainty. The AUD/USD also showed a positive trend, up +0.27%, reflecting resilient Australian economic data and a stable commodity outlook. Conversely, the GBP/USD and EUR/USD pairs faced significant downward pressure, with losses of -1.12% and -0.41% respectively, suggesting bearish sentiment towards the British pound and euro amid concerns over economic stability and potential interest rate adjustments. The USD/CAD’s decline of -0.34% further highlights the dollar’s struggles against the loonie, driven by fluctuating oil prices and market sentiment towards the Canadian economy. Overall, the U.S. dollar exhibits mixed performance, with notable strength against safe-haven currencies and weaknesses against major European currencies.

🔀 Cross Currency Pairs

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EUR/GBP | EURGBP | 0.8794 | +0.70% | +1.33% | +1.29% | +1.15% | +3.11% | +5.51% | +4.30% | +3.35% | 0.8689 | 0.8656 | 0.8534 | 72.36 | 0.00 |

| EUR/JPY | EURJPY | 177.1310 | -0.43% | +0.53% | +0.70% | +1.92% | +5.25% | +11.09% | +10.25% | +4.20% | 174.3231 | 172.4740 | 166.9351 | 46.42 | 0.87 |

| EUR/CHF | EURCHF | 0.9276 | +0.20% | +0.37% | +0.28% | -0.57% | -0.78% | -1.72% | -0.95% | -5.20% | 0.9326 | 0.9343 | 0.9381 | 36.07 | -0.00 |

| EUR/AUD | EURAUD | 1.7643 | -0.68% | -1.26% | -1.59% | -0.58% | -1.32% | +6.92% | +7.58% | +8.00% | 1.7823 | 1.7841 | 1.7533 | 49.18 | -0.00 |

| GBP/JPY | GBPJPY | 201.2580 | -1.20% | -0.85% | -0.65% | +0.68% | +1.98% | +5.21% | +5.62% | +0.74% | 200.6091 | 199.2388 | 195.5411 | 33.39 | 0.68 |

| GBP/CHF | GBPCHF | 1.0544 | -0.52% | -0.96% | -1.03% | -1.73% | -3.81% | -6.88% | -5.05% | -8.29% | 1.0732 | 1.0793 | 1.0995 | 20.03 | -0.00 |

| AUD/JPY | AUDJPY | 100.3360 | +0.19% | +1.76% | +2.27% | +2.45% | +6.59% | +3.85% | +2.42% | -3.58% | 97.8023 | 96.6627 | 95.1983 | 48.66 | 0.52 |

| AUD/NZD | AUDNZD | 1.1409 | +0.47% | +0.93% | +0.65% | +2.17% | +5.61% | +2.91% | +5.08% | +5.25% | 1.1245 | 1.1064 | 1.0997 | 53.03 | 0.00 |

| CHF/JPY | CHFJPY | 190.8540 | -0.66% | +0.13% | +0.39% | +2.46% | +6.03% | +12.98% | +11.24% | +9.86% | 186.9070 | 184.5890 | 177.9676 | 53.59 | 1.39 |

| NZD/JPY | NZDJPY | 87.9210 | -0.28% | +0.82% | +1.68% | +0.28% | +0.93% | +0.91% | -2.55% | -8.40% | 86.9545 | 87.3513 | 86.5472 | 46.43 | 0.23 |

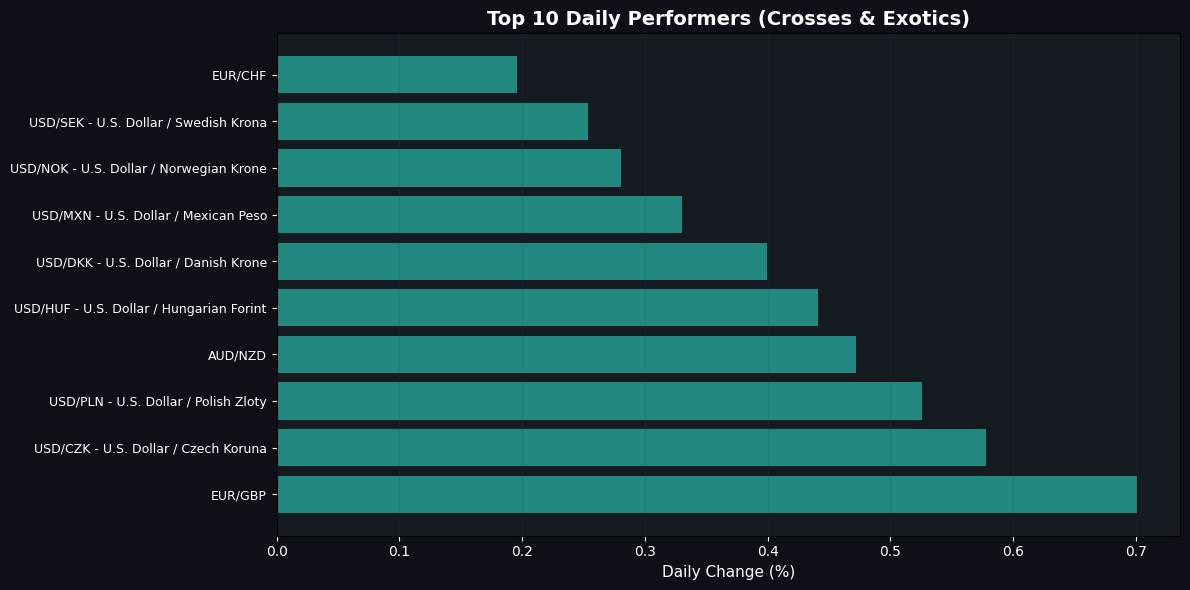

In the latest analysis of cross currency pairs, EUR/GBP leads with a robust gain of +0.70%, indicating strong bullish momentum influenced by favorable economic data from the Eurozone. AUD/NZD also showed resilience with a +0.47% increase, suggesting a strengthening Australian dollar amid stable commodity prices. Conversely, GBP/JPY exhibited notable weakness, declining by -1.20%, likely due to a combination of geopolitical uncertainties and softening UK economic indicators. The overall trend reflects a strengthening Euro against weaker currencies, while the Japanese yen remains under pressure across various pairs.

🌍 Exotic and Emerging Market Currencies

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| USD/TRY – U.S. Dollar / Turkish Lira | USDTRY | 41.9600 | +0.00% | -0.02% | +0.07% | +1.58% | +5.89% | +15.90% | +22.91% | +30.13% | 41.4953 | 40.8509 | 39.1967 | 78.94 | 0.15 |

| USD/ZAR – U.S. Dollar / South African Rand | USDZAR | 17.1815 | -0.17% | -1.19% | -1.06% | -0.90% | -3.05% | -6.35% | -3.62% | -8.15% | 17.3991 | 17.5851 | 17.9905 | 51.34 | -0.04 |

| USD/THB – U.S. Dollar / Thai Baht | USDTHB | 32.3700 | -0.77% | -1.49% | -1.16% | +2.24% | -0.80% | -4.01% | -4.91% | -11.75% | 32.2972 | 32.3832 | 32.9536 | 45.11 | 0.10 |

| USD/SEK – U.S. Dollar / Swedish Krona | USDSEK | 9.4004 | +0.25% | -0.29% | -0.26% | +1.92% | -1.13% | -12.16% | -7.79% | -11.21% | 9.4202 | 9.4967 | 9.8165 | 46.43 | -0.01 |

| USD/NOK – U.S. Dollar / Norwegian Krone | USDNOK | 10.0148 | +0.28% | -0.44% | -0.42% | +2.67% | -0.98% | -9.92% | -4.65% | -5.08% | 9.9989 | 10.0654 | 10.3765 | 54.32 | 0.00 |

| USD/DKK – U.S. Dollar / Danish Krone | USDDKK | 6.4355 | +0.40% | -0.03% | +0.46% | +2.35% | +0.18% | -9.51% | -4.02% | -6.54% | 6.3884 | 6.3979 | 6.6197 | 53.11 | 0.01 |

| USD/MXN – U.S. Dollar / Mexican Peso | USDMXN | 18.4500 | +0.33% | +0.09% | +0.46% | +0.90% | -2.85% | -9.17% | -6.18% | +8.49% | 18.4881 | 18.6261 | 19.3223 | 58.59 | -0.01 |

| USD/PLN – U.S. Dollar / Polish Zloty | USDPLN | 3.6517 | +0.53% | -0.02% | +0.32% | +2.12% | -0.25% | -8.10% | -5.39% | -7.55% | 3.6390 | 3.6465 | 3.7568 | 48.39 | 0.00 |

| USD/HUF – U.S. Dollar / Hungarian Forint | USDHUF | 334.6300 | +0.44% | -0.21% | +0.22% | +2.01% | -3.13% | -12.54% | -5.37% | -6.88% | 334.9187 | 338.7047 | 354.2695 | 44.56 | -0.03 |

| USD/CZK – U.S. Dollar / Czech Koruna | USDCZK | 20.9825 | +0.58% | +0.26% | +0.71% | +2.49% | -1.54% | -12.06% | -6.79% | -8.00% | 20.8293 | 20.9837 | 21.9463 | 52.93 | 0.03 |

In the exotic currency pair market, the U.S. Dollar has shown notable strength against Central European currencies, with the USD/CZK, USD/PLN, and USD/HUF all recording gains of over 0.4%. This trend suggests a strengthening of the dollar in response to regional economic factors or monetary policy divergences. Conversely, the USD/THB and USD/ZAR have displayed weakness, particularly the Thai Baht, which declined by 0.77%, indicating potential economic challenges or shifts in investor sentiment in Southeast Asia and South Africa. The USD/TRY remains stagnant, reflecting ongoing geopolitical uncertainties and inflationary pressures in Turkey that are likely keeping the pair in a tight range.

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.