The European Central Bank hiked rates by 0.25% to 3.75%.

Here a very short summary of the Rate Decision :

The European Central Bank (ECB) has raised key interest rates by 25 basis points to combat persistently high inflation. The Governing Council will continue to take necessary measures to achieve the 2% inflation target. Additionally, the remuneration of minimum reserves is set at 0% to maintain control over monetary policy. The President of the ECB will provide further details in a press conference.

And a summary of the press conference:

The ECB raises interest rates by 25 basis points due to declining but still high inflation. The goal is to achieve a timely return of inflation to the 2% target. Future decisions will be data-dependent, focusing on the inflation outlook and monetary policy transmission. The remuneration of minimum reserves is set at 0%. The economic outlook is uncertain, and risks to growth and inflation are considered. Monetary policy tightening is transmitting effectively to financing conditions. The ECB stands ready to adjust its instruments to ensure price stability and smooth monetary policy transmission.

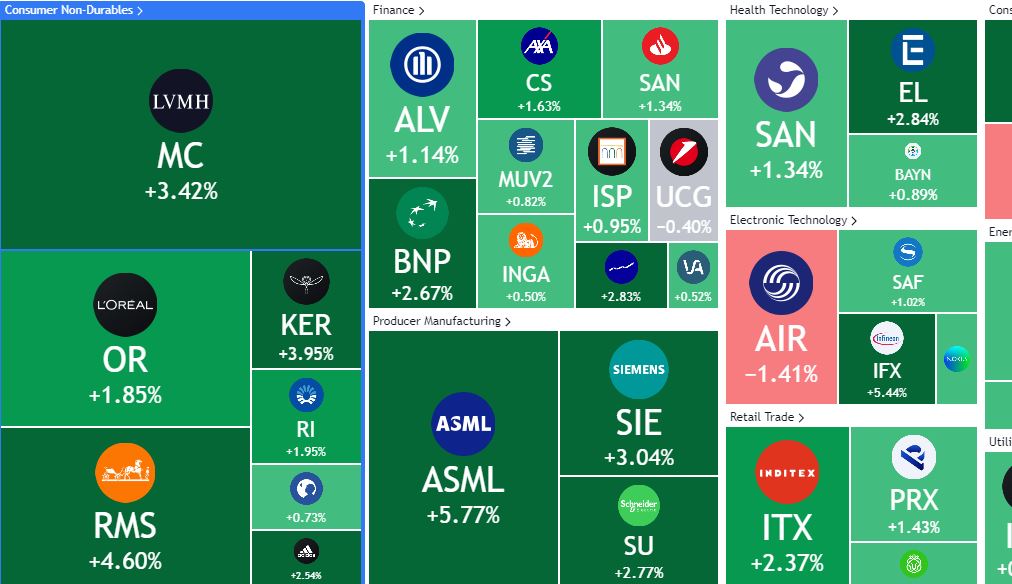

EUR/USD tanking 150 pips from its intraday high. It is trading at 1.0997, down 0.8%, while the EUROSTOXX 50 ,the gauge of the most capitalized eurozone stocks, is up by 2.21% to 4,441.45

One possible interpretation is that Eurozone rates would have likely reached a zenith, with US rates more prone to a rate hike , given the combination of a stronger economy (Confirmed by today Durable Goods Orders figures) and hawkish mindset among FOMC members.