## Forex and Global News

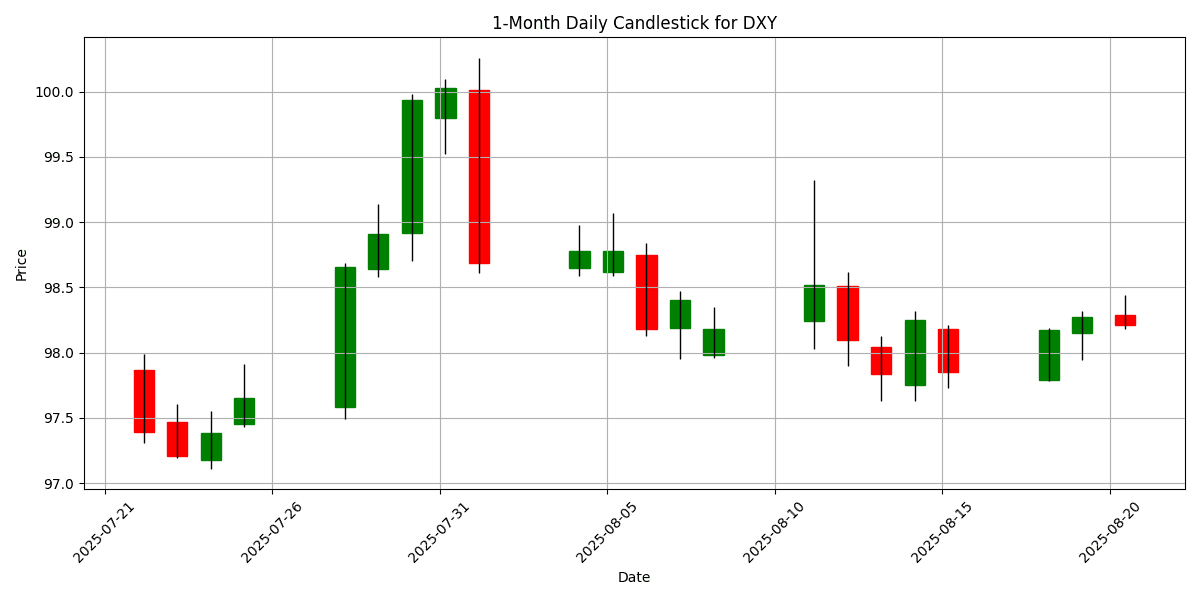

In today’s forex market, the sentiment remains cautious amid geopolitical tensions and mixed corporate earnings reports. The U.S. dollar (USD) is slightly stronger, with the DXY index at 98.21, reflecting a daily change of -0.0580%.

Geopolitical developments are also influencing market dynamics, particularly with Israel’s mobilization of 60,000 reservists for a Gaza invasion, raising concerns about regional instability. Meanwhile, European defense stocks are under pressure amid renewed hopes for a ceasefire in Ukraine.

In commodities, gold prices are testing three-week lows as traders await insights from the Federal Reserve’s upcoming minutes and Jerome Powell’s speech at the Jackson Hole Economic Symposium, which could further impact the USD and related currencies. Overall, the market remains in a wait-and-see mode, with major currencies like the euro (EUR), Japanese yen (JPY), and British pound (GBP) reflecting uncertainty amid these developments.

## Economic Calendar Events Today

All times are in US Eastern Time (New York).

| Date | Time | Cur | Imp | Event | Actual | Forecast |

|---|---|---|---|---|---|---|

| 2025-08-20 | 02:00 | 🇬🇧 | High | CPI (YoY) (Jul) | 3.8% | 3.7% |

| 2025-08-20 | 02:00 | 🇬🇧 | Medium | CPI (MoM) (Jul) | 0.1% | -0.1% |

| 2025-08-20 | 02:00 | 🇬🇧 | Medium | CPIH (YoY) | 4.2% | |

| 2025-08-20 | 02:00 | 🇪🇺 | Medium | German PPI (MoM) (Jul) | -0.1% | 0.1% |

| 2025-08-20 | 03:10 | 🇪🇺 | Medium | ECB President Lagarde Speaks | ||

| 2025-08-20 | 03:30 | 🇸🇪 | Medium | Interest Rate Decision | 2.00% | 2.00% |

| 2025-08-20 | 05:00 | 🇪🇺 | Medium | Core CPI (YoY) (Jul) | 2.3% | 2.3% |

| 2025-08-20 | 05:00 | 🇪🇺 | Medium | CPI (MoM) (Jul) | 0.0% | 0.0% |

| 2025-08-20 | 05:00 | 🇪🇺 | High | CPI (YoY) (Jul) | 2.0% | 2.0% |

| 2025-08-20 | 08:30 | 🇨🇦 | Medium | New Housing Price Index (MoM) (Jul) | 0.1% | |

| 2025-08-20 | 10:30 | 🇺🇸 | High | Crude Oil Inventories | -0.800M | |

| 2025-08-20 | 10:30 | 🇺🇸 | Medium | Cushing Crude Oil Inventories | ||

| 2025-08-20 | 11:00 | 🇺🇸 | Medium | Fed Waller Speaks | ||

| 2025-08-20 | 13:00 | 🇺🇸 | Medium | 20-Year Bond Auction | ||

| 2025-08-20 | 14:00 | 🇺🇸 | High | FOMC Meeting Minutes | ||

| 2025-08-20 | 15:00 | 🇺🇸 | Medium | FOMC Member Bostic Speaks | ||

| 2025-08-20 | 20:00 | 🇺🇸 | Medium | Jackson Hole Symposium | ||

| 2025-08-20 | 20:30 | 🇯🇵 | Medium | au Jibun Bank Services PMI (Aug) |

On August 20, 2025, several key economic events are poised to influence foreign exchange markets, particularly for the GBP and EUR.

At 02:00 ET, UK inflation data was released, showing the Consumer Price Index (CPI) (YoY) for July at 3.8%, surpassing the forecast of 3.7%. Additionally, the CPI (MoM) came in at 0.1%, defying expectations of a -0.1% decline. This stronger-than-expected inflation data could bolster the GBP, as it raises the likelihood of a more hawkish stance from the Bank of England.

In the Eurozone, German Producer Price Index (PPI) (MoM) data released at the same time showed a decrease of -0.1%, falling short of the anticipated 0.1% increase. This negative surprise may weigh on the EUR, indicating potential economic weakness in Germany. However, core inflation data for the Eurozone remained stable, with the CPI (YoY) at 2.0%, aligning with forecasts.

Later in the day, the focus will shift to the U.S. with multiple events, including the release of the FOMC Meeting Minutes and speeches from Fed officials, which could further impact USD volatility, especially ahead of the Jackson Hole Symposium later in the evening.

## Major FX Group

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EUR/USD – Euro / U.S. Dollar | EURUSD | 1.1651 | -0.1491 | -0.0035 | -0.2237 | 0.1736 | 2.8219 | 10.96 | 11.96 | 5.0915 | 1.1647 | 1.1455 | 1.0985 | 68.51 | 0.0012 |

| USD/JPY – U.S. Dollar / Japanese Yen | USDJPY | 147.44 | -0.3205 | -0.1686 | -0.2139 | -0.6663 | 2.5648 | -1.3159 | -6.0849 | 0.5065 | 146.52 | 145.55 | 149.30 | 42.20 | 0.2171 |

| GBP/USD – British Pound / U.S. Dollar | GBPUSD | 1.3495 | -0.0945 | -0.2605 | -0.0648 | 0.5925 | 0.5695 | 6.5117 | 7.5413 | 3.8881 | 1.3505 | 1.3397 | 1.3008 | 69.92 | 0.0013 |

| USD/CHF – U.S. Dollar / Swiss Franc | USDCHF | 0.8072 | -0.0260 | -0.0396 | 0.1315 | 0.7514 | -2.1659 | -10.1174 | -10.6328 | -6.3975 | 0.8038 | 0.8177 | 0.8565 | 40.89 | 0.0011 |

| AUD/USD – Australian Dollar / U.S. Dollar | AUDUSD | 0.6438 | -0.8760 | -0.9174 | -1.4073 | -1.1395 | 0.0747 | 0.5279 | 3.5033 | -4.4158 | 0.6521 | 0.6451 | 0.6388 | 48.52 | -0.0009 |

| USD/CAD – U.S. Dollar / Canadian Dollar | USDCAD | 1.3869 | 0.4847 | 0.4047 | 0.7219 | 1.0565 | 0.0592 | -2.1656 | -3.3506 | 1.7535 | 1.3704 | 1.3801 | 1.4037 | 55.96 | 0.0031 |

| NZD/USD – New Zealand Dollar / U.S. Dollar | NZDUSD | 0.5830 | -1.5909 | -1.5460 | -2.1528 | -2.0707 | -1.7518 | 1.1321 | 3.3660 | -4.7103 | 0.5990 | 0.5944 | 0.5835 | 38.91 | -0.0023 |

In the current forex landscape, select pairs exhibit notable overbought and oversold conditions. The EUR/USD is approaching overbought territory with an RSI of 68.51, while its MACD remains marginally positive, indicating bullish momentum. However, caution is warranted as it nears the 70 threshold.

The GBP/USD is similarly positioned, with an RSI of 69.92, suggesting potential overbought conditions. Its MACD is also positive, reinforcing the bullish sentiment, yet traders should remain vigilant for a possible correction.

Conversely, the USD/JPY shows a more neutral RSI at 42.20, with a positive MACD, indicating a stable environment without immediate overbought or oversold signals. The USD/CHF and NZD/USD both display oversold conditions, with RSIs of 40.89 and 38.91, respectively, coupled with negative MACDs, suggesting bearish trends.

Overall, the EUR/USD and GBP/USD warrant attention for potential revers

## Cross FX Group

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EUR/GBP | EURGBP | 0.8631 | -0.0799 | 0.2358 | -0.1874 | -0.4407 | 2.2147 | 4.1463 | 4.0847 | 1.1770 | 0.8623 | 0.8549 | 0.8441 | 51.80 | 0.0000 |

| EUR/JPY | EURJPY | 171.73 | -0.4943 | -0.1969 | -0.4648 | -0.5196 | 5.4366 | 9.4672 | 5.1075 | 5.6026 | 170.62 | 166.71 | 163.80 | 56.92 | 0.4282 |

| EUR/CHF | EURCHF | 0.9402 | -0.2006 | -0.0797 | -0.1243 | 0.8972 | 0.5669 | -0.3012 | 0.0266 | -1.6837 | 0.9360 | 0.9362 | 0.9387 | 69.84 | 0.0023 |

| EUR/AUD | EURAUD | 1.8100 | 0.7543 | 0.9459 | 1.2202 | 1.3495 | 2.7714 | 10.36 | 8.1754 | 9.9897 | 1.7861 | 1.7755 | 1.7191 | 77.96 | 0.0043 |

| GBP/JPY | GBPJPY | 198.98 | -0.4124 | -0.4224 | -0.2726 | -0.0698 | 3.1584 | 5.1287 | 1.0041 | 4.4175 | 197.86 | 194.98 | 194.02 | 55.18 | 0.4915 |

| GBP/CHF | GBPCHF | 1.0893 | -0.1192 | -0.3011 | 0.0698 | 1.3491 | -1.6087 | -4.2678 | -3.8902 | -2.7820 | 1.0854 | 1.0952 | 1.1123 | 62.64 | 0.0026 |

| AUD/JPY | AUDJPY | 94.88 | -1.2367 | -1.1255 | -1.6564 | -1.8396 | 2.6031 | -0.8082 | -2.8149 | -3.9678 | 95.51 | 93.87 | 95.33 | 39.10 | 0.0128 |

| AUD/NZD | AUDNZD | 1.1043 | 0.7224 | 0.6334 | 0.7582 | 1.0117 | 1.8574 | -0.5745 | 0.1419 | 0.3068 | 1.0885 | 1.0850 | 1.0949 | 75.19 | 0.0028 |

| CHF/JPY | CHFJPY | 182.66 | -0.2854 | -0.1137 | -0.3328 | -1.3972 | 4.8513 | 9.8114 | 5.0979 | 7.4081 | 182.27 | 178.05 | 174.49 | 46.21 | 0.0121 |

| NZD/JPY | NZDJPY | 85.91 | -1.9405 | -1.7397 | -2.3906 | -2.7531 | 0.7411 | -0.2265 | -2.9574 | -4.2606 | 87.72 | 86.51 | 87.06 | 32.70 | -0.2078 |

Currently, the EUR/AUD pair exhibits an overbought condition with an RSI of 77.96, suggesting potential price corrections ahead. The EUR/CHF is nearing overbought territory with an RSI of 69.84, while the MACD remains neutral, indicating a cautious approach. Conversely, the AUD/JPY and NZD/JPY pairs are in oversold territory, with RSIs of 39.10 and 32.70, respectively, and negative MACD values, suggesting potential buying opportunities. The GBP/JPY and GBP/CHF pairs show moderate conditions, with RSIs below 70, indicating stability. Traders should monitor these pairs closely for potential reversals or continuations based on these technical indicators.

## Exotics and Emerging

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| USD/TRY – U.S. Dollar / Turkish Lira | USDTRY | 40.92 | 0.0830 | 0.1717 | 0.3975 | 1.2935 | 5.3745 | 12.45 | 15.90 | 21.20 | 40.21 | 39.41 | 37.56 | 84.18 | 0.1960 |

| USD/ZAR – U.S. Dollar / South African Rand | USDZAR | 17.70 | 0.4208 | 0.6733 | 0.7514 | -0.0119 | -1.5180 | -3.3861 | -5.6819 | -0.0463 | 17.77 | 18.08 | 18.17 | 38.87 | -0.0511 |

| USD/THB – U.S. Dollar / Thai Baht | USDTHB | 32.50 | -0.0308 | 0.1232 | 0.3396 | 0.3706 | -0.6116 | -3.1008 | -4.8010 | -5.3003 | 32.47 | 32.86 | 33.48 | 41.24 | -0.0078 |

| USD/SEK – U.S. Dollar / Swedish Krona | USDSEK | 9.5851 | 0.2812 | 0.0373 | 0.4640 | -0.7417 | 0.1407 | -9.8224 | -13.0514 | -6.9835 | 9.5728 | 9.6388 | 10.21 | 33.03 | -0.0078 |

| USD/NOK – U.S. Dollar / Norwegian Krone | USDNOK | 10.27 | 0.6172 | 0.4871 | 0.5338 | 0.9032 | 0.9179 | -7.4633 | -9.3775 | -2.5125 | 10.13 | 10.25 | 10.68 | 47.23 | 0.0179 |

| USD/DKK – U.S. Dollar / Danish Krone | USDDKK | 6.4088 | 0.1920 | 0.0364 | 0.2845 | -0.1391 | -2.6607 | -9.7716 | -10.5770 | -4.7802 | 6.4075 | 6.5173 | 6.8064 | 32.15 | -0.0063 |

| USD/MXN – U.S. Dollar / Mexican Peso | USDMXN | 18.80 | 0.1835 | -0.0070 | 1.2230 | 0.5060 | -2.9270 | -7.3621 | -8.8806 | 0.7224 | 18.76 | 19.21 | 19.79 | 47.53 | -0.0104 |

| USD/PLN – U.S. Dollar / Polish Zloty | USDPLN | 3.6470 | 0.2350 | -0.2071 | 0.1516 | -0.0566 | -2.4995 | -7.9170 | -11.2012 | -5.1340 | 3.6540 | 3.7162 | 3.8712 | 31.72 | -0.0050 |

| USD/HUF – U.S. Dollar / Hungarian Forint | USDHUF | 338.55 | 0.1435 | -0.1760 | -0.0198 | -1.2833 | -4.6762 | -11.5980 | -14.2921 | -4.7239 | 342.50 | 350.72 | 368.88 | 25.58 | -1.4928 |

| USD/CZK – U.S. Dollar / Czech Koruna | USDCZK | 21.02 | 0.3160 | 0.0419 | 0.3811 | -0.6504 | -4.2302 | -11.8483 | -12.9912 | -7.2726 | 21.14 | 21.64 | 22.76 | 33.51 | -0.0644 |

In the current forex landscape, USD/TRY is significantly overbought with an RSI of 84.18, indicating potential exhaustion in upward momentum, while MACD remains positive, suggesting bullish sentiment persists. Conversely, USD/ZAR and USD/SEK are both in oversold territory, with RSIs of 38.87 and 33.03, respectively, and negative MACD readings, indicating bearish pressure. The moving averages for these pairs suggest a lack of upward momentum. Additionally, USD/HUF shows extreme oversold conditions with an RSI of 25.58 and a notably negative MACD, highlighting significant downside potential. Traders should monitor these indicators for potential reversals or continuations.