## Forex and Global News

Today, forex markets reacted to significant geopolitical and economic developments. The U.S. Federal Reserve’s recent minutes indicated a consensus among officials for potential interest rate cuts by the end of 2025, fostering a cautious sentiment around the dollar. Meanwhile, the Euro (EUR) strengthened against the Pound Sterling (GBP), with the EUR/GBP rising to approximately 0.8680, influenced by political uncertainty in France as President Macron prepares to appoint a new Prime Minister.

In the commodities space, West Texas Intermediate (WTI) crude oil prices rose to $62.24 per barrel, reflecting bullish sentiment. Gold (XAU/USD) remains under pressure but holds above the critical $4,000 mark as traders await insights from Fed Chair Jerome Powell. Additionally, the ongoing peace negotiations between Israel and Hamas, which include a hostage release, may ease regional tensions, impacting market dynamics.

The DXY is currently at 98.86, reflecting a daily change of 0.1378%.

## Economic Calendar Events Today

All times are in US Eastern Time (New York).

| Date | Time | Cur | Imp | Event | Actual | Forecast |

|---|---|---|---|---|---|---|

| 2025-10-09 | 02:00 | 🇪🇺 | Medium | German Trade Balance (Aug) | 17.2B | 15.1B |

| 2025-10-09 | 03:00 | 🇪🇺 | Medium | German Buba Balz Speaks | ||

| 2025-10-09 | 04:30 | 🇬🇧 | Medium | BoE MPC Member Mann Speaks | ||

| 2025-10-09 | 06:00 | 🇪🇺 | Medium | Eurogroup Meetings | ||

| 2025-10-09 | 07:30 | 🇪🇺 | Medium | ECB Publishes Account of Monetary Policy Meeting | ||

| 2025-10-09 | 08:00 | 🇨🇦 | Medium | BoC Senior Deputy Governor Rogers Speaks | ||

| 2025-10-09 | 08:00 | 🇧🇷 | Medium | CPI (YoY) (Sep) | 5.22% | |

| 2025-10-09 | 08:30 | 🇺🇸 | High | Fed Chair Powell Speaks | ||

| 2025-10-09 | 08:35 | 🇺🇸 | Medium | FOMC Member Bowman Speaks | ||

| 2025-10-09 | 11:00 | 🇺🇸 | Medium | Construction Spending (MoM) (Aug) | -0.1% | |

| 2025-10-09 | 11:00 | 🇪🇺 | Medium | ECB’s Lane Speaks | ||

| 2025-10-09 | 12:00 | 🇺🇸 | Medium | WASDE Report | ||

| 2025-10-09 | 12:45 | 🇺🇸 | Medium | Fed Vice Chair for Supervision Barr Speaks | ||

| 2025-10-09 | 13:00 | 🇺🇸 | High | 30-Year Bond Auction | ||

| 2025-10-09 | 13:00 | 🇺🇸 | Medium | Atlanta Fed GDPNow (Q3) | 3.8% | |

| 2025-10-09 | 15:45 | 🇺🇸 | Medium | FOMC Member Bowman Speaks | ||

| 2025-10-09 | 16:30 | 🇺🇸 | Medium | Fed’s Balance Sheet | ||

| 2025-10-09 | 17:30 | 🇳🇿 | Medium | Business NZ PMI (Sep) | ||

| 2025-10-09 | 18:00 | 🇦🇺 | Medium | RBA Assist Gov Kent Speaks | ||

| 2025-10-09 | 21:40 | 🇺🇸 | Medium | FOMC Member Daly Speaks |

On October 9, 2025, key economic events are poised to influence the FX markets, particularly concerning the Euro (EUR) and the U.S. Dollar (USD).

The German Trade Balance for August reported a surplus of €17.2 billion, significantly surpassing the forecast of €15.1 billion. This positive surprise is likely to bolster the EUR, reflecting stronger-than-expected export performance, which may attract bullish sentiment among investors.

At 11:00 AM, the U.S. Construction Spending for August is anticipated to decline by 0.1%. Should this data come in weaker than expected, it could exert downward pressure on the USD, indicating potential weaknesses in the U.S. economy.

Additionally, several speeches from key Federal Reserve officials, including Fed Chair Powell and Vice Chair Barr, are scheduled throughout the day. Market participants will closely monitor their remarks for insights into future monetary policy, which could further influence USD volatility.

Overall, the day holds potential for significant movement in the EUR/USD pair, driven by the German trade data and U.S. economic indicators, as well as central bank communications that could reshape market expectations.

## Major FX Group

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EUR/USD – Euro / U.S. Dollar | EURUSD | 1.1631 | -0.0430 | -0.8027 | -0.8783 | -1.1737 | -0.6131 | 3.3147 | 11.77 | 5.9700 | 1.1689 | 1.1633 | 1.1201 | 32.62 | -0.0008 |

| USD/JPY – U.S. Dollar / Japanese Yen | USDJPY | 152.93 | 0.2675 | 3.9286 | 3.9760 | 3.7777 | 4.5410 | 6.3890 | -2.5886 | 3.2209 | 147.93 | 146.63 | 148.31 | 72.09 | 0.6378 |

| GBP/USD – British Pound / U.S. Dollar | GBPUSD | 1.3387 | -0.1417 | -0.4436 | -0.6912 | -1.2254 | -1.4181 | 3.0397 | 6.6770 | 2.2312 | 1.3471 | 1.3501 | 1.3157 | 37.54 | -0.0021 |

| USD/CHF – U.S. Dollar / Swiss Franc | USDCHF | 0.8017 | 0.0374 | 0.5872 | 0.6011 | 1.1213 | 0.6251 | -2.3222 | -11.2418 | -6.4964 | 0.8010 | 0.8047 | 0.8408 | 65.97 | -0.0007 |

| AUD/USD – Australian Dollar / U.S. Dollar | AUDUSD | 0.6595 | 0.0607 | -0.0468 | -0.3098 | -0.0468 | 0.0152 | 5.9711 | 6.0289 | -2.1455 | 0.6551 | 0.6533 | 0.6417 | 45.92 | 0.0009 |

| USD/CAD – U.S. Dollar / Canadian Dollar | USDCAD | 1.3948 | -0.0072 | -0.0924 | 0.0610 | 1.1091 | 2.1360 | -0.0215 | -2.8000 | 2.1682 | 1.3831 | 1.3761 | 1.3985 | 78.61 | 0.0042 |

| NZD/USD – New Zealand Dollar / U.S. Dollar | NZDUSD | 0.5786 | -0.0518 | -0.5757 | -0.6150 | -2.6760 | -4.2324 | 0.6631 | 2.5939 | -5.6332 | 0.5884 | 0.5947 | 0.5846 | 32.52 | -0.0029 |

In the current forex landscape, several key pairs exhibit notable overbought and oversold conditions based on RSI, MACD, and moving average crossovers.

The USD/JPY is in overbought territory with an RSI of 72.09, indicating potential upward exhaustion. The positive MACD further supports bullish momentum, but caution is warranted as price corrections may occur. Conversely, the USD/CAD is significantly overbought at an RSI of 78.61, with a positive MACD suggesting sustained bullish activity; however, this raises the risk of a sharp pullback.

On the other hand, EUR/USD and NZD/USD are both in oversold conditions, with RSIs of 32.62 and 32.52, respectively. Both pairs show negative MACD readings, indicating bearish momentum, which could present buying opportunities if market sentiment shifts. The GBP/USD and AUD/USD are also in neutral zones, suggesting limited immediate volatility, but they remain influenced by broader market trends. Traders

## Cross FX Group

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EUR/GBP | EURGBP | 0.8686 | 0.1037 | -0.3819 | -0.2080 | 0.0311 | 0.8066 | 0.2505 | 4.7528 | 3.6342 | 0.8676 | 0.8613 | 0.8508 | 51.95 | 0.0010 |

| EUR/JPY | EURJPY | 177.83 | 0.2204 | 3.0702 | 3.0415 | 2.5347 | 3.8903 | 9.8892 | 8.8380 | 9.3594 | 172.85 | 170.52 | 165.87 | 68.49 | 0.7317 |

| EUR/CHF | EURCHF | 0.9322 | 0.0000 | -0.2461 | -0.3016 | -0.0868 | -0.0043 | 0.8885 | -0.8192 | -0.9246 | 0.9360 | 0.9356 | 0.9390 | 41.87 | -0.0009 |

| EUR/AUD | EURAUD | 1.7635 | -0.0850 | -0.7636 | -0.5711 | -1.1258 | -0.6177 | -2.5050 | 5.3968 | 8.2925 | 1.7844 | 1.7805 | 1.7443 | 43.27 | -0.0027 |

| GBP/JPY | GBPJPY | 204.72 | 0.1218 | 3.4696 | 3.2609 | 2.5111 | 3.0670 | 9.6310 | 3.9219 | 5.5332 | 199.22 | 197.95 | 194.91 | 66.57 | 0.6115 |

| GBP/CHF | GBPCHF | 1.0732 | -0.1117 | 0.1418 | -0.0847 | -0.1098 | -0.7959 | 0.6575 | -5.3073 | -4.3835 | 1.0787 | 1.0863 | 1.1040 | 43.52 | -0.0023 |

| AUD/JPY | AUDJPY | 100.83 | 0.3064 | 3.8682 | 3.6376 | 3.7080 | 4.5402 | 12.72 | 3.2830 | 0.9896 | 96.86 | 95.76 | 95.09 | 71.92 | 0.5576 |

| AUD/NZD | AUDNZD | 1.1394 | 0.0878 | 0.5030 | 0.2799 | 2.6681 | 4.4057 | 5.2411 | 3.3287 | 3.6638 | 1.1123 | 1.0980 | 1.0976 | 70.05 | 0.0068 |

| CHF/JPY | CHFJPY | 190.72 | 0.2191 | 3.3162 | 3.3403 | 2.6146 | 3.8846 | 8.9235 | 9.7355 | 10.38 | 184.66 | 182.24 | 176.65 | 68.53 | 0.9631 |

| NZD/JPY | NZDJPY | 88.47 | 0.2232 | 3.3382 | 3.3370 | 1.0093 | 0.1256 | 7.1038 | -0.0587 | -2.5939 | 87.06 | 87.19 | 86.62 | 61.61 | -0.0338 |

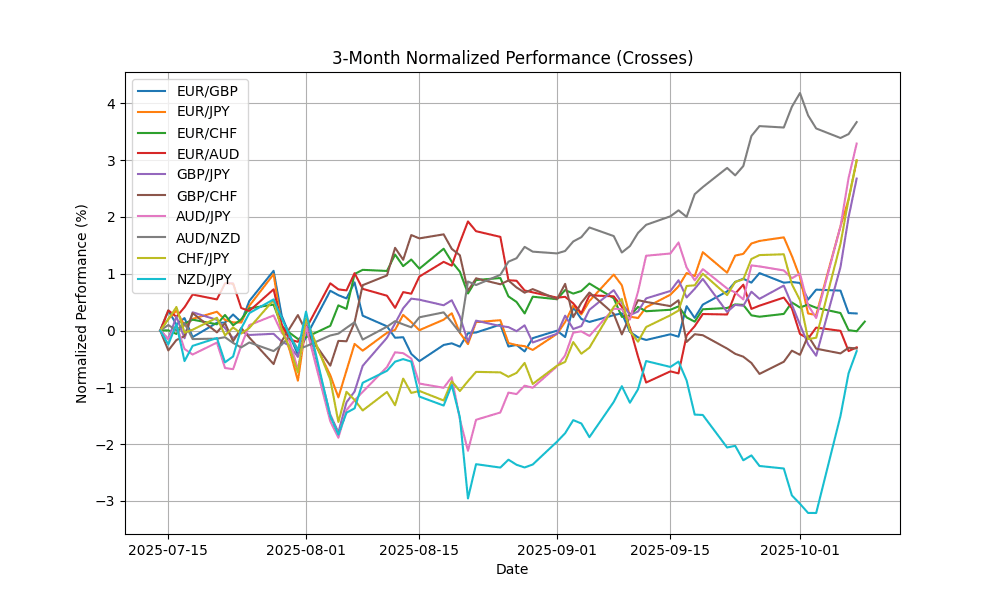

Current analysis reveals mixed conditions across key FX pairs. EUR/JPY and CHF/JPY are nearing overbought territory with RSIs of 68.49 and 68.53, respectively, suggesting potential price corrections. The AUD/JPY and AUD/NZD pairs exceed the overbought threshold at 71.92 and 70.05, supported by positive MACD readings, indicating bullish momentum but caution is warranted for potential reversals. Conversely, EUR/CHF and GBP/CHF display oversold conditions, with RSIs below 50 and negative MACDs, suggesting possible buying opportunities. Overall, traders should monitor these indicators closely for potential shifts in market sentiment.

## Exotics and Emerging

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| USD/TRY – U.S. Dollar / Turkish Lira | USDTRY | 41.71 | -0.0158 | 0.1755 | 0.2904 | 1.0991 | 3.8741 | 9.6733 | 18.15 | 21.75 | 41.17 | 40.47 | 38.74 | 94.06 | 0.1640 |

| USD/ZAR – U.S. Dollar / South African Rand | USDZAR | 17.16 | 0.1371 | -0.6311 | -0.2632 | -1.7243 | -3.1589 | -11.9323 | -8.5457 | -2.3765 | 17.54 | 17.67 | 18.07 | 40.41 | -0.0923 |

| USD/THB – U.S. Dollar / Thai Baht | USDTHB | 32.57 | 0.2154 | 0.4007 | 0.5557 | 2.8093 | -0.0614 | -3.6960 | -4.5959 | -2.9210 | 32.24 | 32.38 | 33.09 | 77.34 | 0.0871 |

| USD/SEK – U.S. Dollar / Swedish Krona | USDSEK | 9.4354 | 0.0796 | 0.4463 | 0.6613 | 0.9013 | -0.6547 | -3.9689 | -14.4091 | -8.6271 | 9.4728 | 9.5176 | 9.9426 | 61.53 | -0.0134 |

| USD/NOK – U.S. Dollar / Norwegian Krone | USDNOK | 9.9829 | 0.1073 | 0.0782 | 0.6953 | 0.0942 | -0.9033 | -7.3450 | -11.8712 | -6.7535 | 10.06 | 10.08 | 10.48 | 62.32 | -0.0180 |

| USD/DKK – U.S. Dollar / Danish Krone | USDDKK | 6.4209 | 0.0577 | 0.8355 | 0.9226 | 1.2162 | 0.7021 | -3.1829 | -10.4077 | -5.4987 | 6.3858 | 6.4159 | 6.6763 | 67.77 | 0.0047 |

| USD/MXN – U.S. Dollar / Mexican Peso | USDMXN | 18.33 | 0.0289 | -0.4188 | -0.2582 | -1.7047 | -1.4319 | -10.9717 | -11.1345 | -5.2235 | 18.58 | 18.75 | 19.48 | 55.30 | -0.0582 |

| USD/PLN – U.S. Dollar / Polish Zloty | USDPLN | 3.6596 | 0.1176 | 0.8052 | 0.8460 | 1.4358 | 0.7940 | -3.2244 | -10.8951 | -6.5523 | 3.6431 | 3.6597 | 3.7928 | 64.41 | 0.0000 |

| USD/HUF – U.S. Dollar / Hungarian Forint | USDHUF | 336.60 | 0.2006 | 1.4907 | 1.6010 | 0.8107 | -1.1782 | -6.3854 | -14.7873 | -7.4647 | 336.40 | 341.32 | 358.82 | 64.58 | -0.4896 |

| USD/CZK – U.S. Dollar / Czech Koruna | USDCZK | 20.95 | 0.1003 | 1.2855 | 1.4292 | 1.4169 | -0.3766 | -5.8638 | -13.2760 | -9.1370 | 20.87 | 21.11 | 22.19 | 65.74 | -0.0069 |

In the current analysis, USD/TRY is significantly overbought with an RSI of 94.06 and a positive MACD, suggesting potential for a price correction. Conversely, USD/ZAR shows bearish momentum with an RSI of 40.41 and a negative MACD, indicating a possible oversold condition. USD/THB is also in overbought territory with an RSI of 77.34, while other pairs like USD/SEK and USD/NOK are nearing neutral territory, with RSIs of 61.53 and 62.32, respectively. Overall, traders should exercise caution in overbought pairs and look for potential buying opportunities in oversold conditions.