FX Today: FX Today: Low Volatility on Monday

📰 Forex and Global Market News

**Market Overview:**

Today’s forex market exhibited mixed signals amid ongoing geopolitical tensions and economic uncertainty. The U.S. Dollar (USD) traded at 98.60, reflecting a modest gain of 0.1575% as traders assessed the implications of potential Federal Reserve rate cuts and the looming U.S. government shutdown.

**Key News Items:**

The Euro (EUR) struggled to maintain momentum against the USD, hovering around 1.1650 as bulls lacked conviction following a recent pullback. The Australian Dollar (AUD) showed resilience, rebounding to 0.6500, buoyed by a new critical minerals agreement with the U.S. that promises an $8.5 billion project pipeline. Meanwhile, the Japanese Yen (JPY) remained under pressure as safe-haven demand shifted towards gold, which surged over 2% to near $4,345, driven by expectations of continued easing from the Fed. Silver also gained, reflecting safe-haven interest amid trade jitters and fiscal concerns.

Geopolitical risks, particularly surrounding U.S. domestic issues and global trade dynamics, continued to weigh on market sentiment. The Canadian Dollar (CAD) awaits crucial inflation data, which could further influence its trajectory.

**Closing:**

Overall, the forex market remains cautious, with the DXY reflecting a stable yet uncertain environment as investors navigate through economic and geopolitical complexities.

📅 Economic Calendar Events Today

All times are in US Eastern Time (ET)

| Date | Time | Cur | Imp | Event | Actual | Forecast |

|---|---|---|---|---|---|---|

| 2025-10-20 | 03:00 | 🇪🇺 | Medium | German PPI (MoM) (Sep) | -0.1% | 0.1% |

| 2025-10-20 | 04:00 | 🇪🇺 | Medium | ECB’s Schnabel Speaks | ||

| 2025-10-20 | 08:30 | 🇨🇦 | Medium | RMPI (MoM) (Sep) | 1.7% | |

| 2025-10-20 | 10:00 | 🇪🇺 | Medium | ECB’s Schnabel Speaks | ||

| 2025-10-20 | 10:30 | 🇨🇦 | Medium | BoC Business Outlook Survey | ||

| 2025-10-20 | 13:00 | 🇪🇺 | Medium | German Buba Balz Speaks | ||

| 2025-10-20 | 15:00 | 🇪🇺 | Medium | German Buba President Nagel Speaks | ||

| 2025-10-20 | 17:00 | 🇺🇸 | Medium | TIC Net Long-Term Transactions (Aug) | ||

| 2025-10-20 | 21:00 | 🇪🇺 | Medium | German Buba President Nagel Speaks |

**Overview:**

Today’s economic calendar features several key events, particularly from the Eurozone and Canada, which are crucial for forex traders. Notably, the German Producer Price Index (PPI) and the Canadian Raw Materials Price Index (RMPI) will provide insights into inflationary pressures and economic health.

**Key Releases:**

1. **German PPI (MoM) – September**: Released at 03:00 ET, the actual figure came in at -0.1%, significantly below the forecast of 0.1%. This unexpected decline may signal weakening inflation in Germany, potentially impacting the Euro.

2. **Canadian RMPI (MoM) – September**: At 08:30 ET, the RMPI showed a robust increase of 1.7%, although no forecast was provided. This positive data could bolster the Canadian dollar, reflecting strong commodity prices.

3. **ECB Speeches**: Multiple speeches from ECB officials, including Schnabel and Buba President Nagel throughout the day, may provide additional context on monetary policy direction, influencing the Euro.

**FX Impact:**

The EUR/USD and EUR/GBP pairs are likely to experience volatility due to the disappointing German PPI. Conversely, the CAD/USD pair may strengthen following the positive RMPI data. Traders should monitor the ECB speeches closely for any hints on future policy adjustments, which could further sway the Euro.

💱 Major Currency Pairs

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EUR/USD – Euro / U.S. Dollar | EURUSD | 1.1644 | -0.1287 | +0.3596 | +0.3585 | -1.2472 | -0.4322 | +2.5790 | +11.90 | +7.5207 | 1.1693 | 1.1653 | 1.1246 | 39.93 | -0.0022 |

| USD/JPY – U.S. Dollar / Japanese Yen | USDJPY | 150.75 | -0.0471 | -0.6452 | -0.8576 | +1.8959 | +2.2678 | +5.6515 | -3.9766 | +0.4344 | 148.54 | 147.26 | 148.07 | 59.28 | 0.9092 |

| GBP/USD – British Pound / U.S. Dollar | GBPUSD | 1.3408 | -0.1341 | +0.6485 | +0.5385 | -1.0919 | -0.6038 | +1.0159 | +6.8443 | +3.0137 | 1.3475 | 1.3492 | 1.3189 | 47.23 | -0.0028 |

| USD/CHF – U.S. Dollar / Swiss Franc | USDCHF | 0.7923 | -0.2015 | -1.1515 | -1.2489 | -0.0265 | -0.7247 | -4.0880 | -12.28 | -8.5030 | 0.7997 | 0.8026 | 0.8365 | 42.90 | -0.0004 |

| AUD/USD – Australian Dollar / U.S. Dollar | AUDUSD | 0.6514 | +0.1230 | +0.3497 | +0.2400 | -1.5700 | -0.2159 | +2.1611 | +4.7267 | -2.7720 | 0.6555 | 0.6537 | 0.6427 | 39.18 | -0.0020 |

| USD/CAD – U.S. Dollar / Canadian Dollar | USDCAD | 1.4033 | +0.1570 | -0.0854 | +0.2465 | +1.7489 | +2.6119 | +1.3425 | -2.2077 | +1.7201 | 1.3868 | 1.3778 | 1.3973 | 76.31 | 0.0056 |

| NZD/USD – New Zealand Dollar / U.S. Dollar | NZDUSD | 0.5745 | +0.1918 | +0.5249 | +0.3180 | -2.4832 | -3.7626 | -3.6184 | +1.8669 | -5.2092 | 0.5857 | 0.5931 | 0.5849 | 41.74 | -0.0042 |

**Overview:**

The Majors FX group is currently exhibiting a mixed trend, with some pairs showing bullish momentum while others indicate bearish pressures. The USD is generally strong, particularly against the CAD, while other pairs are consolidating or in a slight downtrend.

**Key Pairs:**

1. **USD/CAD:** Trading at 1.4033 with an RSI of 76.31, this pair is in overbought territory, suggesting a potential pullback may occur. The MACD is positive at 0.0056, indicating bullish momentum; however, traders should watch for a reversal near resistance levels.

2. **USD/JPY:** Priced at 150.7520, it has an RSI of 59.28, indicating a neutral to bullish stance. The MACD at 0.9092 confirms positive momentum, suggesting potential for upward movement towards resistance.

3. **EUR/USD:** Currently at 1.1644, it shows bearish signals with an RSI of 39.93 and a negative MACD of -0.0022. This pair is approaching support levels, and a break could lead to further declines.

**Trading Implications:**

For USD/CAD, watch for resistance around 1.4100. For USD/JPY

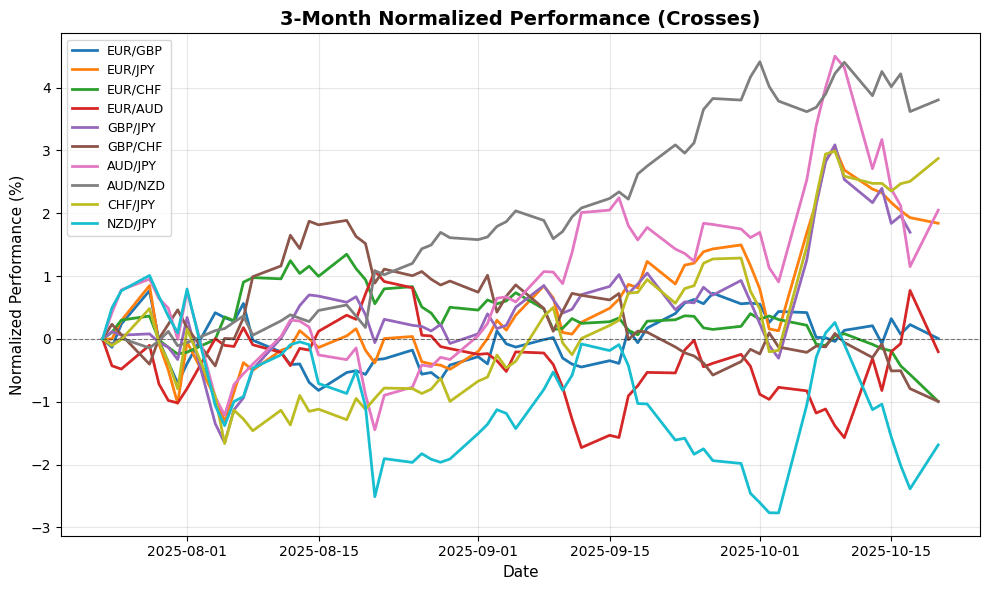

🔀 Cross Currency Pairs

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EUR/GBP | EURGBP | 0.8681 | +0.0115 | -0.3261 | -0.2138 | -0.1782 | +0.1373 | +1.5120 | +4.6925 | +4.3339 | 0.8677 | 0.8636 | 0.8523 | 38.77 | 0.0001 |

| EUR/JPY | EURJPY | 175.47 | -0.1815 | -0.3221 | -0.5323 | +0.5979 | +1.7943 | +8.3413 | +7.3990 | +7.9547 | 173.66 | 171.59 | 166.39 | 56.51 | 0.7240 |

| EUR/CHF | EURCHF | 0.9223 | -0.3242 | -0.8130 | -0.9143 | -1.2791 | -1.1807 | -1.6402 | -1.8725 | -1.6497 | 0.9349 | 0.9351 | 0.9386 | 12.71 | -0.0023 |

| EUR/AUD | EURAUD | 1.7872 | -0.2400 | -0.0017 | +0.1075 | +0.3301 | -0.2066 | +0.3898 | +6.8133 | +10.57 | 1.7838 | 1.7824 | 1.7490 | 51.93 | 0.0021 |

| GBP/JPY | GBPJPY | 202.12 | -0.1965 | +0.0020 | -0.3215 | +0.7839 | +1.6552 | +6.7272 | +2.5995 | +3.4661 | 200.06 | 198.58 | 195.13 | 55.71 | 0.8589 |

| GBP/CHF | GBPCHF | 1.0624 | -0.3471 | -0.4880 | -0.7001 | -1.1003 | -1.3116 | -3.1055 | -6.2602 | -5.7412 | 1.0774 | 1.0828 | 1.1015 | 33.84 | -0.0028 |

| AUD/JPY | AUDJPY | 98.17 | +0.0550 | -0.3229 | -0.6386 | +0.2748 | +2.0318 | +7.9297 | +0.5654 | -2.3649 | 97.35 | 96.25 | 95.13 | 52.27 | 0.2934 |

| AUD/NZD | AUDNZD | 1.1339 | -0.0441 | -0.2024 | -0.0652 | +1.0246 | +3.6972 | +6.0175 | +2.8299 | +2.5796 | 1.1192 | 1.1024 | 1.0988 | 45.41 | 0.0047 |

| CHF/JPY | CHFJPY | 190.24 | +0.1537 | +0.5068 | +0.3870 | +1.9078 | +3.0145 | +10.17 | +9.4617 | +9.7844 | 185.73 | 183.47 | 177.29 | 69.86 | 1.2401 |

| NZD/JPY | NZDJPY | 86.57 | +0.0937 | -0.1281 | -0.5674 | -0.6587 | -1.5848 | +1.8052 | -2.2118 | -4.7962 | 86.96 | 87.30 | 86.56 | 55.61 | -0.0989 |

### Overview:

The Crosses FX group is exhibiting a mixed trend, with several pairs showing signs of bearish momentum while others remain neutral. Overall, the market sentiment appears cautious, particularly evident in the weaker pairs.

### Key Pairs:

1. **EUR/CHF**: Currently at 0.9223, with an RSI of 12.71 indicating oversold conditions and a MACD of -0.0023, suggesting bearish momentum. This pair may be due for a potential reversal if buying interest emerges.

2. **CHF/JPY**: Priced at 190.2400, this pair shows an RSI of 69.86, nearing overbought territory, and a positive MACD of 1.2401, indicating strong bullish momentum. Watch for potential resistance around 191.00.

3. **GBP/JPY**: Trading at 202.1200, it has an RSI of 55.71 and a MACD of 0.8589, reflecting a neutral-bullish stance.

🌍 Exotic and Emerging Market Currencies

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| USD/TRY – U.S. Dollar / Turkish Lira | USDTRY | 41.92 | +0.0231 | +0.2489 | +0.2638 | +1.2709 | +3.7592 | +9.5164 | +18.75 | +22.61 | 41.33 | 40.66 | 38.97 | 97.23 | 0.1691 |

| USD/ZAR – U.S. Dollar / South African Rand | USDZAR | 17.25 | -0.7310 | -0.8022 | -0.9495 | -0.5440 | -1.9958 | -7.3170 | -8.0944 | -2.2663 | 17.44 | 17.62 | 18.02 | 49.78 | -0.0381 |

| USD/THB – U.S. Dollar / Thai Baht | USDTHB | 32.54 | -0.7019 | -0.1840 | -0.2452 | +2.0383 | +1.0245 | -3.0393 | -4.6838 | -1.8224 | 32.26 | 32.38 | 33.02 | 64.60 | 0.1211 |

| USD/SEK – U.S. Dollar / Swedish Krona | USDSEK | 9.4288 | +0.1710 | -1.1806 | -0.8393 | +0.9106 | -1.4520 | -1.7910 | -14.47 | -10.57 | 9.4473 | 9.5108 | 9.8873 | 51.54 | 0.0161 |

| USD/NOK – U.S. Dollar / Norwegian Krone | USDNOK | 10.06 | +0.0946 | -0.9925 | -0.4759 | +1.8920 | -1.0256 | -3.6248 | -11.23 | -7.8854 | 10.03 | 10.07 | 10.42 | 56.40 | 0.0269 |

| USD/DKK – U.S. Dollar / Danish Krone | USDDKK | 6.4148 | +0.1358 | -0.3353 | -0.3309 | +1.3280 | +0.4999 | -2.4810 | -10.49 | -6.8605 | 6.3844 | 6.4052 | 6.6488 | 60.96 | 0.0132 |

| USD/MXN – U.S. Dollar / Mexican Peso | USDMXN | 18.40 | +0.1600 | -0.5494 | -0.6462 | +0.2096 | -1.3583 | -6.1814 | -10.81 | -7.1359 | 18.53 | 18.68 | 19.40 | 52.85 | -0.0184 |

| USD/PLN – U.S. Dollar / Polish Zloty | USDPLN | 3.6388 | -0.0220 | -0.8963 | -0.9624 | +0.7013 | +0.3094 | -3.5277 | -11.40 | -8.4998 | 3.6391 | 3.6529 | 3.7743 | 51.17 | 0.0051 |

| USD/HUF – U.S. Dollar / Hungarian Forint | USDHUF | 333.96 | +0.0857 | -1.0005 | -1.1166 | +1.3502 | -2.0909 | -7.0317 | -15.46 | -9.6312 | 335.45 | 339.95 | 356.59 | 52.04 | 0.1867 |

| USD/CZK – U.S. Dollar / Czech Koruna | USDCZK | 20.85 | +0.1046 | -0.4559 | -0.4102 | +1.2379 | -0.8473 | -5.5029 | -13.67 | -10.42 | 20.84 | 21.04 | 22.07 | 57.45 | 0.0227 |

**Technical Analysis of Exotics FX Group**

**Overview:** The Exotic FX group shows mixed signals, with a generally bullish trend in USD/TRY, while other pairs display neutral to bearish momentum.

**Key Pairs:**

1. **USD/TRY:** Currently at 41.9233, the RSI at 97.23 indicates extreme overbought conditions, suggesting a potential price correction. The MACD of 0.1691 confirms bullish momentum but warns of exhaustion.

2. **USD/ZAR:** Priced at 17.2460, the RSI of 49.78 indicates a neutral stance, while the negative MACD of -0.0381 suggests bearish momentum, presenting potential selling opportunities.

3. **USD/THB:** Trading at 32.5400, the RSI at 64.60 remains bullish, with a positive MACD of 0.1211, indicating upward momentum.

**Trading Implications:** Watch for resistance in USD/TRY around 42.00, with support at 41

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.